Table of Contents

- List of Top 10 Mutual Funds for SIP in 2025

- Details of the Top 10 Mutual Funds for SIPs

- Benefits of Investing in Mutual Funds via SIP for 2025

- How to Choose the Best Mutual Funds for SIP Investments in 2025

- How to Start Investing Through SIP?

- Tips to Maximise Your SIP Returns in 2025

- Common Mistakes to Avoid in SIP Investing

- Conclusion

Everyone wants to build wealth in 2026, but not all of them know how to do it the right way. You definitely do not want to be one of them, right? Then what are you waiting for? Go and start SIP in the top 10 mutual funds for SIP in 2026 and turn your first Rs 500 monthly SIP investment into lakhs with time. Wait a minute, you do not know which are the Best Mutual Funds in 2026 for SIP?

Well, not a new thing, market volatility and too many amazing fund options like Bandhan Small Cap, Edelweiss Mid Cap, Nippon India Large Cap, Invesco India Large & Mid Cap and Nippon India Multi Cap Fund, make SIP investing confusing.

But cheer up, because this guide will help you to pick the best SIP mutual fund for you in 2026, which will perfectly align with your goals, risk tolerance and investment duration. So, dive in to discover the top 10 mutual funds for SIP to invest in 2026, which can help you grow your wealth steadily and securely.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

List of Top 10 Mutual Funds for SIP in 2026

Here is the list of the top performing SIP mutual funds that are highly recommended:

| Fund Name | NAV | AUM (in crore) | 3 Yrs Avg. Returns | 5 Yrs Avg. Returns |

|---|---|---|---|---|

| Bandhan Small Cap Fund | 48.39 | 15,738 | 31.51% | 31.22% |

| Edelweiss Mid Cap Fund | 103.61 | 11,731 | 25.28% | 29.53% |

| Nippon India Large Cap Fund | 94.62 | 46,463 | 20.19% | 25.54% |

| Invesco India Large & Mid Cap Fund | 104.25 | 8,441.21 | 25.38% | 24.17% |

| Nippon India Multi Cap Fund | 307.45 | 47,294 | 22.87% | 30.09% |

| Invesco India Contra Fund | 138.97 | 19,170 | 20.39% | 22.74% |

| Nippon India Pharma Fund | 515.92 | 8,114 | 21.60% | 18.48% |

| ICICI Pru India Opportunities Fund | 40.84 | 30,802 | 24.57% | 34.79% |

| HDFC Balance Advantage Fund | 534.18 | 1,03,041 | 19.05% | 24.58% |

Let us look into the details of these best SIP mutual funds .

Details of the Top 10 Mutual Funds for SIPs

Here are the details of the top SIP funds for long-term investment in 2026:

1. Bandhan Small Cap Fund (8th February 2020)

This fund uses a clear strategy called GARP (Growth at a Reasonable Price). It focuses on quality companies that are growing & valued fairly. Manish Gunwani has managed it since 2023. The fund reduces risk by spreading investments and keeps its holdings below 30%. It has shown strong returns over 3 years (31.51%) and 5 years (31.22%), proving it can create significant wealth even with high risk. The fund charges an expense ratio of 1.65%.

2. Edelweiss Mid Cap Fund (26th December 2007)

This mutual fund targets long-term growth by investing mainly in mid-cap stocks, with a focus on momentum stocks ready to grow. Managed by Trideep Bhattacharya since 2021, it carries a very high risk but has delivered strong 3-year (25.28%) and 5-year (29.53%) returns. The fund balances growth with portfolio diversification to manage volatility effectively and has an expense ratio of 1.67%.

3. Nippon India Large Cap Fund (8th August 2007)

Nippon India Large Cap Fund follows a GARP strategy focusing on stable, high-potential large-cap stocks. Managed by Sailesh Raj Bhan since 2013, it balances growth with stability via mid, small-cap and debt assets. With a 1.5% expense ratio, it offers strong 3-year (20.19%) and 5-year (25.54%) returns despite very high risk.

4. Invesco India Large & Mid Cap Fund (9th August 2007)

The fund focuses on the fundamentals of individual companies and also looks at broader growth trends. Amit Ganatra has managed it since 2022. The fund invests in large and mid-cap stocks to help achieve long-term capital growth. It has an expense ratio of 1.76%. Despite carrying a high level of risk, it has delivered solid returns of 25.38% over three years and 24.17% over five years.

5. Nippon India Multi Cap Fund (25th March 2005)

This multi cap fund, managed by Sailesh Raj Bhan, invests equally in large, mid and small-cap stocks using a blend of strategies. It targets long-term growth with a focus on reasonable valuations. With a 1.51% expense ratio, it offers strong 3-year (22.87%) and 5-year (30.09%) returns, though it carries high risk.

Best Mutual Funds for 2026 Backed by Expert Research

6. Invesco India Contra Fund (11th April 2007)

It is a fund that follows a contrarian strategy, investing in undervalued, out-of-favour stocks with strong fundamentals. Managed by Taher Badshah since 2017, it aims for long-term capital growth by holding such stocks until their actual value is realised. It carries a very high risk with steady 3-year (20.39%) and 5-year (22.74%) returns with a 1.64% expense ratio.

7. Nippon India Pharma Fund (1st June 2004)

Nippon India Pharma Fund aims for long-term growth by investing in pharmaceutical and healthcare stocks. Since 2013, Sailesh Raj Bhan has managed the fund. It carries a very high risk and has an expense ratio of 1.82%. The fund has achieved solid returns of 21.60% over the last 3 years and 18.48% over the last 5 years.

8. ICICI Pru India Opportunities Fund (9th January 2019)

This fund focuses on long-term wealth by investing in special situations like corporate restructuring and regulatory changes. Managed by Sankaran Naren since 2019, it carries a very high risk and has returned around 24.57% over three years and 34.79% over five years, with an expense ratio of 0.64%.

9. HDFC Balance Advantage Fund (1st February 1994)

HDFC Balanced Advantage Fund uses a flexible, dynamic asset allocation to balance growth and stability, shifting between stocks and bonds based on market conditions. Managed by Gopal Agrawal since 2022, it has delivered 3-year returns of 19.05% and 5-year returns of 24.58%. It has a very high risk but strong long-term growth potential with a 1.34% expense ratio.

10. ICICI Pru Multi Asset Fund (31st October 2002)

This mutual fund diversifies across equity, debt, and commodities with a dynamic, contrarian approach to reduce risk and capture opportunities. Managed by Gopal Agrawal since 2022, it carries a very high risk. The fund offers strong 3-year returns of 19.82% and 5-year returns of 25.37%, with a 1.38% expense ratio.

Must Read: Best Mutual Funds to Invest in 2025: Low-Risk Options for High Return

Let us know the advantages provided by the mutual funds for SIP investment in 2025 in the next part.

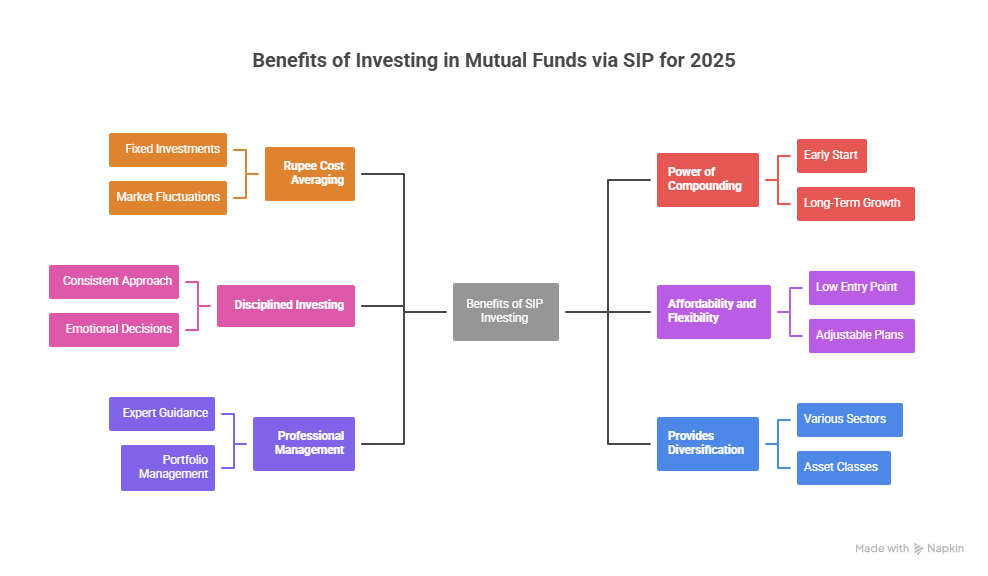

Benefits of Investing in Mutual Funds via SIP for 2026

Mutual fund investments through a Systematic Investment Plan (SIP) benefits in 2026 are as follows:

-

Rupee Cost Averaging

SIPs allow for fixed, regular investments that help you buy more units when market values drop and fewer when they rise, averaging purchase costs over time and reducing risk without needing to time the market.

-

Power of Compounding

Compounding increases your investments by reinvesting returns for more growth. Start SIP early in mutual funds to get more time for growth. The longer you invest, the greater the benefits of compounding.

-

Disciplined Investing

SIPs provide a consistent and stable way to invest in mutual funds, helping you avoid emotional decisions during market fluctuations while keeping you focused on your goals.

-

Affordability and Flexibility

Systematic Investment Plans (SIPs) allow investments from just Rs 500 per month, making them accessible for all investors. You can also adjust, pause, or stop your SIP based on your financial situation.

-

Professional Management

Investing in high return SIP mutual funds in India allows experienced professionals to manage your money, offering expert guidance for those who lack the time or expertise to manage their portfolio actively.

-

Provides Diversification

Investing in mutual funds spreads your money across various sectors & asset classes, which diversifies your investment. SIPs allow for this diversification, reducing risk and stabilising long-term returns.

Now, the million-dollar question: with so many options available, how do you know which mutual fund is best for you?

Keep reading to learn how to choose the right fund.

Start Your SIP TodayLet your money work for you with the best SIP plans.

How to Choose the Best Mutual Funds for SIP Investments in 2026

The best mutual fund for you is the one that goes perfectly with your goals and risk appetite, not the top performer from last year. Follow along the given steps to select the best fund for your SIP:

Step 1: Define Goals and Pick a Suitable Asset Class Based on Your Time Frame

- Short-term goals(1-3 years): Low-risk debt funds (e.g., liquid or ultra-short duration funds).

- Mid-term goals(3-7 years): Hybrid funds or balanced funds.

- Long-term goals(5+ years): Equity funds (large-cap, flexi-cap, multi-cap).

Step 2: Understand the Level of Risk You are Comfortable With.

- If you are a Conservative investor, stick to low-risk SIP mutual funds 2026, like debt or conservative hybrid funds.

- Aggressive investors shouldconsider mid cap, small cap or sectoral funds.

Step 3: Evaluate the Performance and Consistency of the Picked Fund

- You need to examine the performance of the fund in the long-term period.

- Compare the returns with the fund's benchmarks and peers and see if it outperforms the benchmark consistently or not.

- You should also check out the risk-adjusted returns for the selected mutual fund.

Step 4: Understand the Costs and Fees Associated With the Fund.

- Expense Ratio:Pick the funds with a lower expense ratio.

- Exit Load:Choose funds with minimal or no exit loads.

Step 5: Review the Fund Manager's Track Record

- Look for a fund whose fund managers have a stable track record.

- Review the expertise and experience of the manager.

Step 6: Go With the Direct Plans of the Mutual Funds

- Direct plans have a lower expense ratio as compared to regular plans.

- If you can do your own research, direct plans are a better choice for higher potential returns.

Also Read: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

In the next part, you will learn how you can start your first SIP investment in 2026.

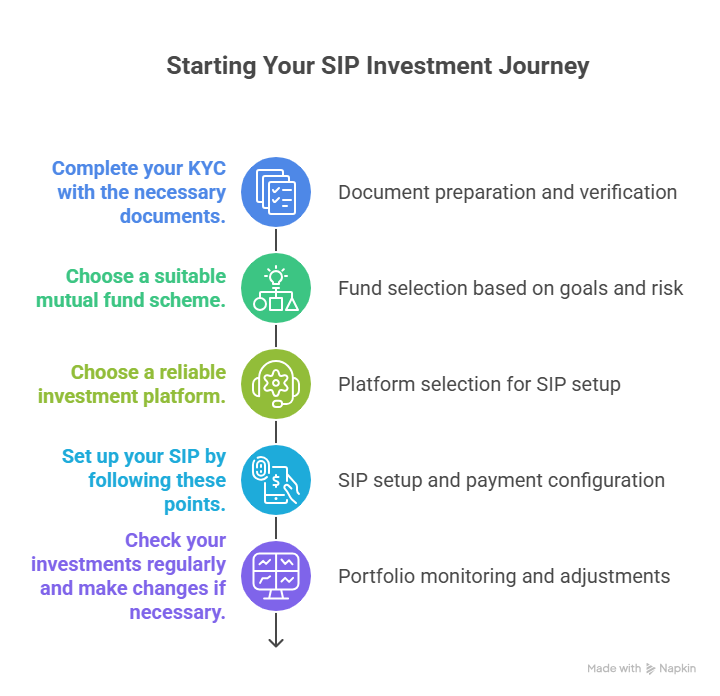

How to Start Investing Through SIP?

Here is the step-by-step process to guide you with your first SIP investment in mutual funds:

Step 1: Complete your KYC with the necessary documents.

Step 2: Choose a suitable mutual fund scheme according to your goals, risk tolerance and investment horizon.

Step 3: Choose a reliable investment platform (Fund house or online platforms).

Step 4: Set up your SIP by following these points-

- Log in to the chosen platform and select a fund.

- Choose the SIP option under the fund.

- Enter the asked details for SIP.

- Set up automatic debits for your SIP payments.

- Confirm and track your SIP performance.

Step 5: Check your investments regularly and make changes if necessary.

Now, let us go through some helpful tips that will help in maximising your SIP returns.

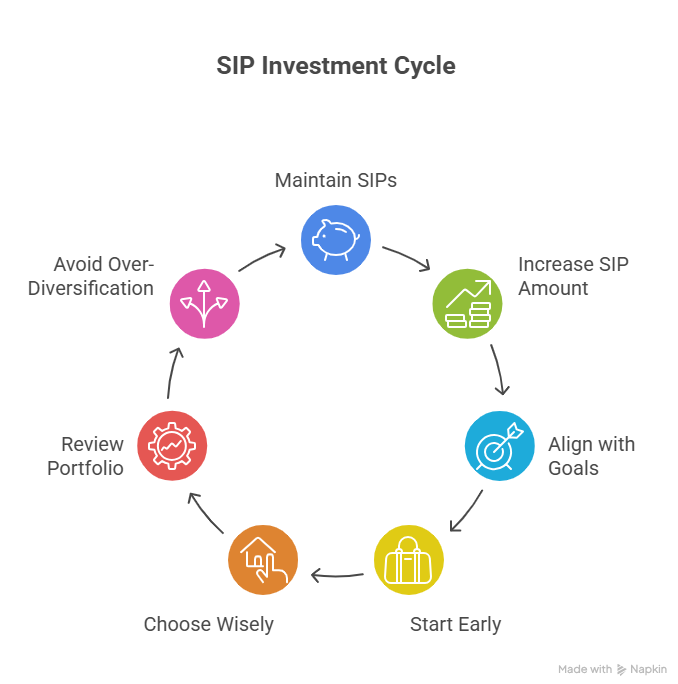

Tips to Maximise Your SIP Returns in 2026

Here are some tips for your next SIP investments to maximise your returns in 2026:

- Increase your SIP amount each year with a Step-Up SIP to outpace inflation and grow your savings faster.

- Keep investing in your SIPs even when the market drops. This strategy helps you take advantage of rupee cost averaging.

- Invest for the long term (more than 5 years) to make the most of compounding benefits.

- Choose funds that fit your goals, like equity funds for growth and hybrid funds for stability.

- Regularly review and adjust your portfolio to stay on track with your objectives.

- Select direct plans to save on fees and increase your overall returns.

Now, let us look at the common mistakes most investors make when investing via SIP that you should avoid.

Common Mistakes to Avoid in SIP Investing

Here are the common mistakes that you should avoid repeating for your SIP investments in 2026:

- Do not stop SIPs during market volatility; you should keep investing to buy more mutual fund units at lower rates.

- You need to increase your SIP amount regularly using Step-Up SIP to grow your wealth with inflation.

- Align your SIP investments with clear financial goals for better focus and optimised returns.

- Avoid delaying your investment; start as early as possible to benefit from compounding power.

- Do not chase short-term fund performance; choose mutual funds with consistent records over the long term.

- Review and rebalance your SIP portfolio at least once a year for optimal alignment with your investment goals.

- Avoid over-diversifying your investments, you just need to focus on a few well-chosen funds for better returns & easier management.

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Smart Investments, Bigger Returns

Conclusion

To conclude, SIP remains a powerful method to build stable wealth in 2026. With consistency, the right mutual funds & a long-term view, you can achieve your financial goals confidently and securely.

For 2026, some funds are perfect to start SIP with, including Bandhan Small Cap, Edelweiss Mid Cap, Nippon India Large Cap, Invesco India Large & Mid Cap, Nippon India Multi Cap Fund, etc. Use diversification, review your portfolio regularly and avoid emotional decisions.

Related Blogs:

1. Is SIP a Safe Investment in 2025? Truth Of Secure Investing

2. How to Calculate Tax On Mutual Fund Redemption?

FAQs

-

What is SIP in mutual funds?

A SIP is a type of investment in mutual funds where you invest a fixed amount regularly to build wealth over time.

-

How do mutual funds work?

Mutual Funds collect money from many investors and invest it in a diversified portfolio managed by professionals.

-

Is a mutual fund safe?

Mutual funds carry market risks but offer diversification and professional management to reduce risk.

-

How to calculate MF return?

The returns of a mutual fund investment are calculated by the percentage gain on the investment, considering NAV changes and dividends.

-

What are the types of mutual funds?

The various types of mutual funds are equity, debt, hybrid, liquid, tax-saving, sectoral and index funds.

-

Are mutual funds taxable?

Yes, mutual fund returns are taxable based on their holding period and type, including capital gains tax on profits.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)