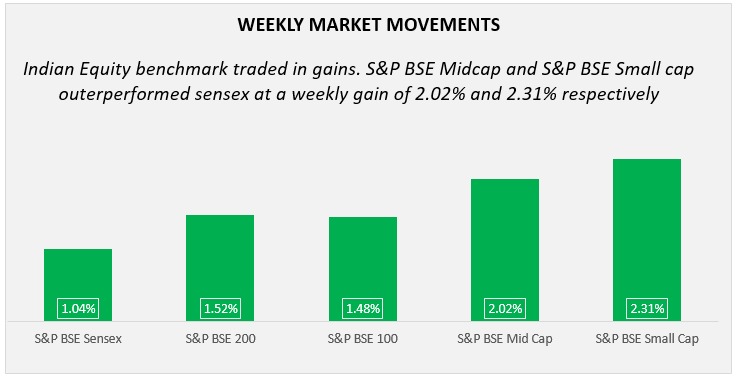

After trading continuously in the losses in the last 5 consecutive weeks, this week, the market registered gains. Sensex grew 1.04% while S&P BSE Midcap and S&P BSE Small cap posted weekly gains of 2.02% and 2.31%, respectively. Investors’ sentiments were largely affected by eased global crude oil prices and RBI’s decision to put Rs. 12,000 crore through open market operations. However, on the other side, heavy sell-off in overnight US market has strongly affected domestic indices where on Thursday, Sensex fell 2.19% but recouped losses the next day. Table of Content

Table of Content

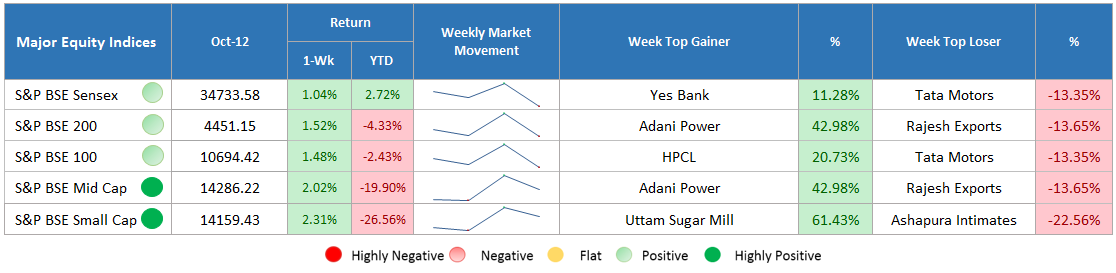

Major Equity Indices Performance

The market was closed in green by posting marginal gains. S&P BSE Midcap and S&P BSE Small cap outperformed Sensex by registering a weekly profit of 2.02% and 2.31%, respectively. However, Sensex, BSE 200, and BSE 100 closed at a profit of 1.04%, 1.52%, and 1.48%, respectively.

On Monday, despite persistent volatility in the finance sector, the market traded in green where Sensex rose 0.28%. The next day, the market ended in red because of the weakened rupee and increasing crude oil price. Both these factors threaten inflationary pressure on the economy, and as a result, investors expect further rate increase by RBI in the future. Later, on the third consecutive day, the market gained ahead of ease in crude oil price and RBI’s decision to put Rs.

12,000 crore into the system by purchasing government bonds. Investors whose sentiments have been heavily affected by a series of debt defaults by lending companies welcome such decision. On Thursday, the market has seen a sharp sell-off mainly due to sell-off in overnight US market. Domestically, declining rupee against the US dollar added to the woes. On the day, Sensex fell 2.19% by 760 points at a closing value of 34,001. Last day, the market recovered earlier day’s losses as Sensex grew 732 points and closed at 34,734. The recovery came on the ground of global market recovery and rebounded rupee. Furthermore, buying in auto and metal stocks added to the gains.

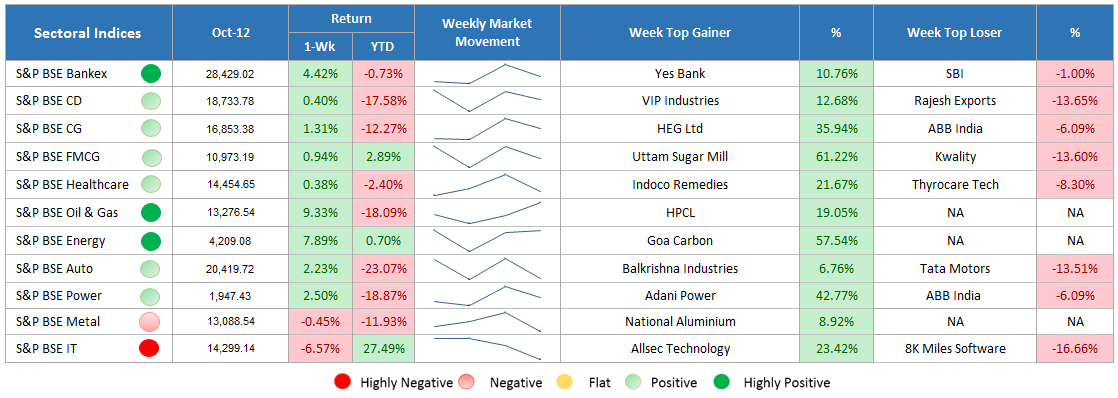

Sectoral Indices Performance

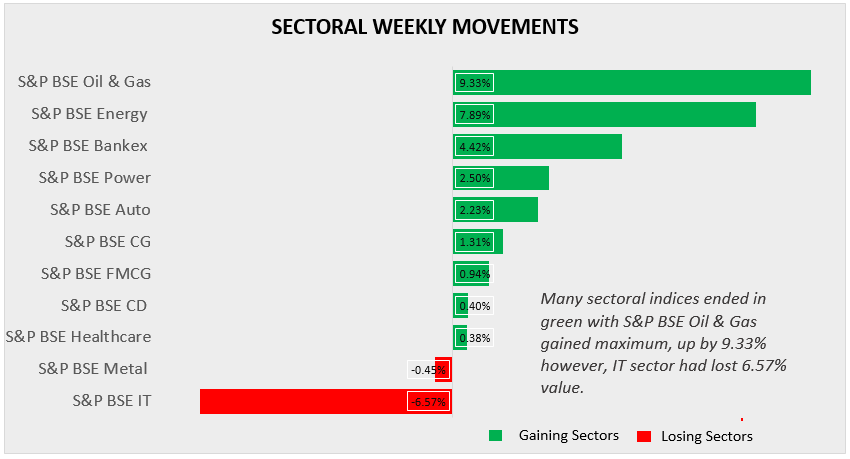

Gaining Sectors

On the sectoral front, Oil & Gas which was the top laggard earlier week which recovered its losses by gaining 9.33% during the last week ended on 12th October. It is mainly because of easing global crude oil prices. S&P BSE Energy and S&P BSE Bankex also seen good buying interest closed at a weekly return of 7.89% and 4.42%. Banking stocks gained ahead of RBI’s decision to inject Rs. 12,000 crore into the system to overcome liquidity worries. Other than this, power, auto, capital goods, FMCG, consumer durables, and healthcare posted marginal gains of 2.50%, 2.23%, 1.31%, 0.94%, 0.40%, and 0.38%, respectively.

Losing Sectors

Among 11 sectoral indices, 2 ended in red where IT suffered the maximum loss, fell 6.57% during the week while Metal lost 0.45%.

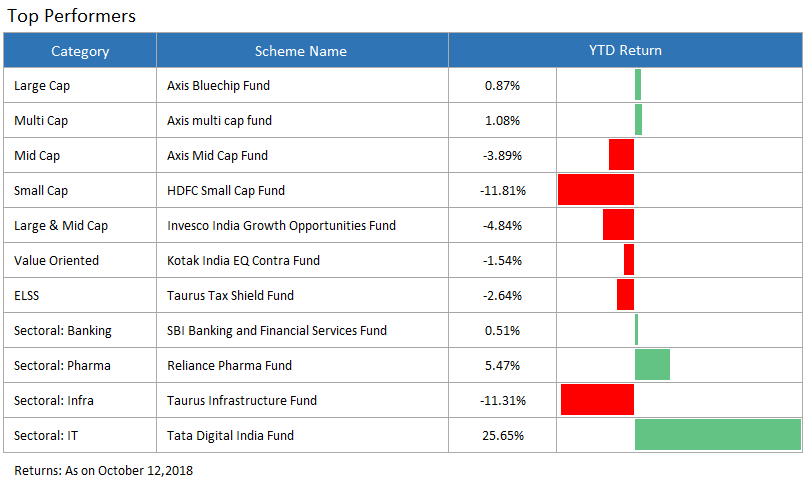

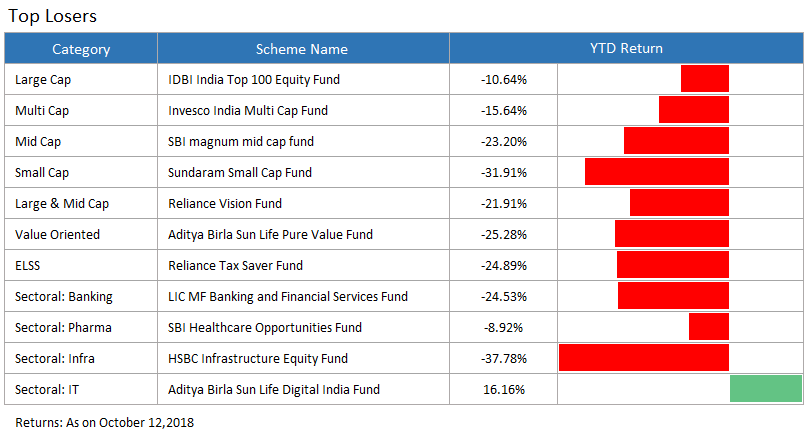

Top Performers & Losers

Conclusion

In the end note, it is clear that the battered rupee is plunging against the US dollar in the midst of weak global trends. Further, there is fluctuation in the crude oil prices. Both these factors have created inflationary pressure on the economy, and as a result, investors expect further rate increase by RBI in the future. The exporting companies/sectors including IT, Pharma, textile, and chemicals get benefit from this rupee depreciation.

The actual impact is something which the time will tell. With this, we are winding up our analysis for the past week. As we believe that no time is bad to make SIP investment, thus use this period as an opportunity for your next mutual fund investment. To seek guidance concerning it, connect with our experts of MySIPonline via email ( support@mysiponline.com) or phone call (+91-9660032889).

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure