Last week, the mixed bag of corporates’ quarterly numbers, central bank’s decision to lower repo rate, and changing the status to ‘neutral’ were the key domestic events that affected the market sentiments. However, on the global front, global growth fears and ongoing US-China trade battle muted the buying interest of the investors.

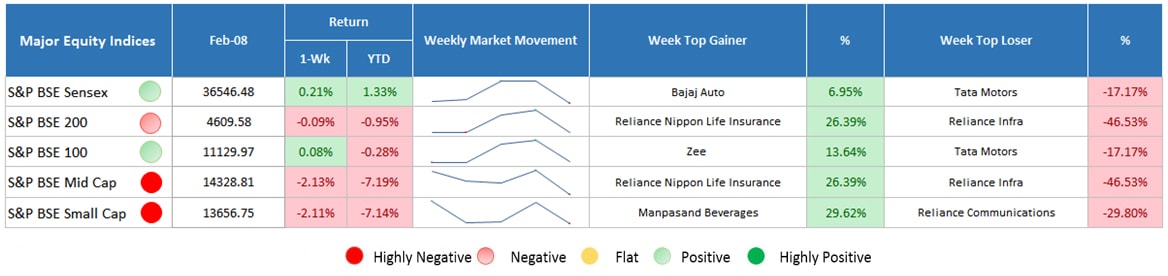

Major Equity Indices Performance

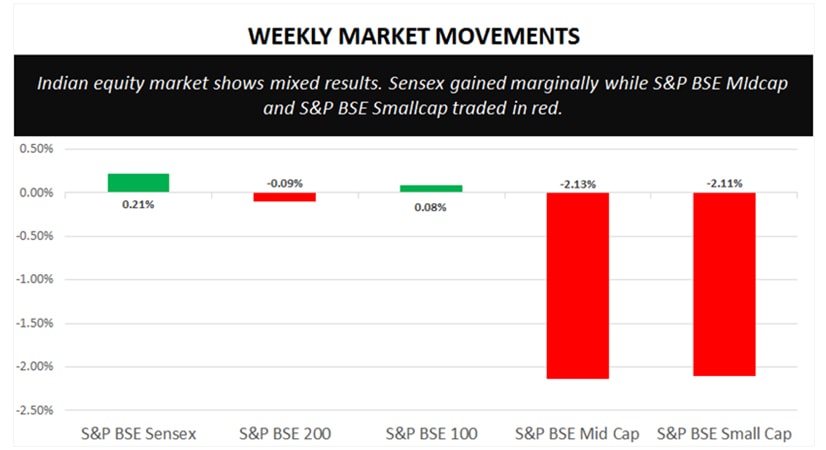

Amid a volatile week, the Indian equity market managed to end marginally higher. Market barometer Sensex traded marginally higher by 0.21% while BSE 200 and BSE 100 ended almost flat. On the flip side, broader indices traded in red. S&P BSE Midcap and S&P BSE smallcap plunged by 2.13% and 2.11%, respectively.

Initially, the market managed to post modest gains due to heavy buying in a few stocks and this pushed the Sensex higher. However, the broader indices traded in loss after Reliance Communication’s decision to opt for insolvency proceeding. Despite this, auto and metal stocks also witnessed pressure due to mixed global cues but later, buying interest was seen in banking and auto stocks and it pushed the Sensex higher.

Optimism was also observed in the market after MPC decided to change its policy status from ‘Calibrated tightening’ to ‘neutral’. Further, the committee has lowered the repo rate by 25 basis points which boosted the market sentiments. Investors can expect a further rate cut in the future. However, on the other side, profit booking post the MPC’s announcement restricted gains. On the global front, the US President’s decision to hold a 2-days summit with North Korean Leader favored the sentiments. However, global economic slowdown fears and concerns over the US-China trade battle muted the buying interest.

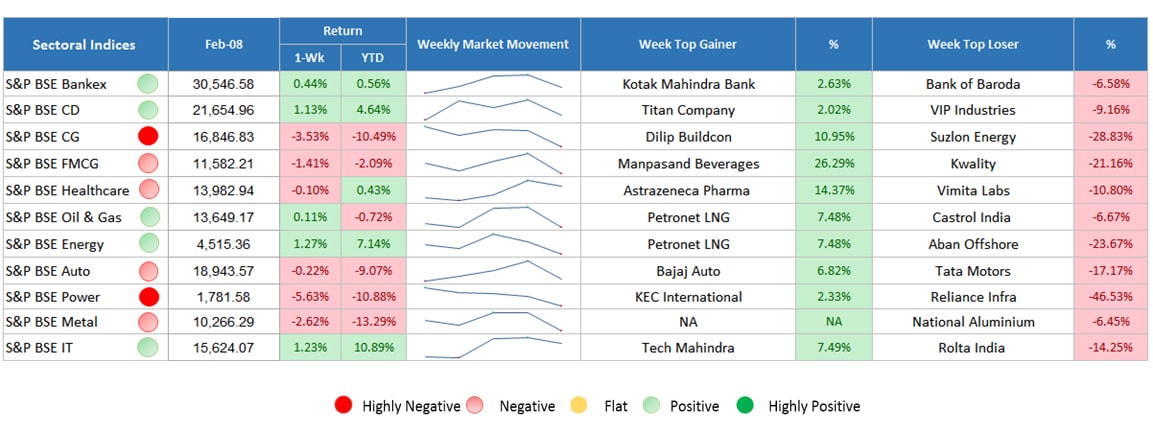

Sectoral Indices Performance

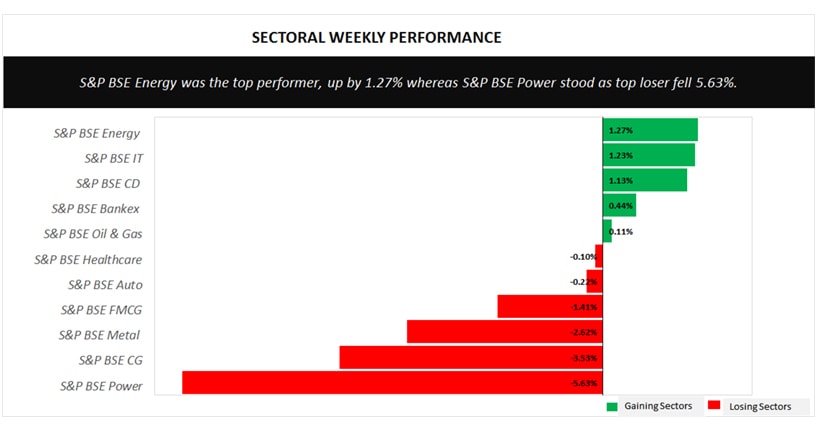

Gaining Sectors

On BSE, sectoral indices showed a mixed trend. Energy sector remained the top-performing sector with a weekly gain of 1.27% followed by BSE IT which was up by 1.23%. IT sector traded in profits after one of the major IT companies announced strong quarterly numbers beating expectations. Consumer durable, banking, and oil & gas gained marginally, up by 1.13%, 0.44%, and 0.11%, respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

Last week, BSE Power remained the top loser, plunged by 5.63%. An industry major, the promoter of Reliance Communications suffered huge sell-offs post its decision to go for insolvency proceedings. Other sectors including capital goods, metal, FMCG, auto, and healthcare also traded lower by 3.53%, 2.62%, 1.41%, 0.22%, and 0.10%, resp.

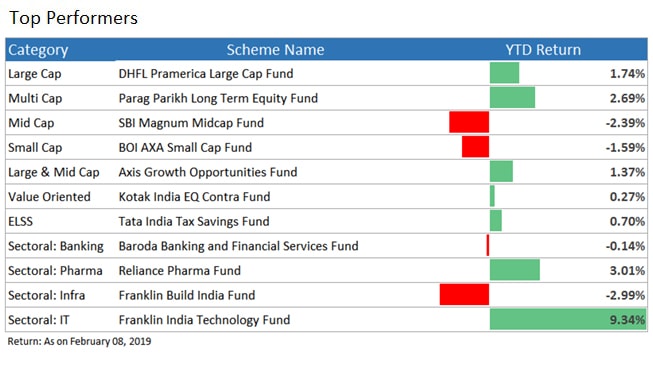

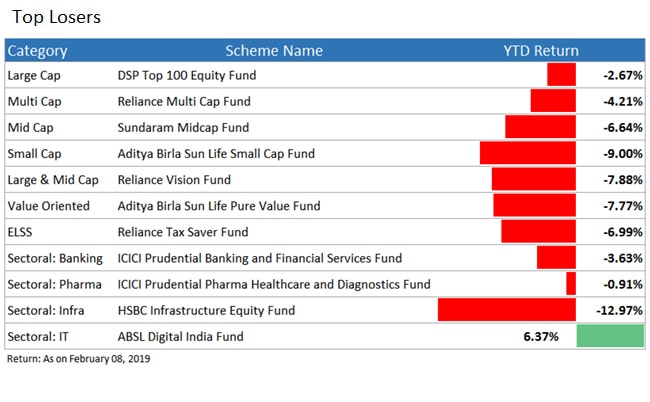

Top Performers & Losers

The Final Take

At the end of the past one week, the Sensex traded in green with a marginal difference. There were a few instances which affected the market sentiments and muted the buying interest of the investors. But overall, it can be seen as a positive week as all such things are a part and parcel of the market. It’s no time to get unnerved by the recent spate of downgrades in the market. One cannot time the market entirely, so it’s better to opt the path of SIP investment and make the most of the market conditions without depending on the weather forecast of the market. The benefit of compounding and rupee cost averaging will help you to make the best of returns to fight volatility as well as inflation in the long run.

Convinced with what we just said? Connect with the experts of MySIPonline for the steps ahead. Seek recommendation based on your personal needs and invest accordingly. If you have any query concerning regular mutual funds that you are looking answer to, then mention it in the form below and we will provide with an answer asap.