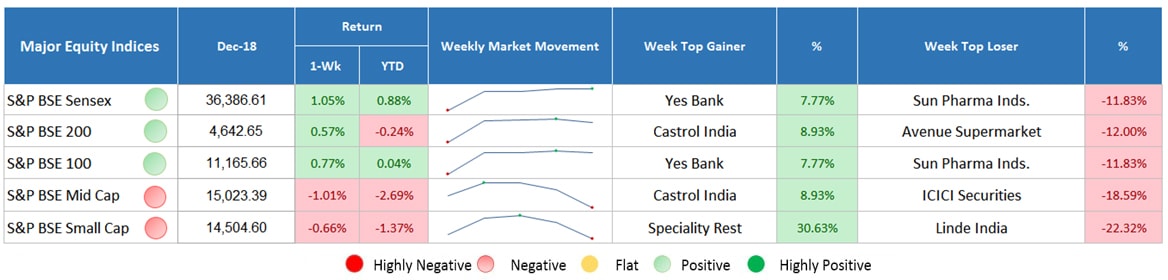

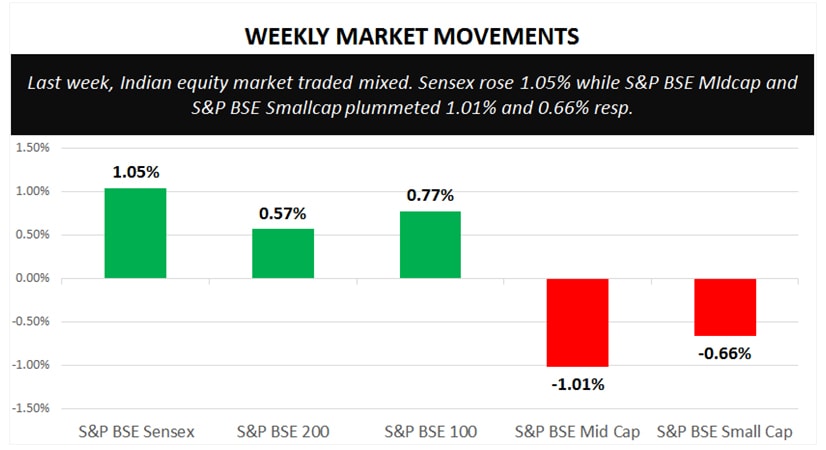

Last week, the Indian equity market traded on a mixed note. Sensex was up by 1.05%, BSE 200 and BSE 100 gained marginally; however, broader equity indices, S&P BSE Midcap and S&P BSE Smallcap fell 1.01% and 0.66%, resp.

Major Equity Indices Performance

On the first day, weak industrial production growth data that came to 17-month lowest point pulled the market lower. However, on the global front, unexpected decline in Chinese trade data that dropped to 2-year lowest point raised the global growth fear among investors. On the day, the market witnessed heavy sell-offs by foreign investors. Stocks of capital goods companies reported huge selling pressure, banking shares too were traded in red. Next day, the market recouped previous day’s losses as Sensex closed 465 points higher. Sentiments turned positive ahead of inflation data; reported to 2.19% lowest in last 18-month opened door of rate cut by RBI in Feb 2019.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Further, globally, China indicated that economy will be supported in the wake of slowing growth concern and poor trade data favored sentiments. Despite this, in the US, major banks announced its earnings beaten estimates. On the day, all the sectoral indices were traded in green.

On Wednesday, the market ended almost flat. It is because, India’s trade deficit narrowed to $13.08 billion in the month of December 2018 against $14.20 billion in the same month of preceding year. Trade deficit declined due to contracted imports by 2.44% whereas exports inched up by 0.34%. However, on the global side, uncertainty around Brexit risen after UK PM faced no confidence vote. Later, the market traded marginally higher as investors stayed sidelines and kept their eye upon some major corporate earnings announcements.

Last day, Sensex ended almost flat while S&P BSE Midcap and S&P BSE Smallcap traded in loss. Reliance Industries has reported solid quarterly earnings and become the first Indian private company that has achieved milestone of Rs. 10,000 crore quarterly profit. On the day, the scrip was the top gainer on Sensex, climbed 4.40%. Among sectoral indices, capital goods and healthcare stocks witnessed selling pressure.

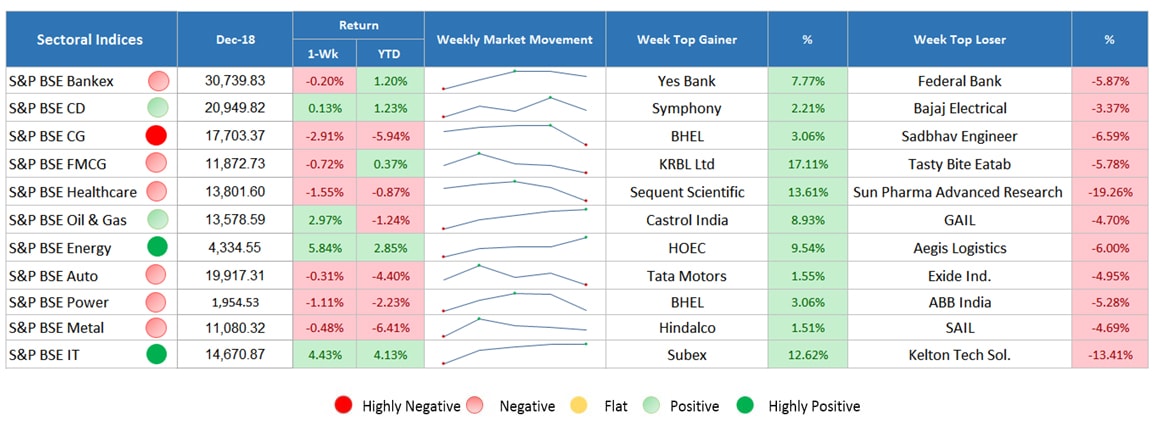

Sectoral Indices Performance

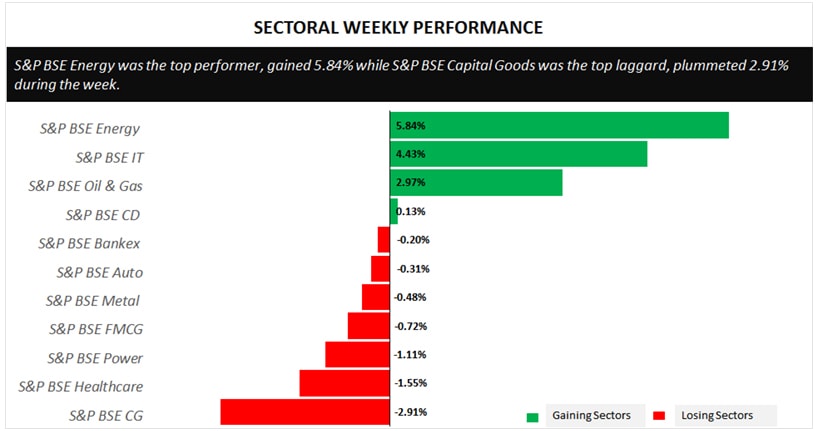

Gaining Sectors

Out of above 11 sectors, only 4 sectors traded in green with Energy topping the list with a weekly gain of 5.84% followed by S&P BSE IT sector which gained 4.43%. S&P BSE Oil & Gas and S&P BSE Consumer Durable traded marginally higher, up by 2.97% and 0.13%, resp.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

S&P BSE Capital Goods was the top laggard at a weekly loss of 2.91%. Graphite India, Sadbhav Engineering, L&T, Dilip Buildcon were the top loser dragged index lower. Other sectors, i.e., healthcare, power, FMCG, metal, auto and bankex also traded in red; plunged by 1.55%, 1.11%, 0.72%, 0.48%, 0.31%, and 0.20%, resp.

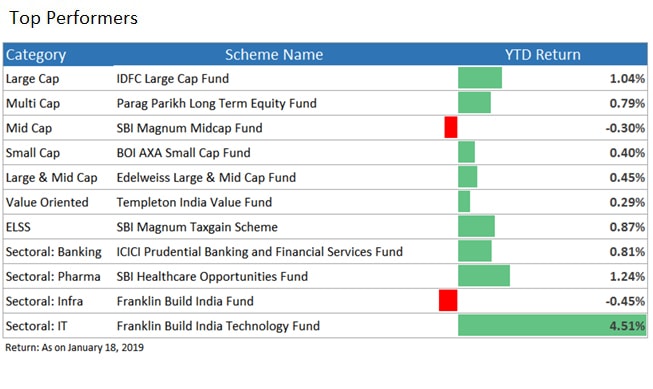

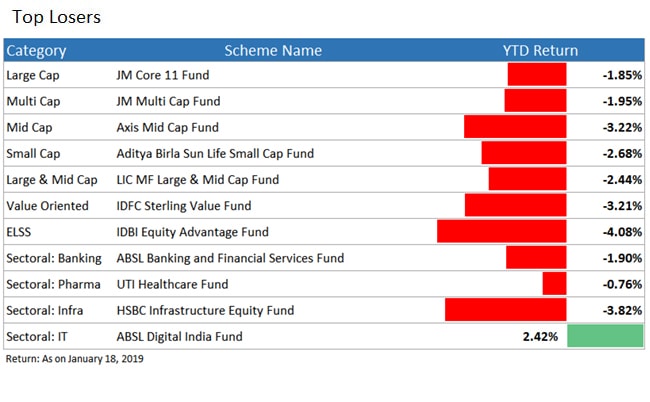

Top Performers & Losers

Conclusion

A mixed bag of emotions was seen in the market as the Sensex experienced a gain of 1.05% while there were dark clouds for S&P BSE Midcap and S&P BSE Smallcap. With all the ongoing corrections, one thing that even Warren Buffet would fear doing is timing the market, though he has a very strong view on the price levels appropriate to individual shares. Seeing the condition of the report generated above, we would also suggest investors to stop timing the market and lose their hard-earned money in the process. It’s time to make investment in mutual funds via SIP as the NAV of most of the schemes are low. Take benefit of rupee cost averaging and make the most from your investments. Connect with the experts at MySIPonline today to seek recommendation on the best mutual funds to invest in now.