Table of Contents

- Tax benefits of up to Rs. 46,350*.

- Lowest Lock-in among 80C instruments.

- Higher long term growth.

- More transparent than conventional methods

The end of the financial year is not that far off now and with that comes one of the important and stressful tasks of the whole year ‘Tax Planning’. With so many options available in the market, picking the right one is always a tough task. Which one to choose, an option that can give stable but low returns (PPF, FD, NSC, etc.,) or an option that can provide volatile but high returns (ELSS Mutual Funds), is a common doubt of the investors. But, as the awareness of mutual funds is increasing, people are shifting more towards Equity Linked Savings Schemes, as in addition to the high returns through equity investments, they also have the lowest lock-in period among all investment avenues under section 80C.

Table of Content

Now, one of the major queries that we have received in the past few months is “Which ELSS should we choose between Aditya Birla Sun Life Tax Relief 96' Fund and Axis Long Term Equity Fund?”. So, today with the help of analysis of various parameters of both the schemes, we will see that which among them is better. Let’s start with the basic details of both the schemes.

| Basic Details | ||

|---|---|---|

| Description | Axis Long Term Equity Fund | Aditya Birla SL Tax Relief 96' Fund |

| Benchmark | S&P BSE 200 TRI | S&P BSE 200 TRI |

| Launch Date | 29-Dec-09 | 29-Mar-96 |

| Asset Size | Rs. 16,467 crore (As on Oct 31, 2018) | Rs. 6,480 crore(As on Oct 31, 2018) |

| Expense Ratio | 2.08%(As on Oct 31, 2018) | 1.92%(As on Oct 31, 2018) |

| Minimum Lumpsum | Rs. 500 | Rs. 500 |

| Minimum SIP | Rs. 500 | Rs. 500 |

| Return Since Inception | 17.36% | 24.49% |

| Exit Load | 0%. Lock-in of 3 years | 0%. Lock-in of 3 years |

Past Performance Comparison

Analyzing the returns a scheme has given in the past is really helpful in seeing how it has performed during different market conditions and what kind of consistency it has shown over the years. Let’s have a look at what kind of track record both of these mutual fund schemes hold.

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Description | 1 Year | 3 Years | 5 Years | 7 Years | ||

| Axis long Term Equity Fund | 3.00% | 11.40% | 20.20% | 19.99% | ||

| Aditya Birla Sun Life Tax Relief 96' Fund | -2.94% | 11.85% | 19.77% | 18.17% | ||

| Benchmark | 0.71% | 12.00% | 14.71% | 16.94% | ||

| Category | -5.57% | 9.74% | 16.56% | 17.47% | ||

| As on Nov 28, 2018 | ||||||

From the above table, it can be seen that both Axis Long Term Equity Fund and Aditya Birla Sun Life Tax Relief 96' Fund have beaten the benchmark as well as the category at all the instances. If we compare them with each other, then we will see that both the schemes don’t have that much of a difference in the past 3, 5, and 10 years' returns. A little bit of difference which is there is compensated by the low expense ratio that ABSL Tax Relief 96' Fund has. Now, the important cycle to notice here is the past 1-year return, where Axis Long Term Equity Fund has managed to cap the losses better than the other one by keeping the returns in positive. This shows that it acts more stable in the downside market, the reason behind this will be discussed further in the answer.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

But as ELSS invest majorly in equities which are long-term instruments, don’t make your investments on the basis of short term volatility. In the longer term, ABSL Tax Relief has provided an exceptional growth, and the return since inception of 24.49% is the proof of that. So, in terms of the past performance, both the schemes have shown great results.

Asset Allocation Comparison

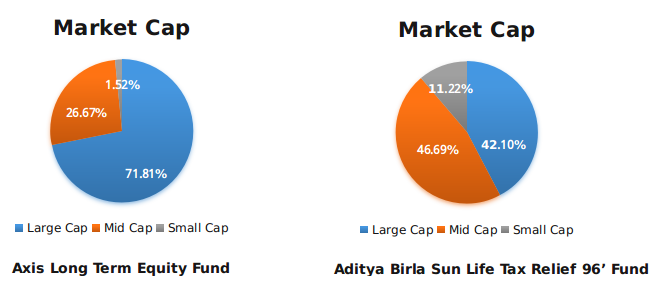

Now, this is the parameter which differentiates both the schemes greatly. Let’s start with the allocation in different market caps that both the schemes have.

From the above pie-charts, it can be easily seen that Axis Long Term Equity Fund is following a large-cap oriented style of investing, whereas Aditya Birla Sun Life Tax Relief 96' Fund is investing majorly in mid cap as well as large cap space. This is a major reason that in the recent volatility Axis Long Term Equity Fund has managed to cap losses better than the latter, as the large cap companies have the capability to show stability even during the market volatility. Let’s move to the sector allocation of the scheme.

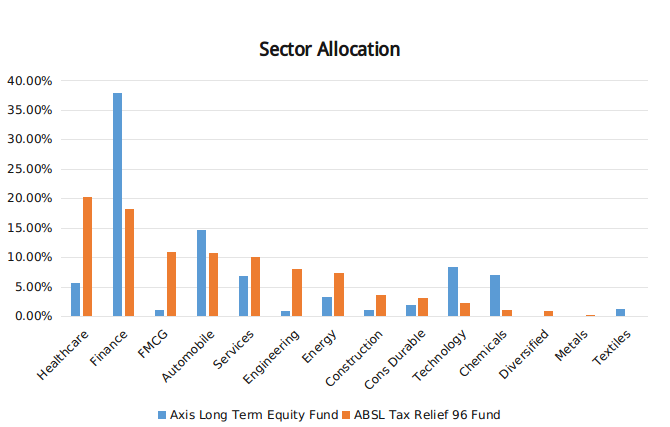

Now, the second major difference among them is their portfolio allocation style. As of now, Axis Long Term Equity Fund is following a focused style of stock picking (investment in 34 stocks), and Aditya Birla Sun Life Tax Relief 96' Fund is following a bit more diversified stock picking strategy (investment in 49 stocks). As for the sector allocation, Axis Long Term Equity is more concentrated towards finance and automobiles sector, whereas ABSL Tax Relief 96' is following a diversified style, with major concentration in healthcare, finance, FMCG, automobile, and services sector. So, in terms of the sector allocation too, both the schemes are excelling in their own way, as the top sectors of both the funds are holding great possibilities for future growth in the coming years.

Risk Parameters Comparison

| Risk Analysis | ||||

|---|---|---|---|---|

| Risk Parameters (%) | SD | Beta | Sharpe | Alpha |

| Axis Long Term Equity Fund | 14.45 | 0.90 | 0.23 | -0.90 |

| Aditya Birla Sun Life Tax Relief 96' Fund | 14.81 | 0.92 | 0.34 | 0.70 |

| Benchmark | 14.84 | 1.00 | 0.32 | - |

| Category | 15.64 | 0.98 | 0.21 | -1.31 |

In terms, of risk parameters both the schemes are excelling in different fields. While Axis Long Term Equity Fund has low SD and Beta, Aditya Birla Sun Life Tax Relief 96'’ Fund has high Sharpe and Alpha. This means, the former show fewer fluctuations in returns during the market volatility, whereas the rewards you get for taking the risk with your investments is much higher in the latter.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

The Winner Is.....

Both!!! Yes, you read that right. As you may have seen that both schemes follow different investment strategies and styles, because of which they are best for different types of investors. So, if you are an investor with a high liking towards the finance sector and want a scheme that shows fewer fluctuations in the market volatility, then you should go for Axis Long Term Equity Fund. And, if you are an investor with a high-risk appetite, don’t panic during the market volatility, and want to follow a bit diversified portfolio with high allocation in mid-cap space, then ABSL Tax Relief 96’ Fund is best for you.

Must Reads: