Large cap and mid cap indices maintained past 2 week’s gaining trend. Sensex was up by 0.85% and S&P BSE Midcap surged by 0.36%. However, S&P BSE small cap shown reversal by trading in loss. During the week, S&P BSE small cap plunged by 1.27%. Many events such as release of consumer price inflation, wholesale price inflation, industrial production, and trade deficit has influenced the market sentiments.

Table of Content

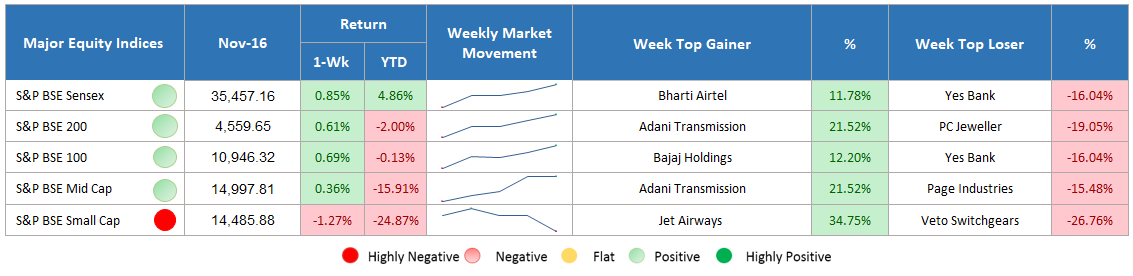

Major Equity Indices Performance

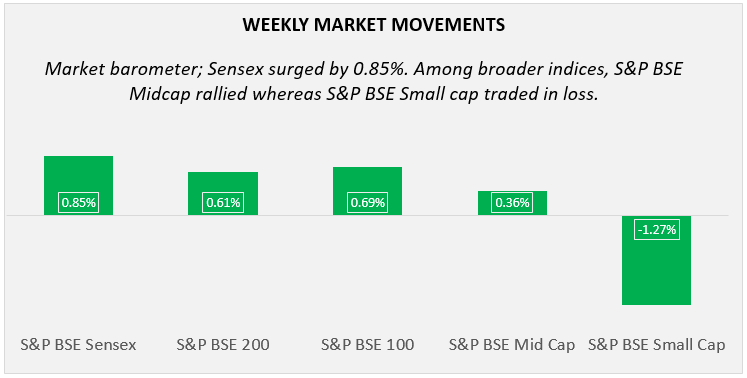

During the past week, the market barometer, Sensex surged by 0.85%. S&P BSE 200 and S&P BSE 100 rose 0.61% and 0.69%, respectively. S&P BSE Midcap also gained marginally as it posted a weekly profit of 0.36% while S&P BSE Small cap reversed its earlier 2 week’s gaining trend and turned negative. During the week, it has posted a weekly loss of 1.27%. On Sensex, Yes Bank stood as the top loser on the exit of company’s non-executive chairman, Ashok Chawla.

Consumer price inflation has plunged down to 3.31% against 3.70% in the earlier month that recorded at 13-months’ lowest point. It supported the market sentiments on the account of decline in consumer food price index that came to -0.86% as against to 0.51% in the last month. Despite this, although index of industrial production slowed to 4.5% in September 2018, still, it grew from 4.1% in the same month of earlier year. Manufacturing sector shown good growth by 4.6% in Sep 2018 against 3.8% growth in the same month of the preceding year. This month, although CPI declined, in contrast, wholesale price inflation rose to 5.28% as against 5.13% in the last month. It is mainly due to the inflation which went up in fuel, power, and manufactured goods. This month, trade deficit widened from $13.98 bn to $17.13 bn in October 2018. Exports went up to $26.98 bn as against $22.89 bn in October 2017, rose by 17.86% and imports also got increased by 17.62%.

In addition to this, softened crude oil prices provided support to oil marketing companies and reduced the concern over widening fiscal deficit and inflationary pressure. The market participants continued to track the ongoing tussle between RBI and the government.

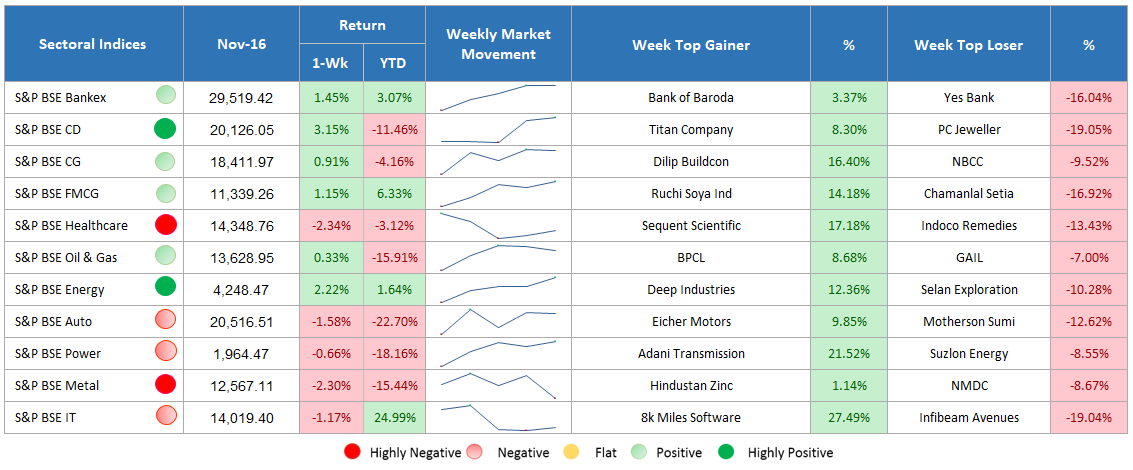

Sectoral Indices Performance

Gaining Sectors

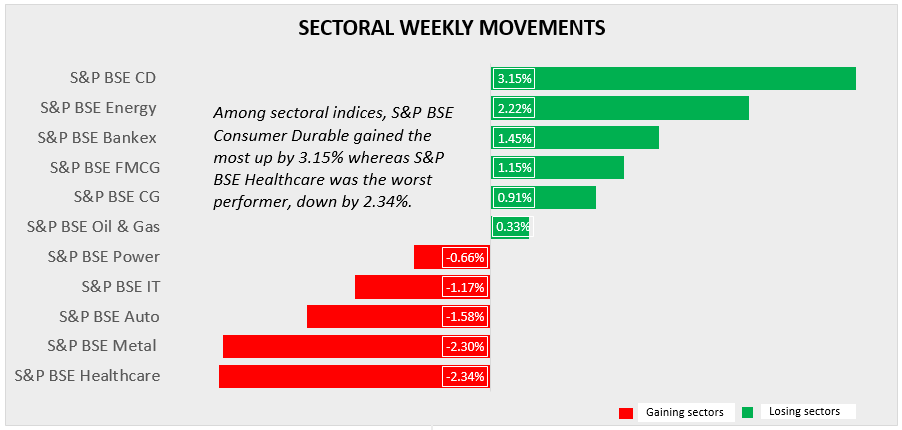

Indices ended on a mixed note, among all, S&P BSE consumer durable remains the top performer, surged by 3.15% followed by S&P BSE Energy up by 2.22%. Other sectors including bankex, FMCG, capital goods, oil & gas also trade marginally higher up by 1.45%, 1.15%, 0.91% and 0.33%, respectively.

Losing Sectors

S&P BSE Healthcare stood as the top laggard, plunged by 2.34% followed by 2.30%. Other than this, sectors, i.e., Auto, IT and Power witnessed selling pressure, down by 1.58%, 1.17%, and 0.66%, respectively.

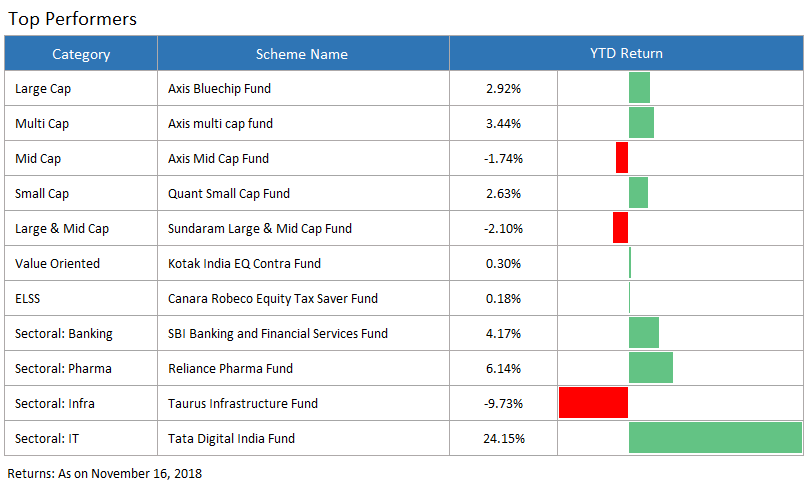

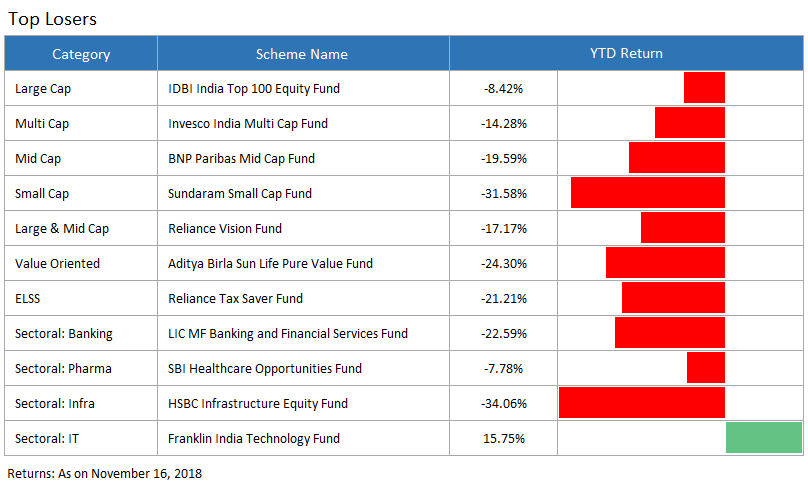

Top Performers and Losers

Conclusion

With the correction and market volatility, investment in Small Cap might be a risky affair for investors with low-risk appetite. However, if you are someone who is willing to invest for a long-term, then this can be an apt choice for you. With the improvement in Large Cap and Mid Cap indices, investment in them can be a safer bet for risk averse investors. We hope you will make the right use of this volatility by investing in for a long-term, especially when almost all the stocks are trading low.

To seek recommendation on this part, consult the industry experts available with us at MySIPonline.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure