Past week bought some cheerfulness among the investors as all the major Indian equity indices ended on a positive note. Among the key indices, Sensex gained marginally but underperformed broader market indices.

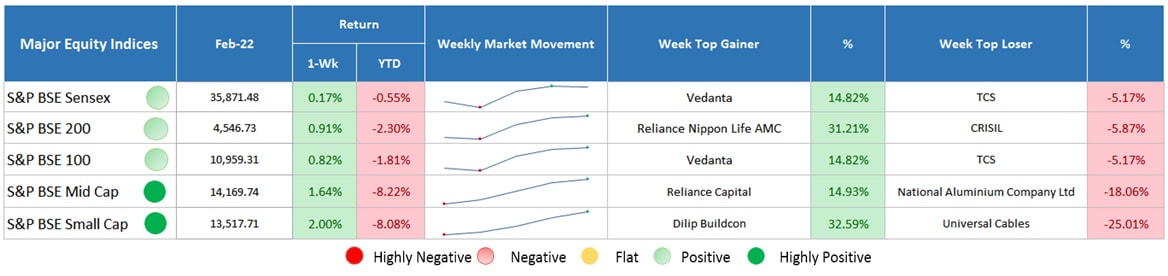

Major Equity Indices Performance

Return: As on Feb 22, 2019

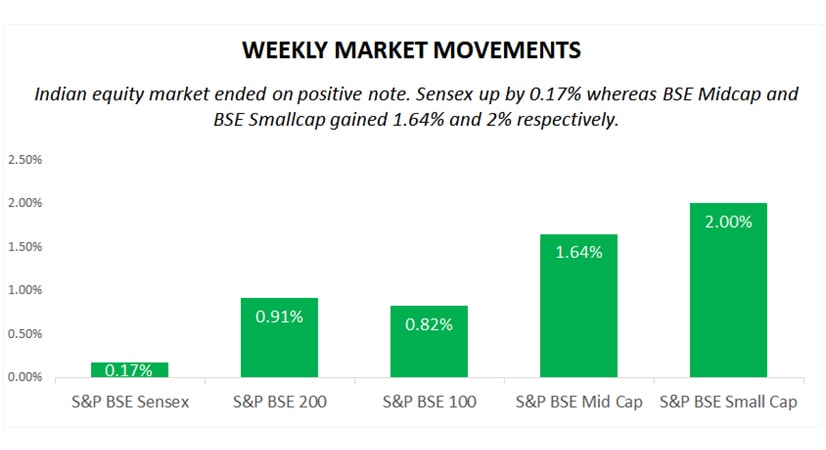

Market Barometer Sensex surged 0.17% whereas S&P BSE Midcap and S&P BSE Small-cap were up by 1.64% and 2.00% respectively. BSE 100 and BSE 200 also mounted 0.82% and 0.91%, respectively.

Last week, optimism was witnessed in the market mainly due to US-China trade talk progress where Xi Jinping and Donald Trump signaled that there is a possibility of a trade negotiation deal between both the countries. The meeting has been further extended for two days. Progressive trade talk turned investors’ sentiments positive. Although in the initial days of the week, FIIs offloaded net equities however Wednesday onwards, they poured more capital in the market. On the other hand, DIIs were the net buyers for all the 5 consecutive trading sessions. During the week, FIIs bought INR 5026.41 crore worth of equities whereas DIIs bought equities worth INR 4654.84 crore.

Moreover, public sector banking stocks witnessed a sharp rise in stock prices after the Finance Ministry’s decision to infuse capital worth INR 48,239 crore in 12 public sector banks. Corporation Bank and Allahabad bank will be the biggest beneficiaries of this plan with the capital infusion of INR 9,086 crore and INR 6,896 crore respectively. The plan will also help banks such as Bank of India, Bank of Maharashtra, Punjab National Bank, Andhra Bank, Union Bank of India, Syndicate Bank and several others to meet their regulatory capital requirement.

In addition to this, in the Monetary Policy Committee meeting, 4 out of 6 committee members voted to cut the repo rate and 2 members voted for rate pause. It has raised expectations of a further rate cut by RBI in the future. Despite this, buying pressure in metal, capital goods, and oil & gas stocks pushed the market higher.

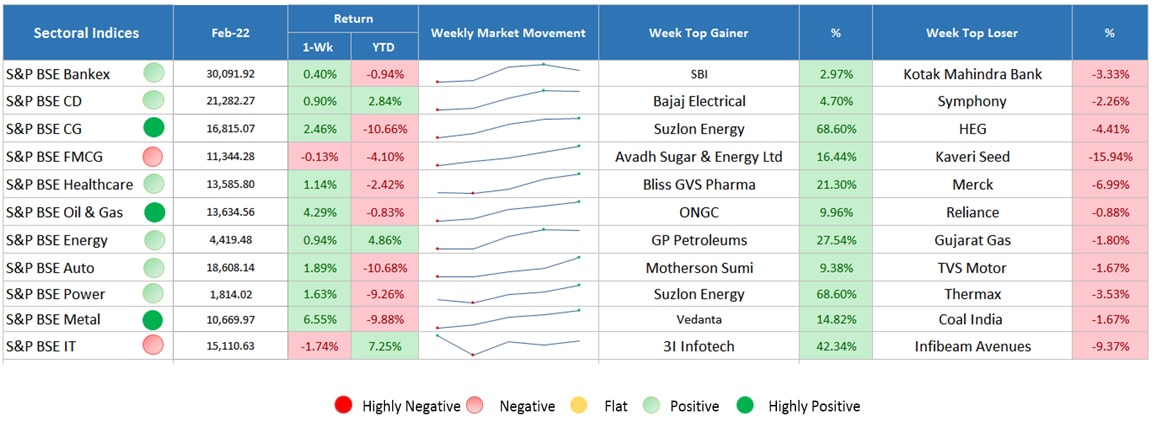

Sectoral Indices Performance

Return: As on Feb 22, 2019

Gaining sectors

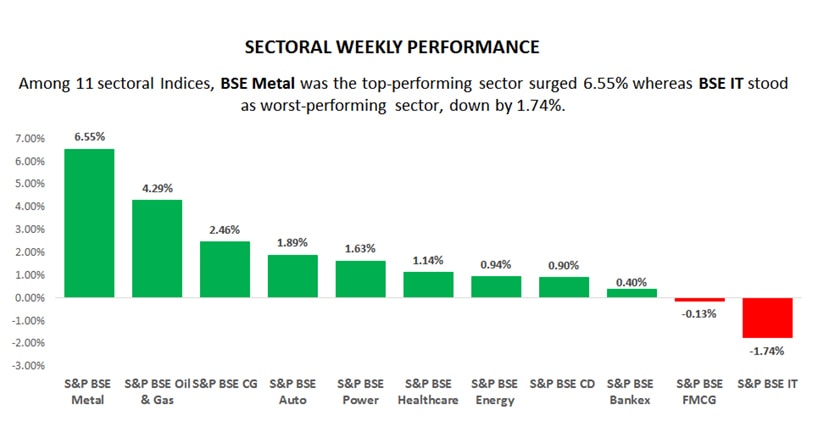

Among the above listed 11 sectors on BSE, 9 sectors manifested positive trends.

BSE Metal was the top-performing sector that surged 6.55%. The market breadth on BSE metal remains strong where the majority of stocks advanced apart from Coal India which ended lower. Moody’s expect domestic steel consumption in India to grow at 5.5%-6% per annum in near future on the account of strong domestic demand driven by higher funds allocation by the government on Infrastructure projects. Further, stock-specific news also added to the gains where Moody’s Investor Service revised Tata Steel and JSW Steel’s outlook to be stable and positive.

BSE Oil & Gas advanced 4.29% ahead of optimism around US-China trade talk progress. Further, output cut by OPEC helps the sector to balance market supply.

BSE Capital Goods, Auto, Power, Healthcare, Energy, Consumer Durable and banking stocks witnessed buying pressure and ended up marginally higher.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing sectors

Last week, BSE IT was the top laggard, marred by 1.74%. Although, the market breadth was strong where out of 54 stocks, 35 stocks advanced but selling pressure in 18 stocks declined which pulled the market downwards.

BSE FMCG ended almost flat, down by 0.13%. On the index, the advance to decline ratio was strong where 50 stocks advanced while 21 stocks declined.

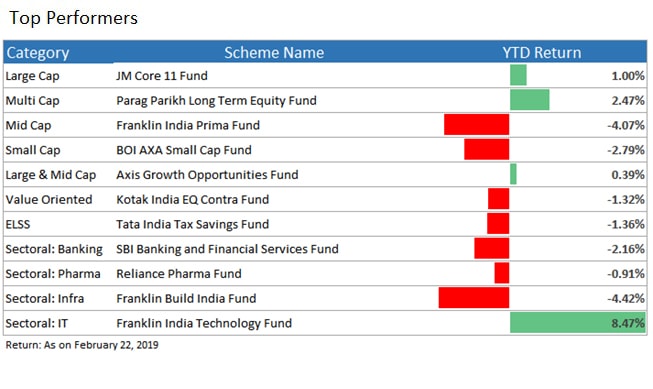

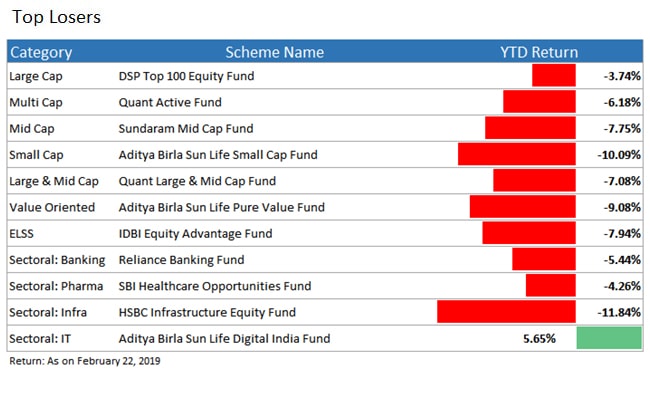

Foremost Mutual Funds

Winding Up

A Majority of indices ended up on a positive note which mitigated the trends of the last few weeks. However, many stocks remained earthbound but the volatility in the market reduced in the later trading sessions of the week. The market has been gaining momentum and can boon the mutual funds' industry if the gains are extended. To make the most out of it, SIP investments in mutual funds can aid to ameliorate the returns. Stay updated with the latest updates and course of the market and become a smarter investor. Connect with the experts at MySIPonline to grab the most appropriate opportunity to enhance your financial stability by making an informed decision. If you have any query regarding regular plans of mutual funds, feel free to clear it out by filling the form below.