With increasing lifespan and inflation, ensuring retirement cash flow is vital. Mutual Funds offer reliable, well-managed, and diversified investment solutions. SIPs are simple and affordable for goal achievement.

“Freedom SIP” is an investment strategy that encourages disciplined investing through systematic investment plans (SIPs) for a set period. It is an optional blend of systematic investment and withdrawal. You invest for 8-30 years in a source scheme, then switch the accumulated fund to a target scheme of your choice.

Source scheme can be equity, and the target can be hybrid or debt to reduce risks.

SWP, a systematic withdrawal plan, starts from the target scheme, and it’s all automated with no investor intervention.

Difference Between Freedom SIP and Regular SIP

Regular SIP is a common way to invest a fixed sum of money at regular intervals (often monthly) into investments like mutual to work towards your financial goals. You have flexibility in choosing the funds, amounts, and investment duration.

The term “Freedom SIP” is less common and may refer to a personalized investment strategy that aims to provide financial freedom. It could involve a customized approach to investing that aligns with your financial goals and helps you achieve a sense of financial independence.

Process of investing in Freedom SIP

-

Decide SIP Amount

Determine a monthly SIP amount within your Budget, Striking a balance between your goals and daily expenses.

-

Select Focus Funds and Target Funds

Identify your investment focus (e.g., retirement, education, or wealth building) and choose funds that match your goals. Opt for equity funds for growth or deb funds for stability. Diversify your portfolio and consider your risk tolerance.

-

Decide SWP

In the future, when you need to take money out of your investment for your expenses or goals, create a plan for how often and how much you’ll withdraw. For example, if you’re saving for retirement, you can set up a plan to take out money every month or year to cover your retirement expenses. Your plan should match your specific needs.

-

Best funds for freedom SIP

Choose the right funds for your freedom SIP based on your goals and risk tolerance.

For long-term wealth, use diversified equity funds. For balancing risk or short term goals, consider debt or hybrid funds.

Pick mutual funds from reputable companies with a good track record.

Diversify across different types of assets for risk management, and review an d adjust your portfolio regularly to stay on track with your goals and comfort level.

Freedom SIP is perfect for retirement, creating a secondary income source for financial independence. It offers an attractive option for retirement planning. It allows monthly withdrawals in multiples of your investments, with multiples for longer tenures. This encouraged disciplined, long-term investing, preventing common behavioral mistakes.

The systematic withdrawal plan (SWP) provides regular income and wealth growth. Freedom SIP combines SIP and SWP for a secure retirement and fulfilling life expenses.

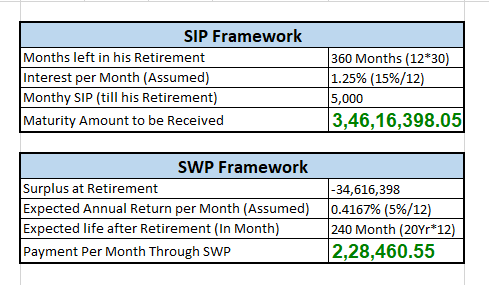

Let’s understand the retirement planning with simple example

Accumulation Phase (Using SIP)

- You start with a SIP by investing RS. 5000 per month.

- Your current age is 30, and you plan to retire at 60, so your investment tenure is 30 years.

- You expect an annual return of 15% (CAGR) on your investments.

Given these Parameters

- Over 30 years of regular investing, your total expected investment would be RS. 18 lakhs (RS. 5000 *12 months*30 years)

- With a 15% annual return, your investment would grow to approximately for 3.5 crores.

Distribution Phase (Using SWP)

- When you retire with RS. 3.5 crores, you plan to use a SWP to generate pension.

- You choose to park your retirement corpus in safe debt funds with no risk.

- These funds offer an annual return of 5%.

- With this setup, you can withdraw approximately RS. 200000 per month as a pension for the next 20 years.

Here’s how SIP in mutual funds can help to pave the way towards a better future for your child:

“Freedom SIP” Helps you sow the seeds of a better future, it rewards the early starters as starting an SIP early can help you take advantage of the power of compounding over time and allowing the dreamers of today to become tomorrow’s achievers.

It also inculcates financial discipline, provides a hassel-free investment experience, assists you in staying invested and tackles inflation better.

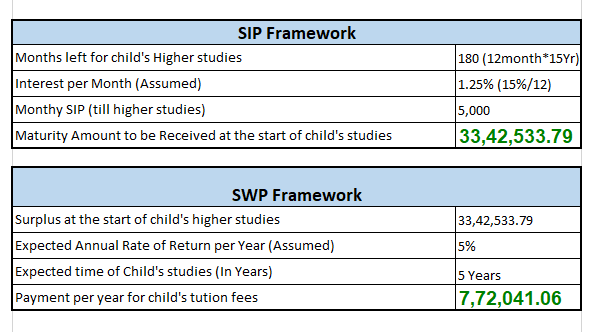

Let’s understand this with a simple example

Accumulation Phase (SIP)

- You start saving for your child’s education when they’re 5 year old.

- You invest RS. 5000 every month for 15 years.

- You expect a 15% annual growth on your investment

- By the time your child reaches 20 years, you aim to have around RS. 33,42,533.79 lakhs saved, which includes your initial investments and the profit you’ve earned.

Distribution Phase (SWP)

- You have the desired amount of RS. 33,42,533.79 lakhs.

- You invest itin safe, low-risk debt funds that return 5% annually.

- You plan to withdraw RS. 7,72,041.06 lakh each year for the next 5 years to cover your child’s college fees.

Conclusion

“Freedom SIP” offers a flexible and disciplined approach for a secure retirement and your child’s education . It encourages systematic investing and provides financial independence while tackling common behavioral mistakes. Through online SIP, it ensures reliable income during retirement. This versatile tool adapts to your unique goals, making your financial future brighter and more accessible. Consulting a financial advisor is a key for a tailored Online SIP plan to secure your financial journey.

Watch to Know More : How to find Best Mutual Funds ?

.webp&w=3840&q=75)