Table of Contents

- SBI Small Cap Fund - Regular Plan - Growth

- SBI Large & MIDCap Fund- Regular Plan -Growth

- HDFC Small Cap Fund - Growth Option

- Quant Large Cap Fund Regular - Growth

- Parag Parikh Flexi Cap Fund Regular-Growth

A Lump Sum Investment in a mutual fund refers to a single, one-time investment of a large amount of money into the fund. Investing a big chunk of money all at once in a mutual fund can be good because you get in on the action right away. However, it's also risky because you might invest when the market is not doing well, diversification and selecting funds aligned with one's investment objectives are crucial considerations when making lumpsum investments in mutual funds. In this blog, we will see the best mutual fund for your lumpsum investment. Let's search for the ideal fund for you.

Best Mutual Fund for Lumpsum Investment

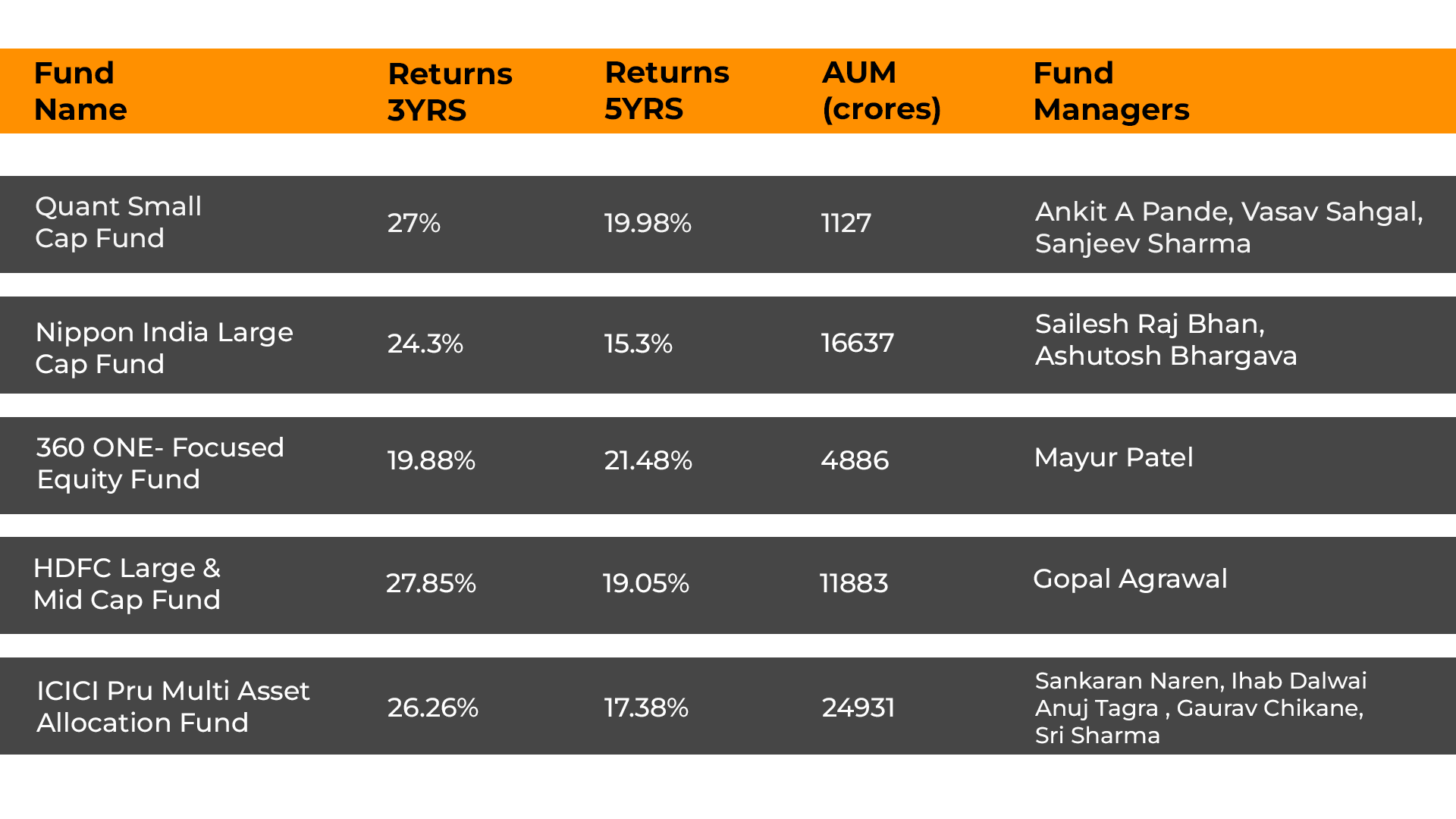

1. Quant Small Cap Fund

One of the top-performing funds in the last three years has given an absolute return of 209%. This fund was introduced to investors on December 11, 2006. The Quant Small-Cap Fund, managed by Ankit A Pande, Vasav Sahgal, and Sanjeev Sharma, aims to achieve consistent revenue growth and potential high returns. These small-cap funds are more volatile and are suitable for investors with a high-risk appetite. The 3-year and 5-year average rolling returns of this fund are 27% p.a and 19.98% p.a, respectively. This fund is suitable for investors who are looking for very high returns in 3-5 years but are capable of tolerating short-term high market volatility risk.

Investment Strategy- This fund focuses on small-cap stocks and is known for their potential high growth.

AUM of Quant Small Cap – 1127 crores

Risk profile – High (Small-cap funds are generally more volatile)

2. 360-ONE-Focused-Equity-Fund

For investors who are interested in investing in a limited stock portfolio, such as high net worth investors, the 360 One Focused Fund is an excellent option. This fund has been very successful as it invests in a limited number of quality-focused stocks that have the potential to be multi-baggers in the long term. However, it may have a high volatility risk in the short term. The fund has been managed by Mayur Patel since November 11, 2019, and aims to achieve consistent revenue growth and higher returns.

3. HDFC Large and Mid Cap

Suitable for moderately low risk investor, those who want to invest in bluechip companies and with that they also prefer investing in growing Mid Cap companies to generate little high returns in the range of 12-15%

HDFC large & mid cap fund is one of the successful fund in the category. The average annual return provided by this fund for 3 and 5 years is 27.85% and 19.05%. Since 16-july-2020 Gopal Agarwal has managed this fund. Risk is moderate to high, but seeks consistent revenue growth, and offers a balance of stability and growth potential

4. Nippon India Large Cap Fund

Ashutosh Bhargava has been managing this fund since September 1st, 2021. The main objective of this scheme is to achieve long-term capital appreciation by investing primarily in large-cap companiesin equity and equity-related securities. The current Asset Under Management (AUM) of Nippon is 16637 crores. The fund is required to maintain at least 80% of its assets in large-sized company stock and equity-related instruments. This fund is suitable for low-risk investors who want to invest in the equity market but do not want to take high risks and expect sustainable moderate returns of 12% annualized returns.

Returns - 24.3% (3-year), 15.3% (5-year)

Risk - Moderate to High (Large-cap funds are comparatively less volatile than small-cap funds but still carry market risk)

Fund Manager- Sailesh Raj Bhan, Managing This Scheme since 12-Jun-2007

5. ICICI Prudential Multi Asset Allocation Fund

Invested in a variety of stocks, bonds, and commodities (often gold), Multi-Asset Allocation Funds ensure that each investment has a minimum 10% allocation at all times. Sankaran Naren has managed this fund since 1 Feb 2012 with the strategy of distributing money among debt, equities, and other asset types. This fund generated return for 3 years is 26.26% and in 5 years is 17.38%. These funds offer diversification and are suitable for investors with a moderate risk tolerance. Launch date- 31-10-2002

AUM- 24931 crores

Other Managers - Ihab Dalwai (Equity) - Managing This Scheme since 05-Jun-2017

Anuj Tagra (Debt) - since 28 May 2018

Gaurav Chikane (for ETCDs) - since 02-Aug-2021

Sri Sharma (for Derivatives transactions)- since 30-Apr-2021

Factor Consider Before investing lumpsum amount in a mutual fund

Return on investment

Review the historical performanceof the mutual fund scheme. Examine the fund's performance against benchmarks and search for returns that have been consistent throughout many market cycles.\

Risk Tolerance

Assess your risk tolerance, understanding how much volatility in the value of your investment you can comfortably endure. This consideration is essential in selecting the right type of mutual fund that aligns with your risk appetite.

Time Horizon

Determine your investment time horizon, or how long you plan to keep your money invested. Different mutual funds suit different timeframes, with long-term investments generally allowing for a more aggressive approach.

Exit Load

Check if the mutual fund scheme has any exit load or charges for withdrawing your investment before a certain period. This is crucial, especially if you anticipate needing the funds in the short term.

Stay Informed

Keep yourself updated on market trends, economic news, and any changes in the regulatory environment. Being educated gives you the ability to quickly modify your investing approach.

Conclusion

In conclusion, mastering market strategies can enhance profitability when making a lump sum Investment in Mutual Funds. However, a prerequisite is a clear understanding of your financial goals, risk tolerance, and time horizon. Choosing the option that aligns best with your needs is imperative. Given the market's inherent fluctuations, the value of your investment will experience ups and downs. Patience and a steadfast commitment to long-term financial objectives are crucial in navigating these market dynamics successfully.

Read More - Tax Benefits Section 80E for Education Loans 2024

.webp&w=3840&q=75)