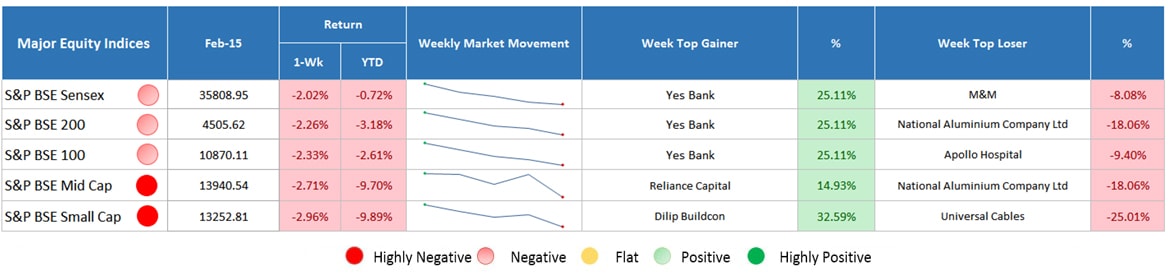

During the week, the overall market trend was negative where all the major equity indices closed on a negative note. The market barometer, Sensex outperformed the broader market indices.

Major Equity Indices Performance

Return: As on Feb 15, 2019

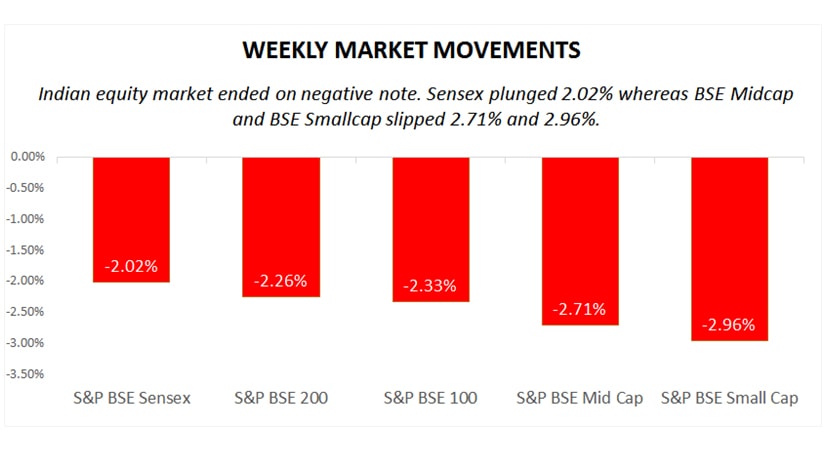

Sensex snapped at 2.02% while BSE Midcap and BSE Small cap slipped by 2.74% and 2.96%, respectively. Also, BSE100 and BSE 200 were down by 2.26% and 2.33%, resp.

The rise in oil prices bolstered by OPEC’s supply cut and higher than expected cut by Saudi Arabia affected the investors’ sentiments. On the global side, weak US retail sales data for the month of December added to the woes. Further, continued selling by DIIs and FIIs extended the losses. Investors traded cautiously and kept their eyes over the US-China trade talks.

However, on the domestic front, the strong IIP data and lowered inflation rate upbeat the sentiments. In December, India’s Industrial Production came on track at a growth of 2.4% against 0.5% in preceding month. The growth is mainly driven by manufacturing sector, expanded by 2.7% against contraction by 0.4% a month before. Moreover, January’s consumer price inflation data has shown a further decline to 2.05% driven by deflation in food products and drop in fuel inflation. Further, January’s wholesale price inflation cooled off to 2.74% on the account of cheaper fuel, lowest since the last 10 months.

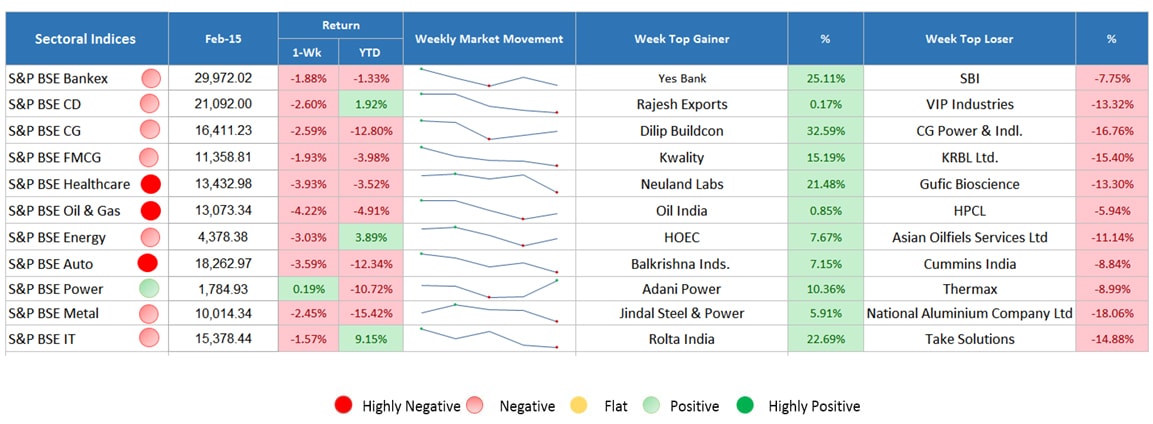

Sectoral Indices Performance

Return: As on Feb 15, 2019

Gaining Sectors

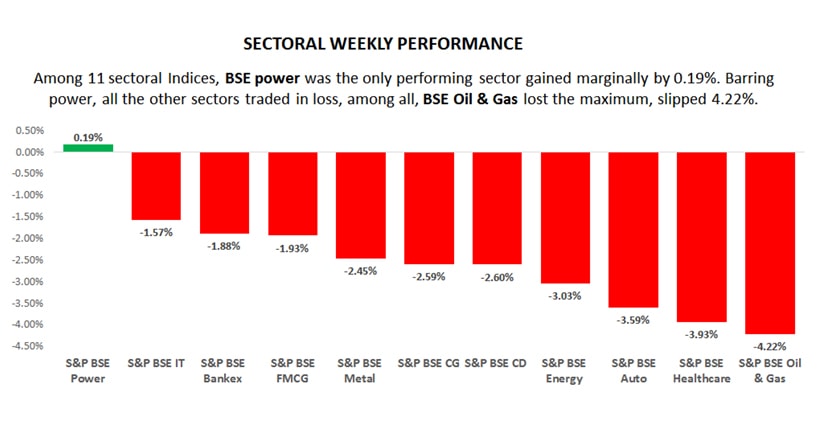

Last week, on BSE front, S&P BSE Power was the only performing sector which traded marginal higher by 0.19%.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

On BSE, all the sectoral indices except for BSE Power, traded in loss. Among 11 sectoral indices listed above, S&P BSE Oil & Gas was the worst-performing sector, slipped 4.22% due to rise in oil prices. BSE Healthcare snapped at 3.93% and BSE Auto shrunk by 3.59%. Other sectors like Energy, consumer durable, capital goods, metal, and FMCG too were traded lower by 3.03%, 2.60%, 2.59%, 2.45% and 1.93%, resp. Bankex and IT were marginally down by 1.88% and 1.57%. Institutional investors raised their exposure to selected banking stocks, i.e., Axis Bank, HDFC bank, and ICICI Bank, and an IT stock, i.e., Infosys Ltd which helped these sectors to restrict losses.

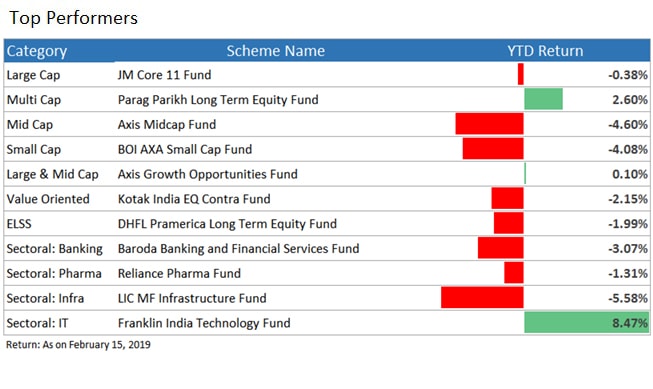

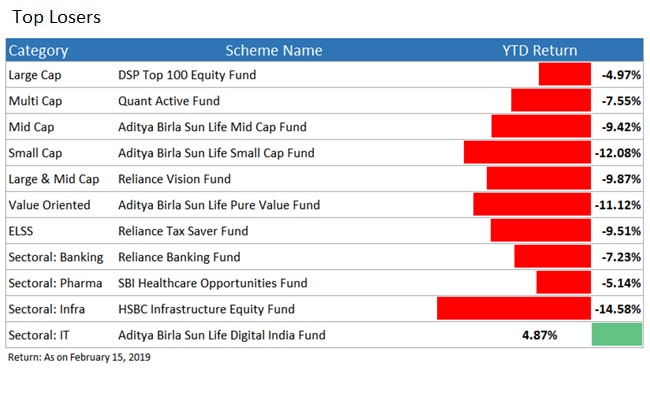

Top Performers & Losers

Summing Up

Volatility in the Indian stock market ramped up again the past week, with major indices trading in red. Fortunately, there are excellent ways which can help investors to protect their portfolios even during such periods of market volatility. If these swings in the stock market seem too chaotic to predict, remember that there’s no reason to subject yourself to such random headlines. Our purpose to provide you with the information is to update you with the regular trend so that you can invest accordingly. Assuming you have a long-term investment horizon of at least five years, there are high chances that the current volatility will pass in a couple of months. The long-term investors can navigate a volatile market by simply investing in mutual funds via SIP.

If you are confused about where to start, simply connect with the experts associated with MySIPonline and get recommendations. If a query concerning regular mutual fund worries you, mention it in the form provided below to get a solution asap.