As the financial year 2017-18 is reaching near to its end on March 31, 2018, people are getting worried regarding tax saving. Taxes have become monsters that are eating up huge bites from the incomes of individuals.

This is why saving the bites of our income from this tax monster has become a prerequisite today. When it comes to tax saving, the aim is not just to save the tax but to use that saved chunk wisely. Witnessing the present scenario, the smart way to do that would be to make an investment in Equity Linked Tax Saving Schemes.

Getting the Clear Picture of ELSS Funds:

Tax saving is an imperative part of financial planning and is priority driven. Section 80C of Income Tax Act, 1961 allows claiming the deductions from the taxable income by letting one invest in certain investment schemes. ELSS is one such escape window to save tax. Equity Linked Saving Schemes are equity diversified funds that aim at providing both capital appreciation and tax saving. These are the mutual fund investment in which people invest throughout the year but some look upon ELSS as an eleventh-hour rescue option. Most people do this because they do not have adequate investments to show for the existing financial year for tax saving. Such schemes are considered ideal for saving tax up to Rs.1.5 lac, provided one has a good appetite for high risk tolerance and investment horizon of more than five years.

Taking a Glance at Five of the Top Performing funds:

- Aditya Birla Sun Life Tax Relief 96 Growth Fund:

This ELSS scheme is one among the best performing schemes in terms of three years trailing returns. This fund is suitable for those seeking long term goals such as retirement planning, child marriage or education etc. It is well diversified and has the right amount of balanced investment in large-cap and small/mid-cap funds. The fund has completed more than 20 years providing outstanding returns to investors. - Axis Long Term Equity Fund:

This fund is the most eminent fund among those investors who opt for ELSS schemes. It focuses on creating wealth appreciation by investing in blue ribbon stocks rather than allocating to already determined sector specific stocks. It is a low risk bearing fund that aims at picking up businesses with great potential and strong balance sheet. - DSP Black Rock Tax Saver Fund Growth:

These fund intents to generate medium to long-term capital gain from a diversified portfolio and is a fine fit for those investors who are capable of taking moderately high risk. It is mostly biased towards investing in large-cap and small cap funds bearing a growth-oriented investment style. - L&T Tax Advantage Fund Growth:

This scheme targets in hatching long-term monetary growth by diversifying the investment in equity and equity-related securities. Fund has managed to outperform the benchmark by giving consistent returns. Investors intending to follow up with moderate risk can opt for this scheme. - Reliance Tax Saver (ELSS) Fund-Growth:

Launched in 2005, it is an above-average performing fund with risk meter flashing moderately high risk on the board. It is an open-ended equity-oriented scheme that aims to spawn capital worth given that investments are done for a longer period of time.

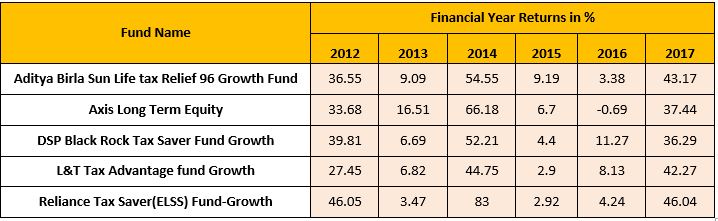

Table to show funds performance over the past year:

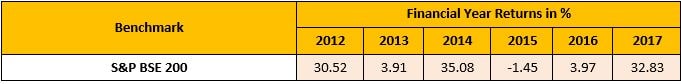

The returns of the benchmark S&P BSE200:

The comparison can be done by scrutinizing both the tables above.

Why to Take ELSS under Advisement?

While choosing on to ELSS for tax saving, we should have prior knowledge of why ELSS has the upper hand on all other schemes:

- Shortest Lock-in Period: This scheme has the shortest lock-in period of three years as compared to Public Provident Fund (PPF) that has a lock-in of 15 years and National Savings Certificate (NSC) which has a lock-in period of 5 years. One thing that must be taken into account is that one cannot withdraw the invested amount before the completion of the lock-in period even at the time of severe emergency. No matter ELSS bears a small lock-in period, one must consider to stay invested for a longer period to acquire higher gains.

- Risky But Proffers High Returns: Because ELSS mostly invests in equities, they tend to bear higher risks. But if one has decided to invest for an extent of five years or more, then only one can actually realize exceptional capital growth, which is comparatively more than other asset classes.

- Compounding: Worth of your money is increased when you invest it at the very moment you learn about investments. Mutual fund schemes including ELSS serves the feature of compounding, i.e., earning interest on interest whilst making you earn multiples on your principal amount.

- No Maximum Limit of Investment: There’s no maximum limit for making an investment in Equity Linked Saving Scheme. But the amount that will be deducted from being taxed is Rs. 1.5 lac under section 80C of Income Tax Act, 1961.

If you are looking to save your income tax scissors, be canny enough to put your income in the right place. ELSS mutual funds are the best way out from the situation. They can help you achieve both the goals of saving tax and increasing the worth of your savings in the future.

-min.webp&w=3840&q=75)