In the last week, the market witnessed significant volatility due to escalating and de-escalating tensions of a conflict between India and Pakistan. Significant transactions were recorded during the week which further increased the volatility in the market. Despite high volatility, market managed to end on a positive note as the cross-border tensions did not embark enough stress on the equities however fiscal deficit has been affected by the defense expenditure. Market barometer, Sensex gained marginally whereas barometer indices soared higher. Mid and small-cap indices enjoyed a notable growth during the week.

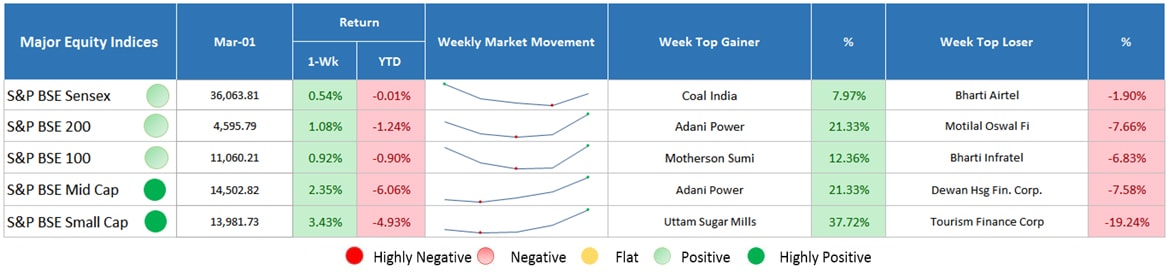

Major Equity Indices Performance

Return: As on March 01, 2019

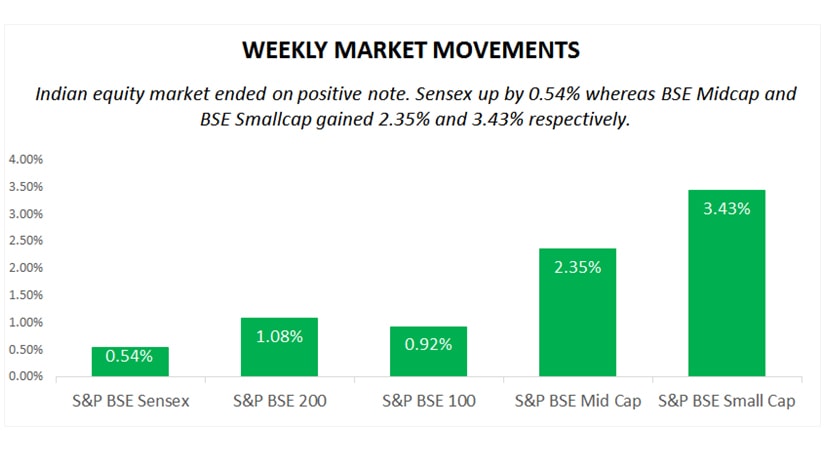

Last week, momentous volatility has been witnessed in the market due to geopolitical tensions between India and Pakistan. Despite this, market ended on positive note, Sensex surged 0.54% whereas S&P BSE Midcap and S&P BSE Small Cap were up by 2.35% and 3.43%. BSE 100 and BSE 200 ended higher by 0.92% and 1.08% respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

In the initial days of the week, optimism were seen in the market over US-China trade deal after the news that US President decision to extend postponed the imposition of tariff on Chinese imports. The decision has raised expectation among investors of possible trade deal between the two countries and turned sentiments positive. Talking about institutional investors, FIIs were the net buyers during all the trading sessions whereas DIIs were reported as net sellers. During the week, FIIs bought equities worth INR 7,640.54 crore whereas DIIs offload net equities worth INR 7,523.43 crore.

On the domestic front, Reserve Bank of India has moved out 3 public sector banks i.e. Dhanlaxmi Bank, Corporation Bank and Allahabad Bank from Prompt Corrective Action (PCA) framework upbeat sentiments. On the other side, poor economic data restricted market gains. According to the reported data, India’s 3rd quarter GDP came to 6.6% lower than 8% and 7% GDP reported in the last two quarters. Construction sector reported growth whereas agriculture and manufacturing sectors reported decline in growth. Apart from this, fiscal deficit touched INR 7.70 Lakh crore, 121.5% of full-year’s revised target. High fiscal deficit is the result of lower revenue collection.

On the global front, Federal Reserve’s patient approach while hiking rates in the future also contributed to the market upliftment. Despite this, Indian currency witnessed volatility amid Indo-Pak tensions but in the latter days, rupee strengthened after the news of release of Wing Commander Abhinandan Varthaman, aided gains.

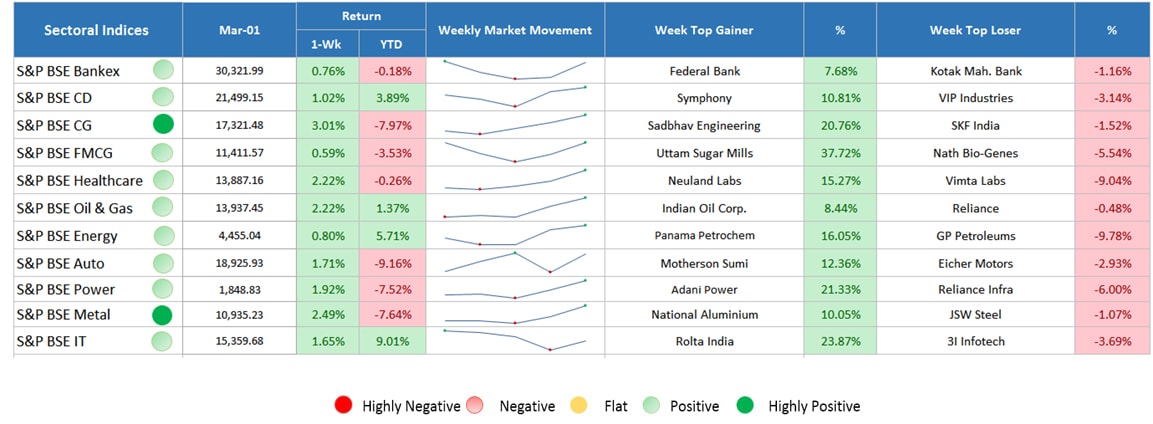

Sectoral Indices Performance

Return: As on March 01, 2019

Gaining Sectors

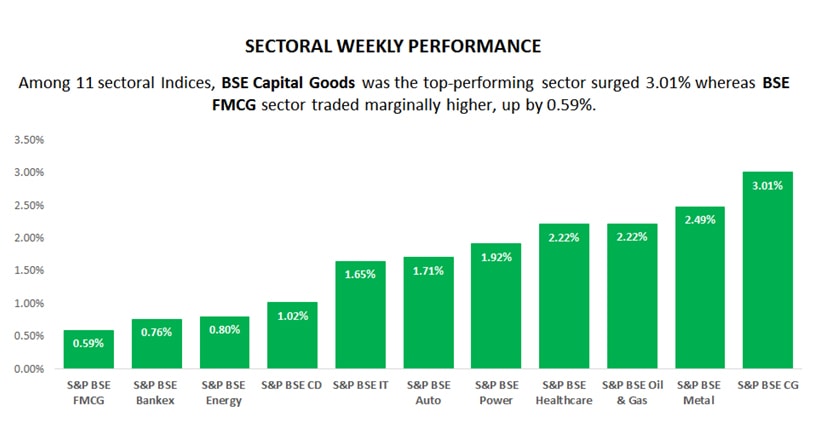

All the above listed 11 sectors on BSE traded positively.

- BSE Capital Goods was the top-performing sector, surged 3.01%. The market breadth on BSE capital goods remained strong where 23 stocks advanced whereas only 3 scrips declined.

- BSE Metal advanced by 2.49%. Metal stocks witnessed gains due to optimism over US-China trade talk progress.

- BSE Oil & Gas surged by 2.22%. Crude oil prices declined on the account of rising U.S. crude inventory. However, downside in oil prices were limited after the reports stated that OPEC & its allies will continue supply cut.

- BSE Healthcare sector advanced by 2.22%. USFDA Chief has reported that Indian generic manufacturers are complying with the US standards upbeat sentiments.

- BSE Power, Auto, IT, consumer durable, energy, bankex and FMCG witnessed some sort of gains due to buying interest.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

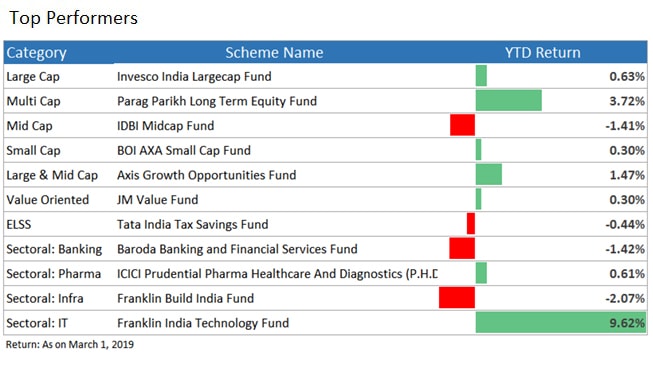

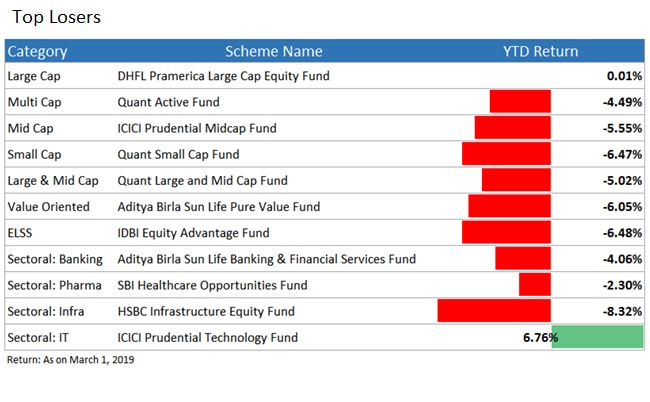

Top Performers & Losers

Rounding Up

Despite the geopolitical tensions between India and Pakistan, the stock market enjoyed a marginal growth due to contribution from every sector. The Indian indices have been showing enhancements since the last two weeks, effects of which can be witnessed from the YTD returns of the barometer indices. The upcoming weeks can be remunerative if the momentum prevails. SIP investments are likely to play a key role in delivering high returns while taking advantage of the corrections. Investors are advised to stay updated in the upcoming days with the latest trends and news to make optimum decisions. Get the supreme financial assistance from the financial experts at MySIPonline to enhance your investment strategy in mutual funds. In case of any query regarding regular plans of mutual funds, fill the form below and get ultimate solutions.