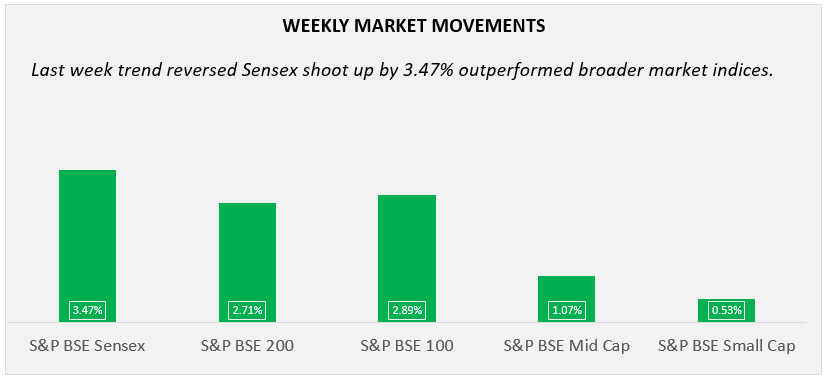

During the week, Sensex shoot up by 3.47% where it outperformed S&P BSE Midcap and S&P BSE Smallcap which both traded marginally higher by 1.07% and 0.53%, respectively. Rebounded rupee, declined crude oil prices, and the US Fed chairman’s dovish commentary over the interest rate supported the market.

Table of Content

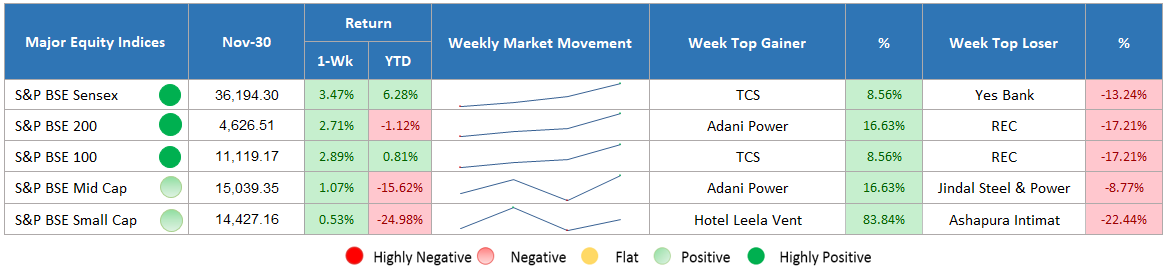

Major Equity Indices Performance

Sensex surged by 3.47% followed by S&P BSE 100 and S&P BSE 200 which traded higher by 2.89% and 2.71%, respectively during the week. However, the broader market indices gained marginally with S&P BSE Midcap and S&P BSE Smallcap by 1.07% and 0.53%, respectively.

Initially, the market gained ahead of positive Asian cues, strengthened rupee against the US dollar, and buying interest in consumer goods companies. On the next day, the market continued the gaining streak mainly on the account of appreciated currency and softened crude oil prices, which in turn, ease concerns over inflationary pressure. However, on the other side, investor sentiments remain jittery over the trade war worries as the US President announced that there is less likelihood that the administration would delay 25% tariff charges on Chinese goods.

Additionally, the gains were also restricted because of expiry of derivative contracts. The market continued the same trend on the third consecutive trading session because investors expect an optimistic outcome of the G20 summit meeting that will end the US-China trade battle. On the day, large cap indices traded in green while midcap and smallcap indices ended lower. On Thursday, Sensex shoots up by 453.46 points due to rebounded rupee that touched 3-month highest point and slipped oil prices that touched the lowest point since October 2017. Apart from this, the US Federal Chairman’s dovish comment over interest rate regime. He said that the interest rate is slightly below the neutral rate which means there is a possibility of a marginal rate hike in future. On the last day, rupee further strengthened by 27 paise and touched 4-months’ high mark since August 1. It is mainly on the account of stabilizing crude oil prices and rise in FII inflows.

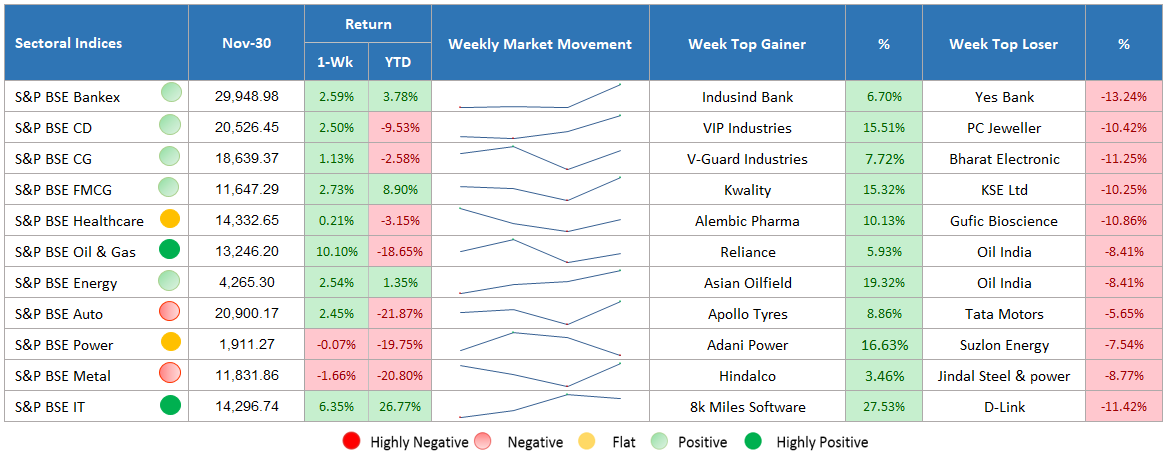

Sectoral Indices Performance

Gaining Sectors

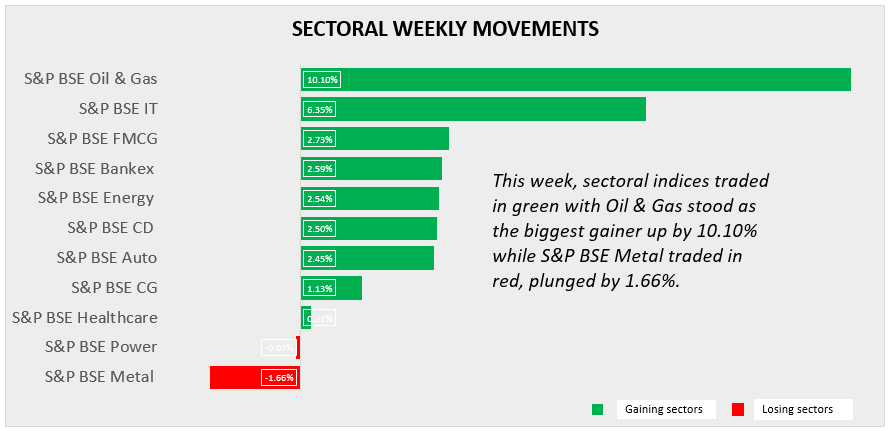

Most of the sectoral indices traded in green, among all, S&P BSE Oil & Gas remains the top gainer which shoot up by 10.10%. Stabilizing crude oil price benefited the oil & gas sector. IT stood as the second biggest sectoral gainer, traded higher by 6.35%. Other sectors including FMCG, bankex, energy, consumer durable, auto, and capital goods have seen buying pressure up by 2.73%, 2.59%, 2.54%, 2.50%, 2.45%, and 1.13%, respectively. Healthcare and power sectors ended almost flat.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

Across 11 sectoral indices on BSE, only S&P BSE Metal traded in red, lost 1.66% value.

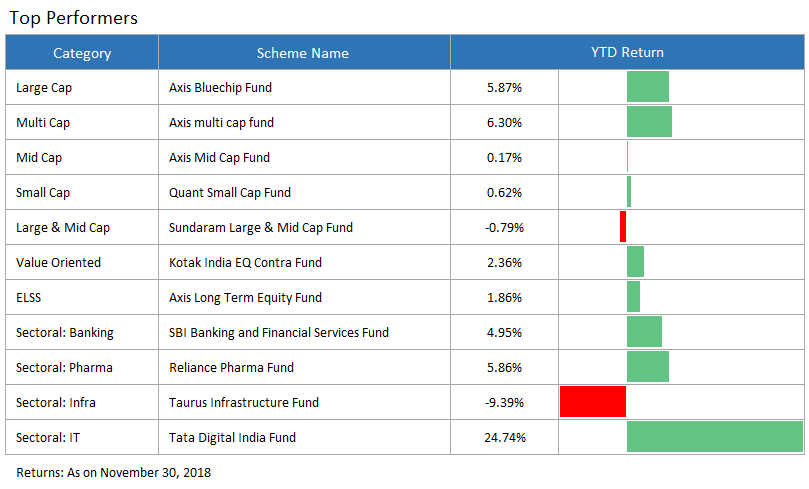

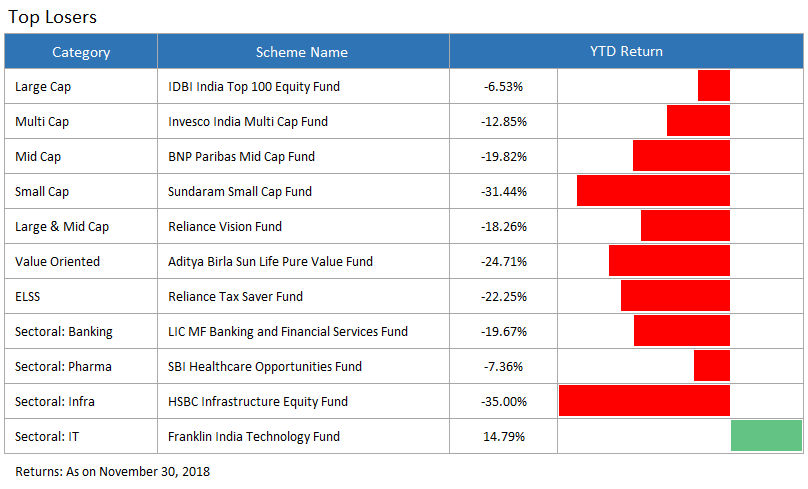

Top Performers & Losers

Conclusion

The market ended on a positive note past week and this is a strong indication towards positive waves coming down the line. The same trend can continue to remain upbeat and we can expect the rally to extend immediately towards 11,000-11,150 levels. These ups and downs are a part of market movement, so the decision you make of investment should no where dependent on it, especially if you are planning on investing in mutual funds. To get the best recommendation from the industry experts, connect with us before making any new investment in mutual funds.