Table of Contents

- Why Is It Challenging to Predict the Gold Rate in India?

- Why Is the Gold Price Expected to Increase in 2026 in India?

- How Reliable Is the Gold Price Forecast for 2026?

- Expected Gold Rate in 2026 in India: What Experts Say

- What Are the Key Drivers of Gold Price Predictions for 2026?

- Are Gold Prices Expected to Increase or Decrease in 2026?

- What Will Be the Gold Price in 5 Years? (Prediction for 2030)

- How Much Gold Do I Need in My Portfolio in 2026?

- Should I Buy Gold for Long-Term Investment in 2025?

- Conclusion: Final Thoughts on Expected Gold Rate in 2026

Did you know that in December 2025, the gold price peaked at Rs 12,835 per gram for 22K gold and Rs 14,002 per gram for 24K gold, setting the highest recorded gold price in India?

This raises the right question: "What will the expected gold rate in 2026 in India look like?” and “Will this streak continue throughout 2026 also?”

Well, with India breaking high records in 2025, the gold rate in 2026 in India is all set to shine even brighter, with domestic prices expected to touch Rs 1,28,000-Rs 1,82,000 per 10 grams for 24-carat gold, depending on economic and geopolitical factors.

But now, with India's 2026 macro boom, like RBI rate cuts, more than 15% FY27 earnings growth expectation and RBI gold buys surging, one question is asked by every investor: "Could gold prices really reach Rs 2,00,000 by 2030?"

This analysis will show the past year's gold trends while learning the various factors that will shape the gold markets in India for 2026.

Hang with us through this entire piece for a list of the Best Gold Mutual Funds to uplift your current portfolio to newer heights.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Why Is It Challenging to Predict the Gold Rate in India?

Now, predicting the price of gold correctly is not an easy task. N number of factors, such as inflation, central bank policies and geopolitical events, influence it and even technological advances, which make it difficult to pinpoint the exact gold prices in the future.

Let us discuss the factors that make the whole process challenging:

- Economic Chaos: When things go south, you are in a hurry to buy gold. Why? Because Gold is that reliable friend who always shows up when everything else is falling apart.

- Global Drama: War, elections or even tweets from influential people can send gold prices soaring. You really cannot predict that.

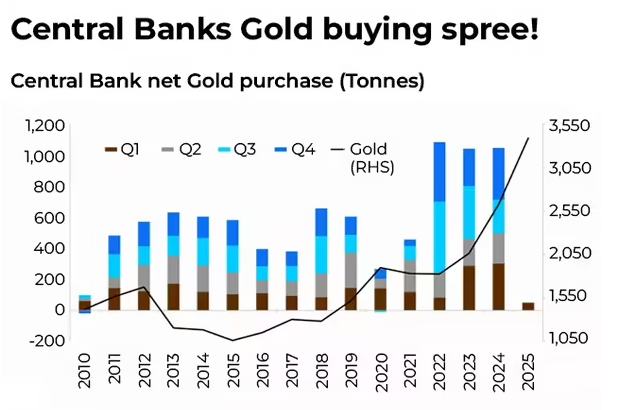

- Central Banks: These banks like to hoard gold like they are preparing for an apocalypse. When they buy a lot, the price goes up. But can you predict what they will do next? Nope.

- Currency Exchange Rates: The exchange rate of the Indian rupee against the US dollar is essential for local gold prices because India mainly imports its gold.

- Government Policies and Import Duties: The Indian government often changes import duties and taxes, like GST, on gold to manage trade deficits, bringing big shifts in the gold rates.

That is why you need an expert's opinion, as predictions are made based on historical trends and global economic conditions, keeping in mind the market sentiments of investors.

By closely knowing the factors that influence gold prices, you can try to find a reasonable estimate for the future, including the expected gold price in 2026 in India.

Why Is the Gold Price Expected to Increase in 2026 in India?

The gold prices in 2026 are expected to rise as they are influenced by the US Fed rate decisions and the strength of the US dollar, in addition to Trump's tariffs.

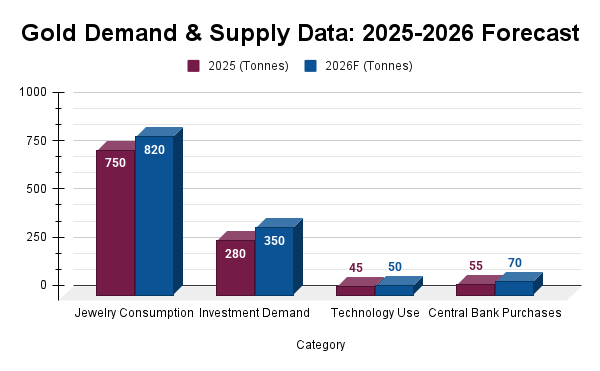

The graph below shows various other factors that also affect the gold prices in India:

- Inflation: When everything gets expensive, gold gets even shinier. In 2026, as inflation worries continue, people are likely to flock to gold like a crowd at a free concert.

- Global Uncertainty: Economic crises, trade wars and political tension are all pushing people to invest in gold as a safe haven. Think of it as the “cuddle buddy” during the cold economic nights.

- Central Banks are All in: If countries like India keep buying gold like it is the latest iPhone, prices are only going to go up. India alone bought 64-65 tonnes of gold in 2025. They must have a serious love affair with the yellow metal.

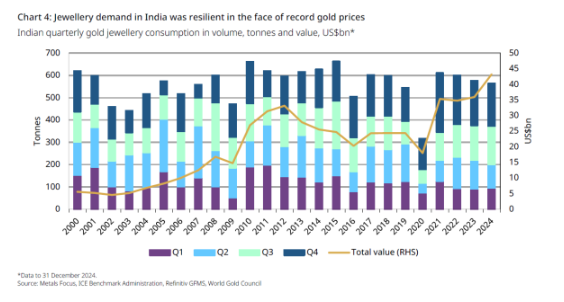

- Jewellery & Investment: In India, gold is not just a precious investment; it is a tradition. Whether it is weddings, festivals or just an excuse to spoil yourself, demand for gold jewellery is never going anywhere.

Must Read: How Much GST on Gold is Charged in India?

How Reliable Is the Gold Price Forecast for 2026?

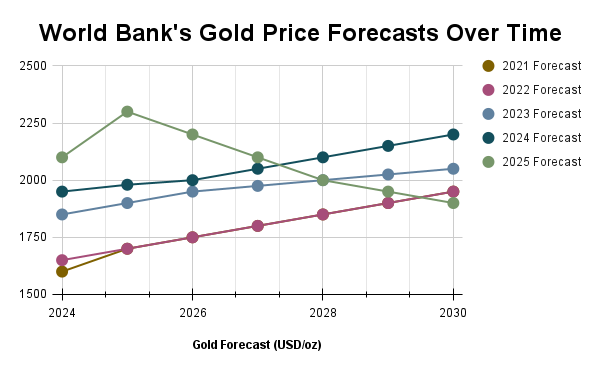

Although it is pretty challenging, the expected gold rate in 2026 in India is based on data-driven insights and analysis. For example, in 2023, experts predicted that gold would be priced around Rs 95,000 per 10 grams by 2026. But recently, in 2025, they have raised their forecast to Rs 1.25-1.9 lakh per 10 grams. This shows that predictions can change a lot over time.

You can see similar changes. For example, in 2010, it was predicted that gold would be around Rs 60,000 per 10 grams in 2020, but the actual price was much lower, around Rs 48,000 to Rs 55,000 per 10 grams.

So, even though experts give their best guesses, gold prices can be unpredictable because they depend on many things, like inflation, the economy and global events. In simple terms, the forecast for gold in 2026 could be higher or lower than expected, depending on what happens in the world.

Best Mutual Funds for 2026 Backed by Expert Research

Expected Gold Rate in 2026 in India: What Experts Say

As said by Dr Renisha Chainani, head of research said that, if there are new fundamental triggers like US tariffs, Middle East escalation or RBI rate hikes in 2026, then gold is expected to touch the Rs 1.9 lakh per 10g milestone.

Here is what the predictions for the expected gold rate in India look like:

Gold Price Trends from 2025 to 2026

The gold prices surged with over a 25% hike since the start of January to December 2025, continuing the upward trend in its prices into 2026. The experts predict that if the RBI/central banks keep buying more than 70 tonnes of gold, the gold rate in 2026 in India will further drive up, crossing Rs 1.9 lakh per 10 grams (by mid-2026).

Yes, you read that right. So, if you are thinking of buying gold in 2026, make sure you have deep pockets.

Gold Rate in 2026 in India Per Gram

In addition, 22-karat gold, which is basically the hero of Indian weddings and festivals, will follow a similar trend. If you are more of a “per gram” person, expect it to cost around Rs 10,500 to Rs 12000 per gram in 2026 as the RBI buys and rate cuts fuel demand.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

What Are the Key Drivers of Gold Price Predictions for 2026?

The price of gold in 2025 in India will be influenced by several important factors. Here are the key drivers to keep an eye on:

Investment Trends

- Bar and Coin Demand: People buying physical gold like bars and coins is currently at around 316 tonnes (in Q3 2025, 17% YoY surge) globally. India and China have seen an increase in demand as the RBI has increased its purchases. You should expect growth to exceed 25%, which could push gold prices to around Rs 1.9 lakh per 10 grams.

- Gold ETFs: Following the predicted rate cuts in 2025, we are expecting significant inflows, projected at more than 25 tonnes in Q4 2025. However, there has been a reversal in profit-taking in Western markets as uncertainty increases. If these sustained inflows continue, we could see a premium increase of Rs 20,000 to Rs 30,000.

- OTC Investment: In the fourth quarter of 2026, we expect a slowdown as some investors take profits. However, this should stabilise because central banks will start to demand more. High trading volumes suggest a possible increase in prices, especially if geopolitical tensions rise.

Central Bank Purchases

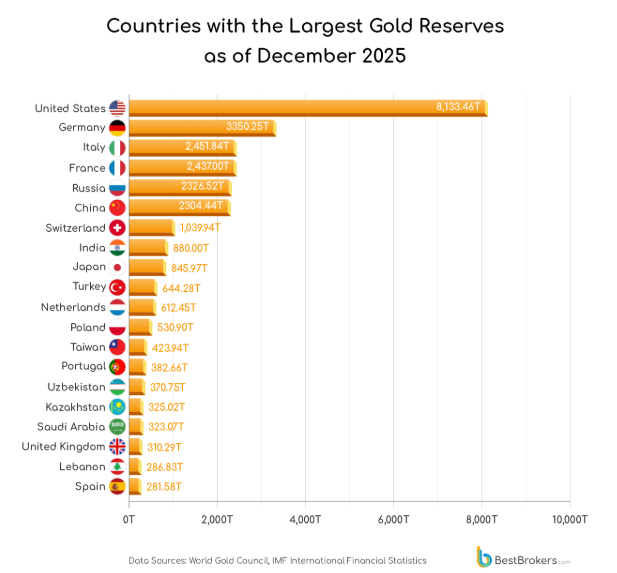

- Largest Buyers: Countries like India, Poland and Turkey are buying gold aggressively. India’s Reserve Bank of India is targeting over 70 tonnes. Overall, gold purchases are up 27% from 73 tonnes in 2025. If this strong demand continues, gold prices could go over Rs 1.9 lakh for every 10 grams in 2026.

- Regional Buyers: Countries like China, Hungary and Serbia have also been increasing their gold reserves. These nations are reducing their reliance on the US dollar and diversifying into gold as a stable asset in response to US tariff threats and pressure on the Indian rupee, which is currently valued between Rs 87 and Rs 89 per USD.

- Gold Sales: Some countries like the Philippines, Kazakhstan and Singapore are selling their holdings at high points, leading to short-term supply changes. However, overall buying remains strong, as central banks keep 37% of their reserves, indicating strength in 2026.

Gold Demand & Supply Trends

- China: China saw a 20% drop in gold jewellery demand since the high in 2025 due to a slow economic recovery. High prices make it harder for people to buy luxury items, leading to a shift in focus towards investment bars, which have increased by 15%.

- India: Cultural demand remains strong even with gold prices reaching Rs 1.32 lakh for 10 grams. The wedding season drives a growth of 5%-8%. Recovery in rural areas and investments from small businesses help keep India as the top consumer, with a forecast of 820 tonnes.

- Turkey & Middle East: A rebound in tourism and money is expected in the first quarter of 2026. Price drops will likely cause a 12% increase in demand, which will help stabilise the supply in the region.

- US & Europe: The cost of living is still high and demand for jewellery has either remained flat or dropped by 5%. Investors are turning to ETFs, which are seeing record inflows. This keeps support from Western investors stable, even without a rise in physical purchases.

Technology Sector Demand

- Electronics: The demand for gold in electronics has grown by 12% to 300+ tonnes. This is mainly because of advancements in AI-driven technology, quantum computing and 6G rollout. Gold conducts electricity well, which helps power next-generation electric vehicles and data centres. This strong demand supports higher prices for gold.

- Sustainable Tech: Gold is also being used in environmentally friendly technologies. Green hydrogen catalysts and improved solar panel efficiency increase gold usage by 15%. Gold recycling reaches 50% as environmental, social and governance (ESG) rules grow, helping to balance supply with rising demand.

Also Read: Gold ETF vs Gold Bees 2026 | Which Gives Better Returns?

This growing demand for green technologies can contribute to higher gold prices in the coming years.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Are Gold Prices Expected to Increase or Decrease in 2026?

In 2026, gold prices are expected to go up for a few main reasons:

Bullish Outlook: Why Gold Prices Might Increase

Here are the reasons that led to the price of gold going up:

-

Inflation Concerns

First, inflation is rising around the world and when that happens, people often turn to gold as a way to protect their savings.

-

Global Economic Uncertainty

Second, the global economy is still facing uncertainty from things like US tariffs and Middle East risks, which makes gold a safer bet.

-

RBI/Central Bank Buying

The RBI and central banks in countries, especially those in emerging markets, are also buying more gold to protect themselves from currency value drops.

Bearish Outlook: Why Gold Prices Might Decrease

The following are the factors that could push gold prices down:

-

Economic Recovery

When the global economy recovers strongly, interest rates go up, which would make bonds and other investments more attractive than gold.

-

Technological Advancements

In addition, as cryptocurrencies and new financial tools become more popular, people might invest less in gold.

In short, while gold prices might experience some ups and downs, the overall trend looks like they will increase in the long run due to inflation and economic uncertainties.

Moving on, you will learn what the expected rate of gold in 2026-2030 will look like.

What Will Be the Gold Price in 5 Years? (Prediction for 2030)

There is a strong possibility that gold prices could hit Rs 2.5 to 3 lakh per gram by 2030, tripling from today's Rs 1.32 lakh. The rising demand from

RBI buying over 70 tons of gold each year, which is a part of a process called de-dollarisation, along with the recent volatility in AI and cryptocurrency markets, all support the expected gold rate in 2026 in India to go up.

Therefore, the gold rate prediction 2026 in India could reflect a gradual rise, with prices reaching Rs 2.25 to 2.67 lakh in 2026 if the global price hits $8,900 per ounce.

How Much Gold Do I Need in My Portfolio in 2026?

You can have 5-10% of your portfolio invested in Gold Mutual Funds, as it serves as a good hedge against inflation and economic instability.

Here is a list of the top 5 gold mutual funds in India to start your SIP at the earliest:

| Scheme Name | Launch Date | AUM (in Cr) | 3 Yrs SIP Ret (%) | 5 Yrs SIP Ret (%) |

|---|---|---|---|---|

| SBI Gold Fund | 30-09-2011 | 9,307.46 | 46.13% | 32.53% |

| Axis Gold Fund | 14-10-2011 | 1,942.52 | 45.67% | 32.30% |

| ICICI Pru Gold Savings FOF | 01-10-2011 | 3,984.72 | 46.23% | 32.50% |

| Nippon India Gold Savings | 05-03-2011 | 4,841.40 | 46.12% | 32.38% |

| Kotak Gold Fund | 18-03-2011 | 4,808.91 | 45.75% | 32.09% |

As of December 29, 2025.

Pro Tip: Get your SIP returns using the SIP Calculator free of cost.

Should I Buy Gold for Long-Term Investment in 2025?

The short answer is yes, gold is an excellent investment option for long-term gains. Plus, the gold prices have multiplied 6 times since 2000. Here is a graph showing how much the price increased in different years:

If you had bought gold worth Rs 1,00,000 in the year 2000, today it would be worth Rs 16.5 lakh by 2026. This means that the price of gold has gone up 52 times since 1970.

Want a more suitable option? Skip this physical hassle of purchasing gold, because 2026 has something new for you. Buy digital gold online via apps or investment platforms and that too in your own budget. This option offers instant liquidity and lower costs.

In simple terms, gold has been a great investment over time, growing its value by more than 6 times from what you paid for it.

Smart Investments, Bigger Returns

Conclusion: Final Thoughts on Expected Gold Rate in 2026

In short, this analysis concludes that the expected gold rate in 2026 in India is influenced by several of the above factors discussed. While it is challenging to pinpoint the exact prices of gold, it is worth every penny you invest in the top 5 gold mutual funds in 2026. Plus, you can take the SIP route to plan your investments like a pro strategically.

Likewise, gold mutual funds have always been a resilient investment option in turbulent markets of the mutual funds and their role as a strategic reserve asset remains stronger than ever.

Related Blogs:

- Digital Gold vs Physical Gold: Which is better To Invest

- Is Digital Gold Investment Good or Bad? Should You Buy Now

FAQs

-

Gold vs silver, which better 2026 investment?

Gold is safer and offers returns of about 10-15%, while silver can be more volatile with potential returns of over 20%.

-

Which month is best to buy gold in 2026?

Avoid investing in gold during the March-April wedding season dip or the Diwali correction. Instead, consider using a SIP for gold ETFs.

-

What will be the gold price in 2026 if the US Fed cuts rates?

The dollar is getting weaker and there is a surge in inflows, leading to a breakout above Rs 2 lakh.

-

Sovereign Gold Bonds vs physical, what is best in 2026?

SGBs offer 2.5% interest and tax-free long-term capital gains. Physical suits are suitable for weddings, while bonds provide better returns in the long run.

-

Digital gold vs physical gold, 2026 comparison?

Digital gold offers lower fees and quick access to cash. Physical gold is favoured for cultural reasons, but comes with making charges.

.webp&w=3840&q=75)

.webp&w=3840&q=75)