After registering gains a week before, in the past week, again the market resumed the decline. Although, during the beginning days, it gained ahead of earning optimism and value buying in IT and Pharma, still, the gains were capped due to the rising crude oil price, weakened currency, and fear of liquidity crisis in NBFC sector.

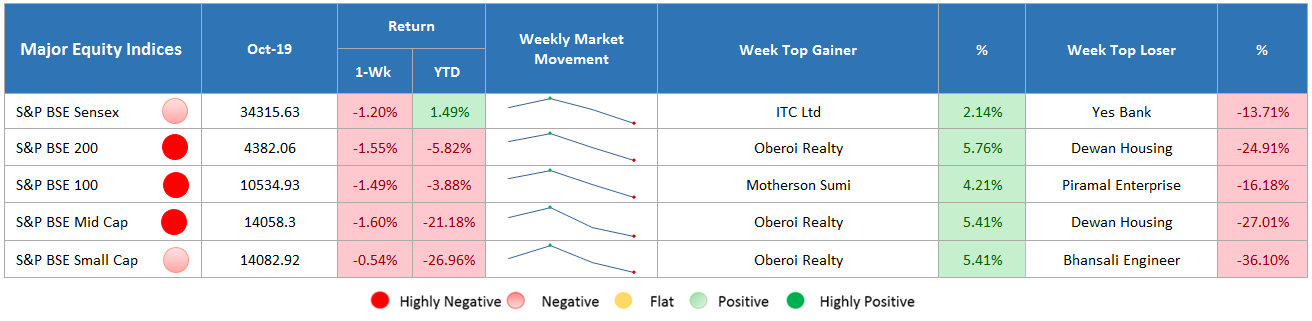

Major Equity Indices Performance

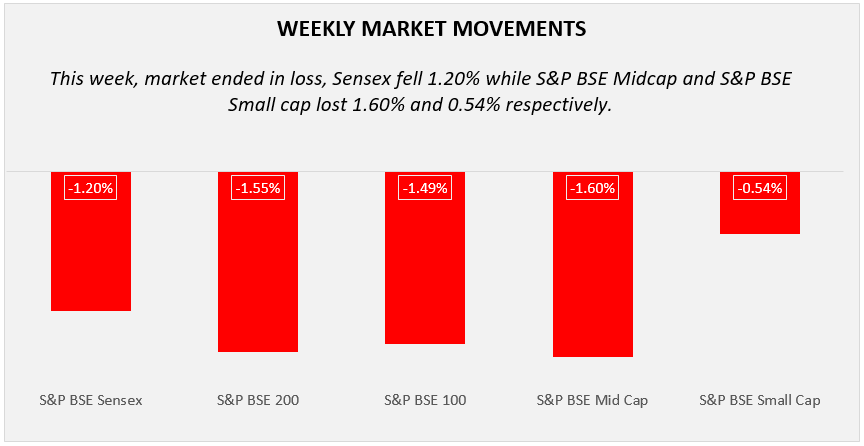

Sensex fell 1.20%, S&P BSE 200, and S&P BSE 100 down by 1.55% and 1.49%. S&P BSE Midcap underperformed Sensex at a weekly loss of 1.60%. However, S&P BSE Small Cap traded down by 0.54%.

Initially, on Monday, the market gained due to value buying in the IT and pharma sectors, still, the gains remain restricted over concerns of the weakening currency and increasing oil prices. Moreover, on the global front, a possible slowdown in the Chinese economy and rising borrowing cost affected investors’ sentiments. Next day, again the market saw a positive momentum and ended in green. It is because of strong corporate earnings reported by financial companies.

Further, favorable global cues supported sentiments. After having profits in three continuous trading sessions, on Thursday, weakened rupee and higher crude oil prices pulled the market lower. On the day, Sensex fell 383 (1.09%) points at a closing value of 34,780. Additionally, NBFC stocks saw weakness due to the concerns over credit default. Again, on the last day, Sensex fell 464 (1.33%) points due to weak global cues. On the global front, China’s GDP has seen its lowest level since 2009 dragged the market down.

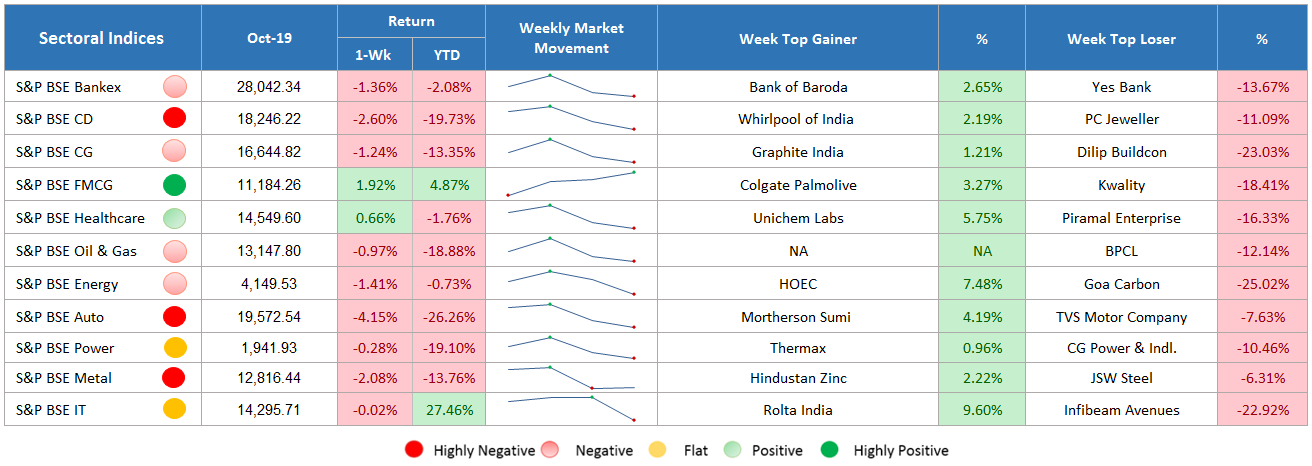

Sectoral Indices Performance

Gaining Sectors

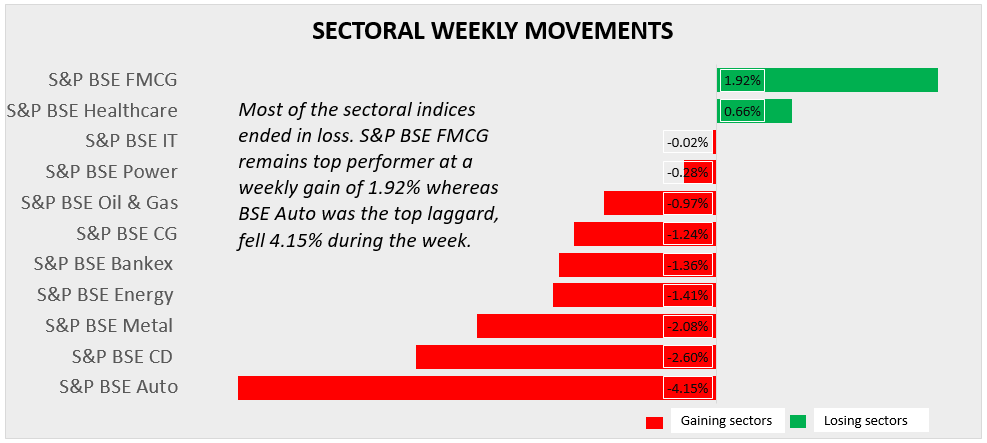

On BSE Sectoral Indices, among 11, only 2 sectors ended in profit. FMCG remained the top performer, up by 1.92% while healthcare gained 0.66% during the week.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

Most of the sectoral indices closed in the red. S&P BSE Auto stood as the top loser, fell 4.15%. It is mainly due to concerns over lower sales volume in festive season due to the high cost of insurance and liquidity concerns from NBFC. Baring Auto, S&P BSE consumer durable lost 2.60% during the week. Other sectors like metal, energy, bankex, capital goods, oil & gas and power also seen selling pressure. IT and power sector almost remained flat.

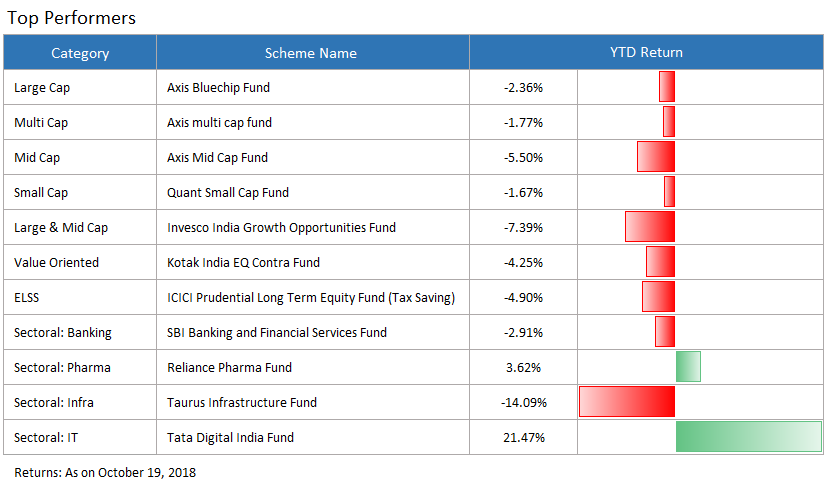

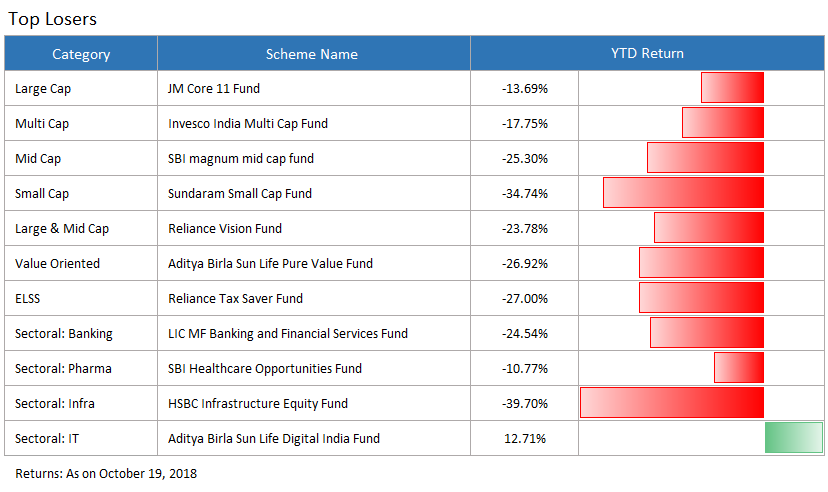

Top Performers & Losers

Conclusion

It has been months of the volatility and correction now. And, if there's one thing that this long, strange correction phase in the market has taught us, it's “Nothing is certain.” It is a particularly important piece of wisdom to keep in mind especially when you an investor in the stock market. Despite the best efforts, no one can correctly predict what a particular company, asset or sector of the economy will do in the future. One can only assess the probabilities and position oneself accordingly.

The prime motto of sharing this report is to help our readers make that decision. In case you still find yourself confused about making choices, it’s good to initiate investment in mutual funds.

To seek the best recommendations on SIP investments or even lumpsum investments, connect with the experts of MySIPonline now via email ( support@mysiponline.com) or phone call (+91-9660032889) or submit your query here