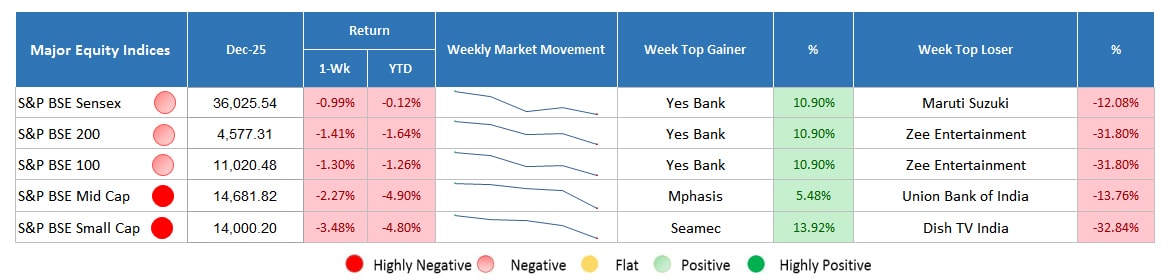

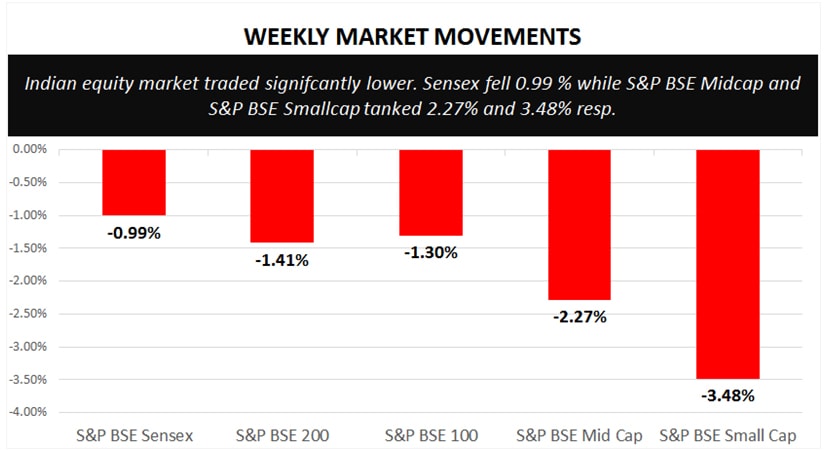

Last week, the market traded lower; Sensex outperformed the broader market indices. Global growth concerns and on the domestic front, quarterly corporate results were the prevailing reasons behind such fall.

Major Equity Indices Performance

On the first day, the market barometer, Sensex ended higher by 192.35 points while S&P BSE Midcap and S&P BSE Smallcap traded in red. On the global front, positive global cues around the US-China trade conflicts that is expected to come to an end through a long-term solution. According to the Media Reports, China has presented an offer to buy more American goods to rectify the trade imbalance with the US upbeat sentiments. On the domestic side, upbeat corporate earnings of large companies like HDFC Bank, Wipro Ltd, etc., buoyed sentiments.

On the day, after the market closed, IMF released World Economic Outlook report projected global growth to 3.5% and 3.6% in 2019 and 2020, down by 0.2% and 0.1% from October’s projection. Its impact has been witnessed in Tuesday’s trading session where Sensex broke past 5 day’s gaining streak by trading lower. Sensex fell 0.37% at a closing value of 36,444.64 while S&P BSE Midcap and S&P BSE Smallcap lost 0.09% and 0.49%, respectively. Losses remain capped due to currency appreciation and decline in the crude oil prices. IMF’s growth projection for Indian economy has been revised to 7.5% for 2019, higher by 10bps and 7.7% for the following year. It is mainly due to low global crude oil price, fallen inflationary pressure, and slower pace of monetary tightening.

The next day, again, the market closed in red, Sensex closed 336 points lower. Globally, cancellation of the US-China meeting risen trade tensions while domestically, heavyweight stock, ITC Ltd dragged the Sensex lower after release of weak quarterly results. Company posted 3.85% YoY rise in its net profit while net sales reported double digit growth on YoY basis. The results were not in line with the estimates, as a result, during the intraday trading session, the scrip has tanked over 4.02%.

On Thursday, the market gained marginally. The UN projected Indian economy to grow at 7.4% during 2018-19 while for 2019-20, growth rate is expected to be at 7.6%. Reports suggest that economy’s GDP may hit to 7.4% in 2020-21 led by robust private consumption and earlier reforms. Investors remain sidelines while in the ending hours, a major private lender Yes bank announced its new MD and CEO pushed the Sensex higher.

On the Last day, over the ending hours, the market turned negative and ended in red. Sensex closed at 36025.54, 169.56 mark lower than the previous close. S&P BSE Midcap and S&P BSE Smallcap were down by 178.21 and 225.19 points, resp. Fall in Maruti Suzuki by 7.64% after posting 17.21% dip in its net profit on YoY basis pulled the Sensex lower. On the another side, despite 50.26% YoY growth in consolidated profits reported by Zee Entertainment, the scrip has tanked 26.61% in Friday’s trading session. Its subsidiary Dish TV tanked 33.23%.

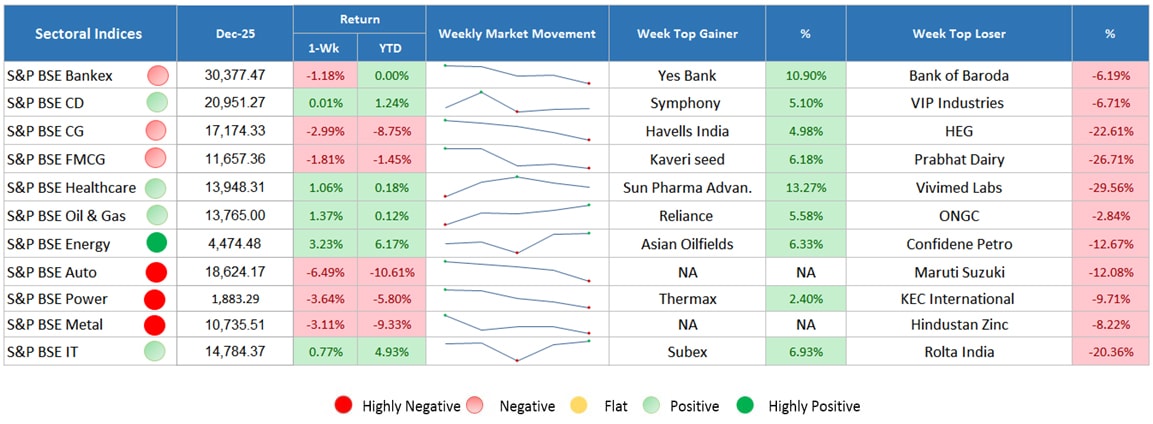

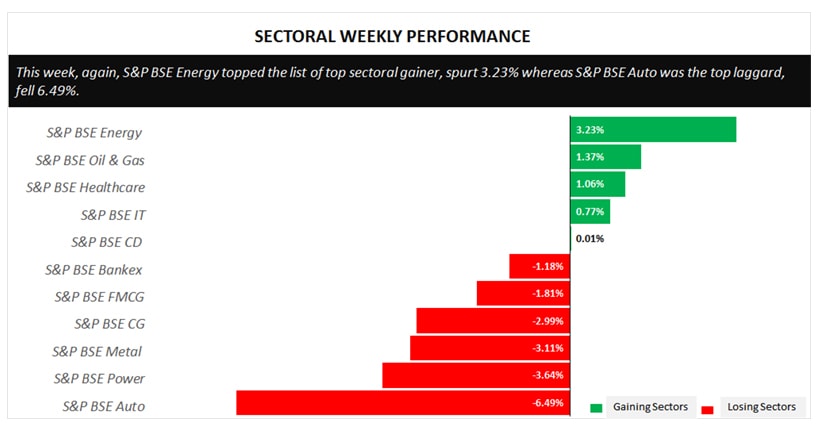

Sectoral Indices Performance

Gaining Sectors

Energy sector followed the previous week’s trend and remained the top sectoral gainer. On BSE front, the sector spurt 3.23% during the week. S&P BSE oil & gas, S&P BSE healthcare, S&P BSE IT and S&P BSE consumer durable followed the trend and traded marginally higher by 1.37%, 1.06%, 0.77%, and 0.01%, respectively.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

On the flip side, S&P BSE Auto was the worst performer, plunged by 6.49% led by fall in shares like Maruti Suzuki (11.60%), Hero Motors (7.73%), M&M (7.03%), and Tata Motors (6.56%). Power, metal, capital goods, FMCG, and bankex too witnessed selling pressure and ended lower.

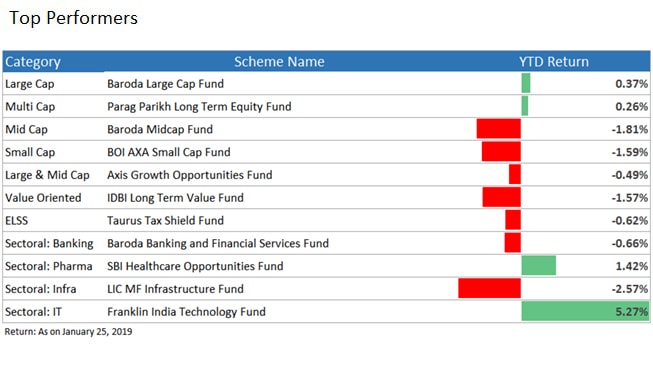

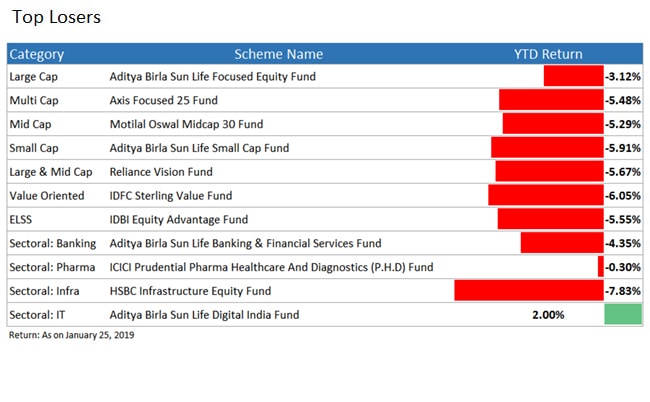

Top Performers & Losers

Expert’s Take

In the past week, Sensex closed in red. The turbulence was seen throughout the week due to one or the other instance. Such conditions will be more prominent in the coming weeks due to expected announcement of the Union Budget and general elections on the calender. Investors must not impact their investing decisions due to any such condition. This can prove to be a good time to make investment for a long-term. To seek personalized recommendation, consult our experts at MySIPonline.

Have some doubt regarding regular mutual funds? Write it down in the form provided below and get your answer asap.