Equity market has rewarded well over the past few years and more people are coming up to start investments and putting money in the market. Many investors are also routing their investments in the growing companies through mutual funds. As we see the past five year, the top mid-cap funds have delivered an annualized returns of 22% returns. However, all this year, mid-caps were going through correction and any further correction in this space would make their valuations further attractive. So, if you want to exploit the opportunities arising out from the current market conditions and the top mid-cap funds, then it’s the best time.

At MySIPonline, we have found mid-cap mutual fund category quite attractive as they have the capability to offer handsome returns. They have upside growth potential that is unmatched by mature companies. Considering this opportunity coming back in this segment, we have listed down top 5 mid-cap funds for our investors which include:

- L&T Midcap Fund (G)

- DSP Midcap Fund (G)

- ICICI Prudential Midcap Fund (G)

- SBI Magnum Midcap Fund (G)

- Invesco India Midcap Fund (G)

Peer Comparison: Returns, AUM, and Allocation

| Scheme Name | AUM (in crores) | Returns | Allocation | |||

|---|---|---|---|---|---|---|

| 3 Years | 5 Years | 10 Years | Equity | Debt & Cash | ||

| L&T Midcap Fund (G) | Rs 3,197 | 13.17% | 25.22% | 23.96% | 88.72% | 11.18% |

| DSP Midcap Fund (G) | Rs 5,249 | 11.45% | 21.52% | 23.59% | 96.25% | 3.75% |

| ICICI Prudential Midcap Fund (G) | Rs 1,475 | 9.24% | 21.79% | 21.31% | 91.66% | 8.34% |

| SBI Magnum Midcap Fund (G) | Rs 3,299 | 4.29% | 18.89% | 22.10% | 96.10% | 3.86% |

| Invesco India Midcap Fund (G) | Rs 245 | 10.87% | 21.34% | 24.65% | 95.77% | 5.33% |

| As on Dec 05, 2018 | ||||||

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Best 5 Mid Cap Mutual Funds

By analyzing the funds on different parameters such as experience of fund manager, risk management, past performance, portfolio of the fund, etc., experts of MySIPonline have selected the top 5 mid-cap funds to invest in 2018. Let’s have a look at them one by one.

L&T Midcap Fund (G)

L&T Midcap is an open-ended scheme which is 14-year old in its category. It has started its journey on Aug 09, 2004, and since then it has managed to deliver high returns to the investors in the long run. The main objective of the fund is to generate high returns and long-term capital gain by investing in equity and equity-related securities.

Mr Soumendra Nath Lahiri is managing L&T Midcap Fund (G) who has over 20 years of experience in the field. He is the Chief Investment Officer of the Investment Management Business at L&T Financial Consultants Ltd., who is also advising the portfolio for more than 9 years. Mr Vihang Niak who joined L&T in 2012 is assisting him since 2016. Their sound investment style has made the fund to stand in the top amongst its peers. L&T Midcap Fund NAV is Rs 130.29 as on Dec 06, 2018.

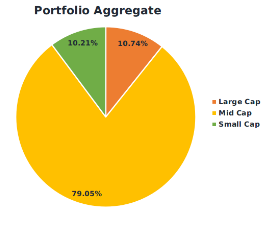

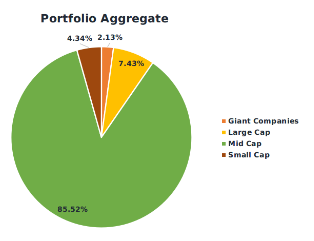

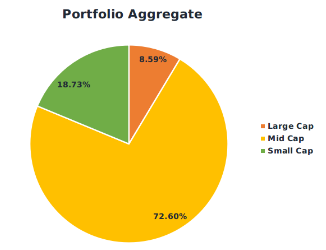

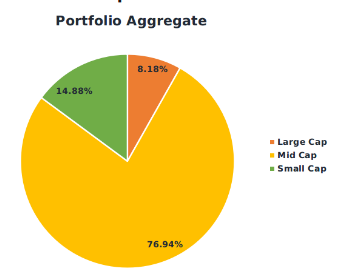

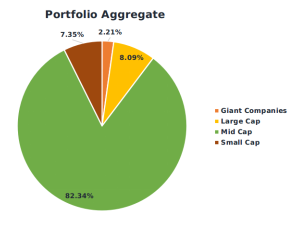

1. Market Capitalization

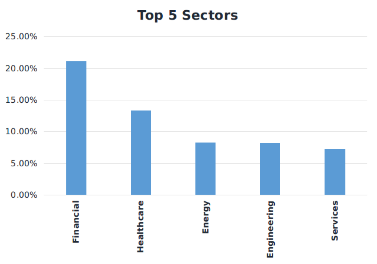

2. Sector Allocation

DSP Midcap Fund (G)

DSP Midcap Fund has completed more than a decade in the mutual fund industry. It is a consistent performer of its category, and also managed to cap the losses in the downside market. Currently, it is managing the assets of Rs 5,249 Cr as on Oct 31, 2018. DSP Midcap Fund NAV is Rs 51.181 as on Dec 06, 2018.

The fund has been co-managed by two of the competent fund managers, Mr Vinit Sambre and Mr Jay Kothari. Mr Smabre has been managing this scheme of DSP Mutual Fund since last 6 years and has a vast experience of mid-cap segment. The main objective of the fund is to generate high returns in the long run and it is good for the investors with a high-risk appetite.

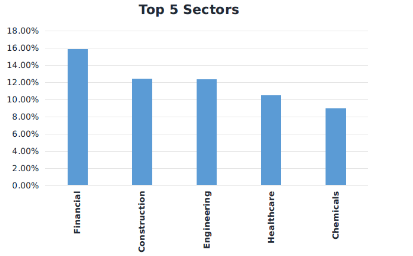

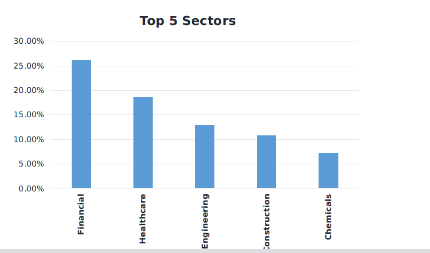

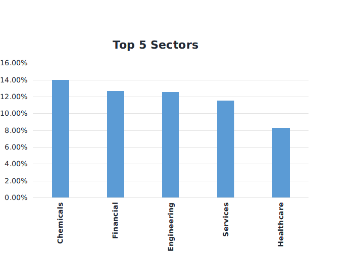

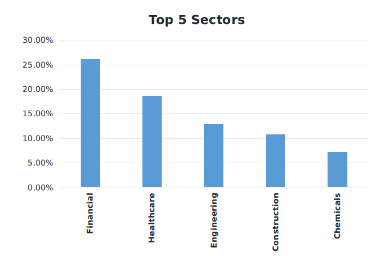

1. Market Capitalization

2. Sector Allocation

ICICI Prudential Midcap Fund (G)

ICICI Prudential Midcap Fund follows the blend of growth and value investing and a very focused investment approach. It is a 14 years old fund, which was started in the year 2004 and has provided good risk-adjusted returns in the long run. In various market drops, it could not manage to cap losses, but has outperformed its peers in the long run.

Mr Mrinal Singh and Mr Mittual Kalawadia co-managed ICICI Pru Midcap Fund where Mr Singh sees after value investing and Mr Kalawadia follows the growth investment strategy for the fund. It is managing the assets of Rs 1,475 Cr as on Oct 31, 2018. ICICI Prudential Midcap Fund (G) NAV is Rs 91.89 as on Dec 06, 2018.

1. Market Capitalization

2. Asset Allocation

SBI Magnum Midcap Fund (G)

SBI Magnum Midcap Fund has completed 13 years in the mutual fund industry and currently it’s managing the assets of Rs 3,299 Cr as on Oct 31, 2018. The fund select stocks which have high growth and available at the fair prices. The fund has performed in a splendid manner for the past many years. It has also managed the losses in the bearish market of 2011.

The fund has been managed by Mr Sohini Andani from the past 8 years who is a astute stock picker. She bets on the high-conviction stocks by evaluating the companies on their management and earning potential. SBI Magnum Midcap Fund (G) NAV is Rs 69.504 as on Dec 06, 2018.

1.Market Capitalization

2. Asset Allocation

Invesco India Midcap Fund (G)

Invesco India Midcap Fund was launched in the year 2007 and has completed 11 years in the industry. The fund has provided high returns in the long run and it has shown its capability to manage losses in the downside market of 2011. Currently, it is managing the assets of Rs 245 Cr as on Nov 30, 2018.

Mr Pranav Gokhle and Mr Neelesh Dhamnaskar are currently managing the fund who invest in the growth stocks. They both have joined the fund management team in March 2008, therefore it is yet to see how the fund will perform under their helm. Invesco India Midcap Fund (G) NAV is Rs 46.43 as on Dec 06, 2018.

1.Market Capitalization

2. Asset Allocation

Risk Comparison:

| Particulars | Risk Measures | Risk-To-Reward Ratio | ||||

|---|---|---|---|---|---|---|

| SD | Beta | Maximum Fall | Downside Ratio | Sharpe | Sortino | |

| Benchmark : S&P BSE Midcap | 18.15 | 1 | -0.1643 | 100 | - | - |

| L&T Midcap Fund | 17.54 | 0.91 | -0.1737 | 84 | 0.45 | 0.58 |

| DSP Midcap Fund | 18.54 | 0.95 | -0.1712 | 92 | 0.37 | 0.51 |

| ICICI Prudential Midcap Fund | 16.39 | 0.83 | -0.1704 | 86 | 0.24 | 0.34 |

| SBI Magnum Midcap Fund | 15.06 | 0.98 | -0.1408 | 93 | 0 | 0 |

| Invesco India Midcap Fund | 16.87 | 0.94 | -0.1582 | 91 | 0.33 | 0.45 |

Conclusion:

From all the above-provided details, it is concluded that

L&T Midcap Fund (G) and DSP Midcap Fund (G) both are aggressive funds in nature which attract high risk but also offer high growth. They have shown the best performance in the category in the past as well as their current fundamentals and valuations are also providing the funds with a good growth.

ICICI Prudential Midcap Fund (G) has expert fund managers, which has provided good performance to the fund in the past and its current portfolio is also attractive which can generate good returns in the long run.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Invesco India Midcap Fund (G) has made its place in the top recommendation because its portfolio is very attractive, irrespective of its past performance and it can help it deliver high returns to investors in the long run.

SBI Magnum Midcap Fund (G) is a lowest risk holding fund in its category with the best risk management but has been underperforming from the past few years. However, the current portfolio is attractive and it can offer high returns to the investors in the long run.

Here ends the discussion on the top 5 mid-cap schemes where you can invest now as recommended by the experts of MySIPonline. Investors can pick the best fund for themselves by considering their own risk appetite, investment tenure, and financial objective. If you have any query or doubt regarding any of the scheme listed above, feel free to contact with our experts. Further, you can even ask any query concerning the regular plans of mutual funds by filling in the form mentioned below:

Must Read: