Table of Contents

- Fundamentals of Systematic Investment Planning

- How Does SIP Work in Mutual Funds?

- What Are The Different Types of SIP?

- Who Should Do SIP?

- How Can a SIP Return Calculator Help You?

- Is SIP a Good Investment?

- Golden Rules to Follow for Your Systematic Investment Plan

- How Do Beginners Start SIP?

- Best SIP to Invest in 2025

- When to Start an SIP?

- What to Check Before Doing SIP?

- Tax Implications of SIP Investments

- Mistakes to Avoid When Investing in SIP

- Are There Any Risks in SIP?

- Conclusion

Want to make lakhs by investing thousands over time? Step into the world of Systematic Investment Planning (SIP), a disciplined practice of investing a small amount at regular intervals in mutual funds.

The main question that arises here is," How SIP works and what are the benefits of SIP?"

Well, SIP investments allow you to benefit from market fluctuations with two wealth-building powers, rupee cost averaging and compounding.

Ready to witness how SIP can transform your financial future? Let us explore SIP in mutual funds.

What is SIP in Mutual Funds?

SIP represents a Systematic Investment Plan that lets you invest a fixed amount of money in Mutual Funds regularly at intervals that are predetermined. Generally, the intervals are set as monthly or quarterly.

SIP makes the process of wealth creation easy by allowing you to invest with a small amount of money, as low as Rs 500, to give you the benefits of long-term investments. When invested for the long term, SIP provides benefits like compounding and rupee cost averaging.

SIP reduces the risks of market volatility through rupee cost averaging, which allows you to buy more units when the market prices are cheap and fewer units when the market is expensive. Through SIP, you can also benefit from compounding that allows you to reinvest your returns to make more returns.

If we talk about SIP's historical performance, it has delivered high returns by hitting an average annual return of 12% - 15% over the past ten years. SIPs are relatively less risky and can be easily managed while allowing you to modify your SIP plan according to your goals and time horizon. SIP is very flexible and effective, specifically in the long term.

Now that we understand 'what is SIP?', let us learn about the core fundamental principles of SIP.

Fundamentals of Systematic Investment Planning

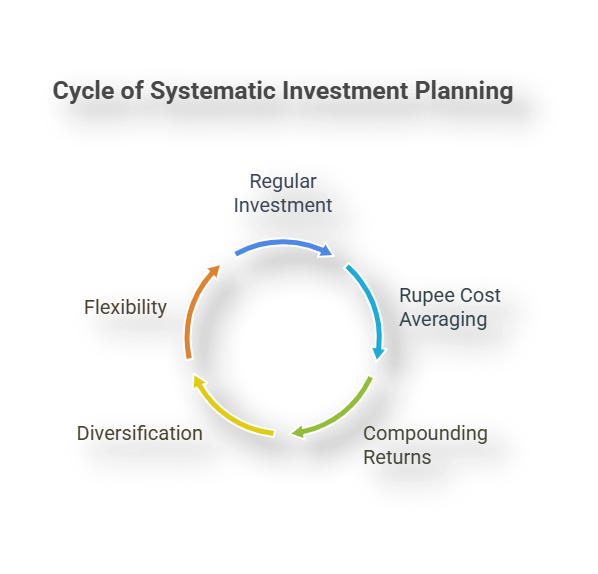

The principles of investment strategy behind the SIP provide you with cost averaging, compounding and disciplined investing for wealth creation over time. Let us discuss in more detail:

-

Regularity

It refers to the commitment to regularly investing a fixed amount of money, developing a habit of saving and investing continuously, making it easy for investors to build wealth over time.

-

Rupee Cost Averaging

When investing regularly, you buy more units in the market when the cost is low and less when the price is high. This concept of rupee cost averaging decreases the overall cost of your investment.

-

Compounding

By using the power of compounding, you can grow your investment more over time. It reinvests your returns from SIP to make more returns. This component works on the "the earlier you start, the more you can benefit" strategy.

-

Diversification

SIP provides investors with the concept of diversification in their portfolios, allowing them to invest in diverse sectors and assets of the financial world. This helps in spreading the risk and reducing the risk associated with a single unit.

-

Flexibility

In terms of investment amount and frequency, we can say that SIPs are very flexible for investing. It provides investors with the control over their investments. They can start with a small amount & grow gradually or can also stop the SIP if required.

Now that we have the basics down, let us check out how SIP works in mutual funds, and see how these ideas play out in real life.

How Does SIP Work in Mutual Funds?

A SIP is simply a method of investing in mutual funds through regular periods. Let us look at the step-by-step guide to SIP in mutual funds:

-

Choosing a Mutual Fund

You need to research and select a mutual fund that goes with your investment goals, risk tolerance & investment horizon from the available mutual funds.

-

Setting Up the SIP

To set up your SIP investment, you need to fill out the mutual fund application form, complete your KYC accurately, and specify the amount you want to invest and the duration of the investment.

-

Automated Deductions

The investment amount is automatically deducted from your account on the chosen date after setting up the SIP. This ensures the consistency of the investment without manual interference.

-

Purchasing and Accumulation of Fund Units

Your deducted investment amount is further used to buy the units of the selected funds at the current NAV on the date of investment. As SIP continues, you can collect these units over time. The value of these units varies depending on the performance of the fund.

-

Monitoring Performance

You should regularly monitor the performance of your investment and make changes if needed.

-

Redemption of Units

You can redeem your units when you want to withdraw your investment. It will be based on the NAV of the mutual fund at the time of redemption.

Let us break down how SIP grows over time with an example and see how it is influenced by the changing market conditions, as they are subject to market risks.

Assume Rihan did an SIP of Rs 10,000 for 12 months, here is a simple breakdown of his investment in two scenarios:

Condition 1: Downturn of the Market

The NAV of the mutual fund decreases each month in the down market. Let us see how the investment will carry on:

| Month | NAV (Rs) | Units Bought |

|---|---|---|

| 1 | 100 | 100.00 |

| 2 | 95 | 105.26 |

| 3 | 90 | 111.11 |

| 4 | 85 | 117.65 |

| 5 | 80 | 125.00 |

| 6 | 75 | 133.33 |

| 7 | 70 | 142.86 |

| 8 | 65 | 153.85 |

| 9 | 60 | 166.67 |

| 10 | 55 | 181.82 |

| 11 | 50 | 200.00 |

| 12 | 45 | 222.22 |

His total investment value is Rs 1,20,000 for a year. Now the NAV continuously dropped from Rs 100 in 1st month to Rs 45 in the 12th month, due to which he bought more units every month (by rupee cost averaging), which led to buying 1,759.77 units in 12 months.

With this, the total investment value at the end of the year was just Rs 79,189 (1,759.77 units × ₹45). This price is less than the original investment amount, with a difference of Rs 40,811, leading to a loss.

It shows that if the market drops regularly, it may lead to a loss in the SIP investment. But what if it rises, let us see.

Condition 2: Uptrend of the market.

In this condition, the NAV increases every month.

| Month | NAV (₹) | Units Bought |

|---|---|---|

| 1 | 45 | 222.22 |

| 2 | 50 | 200.00 |

| 3 | 55 | 181.82 |

| 4 | 60 | 166.67 |

| 5 | 65 | 153.85 |

| 6 | 70 | 142.86 |

| 7 | 75 | 133.33 |

| 8 | 80 | 125.00 |

| 9 | 85 | 117.65 |

| 10 | 90 | 111.11 |

| 11 | 95 | 105.26 |

Here also, his total investment value is Rs 1,20,000 for a year. Now the NAV continuously rose from Rs 45 in 1st month to Rs 100 in the 12th month, due to which he bought fewer units every month (by rupee cost averaging), which led to buying 1,759.77 units in 12 months.

With this, the total investment value at the end of the year was Rs 1,75,977 (1,759.77 units × ₹100). This price has increased from the original amount, with returns of Rs 55,977, leading to a profit.

It shows how SIP grows your money when the market is rising.

Now that you know what is SIP and how it works, let us check out the different kinds of SIP you can choose from.

What Are The Different Types of SIP?

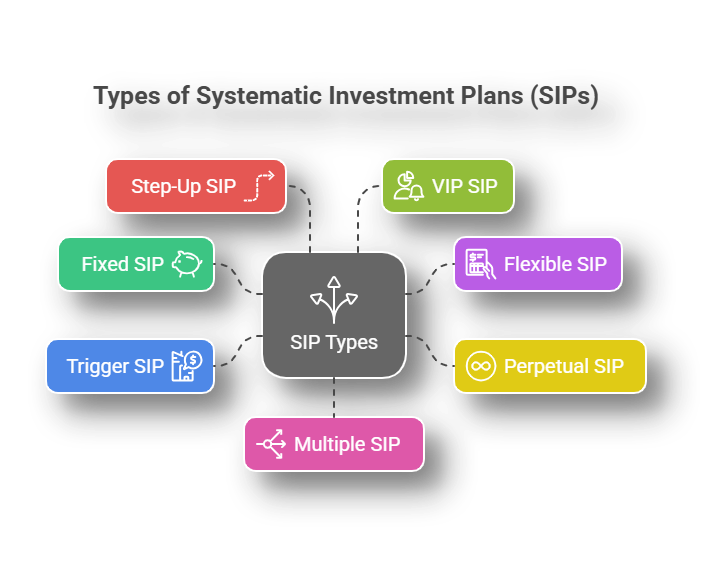

There are different types of SIPs available to serve different investment goals. You choose the right one that goes with your investment style from the following:

- Fixed (Regular) SIP: Contribution of fixed amounts at regular specific intervals for a desired period according to the investors.

- Flexible SIP: Similar to fixed SIP, but it allows the adjustment of the investment amount as per the investor's financial situation.

- Perpetual SIP: In this, the investors are not bound by a time period, they can continue until they want and can stop at any time. (Not Applicable from Oct 2023).

- Trigger SIP: In this, the SIP investments trigger automatically and the investing starts when a pre-defined condition is met.

- Step-Up (Top-Up) SIP: Provides the option of an increment of the investment amount for SIP at a pre-defined rate at intervals.

- VIP (Value Averaging Investment Plan) SIP: In this, the amount you invest each month changes based on how your investments are performing to keep it aligned with your goals.

- Multiple (Multi-Select) SIP: Allows investment in different mutual funds with a single SIP unit. With this, investors can diversify with one SIP.

Knowing about the different types of SIPs is important, but the real question is: who should consider this investment strategy? Let us look into that.

Who Should Do SIP?

SIP is great for anyone, whether working, studying or enjoying retirement. Let us discuss how SIP fits your plans easily:

-

Youngsters (Ages 20-30)

Adults can start SIP to build a financial source for emergencies or for their short-term goals like traveling. Starting early will allow them to take benefit of compounding, leading them to remarkable wealth creation until their 30s or 40s.

-

Early Career Professionals (Ages 30-40)

Normally, at this age, many aim to buy their own house or save for their children's future expenses. SIP allows saving for significant events while providing growth potential.

-

Mid Level Professionals (Ages 40-50)

Individuals at this age focus on retirement planning or aim to grow wealth for a better lifestyle. They can start SIP to spread out costs and reduce risks since they let you invest more over time as your finances grow.

-

Those Near Retirements (Ages 50-60)

Saving for retirement and planning for healthcare costs become crucial at this age. SIP can still be beneficial for these individuals.

-

Retirees (Ages 60+)

People at this age may want their savings to last throughout retirement and some may want to leave a legacy for their children. These people can invest in conservative SIP, like debt or balanced funds, to earn some income while keeping their capital safe.

Pro Tip: A SIP Calculator is a tool that can give you a good idea of your returns and help you in making informed decisions.

How Can a SIP Return Calculator Help You?

A SIP calculator is a simple tool used in finance. It calculates the returns of your investments through SIP in mutual funds.

This tool will calculate the returns according to the input given and display them to you. It helps investors plan and visualize their mutual fund investments.

For example, assume you invest Rs 10,000 every month for 10 years and get a 14% return, let us see how much you could end up with.

Steps to use a SIP calculator to evaluate the returns of your investment:

- Enter your monthly SIP amount (Rs 10,000).

- Select the investment time (10 years or 120 months).

- Specify the expected annual return rate (14%).

- Click Calculate.

This is what you get from the calculator.

| Parameter | Value |

|---|---|

| Future Expected Value | Rs 25,90,689 |

| Investment Amount | Rs 12,00,000 |

| Total Return Earned | Rs 13,90,689 |

This shows that, after investing Rs 10,000 for 10 years at 14% returns, your total investment will be Rs 12 lakhs and your estimated returns will be Rs 13.91 lakhs. So, your total income after 10 years will be Rs 25.91 lakhs.

You can create more conditions like this to know the returns and compare them to find the best investment value and time that suits you the most.

Now that you have a clearer picture of your returns, you might be wondering if a SIP is a good choice. Keep reading to know.

Is SIP a Good Investment?

Yes, a Systematic Investment Plan is an effective way to invest through mutual funds, especially for long-term investments. Here are the reasons why:

- Disciplined Investing:With this approach, you save automatically, so you can invest regularly and not stress over market timing.

- Rupee Cost Averaging:You buy more units when prices drop and fewer when prices rise, reducing your average investment cost.

- Compounding:This allows regular small investments that can add up over time. The earlier you start SIP, the more benefit you get.

- Affordability:Allows you to start with just Rs 500 per month, which is a great opportunity for newcomers.

- Less Stressful Investing:This strategy helps you avoid the pressure of trying to time the market.

- Flexibility:You can pause, increase or stop your SIP whenever you want, as you have total control of your investments.

Must Read: Don’t Underestimate The Power Of Compounding

Now, let us discuss some golden rules to follow to ensure your investment journey is smooth and successful.

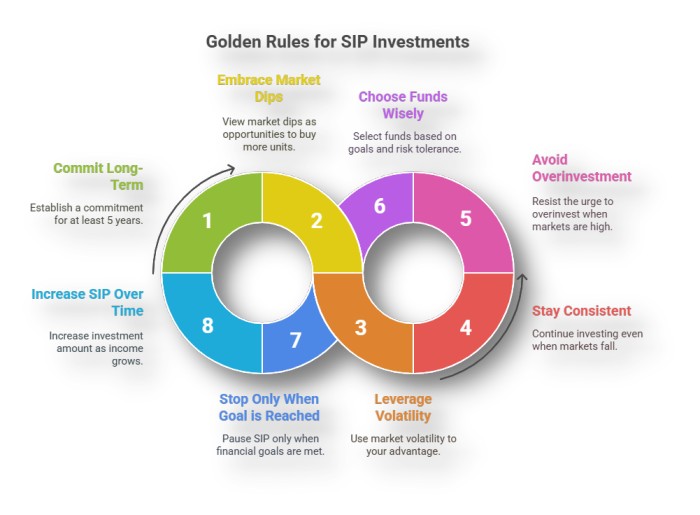

Golden Rules to Follow for Your Systematic Investment Plan

Investing in a Systematic Investment Plan requires patience, but a lot of people get impatient with the current losses and mess up the results. So, before you get impatient, too, here are the eight golden rules for your SIP investments that you should follow.

-

SIP is a long-term commitment (at least 5-years).

Investing in mutual funds through a SIP is not a scheme that will make you rich overnight, it is a long-term process demanding your patience. You need to give it some time, stay consistent and let compounding do its job.

-

Market dips are your best friends.

Market dips are your greatest supporters because when a fall in the market means your SIP buys more units at cheap prices, that gradually leads to higher returns. The market downfalls are like a sale to the investors.

-

Volatility is your Secret Weapon (Even When They Annoy You).

Market volatility is what makes investing through SIP powerful, SIP booms on these market fluctuations. If the market did not fluctuate, SIP would not offer advantages like buying more when prices drop and less when rise.

-

Do not stop SIP when markets fall.

Stoping your SIP during the market downfalls is like returning the shopping you got at a discount in a sale.

Let us look at it in another way, assume your favorite brand jeans that usually cost Rs 3,000 go on sale for Rs 1,500. Would you buy more or stop shopping because you do not believe the low prices? Exactly, you will buy more. This same concept applies to SIP investments.

-

Do not overinvest when markets are high.

When the market reaches new heights, it can make investors greedy and they go all in or they stop investing altogether, both are wrongdoings in this situation. You need to stick to your goals and not mess with your investment plan.

-

Do not pick funds based only on past returns.

Just because a stock or a fund delivered remarkable returns in the past, does not mean that it will do great in the future also. A fund can be affected by changing market conditions. So, carefully select a fund that aligns with your financial goals & risk tolerance.

-

The only time to stop your SIP? When you reach your goal.

Most investors pause or stop their SIP when come across factors like market crashes, scary headlines and FOMO on other investors (switching to other options because someone else made a profit over there). No, your SIP is a pre-set journey to your goal, you need to trust the plan and keep going.

-

Increase your SIP over time.

Investing more as you earn more is the key to reaching your financial destination faster, benefiting you from the power of compounding and accelerating your growth. You need to let your SIP grow with your income.

Market fluctuations will occur if you stress over them every time, then you can not survive in the world of investing. The only thing you can do is stop checking your portfolio daily, you will only get stressed out about it. SIPs work excellently when left on their own to grow gradually.

Pro Tip: The secret to successful SIP investment is patience, discipline and ignoring short-term losses.

How Do Beginners Start SIP?

Starting a SIP is easier than you think. Described below is a step-by-step guide that shows the process of starting a SIP for beginners:

Step 1: Choose Your Investment Goals

Decide the goals you want to achieve through investing in SIP. Identify the reason you are investing like buying a house, children's education or retirement. This will help in choosing the right fund and investment duration for yourself.

Step 2: Selecting Mutual Fund

Select a fund that fits your goals. Research the parameters of the fund before choosing, including 5-year performance, expense ratio and fund manager's experience.

Here is a description of beginner-friendly mutual funds you can pick from:

| Fund Type | Risk | Best For | Examples |

|---|---|---|---|

| Index Funds | Low | Passive investors | Nifty 50, Sensex ETFs |

| Large-Cap Funds | Medium | Safe growth | HDFC Top 100, ICICI Bluechip |

| Balanced/Hybrid Funds | Medium | Growth & Safety | SBI Balanced Advantage |

Note: Avoid Small-cap funds as can be too volatile for starters.

Step 3: Complete KYC Compliance

It is a compulsory process, you need to give identity and address proof. Visit the fund's website or mobile app, and upload your required documents and passport-size photo.

Step 4: Start Your SIP

There are two ways to start your SIP:

Online (through website or app):

- Log in to the AMC website or app.

- Select fund and click on "Start SIP".

- Enter the amount (min ₹500/month), date (1st/5th/10th of the month) and duration of investment.

- Link bank & approve auto-debit.

Offline (through an agent or bank):

- Visit the bank or mutual fund office.

- Fill SIP application form and submit the cheque.

- Get SIP ID within 3-5 days.

Step 5: Track & Optimize

You need to constantly check on your investment. Follow the below tips:

- Check Quarterly: Use apps like ET Money or Coin.

- Review Yearly: Switch funds onlyif they are underperforming for 2+ years.

- Scale Up: Increase SIP by 10% yearly.

Important Tip: Always choose the direct plan of any fund over the regular ones, as have lower fees comparatively.

Now that you know how to start your first investment in SIP, you might be wondering "Which is the best SIP to invest in 2025", right?

Keep scrolling if you want to know.

Best SIP to Invest in 2025

Before investing, doing your research to find the best fit for yourself is a must. Here are the top 10 best SIP plans to invest in 2025:

| Fund Name | Launch Date | AUM (in ₹ Cr) | 3 Yrs SIP Returns | 5 Yrs SIP Returns |

|---|---|---|---|---|

| Bandhan Small Cap Fund | 2/8/2020 | 11,718 | 32.89% | 29.39% |

| Edelweiss Mid Cap Fund | 12/26/2007 | 10,016.40 | 27.59% | 26.47% |

| Nippon India Large Cap Fund | 8/8/2007 | 41,734 | 19.13% | 20.68% |

| Bandhan Large & Mid Cap Fund | 8/9/2005 | 9,096 | 23.60% | 23.05% |

| Nippon India Multi Cap Fund | 3/25/2005 | 40,261 | 22.84% | 25.67% |

| Invesco India Contra Fund | 4/11/2007 | 18,427 | 21.43% | 20.27% |

| Tata Digital India Fund | 12/5/2015 | 11,689 | 16.21% | 15.93% |

| ICICI Pru Manufacturing Fund | 10/7/2018 | 6,231 | 23.72% | 2479.00% |

| HDFC Balance Advantage Fund | 2/1/1994 | 100,260 | 18.27% | 20.34% |

| ICICI Pru Multi Asset Fund | 10/31/2002 | 59,400 | 19.69% | 21.00% |

Now, with these options in mind, you might be asking yourself: " What would be the best time for you to start a SIP?". Let us clear it up in the next part.

When to Start an SIP?

Did you know that if you start investing Rs 1000 per month in a SIP for 20 years at a 12% return, you can make Rs 12 lakhs? This is the power of compounding in SIP investments. But the concern lingering in everybody's mind is, "What is the right time to start SIP?".

The best time to start a SIP is "now". The sooner you start, the more your money can grow. A delay in your investment means missing out on the compounding benefits offered by the SIPs.

Market timing does not really matter with SIP. What makes them work is rupee-cost averaging as they automatically buy more when prices drop and less when prices go up, which helps reduce the impact of market fluctuations. The most important thing is to start early in your career and stick with it for at least five years, let time do its thing.

Must Read: What Is The Best Date For Sip

What to Check Before Doing SIP?

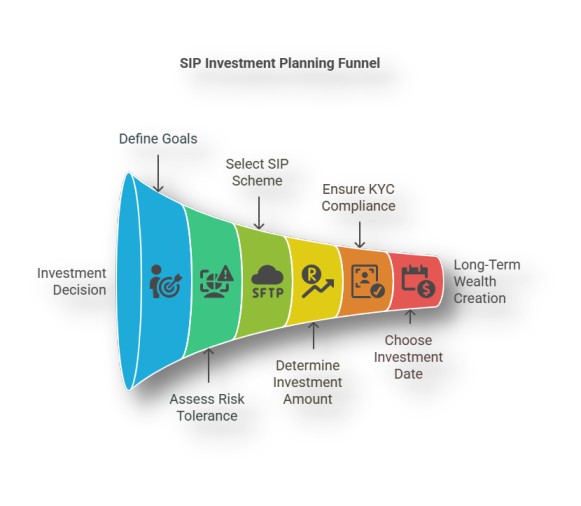

You should consider the following factors before jumping into the mutual fund investment through a Systematic Investment Plan to make informed decisions:

-

Defining Goals

Knowing your goals will help you choose the relevant SIP schemes & the amount you should invest.

-

Identify Risk Tolerance

Identify your comfort with market fluctuations and losses. You can choose a fund that aligns with the level of your risk appetite.

-

Select the Right SIP

Compare various mutual fund schemes to select the best one and consider diversifying your portfolio.

-

Identify Investment Amount and Regularity

Identify the amount of money you can comfortably invest regularly by considering the impact of SIP on your overall financial condition.

-

KYC Compliance

It is a compulsory need for mutual fund investment. Make sure to complete your KYC process to verify your identity and address.

-

Choose an Investment Date

Select an appropriate date for submitting the installments of your SIP investment. Make sure it aligns with your income & expenses.

-

Monitor & Adjust Your Portfolio

Review & monitor your SIP portfolio's performance continuously and adjust as required.

-

Stay Invested for a Long Time

SIPs are best for long term wealth creation, just be disciplined and consistent to benefit from your SIP investment.

Now, let us dive into the tax implications of SIP investments and take a look into what it offers.

Tax Implications of SIP Investments

There are different tax implications for SIP investments applied to various mutual funds. The variation of taxes for SIP is dependent on the fund type and its holding period.

- Long-term Tax Implications: If you make more than Rs. 1.25 lakh in long-term gains, you will have to pay taxes on that. For mutual funds, the tax rate is 12.5% and without any indexation benefits.

- Short-term Tax Implications: The STCG Tax or tax on short-term gains, recently increased to the rate of 20%, from the previous rate of 15%.

- Tax Saving Fund: The ELSS funds can provide you with tax deductions of Rs 1,50,000 maximum under Section 80C of the Income Tax Act, but require at least 3 years of lock-in time.

You should always talk to a tax advisor for personalized advice to grow your SIP returns after taxes.

Imported Read: Best Tax Managed ELSS Mutual Funds

Mistakes to Avoid When Investing in SIP

Let us look at the five costly mistakes that you should avoid if you want to invest smartly in mutual funds through SIP in 2025 and that are:

Stopping Your SIP Investment During Market Crashes.

- Why: You may miss the chance to buy quality stocks when at a discount.

- Solution: Think of market dips as an opportunity to grab units at cheap prices for your SIP.

Chasing Past Performance

- Why: Last year's top fund may not be a winner this year, especially small cap funds.

- Solution: Pick funds with 5+ years of consistent returns.

Over-Diversifying SIPs

- Why: More than 8 SIPs will dilute returns while increasing complexity.

- Solution: Avoid investing in more than 8 funds.

Ignoring Step-Up Feature

- Why: It can increase your overall returns and by ignoring it you will miss out on them.

- Solution: Increase your SIP by 10% annually.

Not Aligning With Goals

- Why: Random SIPs create confusion during redemption.

- Solution: Stick with your goals.

It is crucial to explore the risks that come with SIPs. Understanding these risks can help you make better selections. Let us discuss them in the next section.

Are There Any Risks in SIP?

Although SIP is one of the safest plans for mutual fund investments, it can not be entirely risk-free. The risks in SIPs include:

Market Volatility Risk

- Occurs with the changes in market conditions.

- Mitigation: Long-term holding and rupee-cost averaging.

Fund Performance Risk

- Comes when the fund does not perform well consistently.

- Mitigation: Diversify across large, flexi and index funds and select funds with 5+ years of experience.

Liquidity Risk

- This may occur with lock-in periods and exit loads for withdrawals in some funds.

- Mitigation: Align SIP tenure with financial goals and keep an emergency fund.

Inflation Risk

- Occurs when money loses value over time.

- Mitigation: Invest in equity SIPs and use step-up SIPs.

Behavioral Risk

- Associated with stopping SIPs during market crashes and missing recovery gains.

- Mitigation: Automate SIPs and avoid checking daily NAVs. Remember that time in the market surpasses timing market.

Interest Rate Risk

- Occurs when rising interest rates reduce bond prices.

- Mitigation: Prefer short-duration debt funds and hybrid or equity SIPs for the long term.

Conclusion

In short, SIP is a compelling option for investors who desire to grow financially over time. Systematic Investment Planning provides a structured approach to investing without worrying about market timings.

To start SIP investment in mutual funds can be effective for experienced investors as well as for those just starting.

Do you know that saying "A thousand-mile journey starts with one step?" Well, why not take that step today? Invest in SIP and grow your wealth over time.

FAQs

-

How to choose the best mutual fund for sip?

First, identify your goals & risk tolerance. Then choose a fund that best aligns with your stated parameters.

-

What is the lock-in period for SIP?

The lock-in period for ELSS schemes is primarily 3 years. Other mutual funds do not have a lock-in period.

-

Can I pause my SIP?

Yes, most fund houses give you the option to pause your SIP for a specific period.

-

What happens when SIP ends?

When SIP ends, you can redeem your units according to the NAV at that time. You can withdraw the whole amount or continue holding units.

-

What happens if you don't pay SIP for a month?

Your SIP will not be executed for the month you missed, but it will continue till you formally cancel it.

-

Is there any hidden cost that investors will incur for starting an SIP?

SIP does not have set-up fees, but you can come across hidden costs like expense ratios, exit loads and transaction charges that should be considered.

-

Can I withdraw from SIP anytime?

Yes, you can withdraw your money anytime from SIP by redeeming your SIP units according to the current NAV.

-

Can I withdraw my SIP before 1 year?

Yes, you can withdraw before 1 year from SIP. Just be careful of the exit loads, especially if you invested in multiple funds.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)