Table of Contents

- Axis Small Cap Fund - Regular Plan - Growth

- ICICI Prudential Smallcap Fund - Growth

- HDFC Small Cap Fund - Growth Option

- Edelweiss Small Cap Fund - Regular Plan - Growth

- Baroda BNP Paribas Small Cap Fund - Regular (G)

Introduction

In the complex world of investments, choosing the right Mutual Fund is vital for optimizing returns and managing risk. One notable contender is the Axis Small Cap Fund – Regular Growth.

This fund is old fund as it was launched on 5 November 2013, the fund also has large AUM 16,175.33 Crores. The fund is also considered to be the popular fund amongst the small cap funds as the expense ratio of the fund is 1.66% which is lower compared to its peers. But the fund failed to perform in this recent bull market specifically small cap rally.

Investing Strategy

Market works in a cycle same as market the small cap stocks also have cycles. There are 2 strategies to target small cap stocks:

The first is investing in quality growth stocks for long-term and not worrying about short term falls or corrections. Secondly, time the growth phase and timely exiting during fall.

Axis small cap fund is based on the above mentioned first investing style strategy which is this fund emphasizes strong management, sustainable returns, and financial health for long-term growth. It strategically focuses on quality and growth companies, utilizing a bottom-up stock selection approach. The research process combines quantitative (Profitability, debt, cash flow) and qualitative (Transparency, Controls, Sustainability) analyses to identify promising investments with a focus on long-term wealth creation.

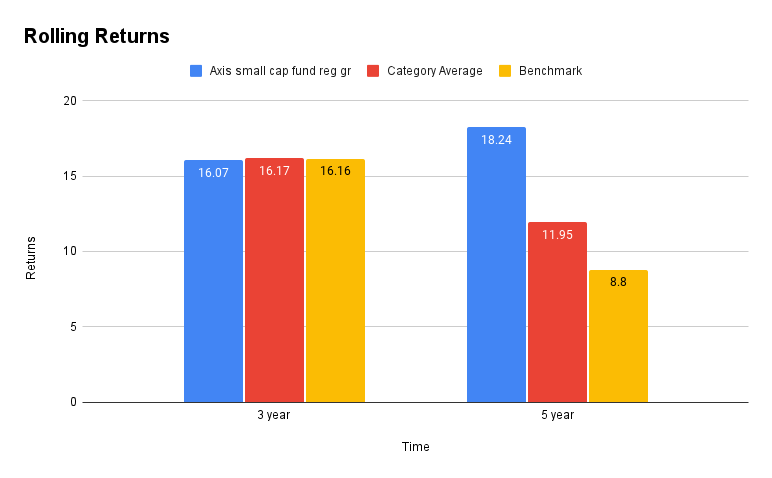

Return Analysis

Now, take a moment to glance at the graph above, as we see it clearly depicts that the first step is to collect data on the fund’s historical, which includes returns over different time frames i.e. (3 year & 5 Year) and benchmark returns to compare the fund’s performance. So, the fund’s average 3 & 5 years rolling returns are 16.07 and 18.24. This suggests that the fund's performance over the past 3 years has been less favorable, while it has demonstrated strong returns over the 5-year period.

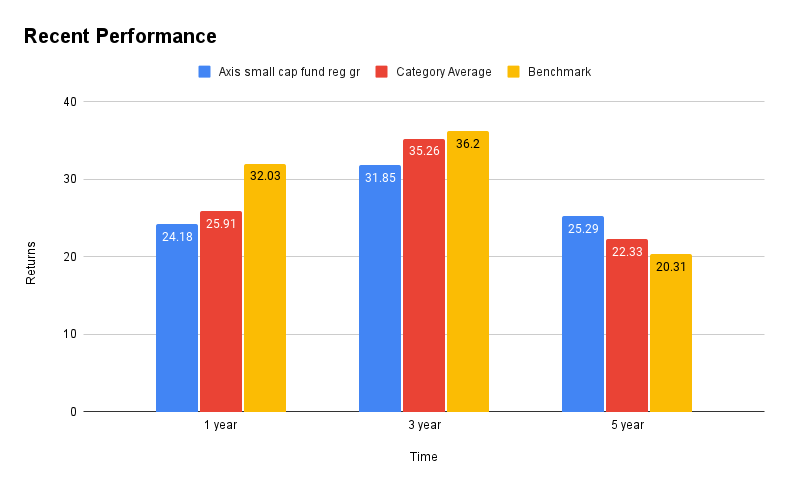

Doing Online SIP in this fund can contribute a good amount in near future so to analyse its returns let’s check its recent performance.

Recent Performance

Reviewing the graph, the fund’s 3 year returns were less favourable at 16.07, but it demonstrated strong consistency with 5 year returns at 18.24. While lagging in 1 and 3 year returns compared to the benchmark, the fund excelled in the 5-year period, recording 25.29 against the benchmark’s 20.31. Despite variations, the fund’s strategy execution and consistent returns have contributed to this popularity.

Now let’s have a look at its risk management

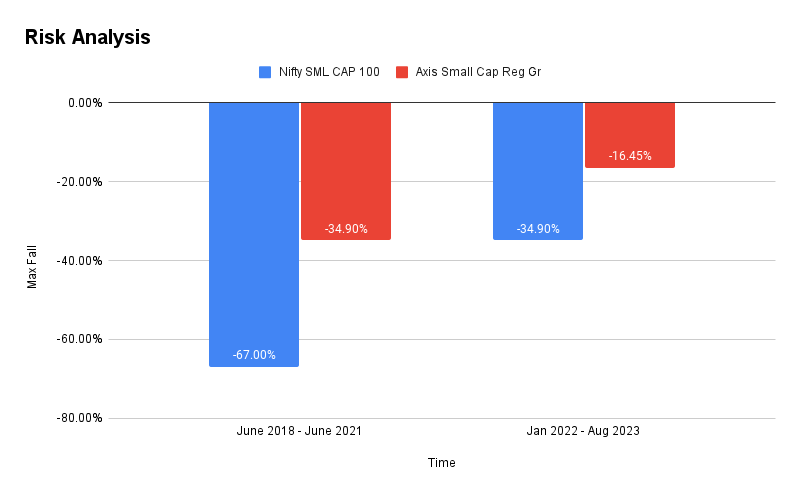

Risk Analysis

In the first phase (June 2018 – June 2021), Nifty smlcap 100 fell by (-67.00%), while Axis small cap fund regular growth showed a milder decline of (-34.90%). In second phase (Jan 2022 – Aug 2023), Nifty smlcap 100 dropped significantly by (-34.90%), and axis small cap fund had a lesser decline of (-16.45%), with recovery on time. Risk analysis indicates lower volatility with a standard deviation of 12.91 compared to the benchmark’s 14.33, and a superior sharpe ratio of 1.84, surpassing the category’s 1.67, highlighting favourable risk-adjusted returns.

Portfolio Allocation

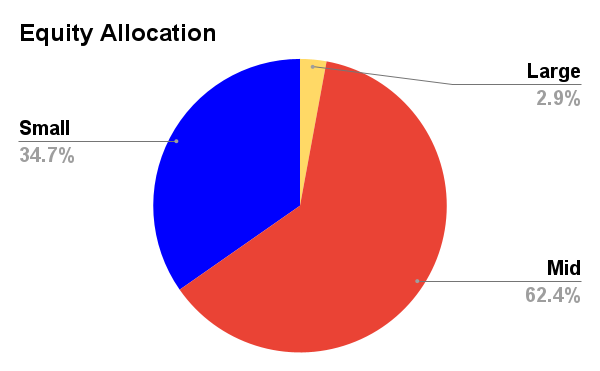

Equity Allocation

In terms of equity allocation, the fund has invested approximately 2.90% in large cap, 62.4% in mid cap funds, and 34.7% in Small Cap Funds.

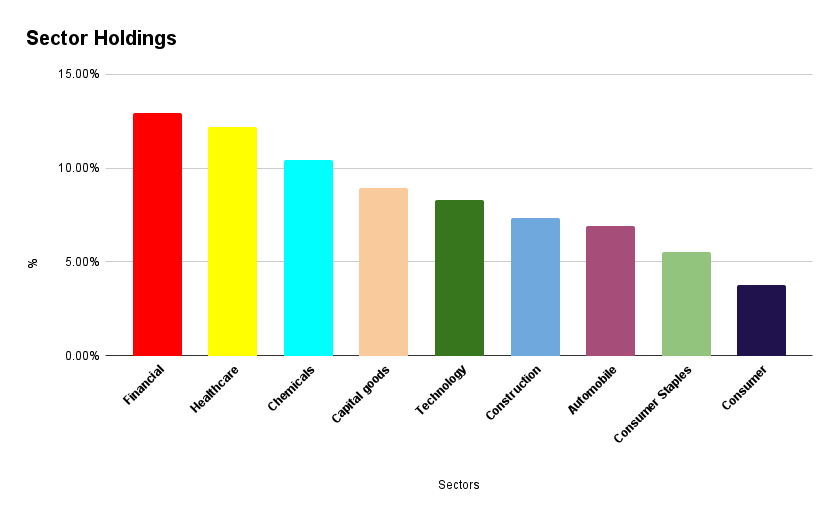

Moving on to sector allocation, the top 10 sectors holding of the fund are as follows

Sector Holdings

Financial – 12.91%

Healthcare – 12.21%

Chemicals – 10.41%

Capital Goods – 8.92%

Technology – 8.31%

Construction – 7.34%

Automobile – 6.89%

Consumer Staples – 5.53%

Metals & Mining – 5.33%

Consumer Discretionary – 3.76%

According to the above portfolio analysis this strategy favours growth stocks over its small-cap peers but maintains a balanced size exposure. It tends to hold fewer high-dividend or buyback-yield stocks.

Overweight in healthcare and basic materials, underweight in industrial and consumer cyclical sectors, the 98 stock portfolio is concentrated, with the top 10 holdings comprising 30.8% of assets, above the category average of 21.4%.

Despite its concentrated nature, the strategy has more patient turnover approach, potentially reducing costs and avoiding performance drag compared to peers.

Conclusion

The Axis small cap fund – Regular growth stands out as a compelling choice for investors seeking long-term capital appreciation within the small cap segment.

Managed by seasoned professionals, the fund’s active approach, emphasis on quality and growth, and well-diversified portfolio showcase a commitment to wealth creation. While acknowledging the inherent volatility of small cap investments, the funds historical performance, risk management strategies, and sector wise allocation provide a well-rounded investment proposition.

Potential investors are encouraged to carefully assess their risk tolerance and investment goals, considering the finds historical performance and aligning it with their own financial objectives.

Assumptions related to future performance of the fund are-

The axis small cap fund faces questions about future performance. With 98 stocks, the portfolio struggles with over-diversification, hindering significant alpha generations. Strategically, the fund allocates heavily to mid-cap (62%) and small cap (32%) stocks for balance approach to returns and volatility.

Notable sector allocations include financials, healthcare, chemicals, technology, and capital goods.

Valuations-wise, there’s potential for a rally in undervalued sectors, though a P/E ratio of 26 indicates relatively high valuations.

Read More : SBI Multi Asset Allocation Fund:A Diversified Investment Approach 2023