Table of Contents

Did you know that the Nifty pharma index was at flat 0.0% at 21803.85 today? Yes, the pharmaceutical industry is in crisis and investors are concerned about, "Will the US tariff derail the growth of Nifty pharma in 2025?"

Well, on hearing the recent announcements of U.S tariffs on pharmaceutical imports have rather left the investors in dilemma, questioning whether these new trade barriers would spike a halt in the strong momentum that was earlier recorded as a solid recovery, where the pharma sector saw 14.3% increase in revenue and 23.6% rise in profits year-over-year.

Let's delve into this further to read what the experts have to say about these tariff changes could affect pharma sectors' growth in the upcoming months.

How U.S. Tariffs are Affecting Pharma Companies in India?

To begin with, the U.S. holds $360 billion, making it the largest shareholder of the pharmaceutical exports, thereby leaving lots of room for impact if there is any trade changes in the policies worldwide.

Muck like in early 2025, President Trump said a new tariff on imports, raising concerns in this sector. However, India was initially exempted, creating a lot of uncertainty in the market.

This uncertainty caused the Nifty Pharma index to drop sharply, with shares of major companies like Biocon, Sun Pharma, and Lupin falling by 1% to 3% in just one day. Experts believe these tariffs are aimed at encouraging the U.S. to make more drugs locally, but they also make it harder and more expensive for companies in India to export their products.

“The announcement of tariffs is worrying,” says Rajesh Sharma, a market analyst. “Even though Indian pharmaceutical products were initially exempt, the fear of future tariffs has made investors anxious.”

Nifty Pharma Showcased Signs of Recovery

Now, despite the raising concerns, the Nifty pharma bounced back, seeing 14.3% increase in revenue, a 23.6% rise in profits compared to last year, supported by the government policies, and new drug launches like, ay for breast cancer, Grafapex and Gomekli etc.

India only faced 26% tariff on many goods, pharmaceutical imports were exempted, offering relief to Indian drug manufacturers.

However, the announcement of potential future tariffs on pharmaceuticals caused immediate concern. This uncertainty led to a drop in the Nifty Pharma index, with Biocon, Sun Pharma and Lupin shares falling by 1% to 3% in a single session.

Why Nifty Pharma May Still Hold Its Ground?

Despite the initial sell-off, Nifty pharma has shown resilience. The sector posted a 14.3% year-on-year revenue growth and a 23.6% profit growth, outpacing the broader market. This performance is supported by strong domestic demand, government incentives & a pipeline of new drug launches. Biocon share, while affected by the tariff news, continues to attract analyst interest due to its robust biosimilars portfolio and global expansion plans.

Market sentiment has been sensitive to policy developments. When the U.S. paused the implementation of some tariffs in April 2025, Nifty pharma rallied by over 3%, with Biocon share and other major constituents recovering some of their losses. This reaction shows the sector’s dependence on export policies but also its ability to rebound when clarity returns once again.

Biocon Share and Market Response

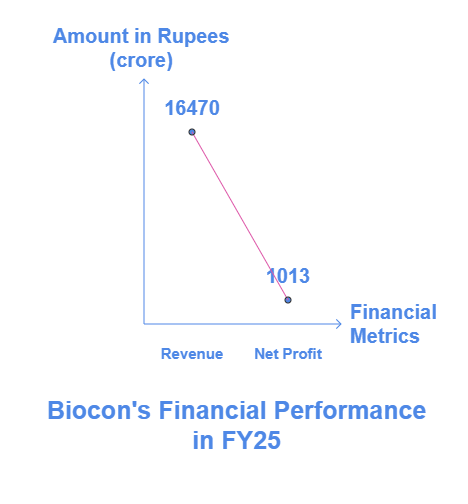

Biocon share has experienced notable volatility in May 2025, reflecting mixed market sentiment and sector developments. The stock recently traded at around Rs.334, down by over 2% in the latest session, after a brief rally earlier in the month. Despite this, Biocon reported solid financials for FY25, with revenue reaching Rs.16,470 crore and a net profit of Rs.1,013 crore.

The company’s biosimilars segment continues to drive growth, securing major market access agreements in the United States. Analyst recommendations remain largely positive, with Biocon share maintaining their relevance in the Nifty Pharma index.

What Should Investors Watch?

Here are a few things you should know:

- Policy Announcements: Any updates on U.S. trade policy or bilateral agreements will directly impact Nifty Pharma and biocon share performance.

- Earnings Reports: Quarterly results from leading companies will reveal how well they are managing cost pressures and maintaining growth.

- New Drug Launches: Success in launching new generics and biosimilars, especially in alternative markets, will be key to sustaining momentum.

- Domestic Market Trends: Continued growth in local demand can offset some of the export headwinds.

Conclusion

In short, while the new U.S. tariffs bring some uncertainty, they don’t mean that Nifty Pharma's growth is over. Companies like Biocon may face some challenges in the short term, but their long-term prospects remain strong because of their solid business strategies and ability to adapt. For cautious investors, now is the time to reassess your approach, not to exit completely. With careful planning, what seems like a risk can turn into a good opportunity for growth in 2025.