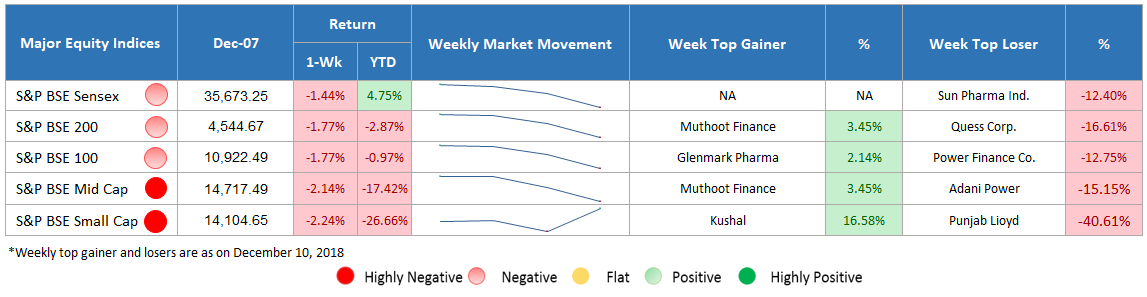

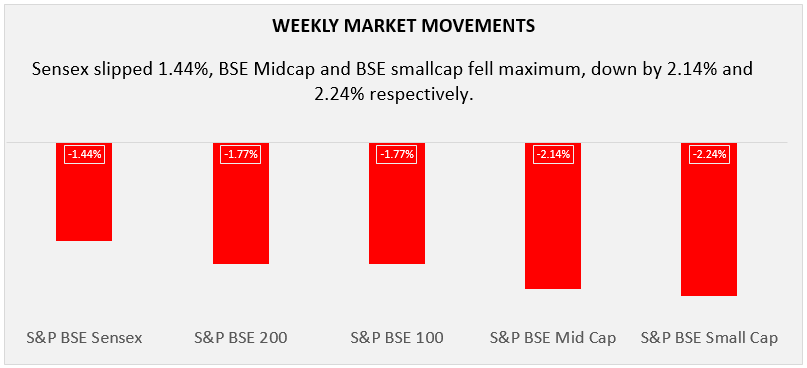

In the first week, the market slipped lower due to escalated trade tensions between the US and China, RBI’s Monetary Policy Committee decision, OPEC meeting, and weak GDP and fiscal deficit figures. Sensex lost 1.44% value while S&P BSE Midcap and S&P BSE Smallcap closed at a loss of 2.14% and 2.24%, respectively.

Major Equity Indices Performance

In the first week of December, the market ended in red. Sensex fell 1.44% while both BSE 100 and BSE 200 are down by 1.77%. Midcap and Smallcap were the top losers plummeted 2.14% and 2.24%, respectively.

Although, on the first trading sessions, the market gained because the US and China decided on a 90-day trade truce, in which, the US decided to not increase tariff from 10% to 25% on Chinese goods worth 200 billion. However, gains remains restricted because of weak GDP figures and fiscal deficit figures that crossed budgetary estimates. Thereafter, the market witnessed heavy sell-off due to many events such as surge in crude oil prices, weakened currency, and escalated trade tensions between the US and China after the arrest of Huawei CFO, alleged for violating the US trade sanctions against Iran.

Furthermore, investors who were hoping change in monetary policy’s status quo from “Calibrated tightening” to “Neutral”, their sentiments were affected after RBI’s decision to keep the status quo unchanged to “Calibrated tightening”. MPC kept policy rates remain unchanged and decided to cut SLR by 25 bps (w.e.f. Jan 2019) targeting 18% SLR in order to raise banks’ lending power. Despite this, the gains were also remain restricted due to OPEC meeting to discuss on the production cut.

Later, on the last trading session, the market broke 3-days continuous falling trend on the account of falling oil prices and strengthening currency. However, on the other side, OPEC decided to cut production by 1.2 million barrel per day that will affect the oil prices. Now, investors are cautious ahead of state assembly elections result to be declare on Dec 11, 2018.

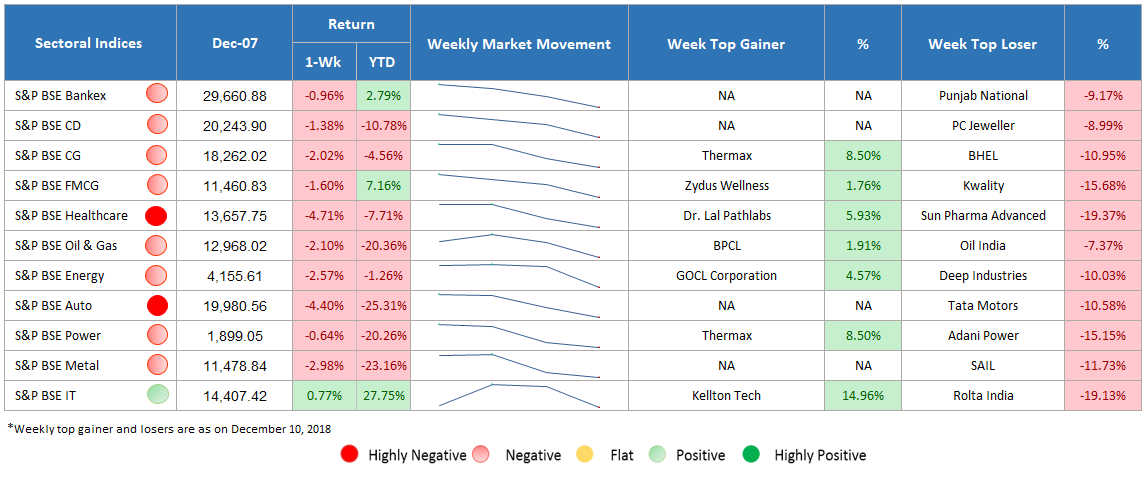

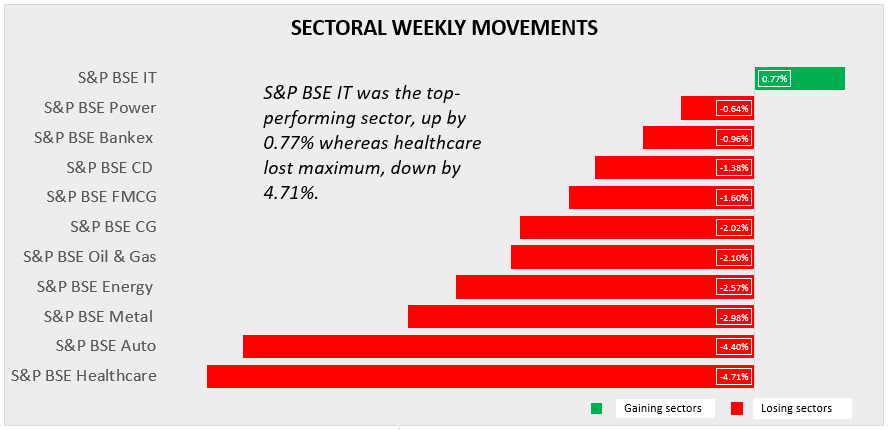

Sectoral Indices Performance

Gaining Sectors

On the BSE Sectoral note, IT was the only index traded positively, gained 0.77%.

Losing Sectors

All the other sectors were traded in red. Among all, BSE Healthcare was the worst-performing sector which slipped by 4.71% followed by BSE Auto ended 4.40% lower. Healthcare sector suffered because India’s biggest pharma company faced allegations of mis-governance and insider trading as well. However, the auto-sector traded in loss after witnessing steep decline in credit rating of one of the luxurious car makers. Other sectors including metal, energy, oil & gas, capital goods, FMCG, power, and banking stocks suffered the selling pressure.

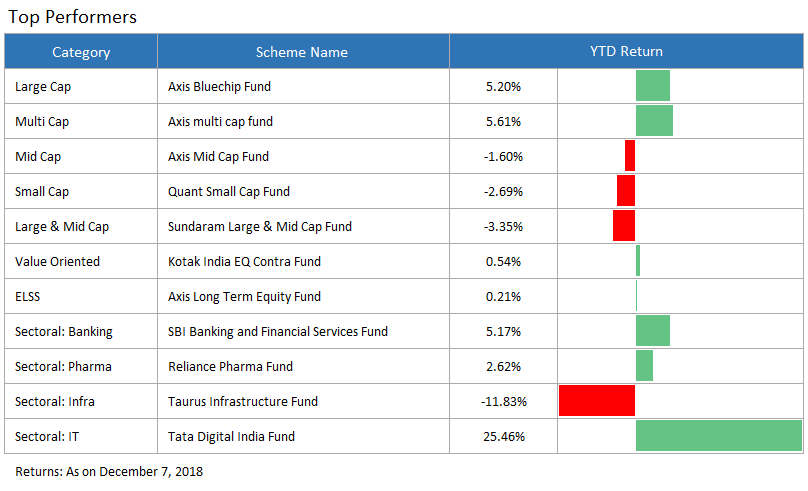

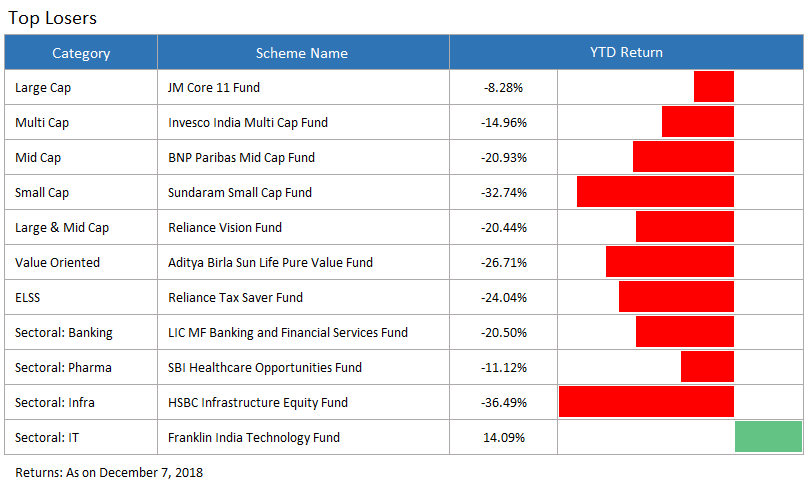

Top Performers & losers

Conclusion

The market was in a bit of chaos in the past week, but will the trend continue this way or there will be some relief to the investors in the next week? This is some where dependent on the assembly election results as well. The market may remain volatile during the week as the election results combined with the global cues can lead it to fluctuate a little. However, all such conditions bring in short term effects which shouldn’t disturb your long-term investment goals. To seek recommendation about the best mutual funds to invest in now, connect with the experts associated with MySIPonline.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure