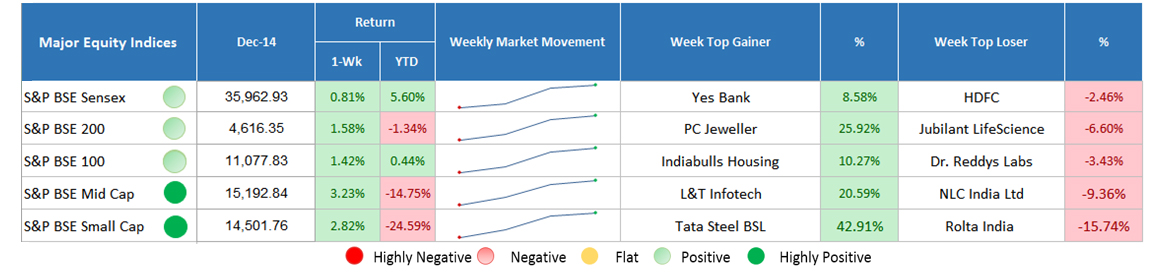

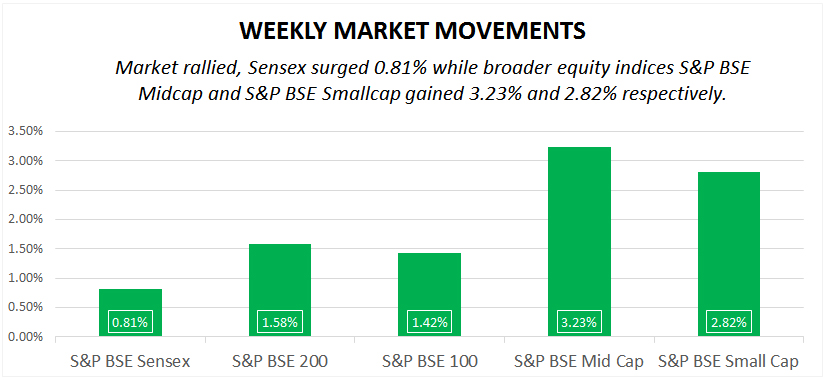

The market rallied, not only election results but also factors like macroeconomic data, possible trade negotiation between the U.S., and China pushed market higher. The market barometer, Sensex surged 0.81% while broader domestic equity indices gained higher. S&P BSE Midcap and S&P BSE Smallcap registered weekly gain of 3.23% and 2.82%, respectively.

Major Equity Indices Performance

The market barometer and broader equity indices ended in green. Sensex surged 0.81% underperformed the broader market indices, S&P BSE Midcap, and S&P BSE Smallcap gained 3.23% and 2.82%, respectively. S&P BSE 100 and S&P BSE 200 shoot up by 1.58% and 1.42%, respectively.

On the first trading session, the market posted losses amid global trade tension between the US and China and uncertainty over state election results. Moreover, banking stocks witnessed sell-off after a major private sector bank, Kotak Mahindra challenged RBI’s decision over the issue of preference share to reduce their promoters’ stake pulled market lower. Additionally, the weaker US job data that were below expectations marred market sentiments due to concerns over global growth. On the day, Sensex closed down by 713.53 points.

Later, on the day of assembly election results, investors kept eye on exit poll results. On the day, the market opened on a weak note, during the morning intra-trade session, Sensex plunged 500 points but soon recovered the losses and ended higher by 190.29 points at a closing value of 35150.01. Investors not only remain jittery over election outcome but also RBI’s governor, Mr. Urjit Patel’s resignation made them worry. Further, on the global front, investors reacted optimistically over the U.S.-China trade-talk. On BSE, the market breadth was strong with 1611 scrips advanced, 811 declined, and 132 scrips traded in flat.

Afterwards, the market continually traded on a positive momentum. Macroeconomic factors like inflation and Index of Industrial Production (IIP) improved sentiments. Retail inflation for the month of November, 2018 stood at 2.33%, the lowest figure since last 17-months. It is mainly driven by decline in price of food items and pulses. Food price inflation is reported to -2.61% against -0.86% in the preceding month. Furthermore, inflation for fuel & light came to 7.39% against 8.55% in the earlier month. It signaled a rate-cut by RBI next year.

Despite this, Huawei executive released on bail that raised expectations of possible trade negotiation between the US and China. Further, investors welcomed new RBI’s governor, Mr. Shaktikanta Das cheered sentiments. While addressing the press release by newly appointee RBI’s governor, he told that he will meet a few public sector banks to examine the prevailing issues facing by the sector. In a step, the government is looking to infuse additional capital worth Rs. 30,000 crore in public sector banks to overcome liquidity worries that favored sentiments.

On Friday, the market closed on a lackluster note and ended marginally higher. Sensex up by 33.29 mark while S&P BSE Midcap and S&P BSE Smallcap ended higher by 29.25 points and 4.07 points. respectively.

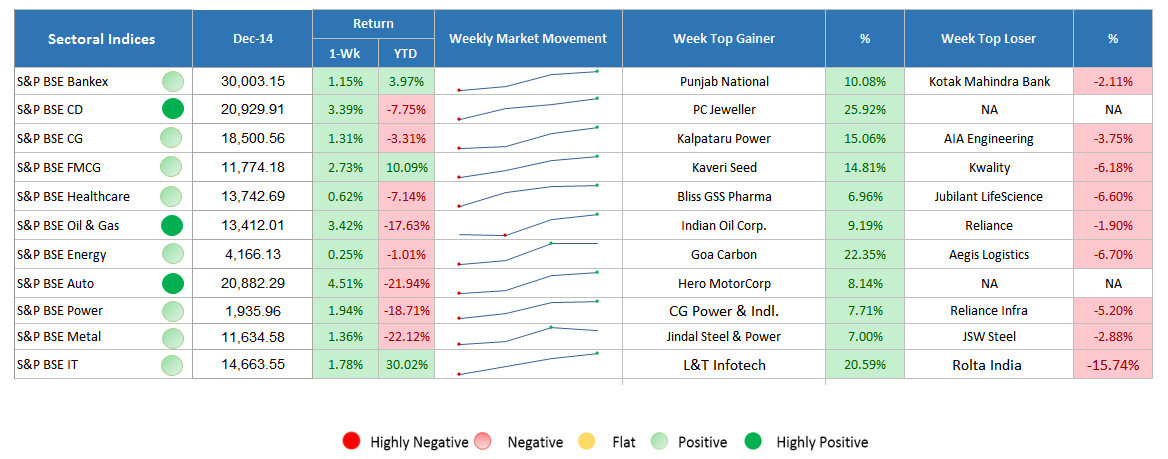

Sectoral Indices Performance

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Gaining Sectors

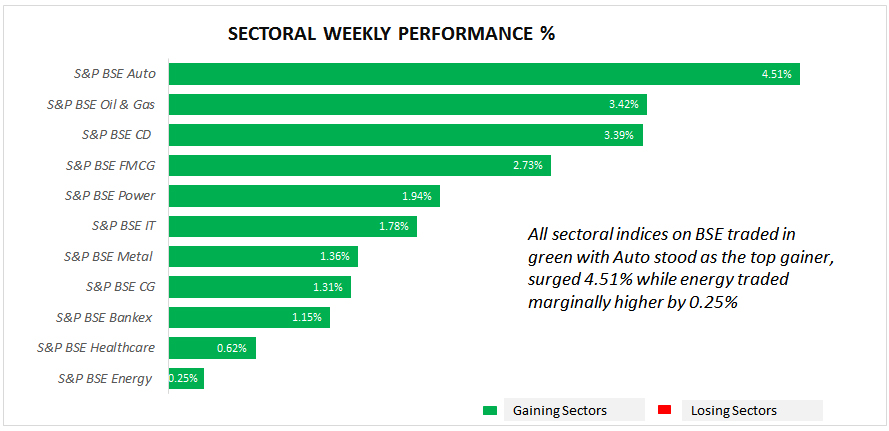

During the week, all the sectoral indices traded in green. Among all, S&P BSE Auto remain the top-performing sector, surged 4.51% followed by S&P BSE Oil & Gas ended higher by 3.42%. During the Friday’s trade, Oil & Gas gained the most with major companies like IOC, ONGC, Petronet LNG were in a positive zone. ONGC gained 3% after the news that the Board of Directors are considering a buyback proposal and in this regards, a meeting is to be held on December 20. Consumer durable, FMCG, Power, IT, Metal, Bankex, healthcare, and Energy too traded in green.

Losing Sectors

Among 11 sectors, none of the sectors ended in red.

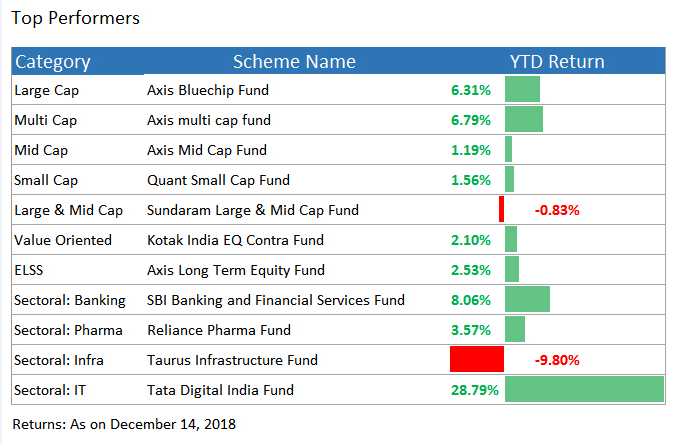

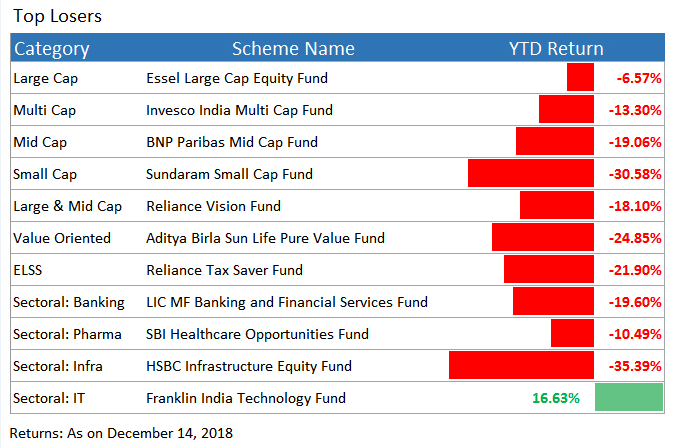

Top Performers & Losers

Conclusion

In the past week, all of the sectors were traded in green But will the trend continue in the same way? Well, this is something that we all wanted to know. The market is currently in a volatile position due to several things happening around. The assembly elections combined with the global cues can lead it the market to fluctuate a little more. However, all such conditions bring in short term changes which shouldn’t disturb your long-term investment goals. To seek recommendation about the best mutual funds to invest in now, connect with the experts associated with MySIPonline.

Clear out all your queries about the Regular Plans of mutual funds by submitting them in the given form below: