Continuing with the positive performance, market extended the winning streak with Sensex outperforming broader market indices. Continued inflow from foreign institutional investors, RBI’s decision to infuse more liquidity and narrowed trade deficit upbeat sentiments whereas on the contrary side, higher inflation and weakened factory output data capped market gains. Let’s find out what happened in the market last week.

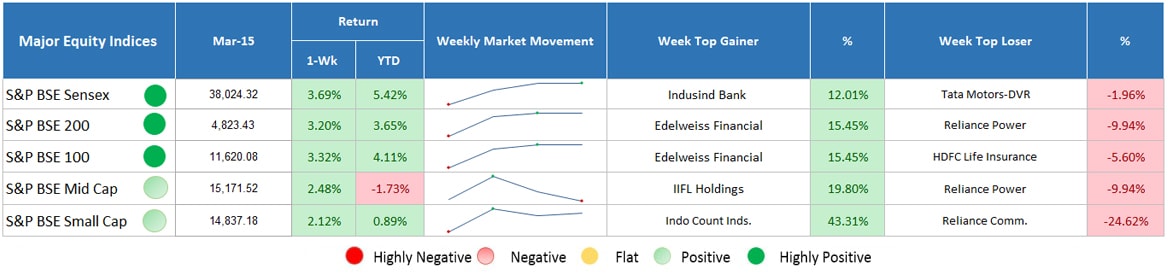

Major Equity Indices Performance

Return: As on March 15, 2019

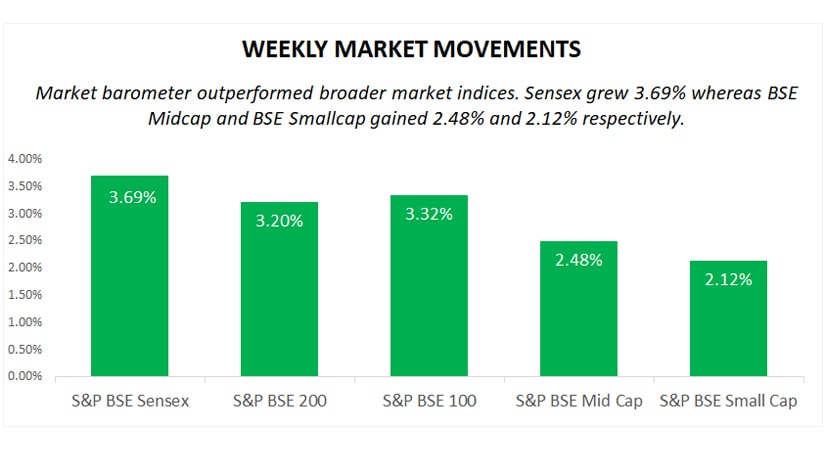

In the past week, Sensex closed 3.69% greater than broader market indices, whereas BSE Midcap and BSE Smallcap ended with weekly gains of 2.48% and 2.12%. BSE 200 and BSE 100 went up by 3.20% and 3.32%, respectively.

One of the major reasons that improved sentiments is continuous inflow from FIIs (Foreign Institutional Investors) that reflect that they are optimistic on the Indian market. This week, FIIs bought INR 14,817.09 crore worth of equities more than thrice to that of last week. On the contrary side, DIIs remain net sellers and offloaded equities worth INR 7402.30 crore. Higher FIIs inflow than DIIs outflow upbeat market sentiments. Moreover, sustained foreign inflow and buying in domestic equities strengthened rupee.

Adding to a great market movement, banking stocks also showed good gains and contributed to the index rally. The major reason for the upside is the decision of RBI to put more liquidity into the system through forex swap. This is a new tool that central bank has decided to use for resolving ongoing liquidity issues. On the global side, stronger US retail sales data than expectations boosted sentiments.

Last week, inflation and index of industrial data were released and according to the reports, inflation grew while factory output came down which spell bad news for the economy. Evidencing it, in February, wholesale price inflation rose to 2.93%, which was 2.74% in the preceding month. High inflation is the result of spike in food and fuel prices. Similarly, consumer price inflation also grew from 1.97% to 2.57%, highest since last 4 months. It clearly signals that inflation is moving up at both the retail and wholesale level. However, CPI which is still below the RBI’s medium term target level raise expectations of further rate cut in future.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Apart from this, Index of Industrial Production (IIP) for the month of January dropped to 1.7% which was 7.5% in the same month of last year. Slowdown in IIP were driven by deceleration in manufacturing and capital goods sector. Among all, construction sector witnessed strong growth of 7.9% still relatively lower than preceding month’s growth of 10%.

On the other side, trade deficit narrowed to $9.5 billion on the account of sharp fall in the import of oil, gold and electronics whereas export went up to $26.7 billion which further improved sentiments and added gains.

On the global front, Brexit remains the key focus where Prime Minister Theresa May announced that she is ready for no-deal brexit on 29th March 2019. However, lawmakers voted against and asked her to rule out without deal brexit because it will have a direct impact on the trading activities and political relationship. Therefore, later, Theresa requested to extend the brexit to 30th June, so that, a deal can be finalized during the extension period.

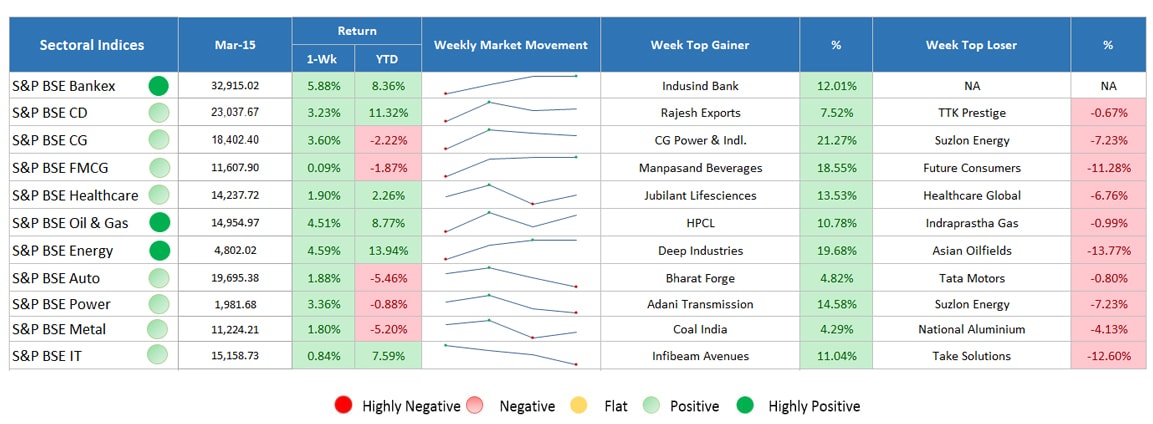

Sectoral Indices Performance

Return: As on March 15, 2019

Gaining sectors

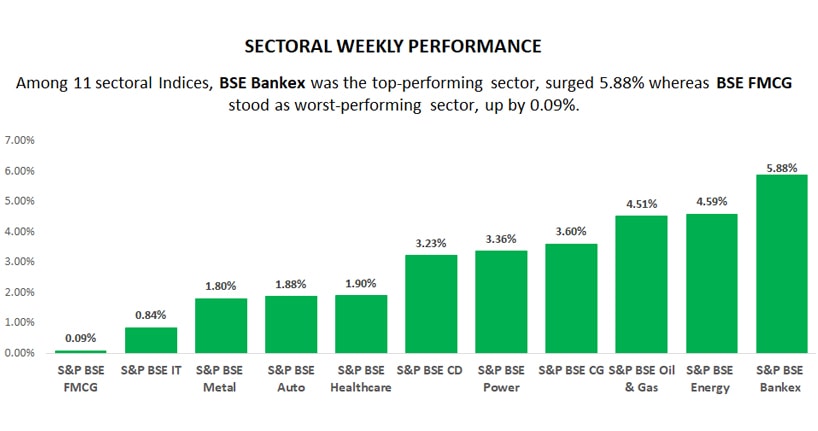

Among 11 above listed sectors on BSE, all the sectors showed a positive growth.

- BSE Bankex was the top-performing sector, and showed a rise of 5.88%. RBI’s decision to pour more liquidity into the banking system through forex swaps, improved sentiments.

- BSE Energy and BSE Oil & Gas grew 4.59% and 4.51%.

- BSE capital goods, advanced by 3.60%. Other sectors including power, consumer durable, healthcare, auto, metal, IT and FMCG gained marginally by 3.36%, 3.23%, 1.90%, 1.88%, 1.80%, 0.84% and 0.09%, respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

- Last week, none of the sector traded in red.

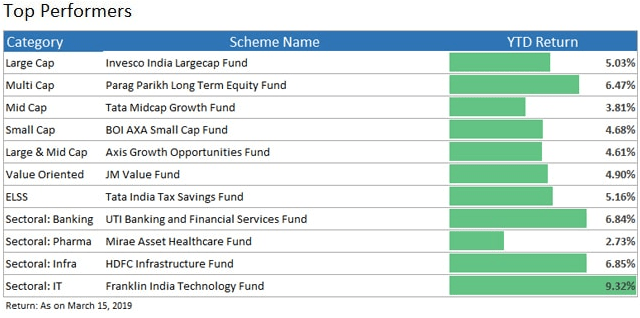

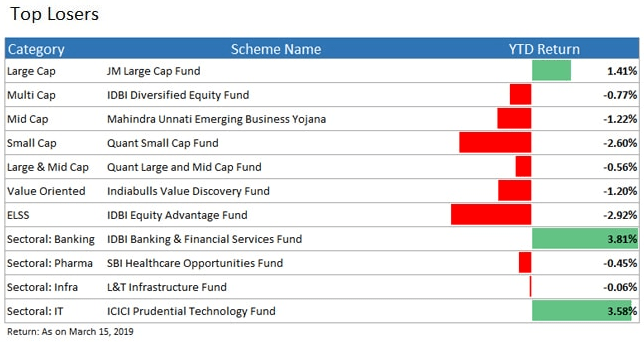

Mutual Fund Categories: Top Performers & losers

The Final Note:

Reading the above report you can see that market stayed on a positive note and all the sectoral indices closed in green. Now, looking at the current market conditions a positive growth can be expected in the coming sessions too, but it may be possible that it will be sector based. Stay tuned to get updated with the next weeks performance, and in case of any query or to make investments, feel free to connect with the experts of MySIPonline.