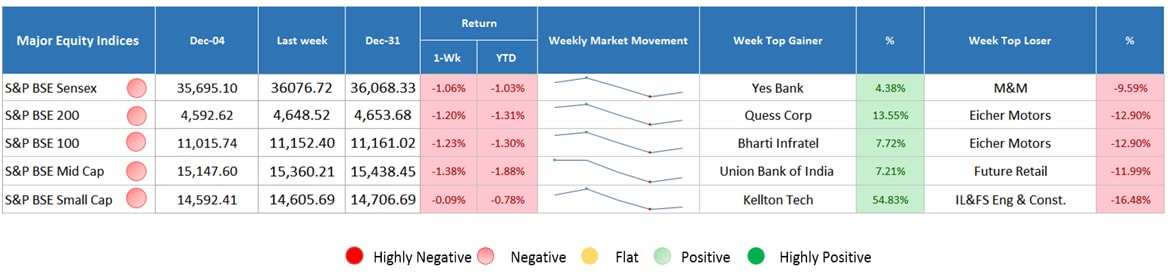

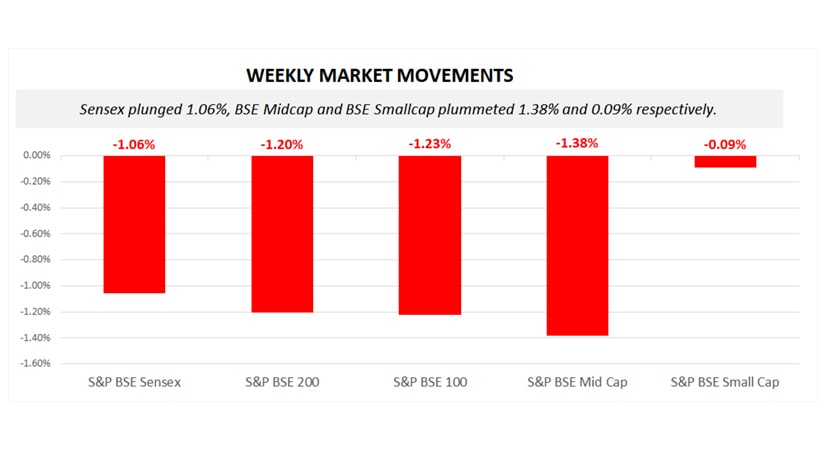

Sensex plunged 1.06%, BSE 100 and BSE 200 plummeted 1.20% and 1.23%. Among broader indices, S&P BSE Midcap down by 1.38% while BSE Small cap fell 0.09%. Although, on the first trading session of 2019, the market started on a positive note, by the end of the week, it pared all the gains.

Major Equity Indices Performance

Sensex down by 1.06%, BSE Midcap and BSE Smallcap lost 1.38% and 0.09%, resp. On Monday, the market ended on flattish note ahead of poor Chinese economic data, which in turn, raised concerns over slower global economic growth. On the other side, investors took a sigh of relief after the positive commentary by both the US and China’s president over their trade talk progress which boosted the market sentiments. On New Year day, during the intraday trade, Sensex was down significantly due to poor growth in core sector that came to 3.5% in November against 4.8% in the earlier month. However, by the end of the day, the market capped all the losses and ended in green due to buying interest witnessed in financial stocks and gain in some heavy weighted stocks like HDFC Bank. On the next day, the market pared all the gains as Sensex closed down by 363 points due to disappointing December month’s auto sales data, fell in global base metal price, and weakened currency. On the global front, fall in Nikkei India

Manufacturing Purchasing Managers Index added to the woes. On Thursday, the sentiments turned cautious ahead of corporate earnings season in the next week. On the global front, unstable US economic environment affected the sentiments. After two day’s consecutive fall, on Friday, the market ended higher. Gains in financial stocks like HDFC Bank and Housing Development Finance Corp offset losses in IT stocks. On the global front, investors are expecting rate cutting by the US Federal. Additionally, investors are waiting of corporate earnings results, at the time of upcoming election, analyst expect that these results will not have a significant impact on the market, unless companies’ earnings are dramatically beyond the expectations.

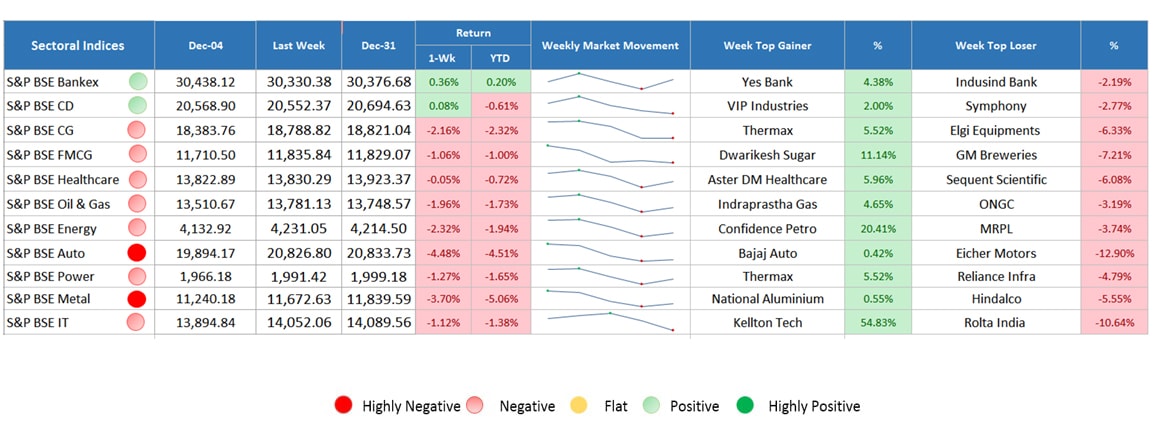

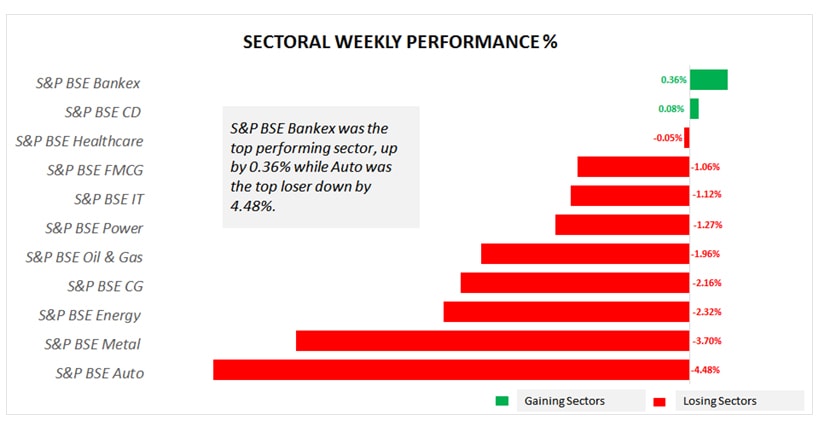

Sectoral Indices Performance

Gaining Sectors

Last week, S&P BSE Bankex was the top gainer, up by 0.36% due to some buying interest. Further, stocks also got support from the government plan to inject Rs 10,882 crore in four public sector banks. Consumer durable gained marginally, rose 0.08%.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

S&P BSE Auto was the top laggard, fell 4.48%. Weak sales data for the month of December affected the auto stocks. Decline in global base metal price affected the metal stocks, plummeted 3.70%. Other sectors including capital goods, oil & gas, power, IT, FMCG, and healthcare traded in red.

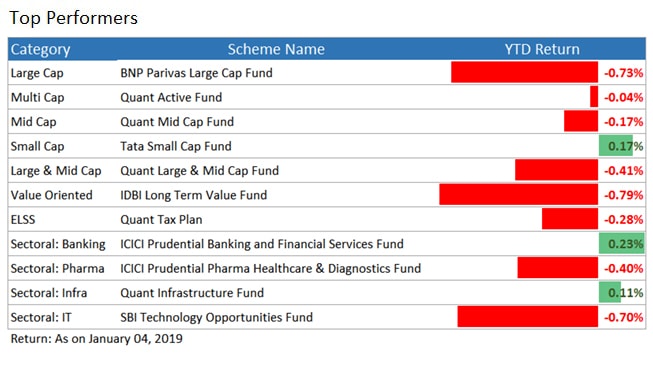

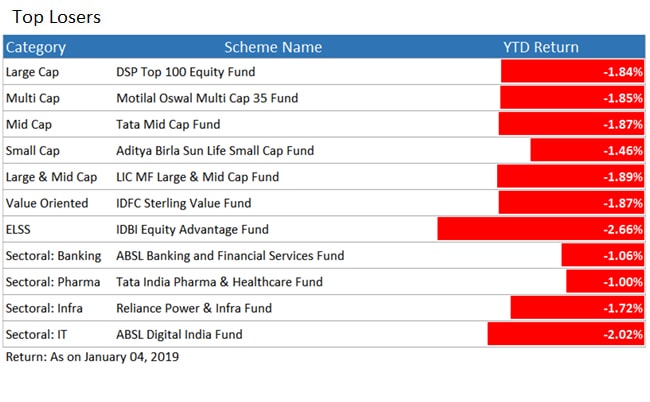

Top Performers & Losers

Conclusion

The turbulence seen in the past week, especially in the mid week, dampened the investors’ sentiments greatly. Even though there is no major change in the macroeconomic conditions, when a sell-off occurs, it is very hard to predict the outcomes. Experts also believe that such conditions can be seen in the future as well till the time of general elections. However, it is indeed a good time to make long-term investments. To seek a recommendation from our experts on the best SIP plans to invest in now, connect with MySIPonline.