Mutual fund market is full of ups and downs, it is this reason that makes the market work in red and green from time to time. Talking of the last week, sensex ended higher by 0.42% and underperforming S&P BSE Small Cap went up by 1.43%. Sentiments of the investors were supported by the falling crude oil prices, optimistic quarterly results of companies and the festive season. However, gains were restricted due to hawkish stance maintained by US Federal Reserve.

Table of Content

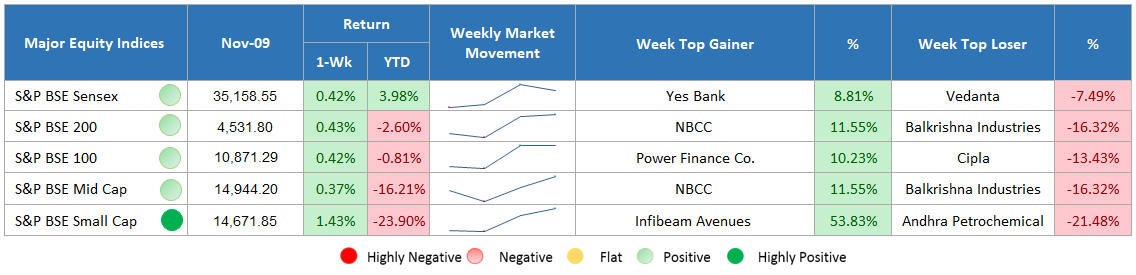

Major Equity Indices Performance

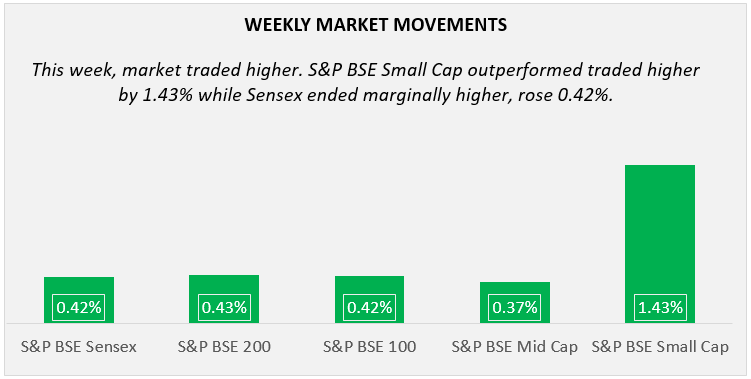

During the truncated week, Sensex traded higher by 0.42% while underperformed S&P BSE Small Cap surged by 1.43% and outperformed S&P BSE Mid Cap rose by 0.37%. S&P BSE 200 and S&P BSE 100 traded in green at a weekly gain of 0.43% and 0.42%, respectively.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Many factors supported investors’ sentiments such as falling crude oil prices, strong quarterly results and gains in large cap stocks. Further, due to festive season, during muhurat trading on Diwali, all of the sectors ended in green. However, on the contrary side, gains remain restricted after US Fed Reserve maintained its hawkish stance over the rate of interest. Further, the difference between Italian government and European Union is expected to deepen.

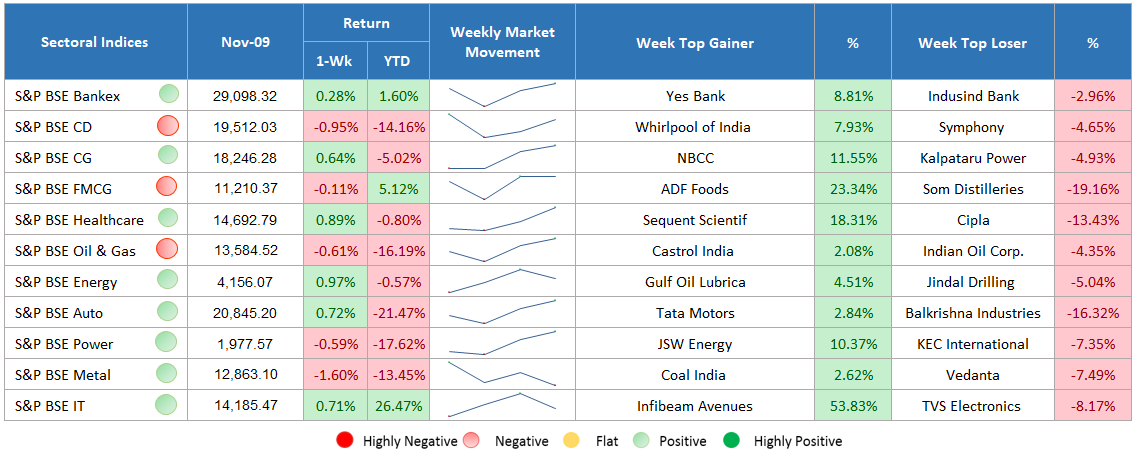

Sectoral Indices Performance

Gaining Sectors

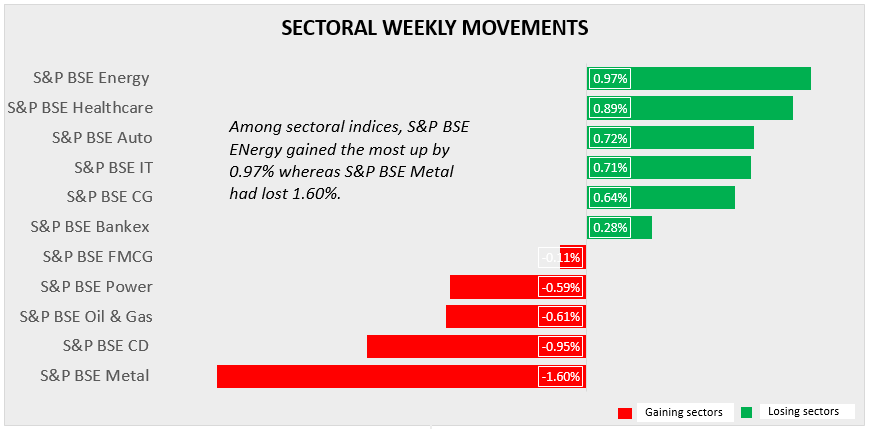

BSE Sectoral Indices ended on a mixed note; some traded up while others went in red. Among all, S&P BSE Energy was the top performer on the account of falling crude oil, trading higher by 0.97%. Healthcare, Auto, IT, Capital Goods, and Bankex also gained marginally, went up by 0.89%, 0.72%, 0.71%, 0.64%, and 0.28% respectively.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

S&P BSE Metal lost the maximum, plummeted by 1.60%. Other sectors including consumer durable, oil & gas, power and FMCG also suffered selling pressure, plunged by 0.95%, 0.61%, 0.59% and 0.11% respectively.

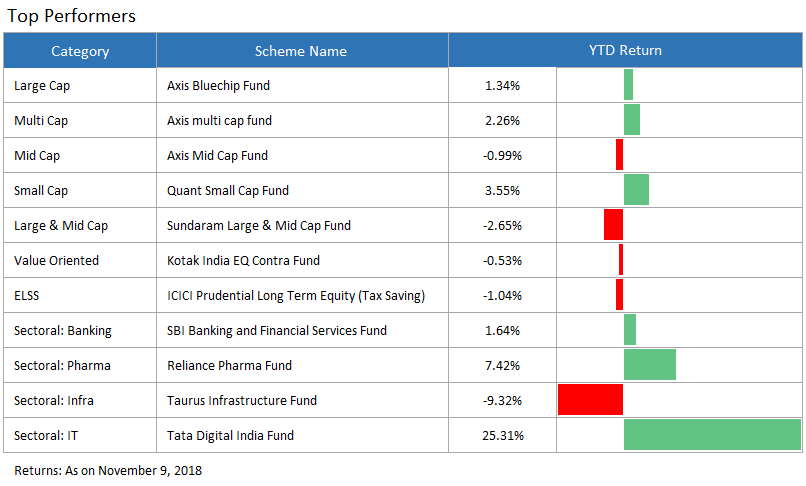

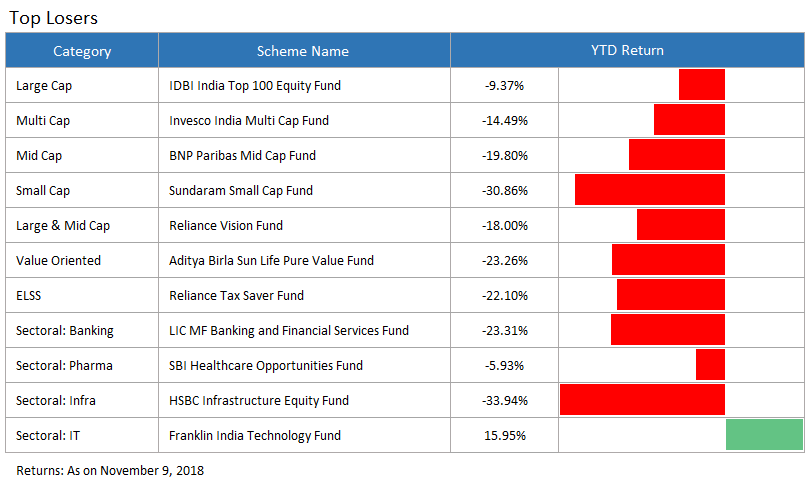

Top Performers and Losers

The End Note

Hope you have gone through this clear cut report on the last week’s market performance, which will help you in making the right investment decision. Our sole aim behind this market report is to help you in earning best returns by keeping you updated regarding the changes. This is all one can do, as being sure about something regarding mutual funds is not possible, for it is always subject to market risk. Further, if you have any query regarding investing in mutual funds, you may consult our financial experts at MySIPonline and in case you have doubts related to the regular fund, you may post the same here.