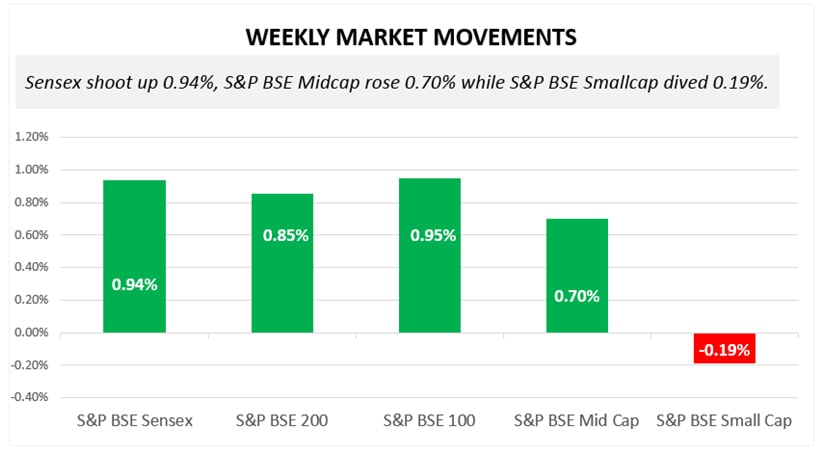

Amid global volatility, Sensex rallied 0.94%, S&P BSE Midcap advanced 0.70% while S&P BSE Smallcap dived 0.19%.

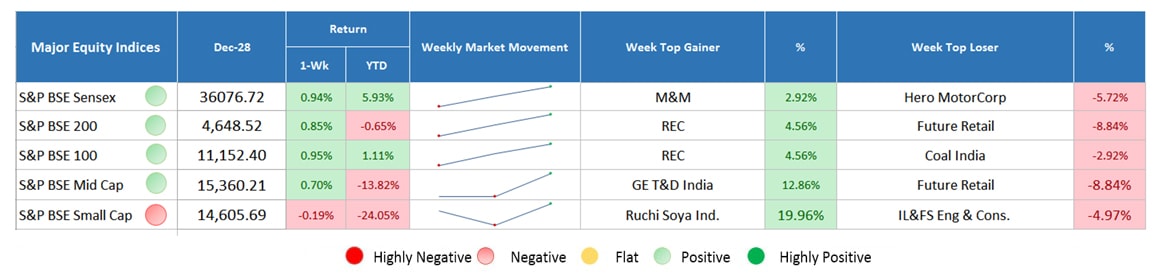

Major Equity Indices Performance

Sensex rallied 0.94%, S&P BSE 100 and S&P BSE 200 shoot up 0.85% and 0.95%, respectively. Broader market indices; S&P BSE Midcap gained 0.70%, however, S&P BSE Smallcap lost 0.19%.

On Monday, the market witnessed loss where Sensex lost 0.74%. On the global front, concerns over slower world economic growth and political uncertainty in the US affected domestic equity market too. However, later, the market recovered earlier session’s losses to some extent ahead of derivative contracts expiry. On domestic front, a statement by Finance Minister, Arun Jaitley to cut GST rate on 23 items from 28% to 18% and 12% tax slab affected the market sentiments. It is a step forward to adopt a single standard GST system in the forthcoming period where the standard rate may be in between the two standard rates; 12% and 18%. Again, the market saw further upside and recovered all the losses of Monday’s trading session. Sensex rose 157 points and closed at 35,807 mark. Weakened crude oil prices and the government’s plan to ease liquidity worries among state run banks by injecting capital worth Rs. 286.15 billion boosted the market. On the contrary side, the gains remains restricted on the expiry of futures & options. Last day, the market continued to edge higher led by an uptick in banking and financial stocks. Sensex gained 0.75%, S&P BSE Midcap and S&P BSE Smallcap up by 0.93% and 0.86%, respectively.

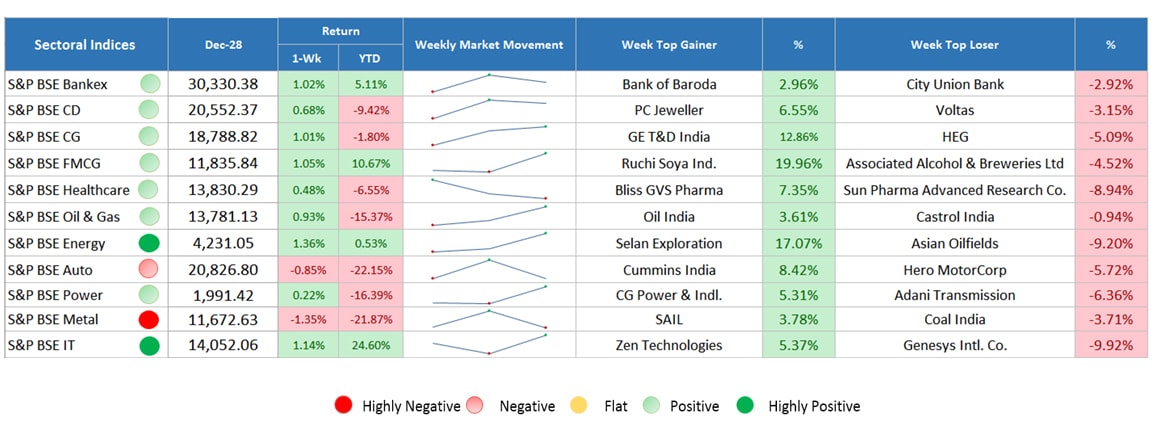

Sectoral Indices Performance

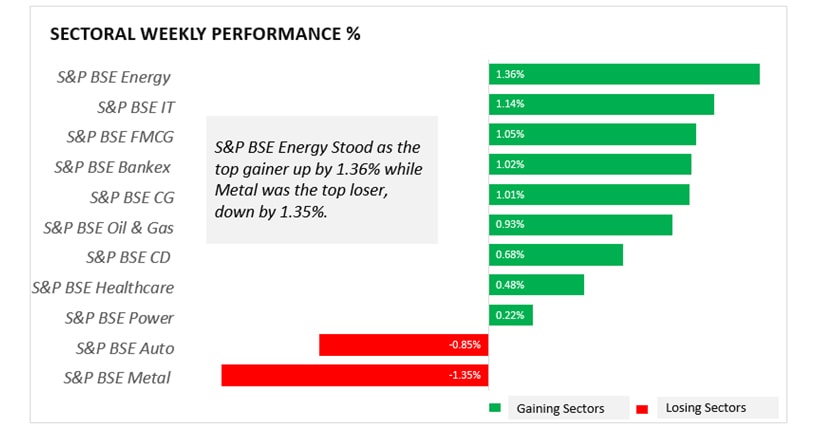

Gaining Sectors

Among sectoral indices, S&P BSE Energy gained the highest, up by 1.36%. IT, which was the top laggard in the earlier week, turned into the second most gaining sector, up by 1.14% on BSE. The government’s plan to inject liquidity into state-run-banks brought buying interest in banking stocks witnessed by S&P BSE Bankex, up by 1.02%. Other sectors including FMCG, Capital goods, Oil & Gas, Consumer durable, Healthcare, and Power also gained marginally.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

S&P BSE Metal witnessed selling pressure, dived 1.35% followed by S&P BSE Auto, down by 0.85%. Auto stocks affected after ICRA’s forecast that 2-wheeler auto sales is likely to rise 8%-10% per annum. Slower demand growth is driven by the rising cost of acquisition due to high insurance price and high raw material cost. On the other side, growth is supported by growing per capita income, higher MSP, farmers’ loan waiver in a few states, and normal monsoon expectation.

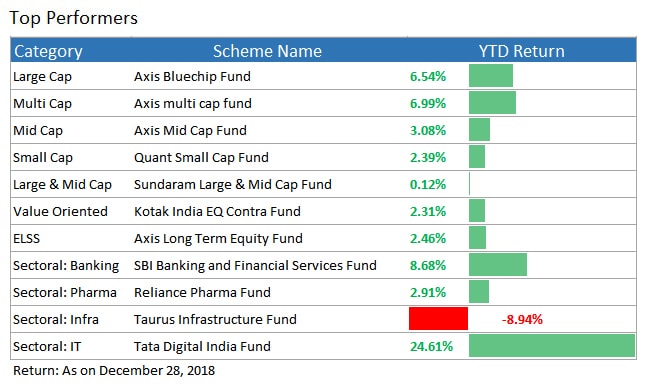

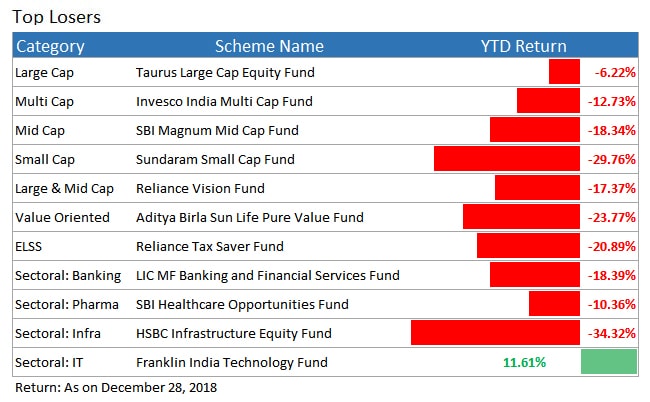

Top Performers & Losers

Summing Up

Despite of the weak global cues and several other domestic factors, there was rally in the market with about 0.94%. This clear cut report on the last week’s market performance will help you in making the right investment decisions for the upcoming new year ahead. This is the last report from the year 2018, and therefore we wish that the year didn’t went that bad for you. Our motive behind publishing it is to help you earn optimal returns by keeping you updated of the swings of the markets. To play a safe bet, we want you to invest in mutual funds. If you have any query regarding investing in mutual funds via SIP or lumpsum, you may consult our experts at MySIPonline and in case you have doubts related to the regular funds, you may post the same here.