Table of Contents

Are you ready to capture the future with a unique investment opportunity designed to take advantage of the rapid growth of the IT Sector? Yes, the NFO Whiteoak Capital Digital Bharat Fund launched by Whiteoak Capital MF is here to make you a participant in the new evolution of tech industries. It is open for subscription from 20th September to 02nd October 2024, you will find the necessary details in this post.

Now that brings you back to why this will be the right time to invest in this fund.

Well, without any further delays, let's give you an expert review of this new NFO and see if it's worth adding to your portfolio or not.

Let's start with learning what it’s made of so for that, you must have a look at the investing strategy.

Investment Strategy Used by Whiteoak Capital Digital Bharat Fund

To put it simply, this fund finds growth opportunities in technology or tech service-based companies covering its broader theme concept of two interconnected sub-sectors based on structural and tactical bets.

You will see how this New NFO will use a structural theme to capitalize on the market trend which has the potential to make good returns for you in the long term.

Likewise, with a tactical theme or say practical approach you will see Whiteoak Capital Digital Bharat Fund making active decisions to make high returns in shorter periods.

Moreover, its prime focus lies in 5 key parameters of each company it invests:

- Capabilities: Investing in top tech companies that adopt efficient digital strategies like cloud, analytics, automation and enterprise solutions as their base.

- Business Mix: Strongly positioning itself vertically and horizontally amongst competitive tech industries.

- Quality of Client Portfolio: The fund makes sure it invests in quality stocks and holds them for longer durations to increase the cash flow of the portfolio.

- Good Execution of track record: It strives to make good returns by targeting scalable companies with a good track record of giving high returns in the long term.

- Increasing Profitability: It carefully asses that the fund generates high revenue margins for investors that's why giving stresses on onshore and offshore revenue mix, gross margins and SG&A costs (cost of day-to-day operations).

To support our theory, let’s have a look at the long-term performance of the IT Sector Mutual Funds:

You see, historically Nifty IT TRI has delivered better returns on average compared with the broader market.

Although this outstanding performance makes a strong case to invest in this fund, let’s add some more reasons in our next question.

Why invest in the Whiteoak Capital Digital Bharat Fund?

There are four major reasons to invest in this Thematic Mutual Fund:

A Large & Experienced Analyst Team: It is built on a heterogeneous business model giving unique services that are manufactured, sold and used at one time.

For example, iTunes music stores in 2003 started the trend of paid downloads while services like Spotify became more popular in 2008. If active management is what you seek then it is the perfect match for you to generate high returns within the digital theme.

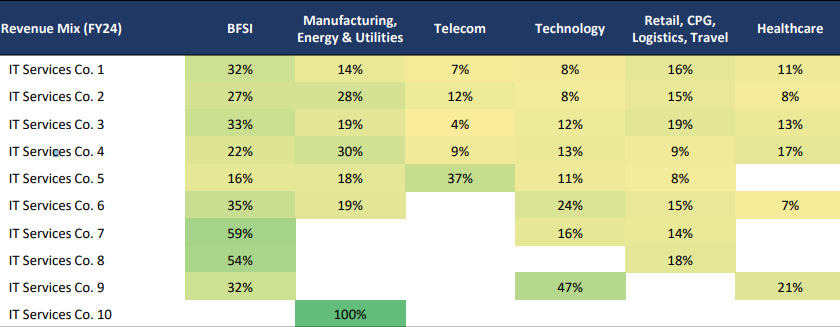

Let's have a look at the revenue contribution of IT service companies:

- Reasonable Allocation to New-age Businesses: It gives meaningful exposure to new-age businesses, which are at the forefront of shaping "Digital Bharat". This initiative plans to connect rural areas to turn into high-speed internet networks. For example, jio, airtel MediaTek etc.

- Market Cap Distribution: It uses a bottom-up approach when selecting stocks focusing on how much quality they bring to your portfolio.

- High Active Share: Whiteoak Capital Digital Bharat Fund keeps an active share, which is one of the necessary components for potential alpha generation.

Fund Manager’s Expertise Leading Whiteoak Capital MF to Success

Meet Mr. Ramesh Mantri with 19+ years of expertise is driving one of the few industries with the DNA of investment management. Backed by the strong reputation of Whiteoak Capital Mutual Fund and expert investing style, it has made a strong pan-India presence with 467K unique investors. In short, if you are looking to make high returns in this sector objectives and expertise of this fund are a perfect pair.

Basic Details of Whiteoak Capital Digital Bharat Fund

| Scheme Name | Invesco India Technology Fund |

|---|---|

| Issue Open Date | 20.09.24 |

| Issue Close Date | 02.10.24 |

| Category | Equity-Sectoral-Technology |

| Benchmark | BSE Teck TRI |

| Minimum Application Amount | Rs.100 |

| Fund Managers | Mr. Ramesh Mantri |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

Conclusion- Who Should Invest?

To sum up, if you are someone looking for actively managed funds while making good profits from the booming technology sector will find it a good option to invest. Just make sure you invest via SIP as these are likely to have higher risk for higher rewards. On that note, as the experts quote, "a smart addition to portfolio riding the wave of India's digital future", that's the tag given to this IT Sector Mutual Fund.

Also Read : Should You Invest in NFOs?

.webp&w=3840&q=75)