Table of Contents

- What is Assessment Year with Example?

- Financial Year Vs Assessment Year in India for the Recent Years

- What is the Difference Between AY and FY?

- Key Characteristics of the Assessment Year (AY)

- Importance of the Assessment Year

- Why Does an ITR Form Have an Assessment Year (AY)?

- Things to Remember While Filing ITR During the AY

- Conclusion

You must have filed your income tax return, right? Then you would have come across the term Assessment Year (AY) in income tax and wondered what it means. It is a vital part of the tax process in India & easy to understand.

Imagine you are working on a project from April 2023 to March 2024, that is your financial year, the manager checks & examines your work in the next year, that is the assessment year meaning in the income tax.

Similarly, the Assessment Year is the year in which the government examines & taxes the income you earned in the previous year (PY), called the Financial Year (FY).

Understanding the difference between these two years helps you file your taxes correctly & avoid any mistakes.

In this blog, you will see what the Assessment Year is, how it differs from the financial year, why it is important and what you need to keep in mind when filing your tax return.

Now, before you proceed with your Mutual Funds investments for 2025, let’s quickly cover the role of the assessment year in income tax in the next heading.

What is Assessment Year with Example?

Using that easy example to understand the assessment year definition in income tax:

Assume that in 2025, your parent is looking into your grades through the 2024 school year, which you just finished.

- When terms of income tax, the assessment year is the government calculates how much tax you have to pay according to the money you make from that year.

- Your income and taxes will be analysed by the government in the Assessment Year 2025–2026 if you generated income during April 2024 and March 2025.

- The time frame of twelve months following the end of the fiscal year is referred to as the Assessment Year.

- Income earned all over the financial year is payable in taxes from April 1–March 31.

Note: Always remember to file your income tax return within the relevant AY.

Financial Year Vs Assessment Year in India for the Recent Years

Here is the table to understand the financial year and assessment year

| Period | Financial Year | Assessment Year |

|---|---|---|

| 1 April 2024 to 31 March 2025 | 2024-25 | 2025-26 |

| 1 April 2023 to 31 March 2024 | 2023-24 | 2024-25 |

| 1 April 2022 to 31 March 2023 | 2022-23 | 2023-24 |

| 1 April 2021 to 31 March 2022 | 2021-22 | 2022-23 |

| 1 April 2020 to 31 March 2021 | 2020-21 | 2021-22 |

Be 1 step ahead with Tax Calculator r before filing your ITR in 2025.

What is the Difference Between AY and FY?

A financial year is referred to as a year in which an individual receives income for taxation purposes. On the other hand, the assessment year in income tax is the year that follows the financial year, during which the income from the previous fiscal year is determined, taxes are paid, and an Income Tax Return (ITR) is submitted.

The key differences between FY and AY are in the following way:

| Point of Comparison | Financial Year (FY) | Assessment Year (AY) |

|---|---|---|

| Meaning | The year in which you earn your income. | The year in which that income is assessed and taxed. |

| Purpose | Income is generated through a job, business, or investments | Income tax returns are filed and taxes are paid |

| Time-Period | April 1 to March 31 of the following year | April 1 to March 31 after the financial year ends |

| Example | FY 2024–25: April 1, 2024 – March 31, 2025 | AY 2025–26: April 1, 2025 – March 31, 2026 |

| Tax Filing Based On (ITR) | Income earned in this period | Income of this year is filed in the corresponding AY |

| Who Uses It | Employers, accountants, and individuals need to track income | Income Tax Department and taxpayers for return filing |

Why It is Crucial:

- Based on your income from the Financial Year, you submit your income tax returns for the Assessment Year.

- When filing tax forms or dealing with a tax professional, being familiar with the differences helps avoid mistakes.

The assessment year includes key characteristics. Read more to know.

Key Characteristics of the Assessment Year (AY)

Here are the crucial characteristics of the Assessment Year (AY):

-

Follows the Financial Year

The Assessment Year always comes right away soon after the Financial Year. (Example: For income earned in FY 2024–25, the AY is 2025–26.)

-

Used for Tax Filing

You file details Income Tax Return (ITR) in the Assessment Year for the income you earned in the previous Financial Year.

-

Income is Reviewed and Taxed

The Income Tax Department evaluates your revenue, expenses and determines the taxes during the Assessment.

-

Applies to All Taxpayers

Your income is evaluated in the AY, no matter if you are an investor, freelancer, business owner, or employed individual.

-

Important for Compliance

The Assessment Year is when all tax-related actions, including filing returns, paying taxes, claiming refunds and evaluations, take occur.

-

Mentioned in Tax Forms

All ITR forms and notices from the Income Tax Department refer to the Assessment Year, not the Financial Year.

-

Refunds

During the AY, your tax refund is handled and issued if you apply for it.

Importance of the Assessment Year

The assessment year plays an important role in ITR taxes. Here are the important key points:

- Tax Monitoring: By providing a particular time frame for income filing and payment of taxes, it supports individuals living fulfilling their tax obligations.

- Government Revenue: The AY allows it to be achievable for government to gather taxes, which simplifies distribution of resources and financial preparation.

- Account maintaining: It makes tax administration simpler by maintaining a precise record for each revenue collected and tax payable.

- Avoiding Penalties: Filing taxes within the AY's deadlines helps individuals avoid penalties and legal consequences for late filing or non-compliance.

Why Does an ITR Form Have an Assessment Year (AY)?

The Assessment Year on your ITR form shows the year in which your income from the previous financial year is reviewed and taxed by the government:

- You check your income before the financial year (FY) when you complete your Income Tax Return (ITR). The government identifies the year that involves your income has been checked and determined by taxes via the Assessment Year (AY) to keep the organization.

- The tax department and you can figure out which year your income is being analysed for tax reasons by examining the AY on the ITR form. By clearly separating the year you obtained the income (FY) and the year you paid taxes on it (AY), it helps avoid conflicts.

In short, the AY on the ITR form shows the tax year in which your income from the past financial year is being checked & taxed.

Do you know there are some major points to remember while filing ITR? Read the next headline to know.

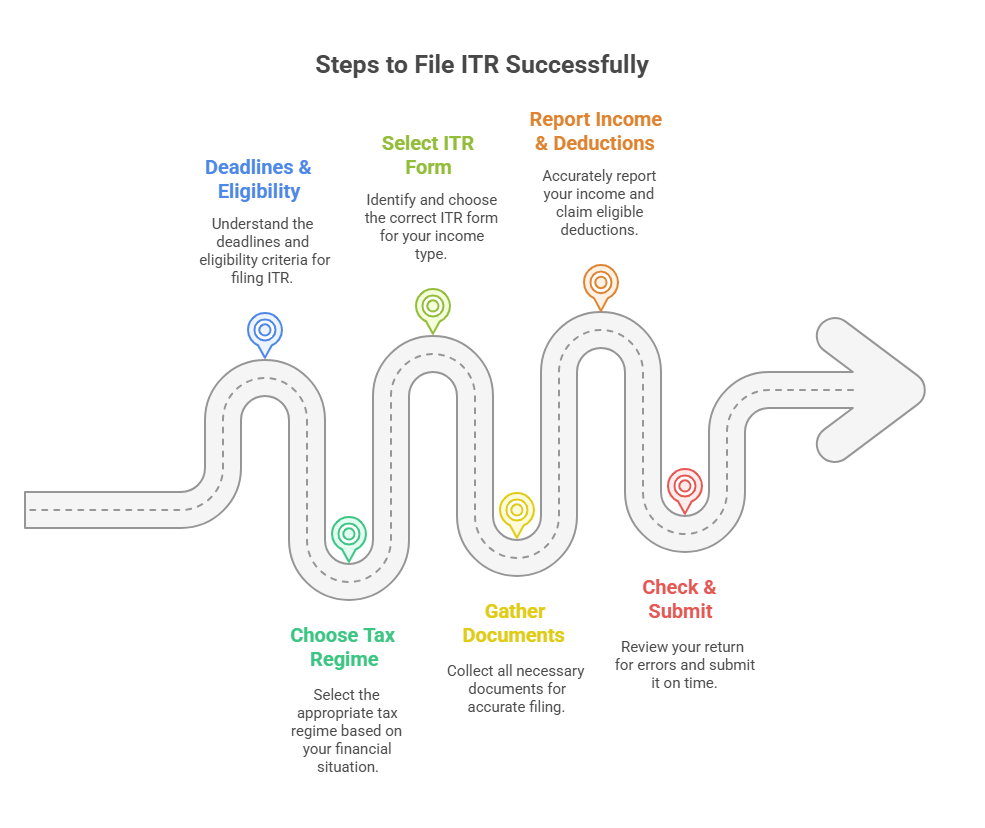

Things to Remember While Filing ITR During the AY

There are many things to keep in mind while filing the ITR return during the AY:

1. Deadlines & Eligibility:

- For individuals who are not based in the audit, the deadline for filing an ITR is July 31st of the assessment year.

- Before filing ITR it is important to know your criteria and eligibility that you fulfil the requirements. You have to submit an ITR if your gross total income (GTI) (before deductions) goes over the essential exemptions limit.

2. Choosing the Right Tax Regime:

- As India offers two tax regimes, the old regime with exemptions & deductions, and the new regime with low tax rates but with few deductions.

- Know about the old and new regimes and their based rules, then determine which one is suited according to your income, deductions & exemptions

3. Selecting the Correct ITR Form:

- There are multiple ITR forms (ITR-1 to ITR-7) according to the money you make, streams, and categorization.

- Choose the appropriate ITR form based on your suitability and sources of revenue (such as salary, company, and capital gain).

4. Gather Important Documents

- Form 16. This is a certificate from your employer that shows your salary & how much tax has already been subtracted.

- Form 26AS Check this form online to see all the tax that has been paid or deducted against your PAN (Permanent Account Number). It helps to confirm that your tax details are correct or incorrect.

- Other Documents such as PAN card, Aadhaar card, bank statements, proof of investments, and any other papers related to your income or tax handy.

5. Report Your Income & Claim Deductions

- Mention all the money you earned during the year salary, interest from the bank, rent from property, profits from selling things, etc.

- Do not forget to include tax deductions you claim, like investments or expenses allowed by the government to reduce your taxable income.

6. Check and Submit Your Tax Return

- Review Pre-Filled Info If the tax website fills some details for you, make sure they are correct & without error.

- E-Verify Your Return After submitting, verify your return online using options like Aadhaar OTP, net banking, or bank account.

7. Important Tips to Remember

- Compare your income and tax deducted with what is shown in Form 26AS to avoid mistakes.

- If you have any money or property outside India, report it properly and honestly.

- Take your time to carefully fill out and review your tax return to avoid errors.

By following these guidelines, you can ensure accurate and timely ITR filing.

Conclusion

Lastly, the Assessment Year in the income tax is the year when the government checks & taxes the money you earned the year before. It is different from the Financial Year, which is when you actually made the money.

Knowing about the Assessment Year helps you file your income tax return correctly and on time. It also makes sure there is no confusion regards which year your income belongs to & when to pay taxes.

So, whenever you file your tax return, remember the Assessment Year is the year you are paying tax for the income you earned before. This makes the whole tax process easier & helps you avoid mistakes or any delays.

Frequently Asked Questions

-

What is the consequence of filing my tax return after the assessment year has closed?

In the case that you file after the last date, you will get a fine and additional interest. Therefore, it is necessary to file on time to minimize cost.

-

Is it possible for me to revise my tax return in the course of an ongoing assessment year?

It is possible that you may create a revised version of your return if you submit it before the closure of the assessment year.

-

What are the necessary documents required to file taxes for a particular assessment year?

There are major things required to file taxes are Form 16 or its equivalent from the employer, issued PAN, Aadhaar, 26AS document recognized as a tax credit statement, along with several credit bank statements of the PY & Proof of investments or expenditures claimed to be reduced by tax.

-

Why is the Financial Year and Assessment Year not the same?

These two different terms help confine and organise the tax system, this way you submit taxes after the income year that was completed.

-

What do the terms AY and PY mean in income tax?

AY (Assessment Year) refers to the year during which your income, which the government will be taxing for the previous year, is reviewed and taxed, while PY (Previous Year) refers to the financial year in which you realize your income. It is the year preceding the Assessment Year.

.webp&w=3840&q=75)