The economy has been facing multiple changes in the recent times due to a number of reasons and that is affecting the mutual fund investment market right away. Like always, here we bring to you the weekly market update report which has been made by our expert after thoroughly going through the changes across stocks, indexes, and schemes that are available in the market.

Domestic Market Continued its Losing Streak Last Week

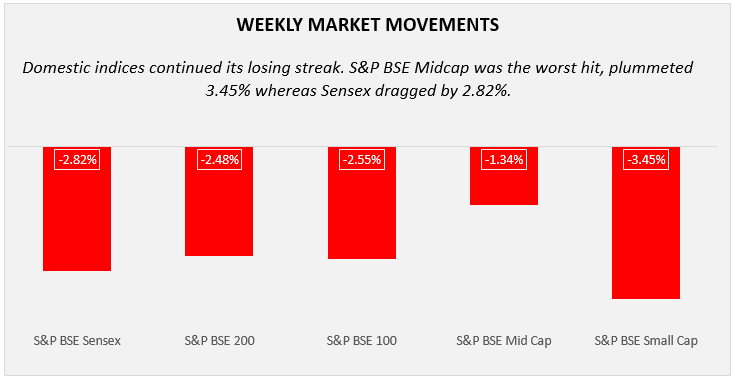

Market followed previous week’s trend by trading in red. S&P BSE Midcap index faced the worst hit by falling 3.45% while Sensex ended with a weekly loss of 2.82%. However, S&P BSE Small Cap dragged marginally by 1.34% during the week.

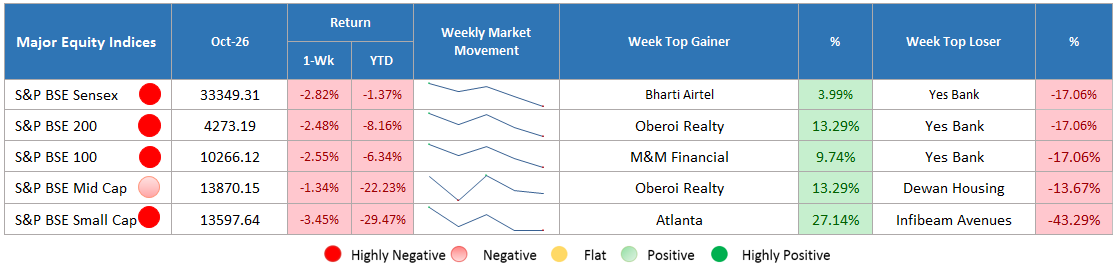

Major Equity Indices Performance

Domestic indices continued its losing streak. Sensex fell 2.82%, outperforming S&P BSE Midcap sharply fell by 3.45% while underperforming S&P BSE Small cap declined marginally by 1.34%. Other indices i.e. S&P BSE 200 and S&P BSE 100 plummeted 2.48% and 2.55%.

During the first session of the week, market traded in red. Market witnessed selling pressure due to heightened crude oil prices, fallen currency and persistent liquidity fears. Further, disappointed second quarterly earnings of some bluechip companies also dampened sentiments. On the day, Sensex closed at a loss of 181 mark. In the second consecutive session, market remained in its declining trend ahead of weak global cues and ongoing geopolitical tensions. On Tuesday, Sensex ended lower by 287 points while S&P BSE Small cap closed down by 168 points.

Later, on Wednesday, market reversed by trading in gains ahead of expiry of October series futures and options contract. However, the gains were snapped off in the Thursday’s trade when Sensex came to its seven month lowest point at a closing value of 33,690. It is mainly due to weak global cues and disappointed quarterly earnings. Investors also remained cautious over further rate hike by US Federal ahead of ongoing US-China trade battle. Again last day, market closed in red due to weakened currency and selling pressure on banking stocks.

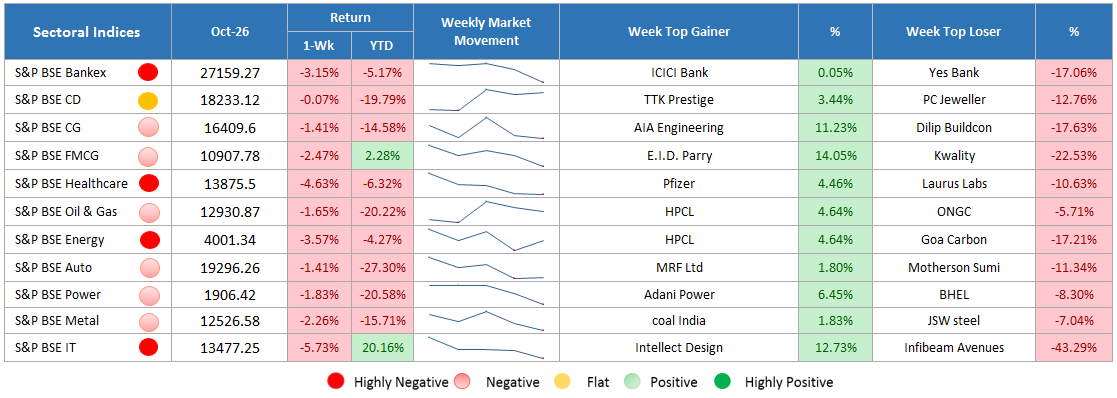

Sectoral Indices Performance

Gaining Sectors

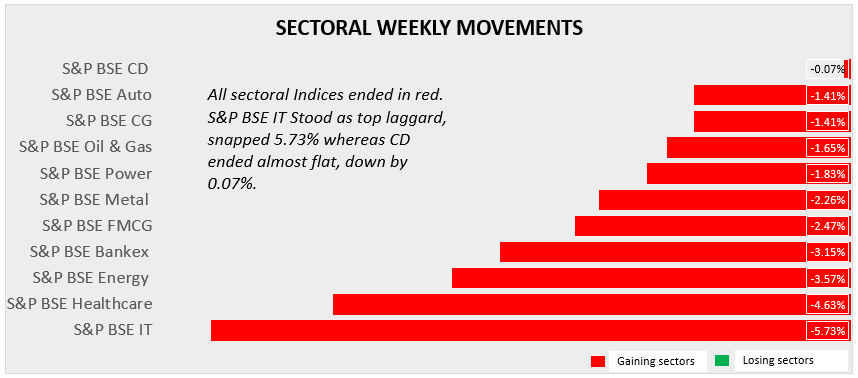

Last week, none of the sectors traded in green.

Losing Sectors

On BSE Sectoral front, each indices closed in red. S&P BSE IT stood as the top loser, plummeted 5.73% followed by healthcare, snapped 4.63%. Liquidity crunch possibility continued to dampen investors’ sentiments as a result, Bankex closed down at a weekly loss of 3.15%. Other sectors including Energy, FMCG, Metal, Power, Oil & Gas and capital goods witnessed selling pressure. Auto sector marginally declined and plunged by 1.41% during the week and consumer durable traded flat.

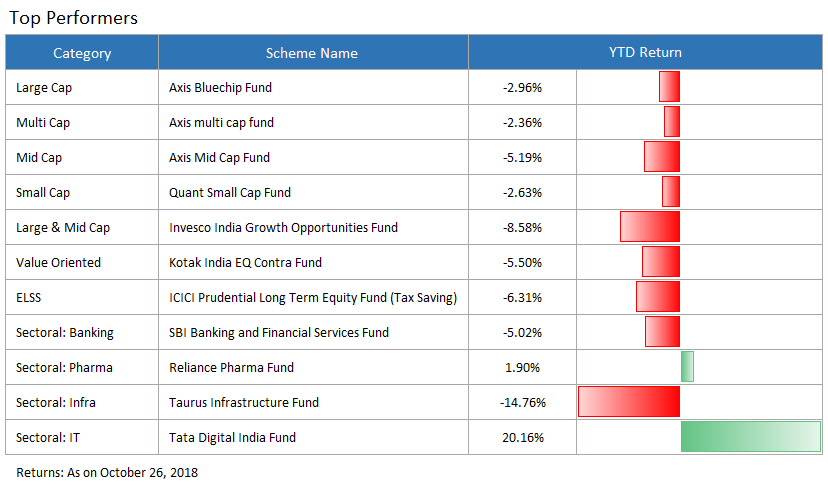

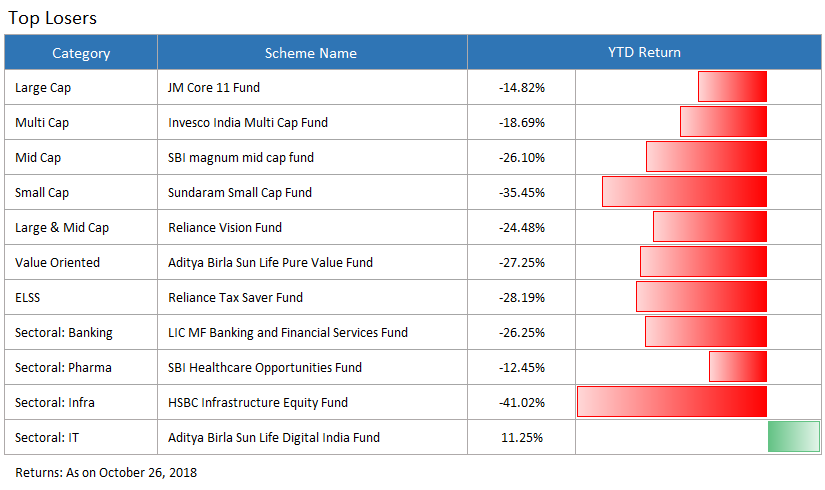

Top Performers and Losers

The Final Note

Mutual funds are always subject to market risk, therefore it is really important to keep an eye on the changes that happen in the market from time to time. All one can do is anticipate how the investment returns may turn out to be. The sole reason behind sharing this report is to help you in taking the correct investment decision. Hope you have found this report helpful, in case you have any query that you would like to share or discuss, you can either connect with our financial experts or can post the same here.