Table of Contents

- Kotak Gold Fund Growth

- Axis Gold Fund - Regular Plan - Growth Option

- Nippon India Gold Savings Fund-Growth plan- Growth Option

- SBI Gold Fund Regular Plan - Growth

- HDFC Gold Fund - Growth Option

Introduction

Gold prices have recently reached an all-time high, and this has occurred within the last month. In this analysis, we will examine the data and investigate why the price of gold has increased so dramatically. We will also provide guidance on how to estimate gold prices by yourself so that you can invest in gold at the right time, well let's delve into this blog so you can gain detailed knowledge about Gold Funds.

- Zero Fees

- Free KYC Check

- Best SIP Plans

- Track & Manage Investments

Understanding the General Economics of Demand and Supply

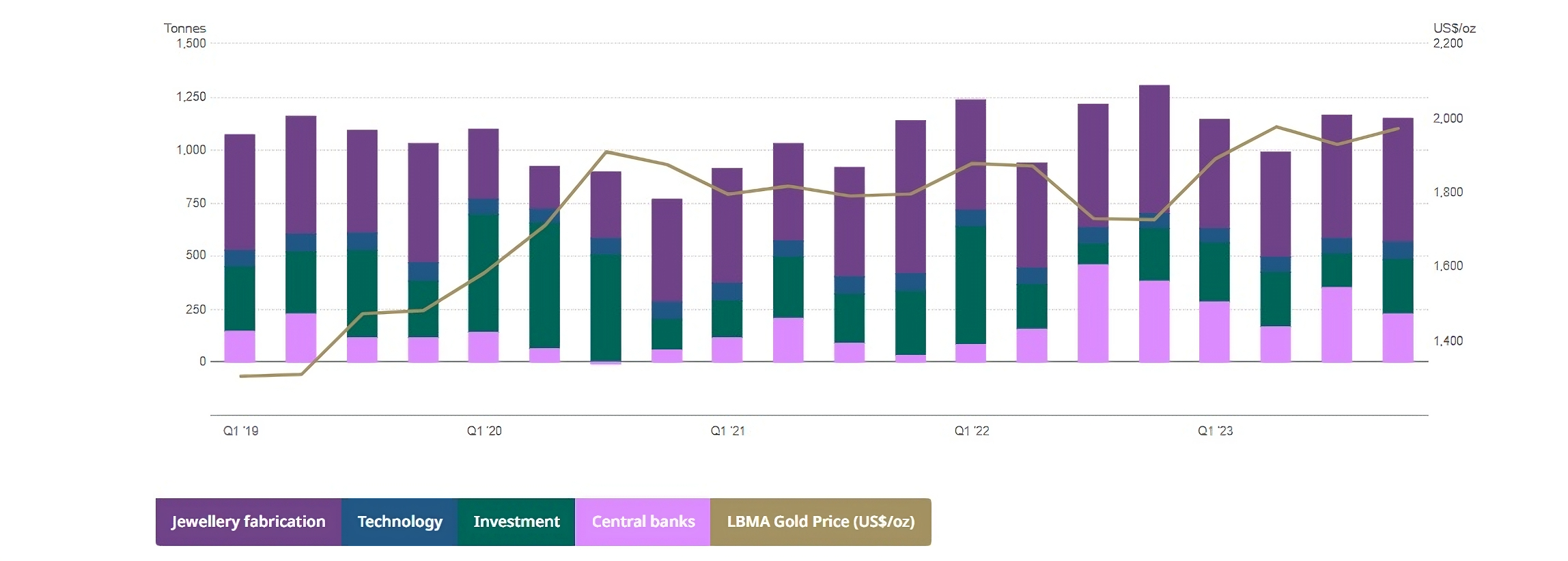

The prices of assets tend to go up when the demand for them increases. This is also true for gold, which is mainly bought as jewellery or for investment purposes. Additionally, central banks around the world include gold in their foreign reserves.

So when we deeply analyzed the purchase side, we found that there is a correlation between the amount of gold purchased by central governments and the price of gold. For example, after the outbreak of COVID-19 in 2020, central governments significantly reduced their purchases of gold, causing the price to fall.

However, since the third quarter of 2022, central banks have increased their gold purchases, leading to a rise in the price of gold from 50000 to 70000.

Why are Central Banks Increasing Gold Purchases, and Which Countries Are Buying More?

The story starts with China and Developing Nations Increasing Gold Purchases, while the geopolitical tensions and the large debt of the US economy have left many central banks feeling concerned about their foreign reserves.

In response, these banks are turning to gold as a way to diversify their holdings and protect against risk. China and India have been leading the way, with China purchasing over 1000 tons of gold in just the last year.

Gold Reserves by Country

| Rank & Country | Gold Reserve (in tonnes) | Gold Reserve Holdings in % |

|---|---|---|

| United States of America | 8133 | 69.89% |

| Germany | 3353 | 69.06% |

| Russian Federation | 2333 | 26.05% |

| China | 2235 | 4.37% |

| India | 804 | 8.54% |

It's easy to see why so many countries are turning to gold. Unlike paper currency, gold has a long history of holding its value and is not subject to the same volatility. This is why China's gold reserve now makes up 4.33% of its total foreign reserve, while India's gold reserve share is 8.54%.

In contrast, the US and Germany have a much higher share of gold in their foreign reserves, at a staggering 69%. It's clear that these countries understand the value of gold and the need to diversify their holdings in order to manage risk.

If you're concerned about the state of the global economy and want to protect your wealth, consider following the lead of these central banks and investing in gold. It's a smart move that can help you weather any economic storm.

Will Gold Price Cross Rs.200000

Are you curious about gold prices and how they may change in the future? According to the World Gold Council, most central banks plan to increase their gold reserves in the next 5 years.

This is due to geopolitical tensions, which are on the rise, and the fact that equity markets are currently at all-time highs with high valuations. Based on historical data, the demand for gold will likely remain strong, and gold could potentially triple in value over the next 6 years, reaching up to Rs. 200000.

To take advantage of this opportunity think about investing in digital gold funds through mutual funds. But first, let's break down what digital funds are all about. They are basically online platforms where you can invest in different stuff like stocks, bonds, ETFs, and mutual funds. These platforms make it super easy for anyone to invest using the internet

Ready to level up your investments? Find out how simple and convenient it is to invest in Mutual Funds with these best digital funds right at your fingertips!

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Top 5 Gold Funds

| S. No | Scheme Name | 3 Yrs CAGR | 5 Yrs CAGR |

|---|---|---|---|

| 1 | SBI Gold Fund | 13.41 | 16.7 |

| 2 | Axis Gold Fund | 13.4 | 16.65 |

| 3 | HDFC Gold Fund | 13.16 | 16.42 |

| 4 | Nippon India Gold Savings | 13.06 | 16.38 |

| 5 | Kotak Gold Fund | 12.93 | 16.36 |

SBI Gold Fund

SBI Gold Fund has been doing well over the last 3 and 5 years. It has shown an average growth of 13.41% each year for the past 3 years, and by about 16.7% each year for the past 5 years. These numbers help us understand how much money investors might have made if they invested in this fund during these periods.

Axis Gold Fund

Axis Gold Fund has demonstrated an average annual growth rate of 13.4% over the last 3 years and 16.65% in the previous 5 years. These figures reflect the fund's ability to generate returns for investors consistently over time.

HDFC Gold Fund

The HDFC Gold Fund has performed strongly, with an average annual growth of 13.16% over the past 3 years and 16.42% over the past 5 years. This shows how much profit it has made for investors compared to its peers.

Nippon India Gold Fund

Nippon India Gold Savings has shown an average yearly growth of 13.06% in the past 3 years and 16.38% in the past 5 years. It tells us how well the fund has performed for investors throughout these periods.

Kotak Gold Fund

The last three years have seen an average annual growth rate of 12.93% for Kotak Gold Fund, while the last five years have seen an average annual growth rate of 16.36%. This provides us with an estimate of the amount of money investors have received from the fund over these periods.

.webp&w=3840&q=75)