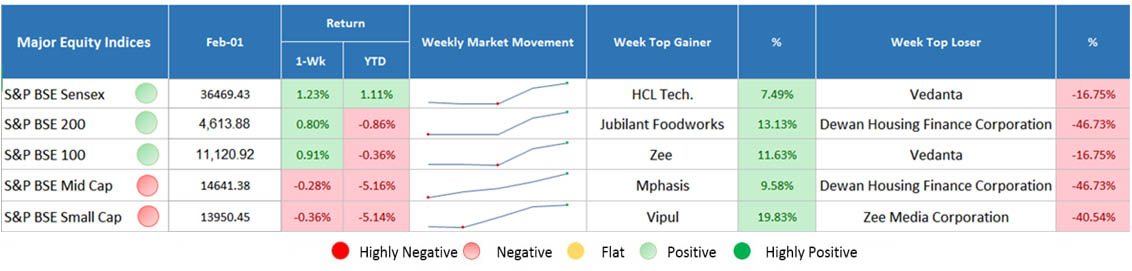

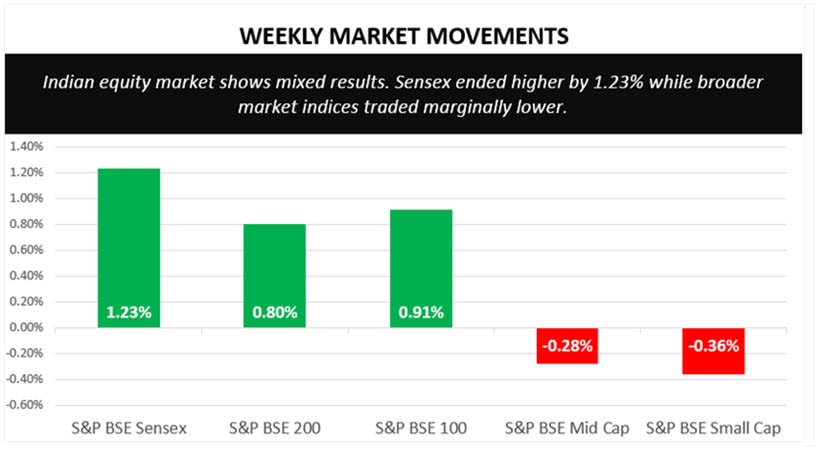

As the week ended, the market recouped all the losses and ended marginally higher; however, in the broader market indices, S&P BSE Midcap and S&P BSE Smallcap plunged marginally by 0.28% and 0.36%, respectively.

Major Equity Indices Performance

The Sensex gained 1.23% followed BSE 100 and BSE 200 rose 0.91% and 0.80%, respectively. On the contrary side, S&P BSE Midcap and S&P BSE Smallcap plummeted by 0.28% and 0.36%, respectively.

By the week starting, the market opened negative after the disappointed December quarterly results reported by the Auto Major, Maruti Suzuki. The company’s third quarter profits fell 17% and came to Rs. 1,489 crore. High commodity costs, heavy discount offering, and adverse forex movement were the key reasons behind decline in the profits. On the day, the market barometer witnessed heavy selloff than BSE Midcap and BSE Smallcap. The Sensex closed 368.84 mark lower whereas BSE Midcap and BSE Smallcap ended 270.28 and 278.66 points lower, resp.

During the week, investors traded anxiously ahead of many scheduled events like US Fed Reserve’s FOMC meeting, US-China trade talk, F&O expiry and interim budget. On Tuesday, the broader indices relatively outperformed the broader market. Healthcare stocks seen some buying pressure and pushed S&P BSE Pharma sector 0.75% higher. On the third day, the market ended flat as investors looked forward to the January month’s F&O expiry and upcoming interim budget. On the global front, investors keep their eye upon the US-China Trade talk and Federal Reserve meeting outcome. BSE midcap and BSE smallcap rose 0.22% and 0.78%, resp., on the day.

On Thursday, upbeat sentiments brought a rally in the market. Investors’ sentiments turned positive because the US Federal Reserve did not change the interest rates. Furthermore, the market participants started expecting from the interim budget to be declare on the very next day. On the day, the Sensex closed 665 points higher and recouped last 3 day’s losses outperforming the broader indices.

Last day, investors cheered after the announcement farm-friendly budget. The market extended gains where the Sensex closed 0.59% higher and BSE midcap and BSE smallcap rose 0.56% and 0.17%, respectively. Among sectoral indices, BSE Auto and BSE FMCG sector witnessed good buying, gained 2.65% and 1.14%, respectively. On the flip side, banking and finance stocks witnessed heavy selling.

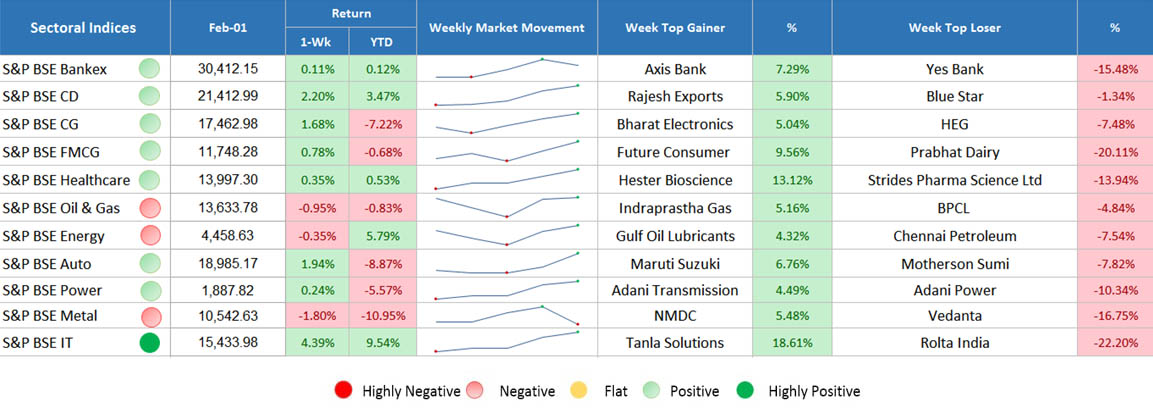

Sectoral Indices Performance

Gaining Sectors

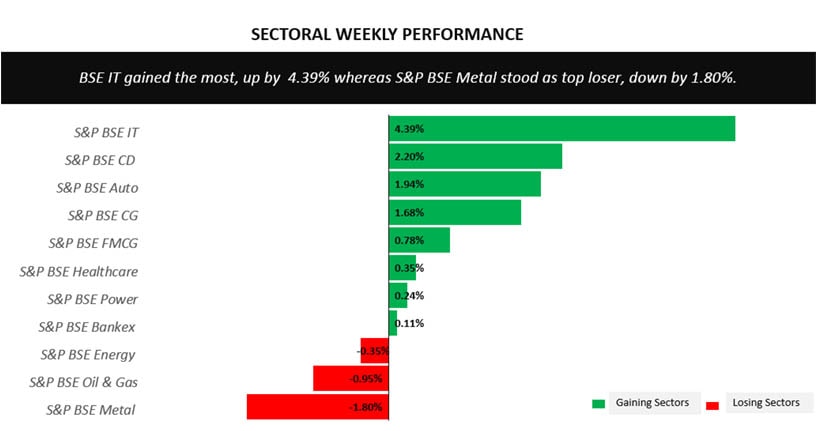

Many sectoral indices on BSE traded in green. IT topped the list with 4.39% weekly gain. Stock seen buying interest after strong December quarterly returns. Sector continuously traded in profits for five consecutive trading session. Consumer durable, auto, capital goods, FMCG, healthcare, power, and bankex too ended marginally higher. The upbeat sentiments in auto stocks were mainly supported by farm-friendly budget declaration. On Friday, big auto companies like Hero Motor Corporation and Maruti Suzuki rallied 7.50% and 5%, respectively. Other companies, i.e., TVS Motors, Bajaj Auto, etc., too were ended in green.

Losing Sectors

BSE Metal lost the maximum, plunged by 1.80%. Metal stocks slipped due to heavy losses suffered by Vedanta where on Friday, the stocks plunged by 17.82%. Company has reported poor quarterly numbers due to decline in commodity prices and disruption in copper smelter operations. BSE Oil & Gas and BSE Energy fell marginally by 0.95% and 0.35%, respectively.

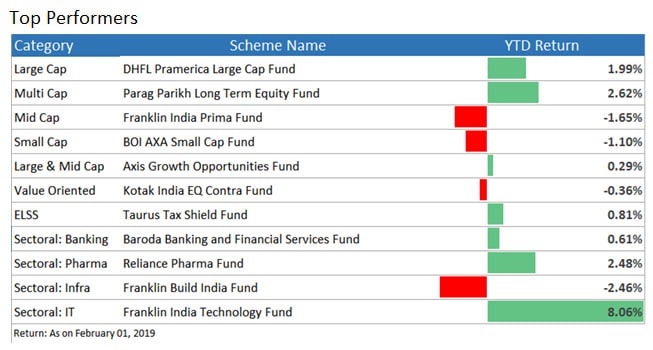

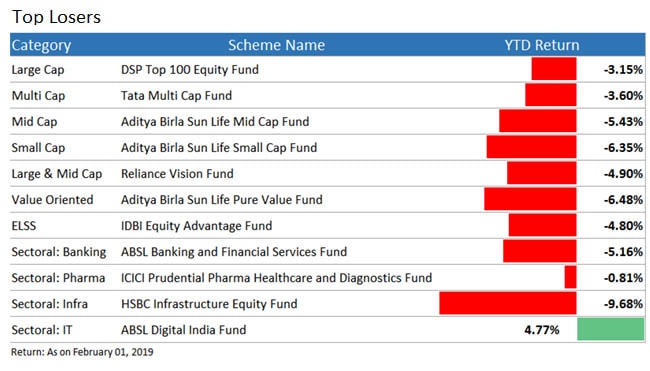

Top Performers & Losers

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Conclusion

Interim Budget’s outcome has been marginally better than what was expected by the market as it provided incentives to small farmers and common man while maintaining a rationality in the long term. The proposal to give full rebate to tax payers having annual income up to Rs. 5 lakh has given a good boost to the equity market. These were a few of the highlights of the week which were responsible for the movement in the market. For more such market updates, stay tuned with the experts at MySIPonline. In case you are willing to know where the investment should be made in this critical time, contact our mutual fund experts asap. We will provide you with a customized portfolio suiting your needs. Have a query related to regular mutual funds? Mention it in the form provided below to seek answer.