Last week, Sensex fell 0.61% while Midcap and Smallcap indices were traded in green. On the last trading day, Sensex plunged 689.60 points due to weak global cues after rate hikes by the US Federal Reserve, though it was in line with the expectations.

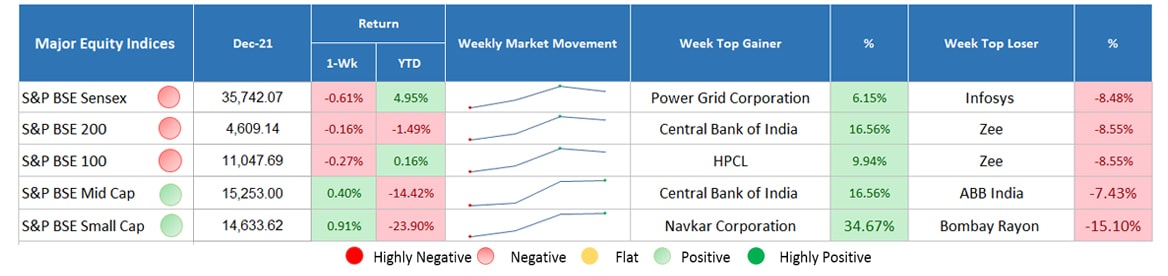

Major Equity Indices Performance

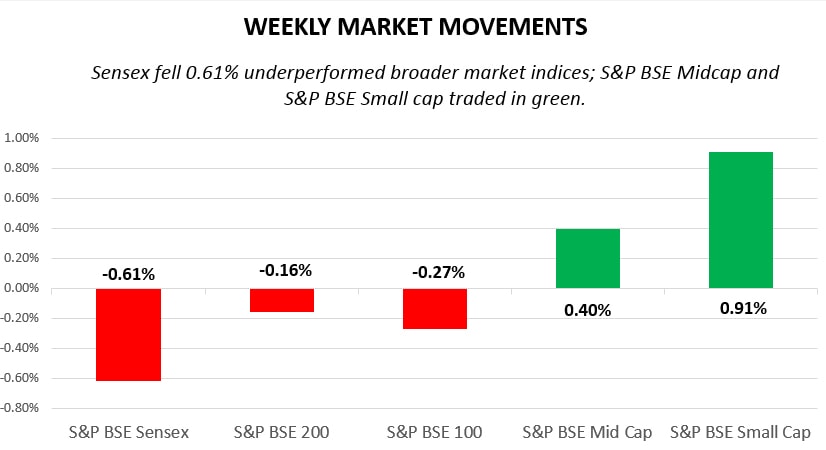

By the end of the week, domestic equity indices closed on a mixed note. Sensex fell marginally by 0.61%, followed by BSE 200 and BSE 100 down by 0.16% and 0.27%, respectively. Broader equity indices; S&P BSE Midcap and S&P BSE Small cap gained marginally, up by 0.40% and 0.91%, respectively.

During the week, initially, the market gained for the three consecutive trading sessions mainly on the account of strengthened rupee value against the dollar and fall in crude oil prices. Further, to ease ongoing liquidity concerns in the PSU sector, RBI announced to inject Rs. 50,000 crore in the month of December that boosted sentiments. Later, the government plans to strategically pump Rs. 83,000 crore into state-run banks by the end of the current financial year. However, on the other side, ongoing anxiety over the meeting scheduled among global commercial banks and uncertainty over Federal decision capped the market gains. On Friday, Sensex witnessed a sharp knock, fell 689.60 points pared all the gains. The market fell mainly on the account of rate hike by US and fears of possible government shutdown. Despite this, rise in oil prices and fallen currency by 56 paise marred sentiments. Energy stocks came into pressure due to sharp fall in crude oil prices over the last few days.

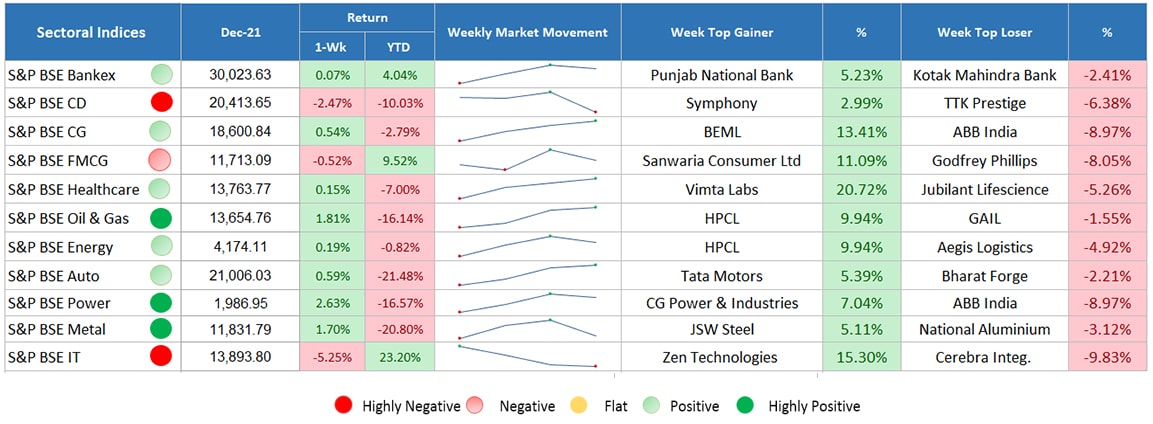

Sectoral Indices Performance

Gaining Sectors

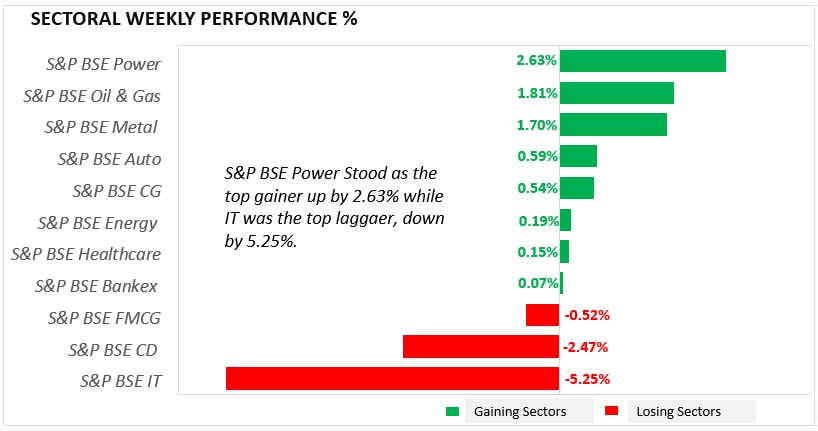

S&P BSE Power stood as the top gainer, gained 2.63% followed by BSE Oil & Gas and Metal rose 1.81% and 1.70%, respectively. Other sectors including Metal, Auto, Capital Goods, Energy, Healthcare and bankex seen some buying pressure and traded marginally higher.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

IT lost the maximum, down by 5.25%. Most of the IT stocks fell due to appreciation in rupee. Other sectors including consumer durable and FMCG were also traded in red, fell 2.47% and 0.52%, respectively.

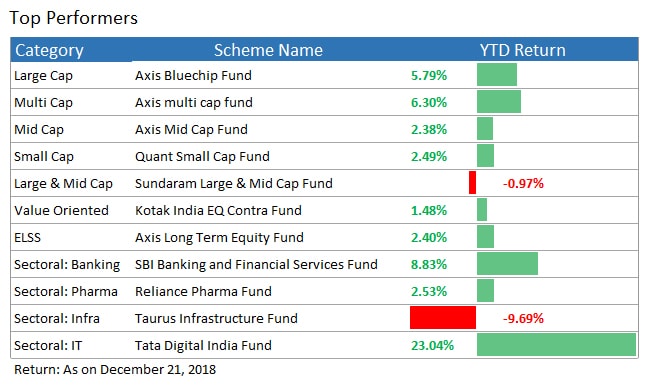

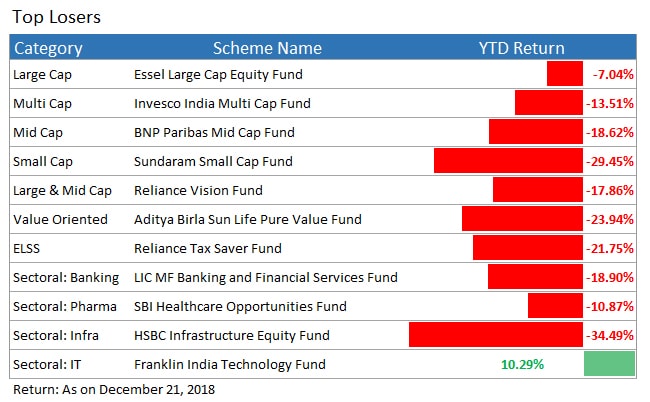

Top Performers & Losers

Conclusion

With the weak global cues and several other domestic factors, there was some friction in the market. However, things will soon get corrected because these are just the short-term effects. This clear cut report on the last week’s market performance will help you in making the right investment decision. Our motive behind publishing this market update is to help you earn the best returns by keeping you updated regarding the ups and downs of the markets. This is all one can do, as being sure about something regarding mutual funds is not possible, for it is always subject to market risk. Further, if you have any query regarding investing in mutual funds, you may consult our financial experts at MySIPonline and in case you have doubts related to the regular fund, you may post the same here.