Table of Contents

- Listing 3 Best Performing Flexi Cap Mutual Funds in India For 2026

- Performance Overview of Best Flexi Cap Mutual Funds: Rolling Returns and SIP Returns

- Overview of the Best Flexi Cap Mutual Funds in India

- How to Choose the Best Flexi Cap Mutual Fund for Higher Growth in 2026?

- Benefits of Doing a SIP in Flexi Cap Mutual Funds for Long-term Growth?

- To Conclude on the Best Performing Flexi Cap Mutual Funds for 2026

Are you looking for the right investment to grow your wealth in 2026? If yes, these Best Flexi Cap Mutual Funds offer an excellent opportunity to achieve your long-term wealth. Did it get you wondering how?

If so, here is your answer the best performing flexi cap mutual funds have outperformed their category average and benchmark for both rolling returns and SIP returns and that too for the two time horizons, 3-year and 5-year. Impressive right? However, how do you know which fund will be a valuable addition to your 2026 portfolio?

This analysis brings you the 3 Best Performing Flexi Cap Mutual Funds that are checked out by expert analysts based on performance, strong foundations and expert investment strategies. So, let us dive into getting the list.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Listing 3 Best Performing Flexi Cap Mutual Funds in India For 2026

The following are the 3 best flexi cap mutual funds that will help you achieve your long-term growth in the financial year 2026:

| Fund Name | Launch Date | AUM (Cr) | Expense Ratio | AMC | Fund Manager |

|---|---|---|---|---|---|

| Franklin India Flexi Cap fund | 29-09-1994 | 20,022 | 0.89% | Franklin Templeton Mutual Fund | R Janakiraman |

| HDFC Flexi Cap Fund | 01-01-1995 | 93,973 | 0.66% | HDFC Mutual Fund | Chirag Setalvad |

| Parag Parikh Flexi Cap Fund | 05-05-2013 | 1,29,780 | 0.63% | PPFAS Mutual Fund | Raunak Onkar |

*01-Dec-2025

Must Read: Parag Parikh Flexi Cap Fund vs HDFC Flexi Cap Fund: Best Pick for 2026

Now, let us analyse the performance of these three flexi cap funds.

Performance Overview of Best Flexi Cap Mutual Funds: Rolling Returns and SIP Returns

Let us analyse how the top 3 flexi cap funds for 2026 performed over a three and five years time period for both their rolling returns and SIP returns:

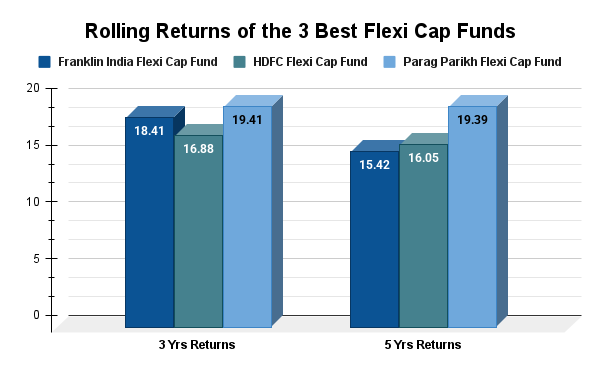

Rolling Returns of the 3 Best Flexi Cap Mutual Funds

In terms of the rolling returns, all three flexi cap funds have generated higher returns than their benchmark. While the benchmark stood at around 14-15% returns, the Franklin India Flexi Cap Fund gave 18.41% 3-year returns and 15.42% 5-year returns, the HDFC Flexi Cap Fund had 16.88% 3-year returns and 16.05% 5-year returns and the Parag Parikh Flexi Cap Fund delivered 19.41% 3-year returns and 19.39% 5-year returns. Look at the graph below to compare the returns of the funds:

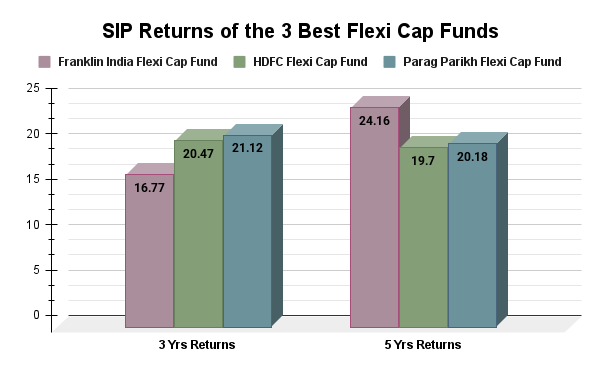

SIP Returns of the 3 Best Performing Flexi Cap Mutual Funds

For SIP returns, the category average was 15.02% for 3-year and 16.59% for 5-year and the benchmark was 15.02% for 3-year and 17.02% for 5-year investment horizon. The Franklin India Flexi Cap Fund gave 16.77% and 24.16%, the HDFC Flexi Cap Fund generated 20.47% and 19.07% and the Parag Parikh Flexi Cap Fund delivered 21.12% and 20.18% returns for the 3-year and 5-year investment horizons, respectively. Here is the comparison graph of the SIP returns of the funds:

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Now, let us explore the other major details of the Mutual Funds.

Best Mutual Funds for 2026 Backed by Expert Research

Overview of the Best Flexi Cap Mutual Funds in India

The flexi cap funds are types of Equity Mutual Funds that invest in all market caps. Here are the details of the 3 best performing flexi cap mutual funds in India for 2026:

1. Franklin India Flexi Cap Fund

After being launched on 29th September 1994, the Franklin India Flexi Cap Fund has delivered impressive returns in the past years, outstandingly beating its benchmark.

But what is the investment style adopted by this fund that led to this fantastic performance? You see, Franklin India Flexi Cap Fund combines value and growth, along with picking high-quality businesses that show strong balance sheets with a reliable team of management.

Yes, it keeps a major investment in new emerging opportunities that are more focused on technology-driven sectors. Moreover, it gives you a diverse portfolio by investing across different market caps, likely avoiding momentum-driven bets and using the popular buy-and-hold approach.

However, check out the current quality of stocks before investing in this flexi cap fund:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 13.38% |

| Earnings Growth | 10.65% |

| Cash Flow Growth | 10.62% |

| P/E Ratio (Valuations) | 24.49 |

The above data shows a strong growth with signs of profitability and sound financial health. A 24.49% PE (Price-to-earnings ratio) is a reasonable value for long-term future growth.

2. HDFC Flexi Cap Fund

Launched on 1st January 1995, the HDFC Flexi Cap Fund has also outperformed its benchmark over the past years with its proven investment strategy.

The fund adopts a buy-and-hold approach, focusing on long-term capital appreciation by investing in high-quality companies with competitive advantages and sustainable growth. It follows a Growth at a Reasonable Price (GARP) strategy with elements of value investing, while actively adjusting sector and market cap allocations to capitalize on market cycles, while maintaining a core focus on large caps for stability. It follows a bottom-up approach for its research and focuses on fundamentals like revenue growth, profitability, cash flow and the quality of management. It also considers both quantitative and qualitative factors.

Here is the current quality of stocks of this flexi cap mutual fund:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 12.57% |

| Earnings Growth | 11.25% |

| Cash Flow Growth | 2.04% |

| P/E Ratio (Valuations) | 21.44 |

3. Parag Parikh Flexi Cap Fund

This fund follows an active investment strategy with a major focus on generating high returns by using value investing and capital preservation. Likewise, with a flexible allocation between domestic and foreign equities, it targets investment in the top-listed Indian stocks with the aim of deriving long-term capital appreciation.

Let us check out the quality of this fund and for that, you need the following checks.

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 10.78% |

| Earnings Growth | 8.52% |

| Cash Flow Growth | -0.09% |

| P/E Ratio (Valuations) | 20.24 |

This fund has diversified up to 35% in foreign securities with a core focus on long-term investments, giving a robust sales growth of 13.70% and 17.79% earnings growth. It shows steady revenue expansion and improving profitability.

The strong 20.77% cash flow shows healthy financial stability, offering chances of reinvestment for future growth. Additionally, a 15.70% P/E ratio suggests the fund is fairly valued, offering attractive opportunities for long-term investors.

Also Read: Top 10 Flexi Cap Mutual Funds: High-Return Picks in India 2025

In the next part, let us learn how to choose the best flexi cap fund for your investment in 2026.

Start Your SIP TodayLet your money work for you with the best SIP plans.

How to Choose the Best Flexi Cap Mutual Fund for Higher Growth in 2026?

Here are the 5 parameters on which you can filter the best flexi cap fund for yourself:

- Look for Steady Performance: The best flexi cap fund is trusted on the basis of delivering consistent returns and its ability to beat the market ups and downs.

- Check the Fund Manager’s Experience: Look at the time frame of how long the fund manager has been managing Mutual Funds successfully through different market conditions.

- Review the Fund’s Holdings: Make sure the fund keeps a diversified portfolio by investing in a variety of growth stocks across different sectors.

- Compare Expense Ratios: Conduct a thorough comparison of the expense ratio with other flexi cap funds and go for the lower one with lower costs will help you earn maximum returns.

- Understand the Fund’s Strategy: Check the fund’s investment approach to make sure it fits with your investment goals.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

Next, let us look at the benefits of doing a SIP in these flexi cap funds.

Benefits of Doing a SIP in Flexi Cap Mutual Funds for Long-term Growth?

You can easily start a systematic investment plan or SIP in these 3 best performing flexi cap mutual funds for 2026. The following are the merits of SIP:

- Flexible Investments: Flexi Cap funds invest in large, mid and small-cap companies, adapting to market opportunities.

- Rupee Cost Averaging: SIP allows you to buy units at different price levels, reducing the impact of market volatility.

- Power of Compounding: Regular investments via SIPs help you make good earnings on the invested amount plus the accumulated interest.

- Steady Wealth Creation: SIP in Flexi Cap funds is ideal for long-term goals, offering balanced growth and diversification.

Pro Tip: Use a SWP Calculator to plan for your regular mutual fund unit withdrawals.

Smart Investments, Bigger Returns

To Conclude on the Best Performing Flexi Cap Mutual Funds for 2026

In short, if you are looking to find a balance between growth and long-term wealth creation, these 3 best flexi cap mutual funds strike a good bargain. You can start your SIP investments today and take the first step toward securing your financial wealth with ample confidence in 2026.

Related Blogs:

- Top 10 Mutual Funds for SIP in 2025: Best Picks to Grow Wealth

- Top 5 Mutual Funds for Lumpsum Investment 2026: Expert Picks

FAQs

-

What is a flexi cap mutual fund and how does it work?

It is an equity scheme that can invest in large cap, mid cap and small cap stocks without any fixed allocation, allowing the fund manager to shift between market caps based on opportunities and risk.

-

Are flexi cap mutual funds risky for new investors?

Flexi cap funds do carry market risk. However, their ability to diversify across different market caps makes them relatively more balanced for beginners.

-

Is SIP better than a lump sum for investing in flexi cap mutual funds in 2026?

A SIP spreads your investments over time, helping average out market volatility. Investing a lump sum can be effective when you have a large sum of money to invest.

-

How much should I invest in flexi cap funds as a percentage of my portfolio?

Retail investors can put 20-40% investment, conservative investors should put a lower amount and aggressive ones should mix it with other funds.

-

What is the ideal time horizon for investing in these funds?

Because flexi cap funds invest in equities, the ideal holding period is at least 5–7 years. This duration gives the fund time to benefit from compounding and to recover from short‑term risks.

_(1).webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)