Table of Contents

- Axis Flexi Cap Fund Overview

- Axis Flexi Cap Fund Investment Strategy

- Analysing Performance of Axis Flexi Cap Fund

- Top Holdings of Axis Flexi Cap Fund

- Axis Flexi Cap Fund Portfolio Composition

- Who manages the Axis Flexi Cap Fund?

- Analysing the Risk and Stock Quality of Axis Flexi Cap Fund

- Is Axis Flexi Cap Fund Good or Bad for Investment in 2026?

- Conclusion for Axis Flexi Cap Fund Review

Did you know that 70% of flexi-cap investors remain long-term for compounding benefits because flexi-caps like Axis Flexi Cap Fund adapt more quickly than large-caps in bull runs? The impressive Rs 13000 crore AUM of the Axis Felxi Cap Fund shows it outperforms competitors with balanced risk during the chaos of 2026.

But you know what is cooler, how it smartly spreads your investments across large, mid and small cap companies, adapting to the market, making it suitable for aggressive investors.

Are you ready to join them and beat 2026 market swings? Let us jump into this Axis Flexi Cap Fund Review and see if it is worth your investment in 2026.

Axis Flexi Cap Fund Overview

The Axis Flexi Cap Fund is an Equity Mutual Funds scheme launched in November 2017 by Axis Mutual Fund. It is a highly volatile fund that invests dynamically across various market caps, including large, mid and small. It works for gaining a long-term capital appreciation with at least 65% equity exposure.

Recently, the fund has experienced a strong performance turnaround after a period of under-performance. This scheme is highly suitable for investors with a very high risk tolerance and an investment horizon of 3-5 years or more.

Here are the key details of the Axis Flexi Cap Fund:

| Factors | Value of Axis Flexi Cap Fund |

|---|---|

| NAV | Rs 29 |

| AUM | Rs 13,319 Crore |

| Expense Ratio | 0.71% |

| Exit Load | 1% for redemption within 12 months |

| Benchmark | Nifty 500 TRI |

| Minimum SIP | Rs 100 |

| Minimum Lump Sum | Rs 100 |

| Turnover | Low (18%) |

*01-Dec-2025

Now, let us understand the strategy this fund works on.

Axis Flexi Cap Fund Investment Strategy

Axis Flexi Cap Fund works on the long-term appreciation investment philosophy by dynamically investing in a mix of high-quality equity across large, mid and small-cap stocks. These types of mutual funds focus on companies offering competitive advantages and carrying strong fundamentals to mitigate (reducing) risk.

This fund focuses on growth while ensuring quality. It looks for companies with a high return on equity (over 15%), consistent growth and reasonable valuations (GARP elements). They also adjust their investments according to market trends, such as increasing their investments in mid and small companies during recovery phases.

This fund employs a bottom-up approach for stock selection, focusing on the financial health, management quality and overall analysis of the company. To make the choices, they use quantitative models and evaluate how sustainable a company’s growth is and assess the risks involved.

Must Read: Top 10 Flexi Cap Mutual Funds: High-Return Picks in India 2025

Next, let us analyse the performance of this flexi-cap mutual fund.

Analysing Performance of Axis Flexi Cap Fund

Here is the detailed analysis of the Axis Flexi Cap Fund's performance based on its SIP and rolling returns:

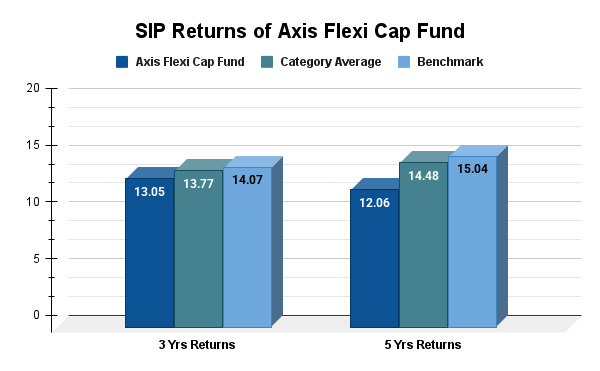

1. SIP Returns

The SIP returns of Axis Flexi Cap Fund are clearly lower than the category average and the benchmark over 3-year (13.5%) and 5-year (12.06), particularly in the 5 years. This indicates that doing SIP in this fund would have generated income for you, but not as fast as an average peer of flexi-cap mutual funds.

Existing investors need to review the fund for a short time and consider switching gradually if the performance gap does not improve.

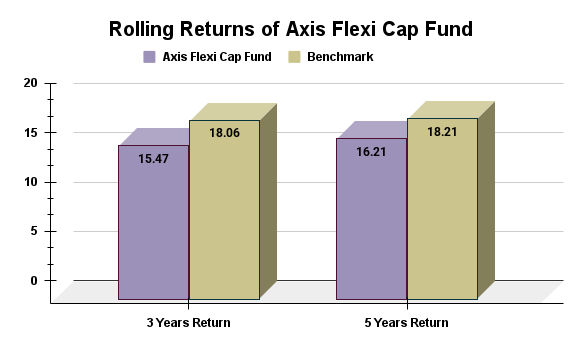

2. Rolling Returns

Over 3 and 5 years, Axis Flexi Cap Fund has lagged behind the benchmark with rolling returns. The fund generated 15.47% and 16.21% returns, while the benchmark stands at 18.06% and 18.21% for 3 and 5 years, respectively. But the interesting twist is in the consistency scores, where the fund actually looks stronger over the long-term with consistency of 87.21% vs 91.66% over 3 years, but a very impressive 96.08% vs 86.79% over 5 years.

The fund slightly underperforms the benchmark in 3-year and 5-year averages because of its focus on quality. However, it shows strong consistency, outperforming in about 95-96% of periods over 5 years, showing its ability to hold up in volatile markets.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

In the next heading, let us look at the top holdings of this fund.

Top Holdings of Axis Flexi Cap Fund

The following are the top 10 current holdings of the Axis Flexi Cap Fund:

| Top Holdings | Portfolio Percentage |

|---|---|

| ICICI Bank Ltd. | 8.39% |

| HDFC Bank Ltd. | 7.52% |

| Bajaj Finance Ltd. | 5.92% |

| Bharti Airtel Ltd. | 4.92% |

| Eternal Ltd. (Erstwhile Zomato Ltd.) | 4.18% |

| Bharat Electronics Ltd. | 3.77% |

| Mahindra & Mahindra Ltd. | 3.53% |

| Krishna Institute of Medical Sciences Ltd. | 3.37% |

| Infosys Ltd. | 3.15% |

| InterGlobe Aviation Ltd. (Indigo Airlines) | 2.89% |

*01-Dec-2025

Let us explore the portfolio composition of the fund in the next heading.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Axis Flexi Cap Fund Portfolio Composition

The fund includes 58 stocks, with the top 10 holdings making up about 50% of the total assets. Here are the details of the allocations of Axis Flexi Cap Fund:

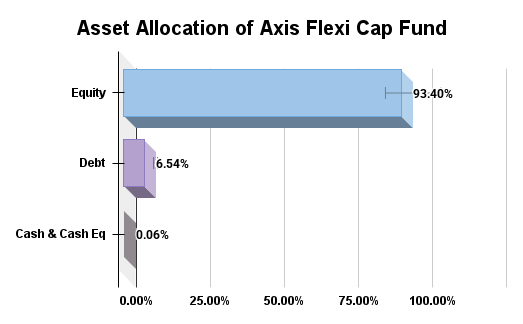

1. Asset Allocation

With about 93.40% in equity mutual funds, the fund's portfolio is tilted towards the potential of higher returns, but also faces strong fluctuations in the short term. 6.54% in debt offers a cushion, but it is not enough to reduce volatility. Cash and cash equivalents are almost negligible at 0.06%, showing that the fund manager prefers to stay fully invested rather than timing the market.

The above graph of the asset allocation clearly shows that this is a high-risk and growth-oriented fund.

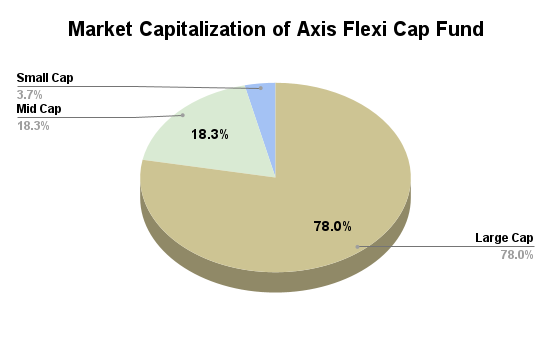

2. Market Cap Allocation

The fund leans heavily towards the established and relatively stable companies, with 78% exposure in large caps for stable growth. At the same time, around 18.33% in mid-caps and 3.67% in small-caps adds a meaningful growth kicker without turning the portfolio into a high-risk bet.

This mix provides stability while keeping the fund exciting for long-term wealth creation.

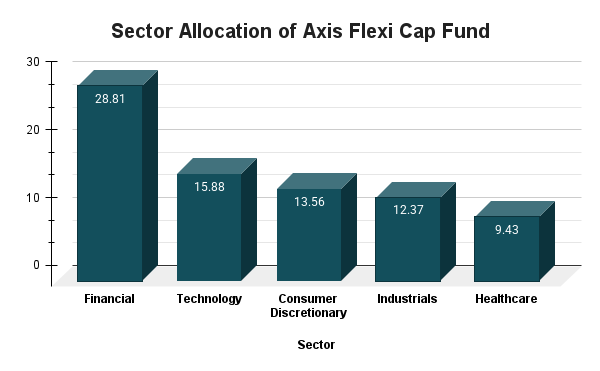

3. Sector Allocation

The fund has a slight preference for India’s key structural themes. The biggest contribution of the fund is in financials (28.81%) for stability. 15.88% in technology and 13.56% in consumer discretionary signal a clear bet on digital businesses, while industrials at 12.37% and healthcare at 9.43% add exposure to capital goods, infrastructure and pharma sectors.

For an investor, this mix works like a balance of stability and opportunities for faster earnings growth, making the fund suitable for those seeking long-term growth.

In the next part, let us know who manages this fund.

Who manages the Axis Flexi Cap Fund?

Since February 2024, Sachin Relekar has been the lead manager of the Axis Felxi Cap Fund. He has over 15 years of experience in equity research and fund management. He has an education background in B.Com and MBA.

Sachin has also previously managed other schemes at Axis Mutual Funds, such as the Axis Focused 25 Fund and other equity schemes. His leadership has helped improve consistency in performance after the market changes in 2024.

He is skilled in quality growth investing, which he developed while working at UTI Mutual Fund. He focuses on sustainable advantages and careful valuation. Under his leadership, the fund has invested in companies with high returns on equity (ROE).

Also Read: Top 10 Mutual Funds for SIP in 2025: Best Picks to Grow Wealth

Let us analyse the risk factors and stock quality of the fund in the next heading.

Analysing the Risk and Stock Quality of Axis Flexi Cap Fund

Here is the detailed analysis of the risk measures & stocks quality of the Axis Flexi Cap Fund:

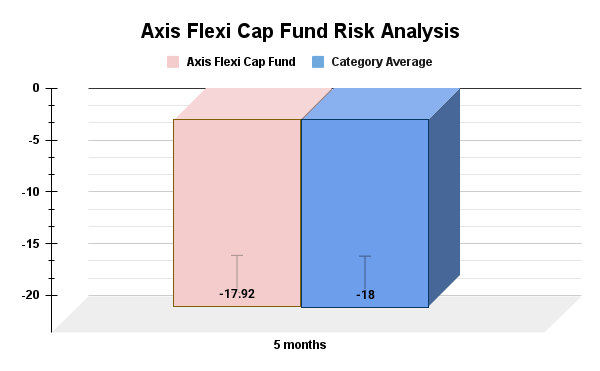

1. Analysis of Risk Measures

The fund has a standard deviation of 13.17, which is close to the average of 13.20 for similar funds. This means it has a similar level of risk as its peers. Its Sharpe ratio is 0.56, lower than the category average of 0.75, which indicates it earns less return for the risk it takes. The fund has a negative alpha of -0.88, compared to the category's 1.46, indicating poorer performance against its benchmark. With a beta of 0.96, it moves in line with the market and its maximum drop of -17.92% is slightly better than the category average of -18%.

Altogether, the graph shows that the fund has not lost more than its peers during market declines.

2. Stock Quality Analysis

The analysis shows that the fund prefers high-quality and fast-growing companies. The fund has a P/E ratio of 30.9, higher than the category average (26.09). However, this ratio is backed by stronger results, 20.46% earnings growth and 16.33% sales growth. The biggest advantage is in cash-flow growth, which is 15.21% for similar companies.

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 16.33% |

| Earnings Growth | 20.46% |

| Cash Flow Growth | 15.21% |

| P/E Ratio (Valuations) | 30.9 |

*01-Dec-2025

This analysis suggests that the portfolio holds businesses that not only show growth in reports but also generate real cash.

Lastly, let us know who should invest in this fund in 2026.

Is Axis Flexi Cap Fund Good or Bad for Investment in 2026?

Deciding whether the Axis Flexi Cap Fund is good or bad for 2026 totally depends on the individual who is asking the question. The fund went through a rough time, but it has already made a comeback, even beating its benchmark for the last year. This shows that the recent investment strategy and stock choices of the fund are working better now.

Its flexible mandate across large, mid and small caps makes it a strong candidate for investors who want long term equity growth and are comfortable riding out volatility. The fund has a high risk, so it is suitable for investors with a high risk profile.

Pro Tip: Use a Financial Calculator to calculate SIP growth and future investment value accurately.

Smart Investments, Bigger Returns

Conclusion for Axis Flexi Cap Fund Review

To conclude the Axis Flexi Cap Fund Review, the fund can be a sensible pick for investors with a high risk tolerance, a long-term investment horizon (at least 5-7 years) and a goal of wealth creation rather than stability.

For conservative investors or those with a 2-3 year investment horizon, other funds, like more defensive equity funds or simple index funds, can be more suitable.

Relatable Blogs:

1. Parag Parikh Flexi Cap Fund vs HDFC Flexi Cap Fund: Best Pick for 2026

2. Nippon India Flexi Cap Fund Review: Should You Invest in 2025?

FAQs

-

Is Axis Flexi Cap Fund worth investing in 2026?

Yes, Axis Flexi Cap Fund is highly suitable for aggressive investors who are seeking high returns.

-

How is Axis Flexi Cap Fund taxed?

Short-term gains (under 1 year) of this fund are taxed at 20% & long-term gains (over 1 year) are taxed at 12.5% if they exceed Rs 1.25 lakh.

-

How does Flexi Cap differ from Multi Cap funds?

Flexi Cap offers dynamic allocation across caps (min 65% equity), whereas Multi Cap invests a minimum of 25% in each cap.

-

Should I invest via SIP in Axis Flexi Cap Fund for 2026?

SIP in this fund is ideal to reduce volatility and suits investors who can handle high risk, aiming for wealth creation.

-

Why Axis Flexi Cap Fund Could Be the Smartest Choice in Volatile Markets?

In volatile markets, this fund shines with flexible allocation, low risk during downturns and strong recent outperformance for steady gains.

.webp&w=3840&q=75)

.webp&w=3840&q=75)