Table of Contents

Are you aware that there is a whole mutual fund category devoted to the FMGC sector (Fast-moving Consumer Goods Sector)? Yes, widely known as Consumption Mutual Funds, it falls under the thematic category that invests in top companies (like Hindustan Unilever, ITC and Nestle India) that manufacture and sell consumer-related goods.

But how do you pick the winners from varied consumption schemes offered by promising reputed Asset Management Companies?

This analysis will give you the 3 Best Consumption Funds to pick from and grab the chance to make high returns for your portfolio.

List of 3 Best Consumption Mutual Funds in 2024

| Fund Name | Launch Date | AUM (Cr) | Fund Manager | 3 Year SIP Return (%) | 5 Year SIP Return (%) |

|---|---|---|---|---|---|

| ICICI Prudential Bharat Consumption Fund | 09.04.2019 | 2,894 | Mr Sankaran Naren | 31.5 | 26.82 |

| Nippon India Consumption Fund | 30.09.2004 | 2,023 | Mr Amar Kalkundrikar | 33 | 30.34 |

| Canara Robeco Consumer Trends Fund | 14.09.2009 | 1,849 | Mr Shridatta Bhandwaldar | 30.2 | 26.73 |

1. ICICI Prudential Bharat Consumption Fund: As a consumer-theme fund, the core strategy is picking up growing companies with the finest quality. Likewise, the ICICI Pru Bharat Consumption Fund follows an active investing style. In which the manager, Mr Sankaran Naren has full flexibility to shift the portfolio by actively studying the macroeconomic factors and the trending sectoral Mutual Funds. This will give you a blend of growth and value-based stocks in your current portfolio.

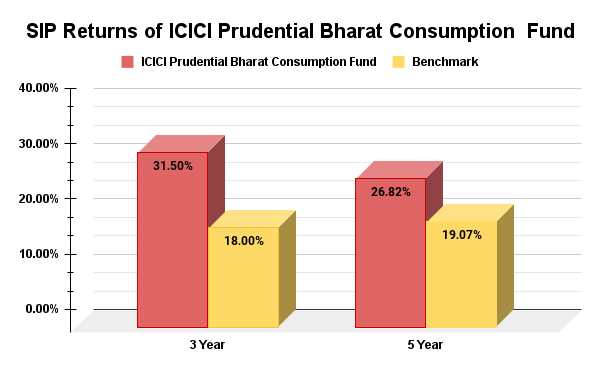

Well, this was a brief idea about what this fund is made of; let's see the results it has achieved by looking at the SIP returns.

The above graph shows the fund SIP returned 31.50% in 3 years and 26.82% in 5 years outperforming its benchmark of 18% and 19.07% respectively.

Now imagine, if you had started a SIP of Rs.3000 in this fund 5 years ago, your investment would be only Rs.1,80,000 where as your profits will stand at a total of Rs.3,42,327 as of now.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Furthermore, before starting a systematic investment plan (SIP) check out the current quality parameters of ICICI Prudential Bharat Consumption Fund:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 15.92% |

| Earnings Growth | 21.31% |

| Cash Flow | 33.64% |

| PE- Valuations | 36.88% |

2.Nippon India Consumption Fund: This fund follows a broader investment approach. That is known as the Flexi cap method, which involves investing across different market caps like large, mid and small caps.

Now, how will it help you to make high returns? It's very simple, it uses the famous buy-and-hold approach to invest in companies with strong business models at low valuations and hold them for long durations to get high returns on investment.

This reliability helps in generating healthy cash flow and also makes sure you avoid investing in high-debt companies.

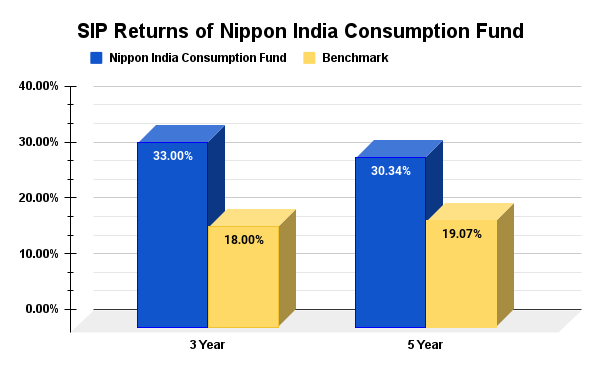

Now without any further delays, let's take a quick look at the SIP returns of 3 to 5 years delivered by this fund.

In the above graph, you can see the Nippon India Consumption Fund delivered 33% SIP returns in 3 years outstandingly beating its benchmark of returns of 18%.

If you had started a SIP of Rs.3000 that too 3 years ago, the total investment would be Rs.108,000. In comparison, your portfolio will show a whopping total of Rs.1,68,809 on today’s date.

The next step is to check out the quality of this fund and for that, you need the following checks:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 15.29% |

| Earnings Growth | 33.76% |

| Cash Flow | 27.80% |

| PE- Valuations | 46.49% |

This last consumption fund will give you a perfect blend of the investment strategy of the above two Mutual Funds. Let’s see how.

3. Canara Robeco Consumer Trends Fund: It uses both approaches, buy and hold and active investing. It mainly invests in companies, which have a competitive edge that helps you gain high returns on your investment. The speciality of the Canara Robeco Consumer Trend Fund lies in targeting funds based on the business cycle theme. Let’s take a quick look at its stock quality:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 16.87% |

| Earnings Growth | 43.86% |

| Cash Flow | 39.45% |

| PE- Valuations | 22.62% |

This means it is suitable for investors seeking active management with timing the market correctly for the right entry and exit into different cycles and industries.

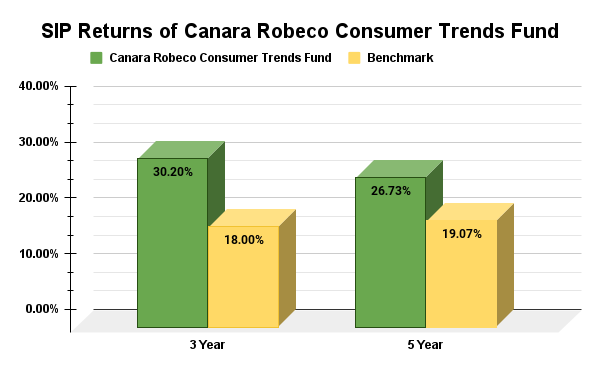

This strategy has been proven helpful and can be confirmed by looking at the below graph tracking its performance:

As per the above graph, the Canara Robeco Consumer Trend has given 30.20% SIP returns in 3 years and 26.73% SIP returns in 5 years. In contrast, its benchmark only gave 18% and 19.07% returns in the respective years.

Let’s say you started SIP of Rs.3000, 3 years ago. At this time your total investment would be Rs.1,08,000 and the profits will stand at Rs.1,62,940. If you don’t want to miss out on this chance to make high returns, start your systematic investment plan at just Rs.1000.

Summary

In short, the above-filtered 3 best consumption mutual funds have gone through every parameter and checked out with all the green signs for you to add any of these to your portfolios. However, one thing to note is that these funds belong to a thematic fund category, carrying a high reward with a high-risk nature. Therefore, the best investment strategy will be to keep an investment duration for the long term (at least 5-7 years).

.webp&w=3840&q=75)

.webp&w=3840&q=75)