Table of Contents

- ICICI Prudential Multi-Asset Fund - Growth

- Axis Multi Asset Allocation Fund - Regular Plan - Growth Option

- SBI Multi Asset Allocation Fund - Regular Plan - Growth

- HDFC Multi-Asset Fund - Growth Option

- Edelweiss Multi Asset Allocation Fund - Reg (G)

Table Of Content

Is it Good to invest in the SBI Multi Asset Allocation Fund?

SBI Multi Asset Allocation Fund is a mutual fund offered by SBI Mutual Fund one of the leading asset management companies in India. This mutual fund house offers very qualitative funds in other categories. As it strategically allocates investments across a blend of three primary asset classes, equities, debt instruments, and gold. The combination of these three asset classes results in good diversification and an improved risk profile for the portfolio. So is this the best fund to invest in Online SIP for good returns for beginners or investors who are not comfortable with high risk?

let’s first understand what is the strategy of the SBI Multi Asset Allocation Fund.

SBI Multi Asset Allocation Fund is designed to enhance both the potential return and risk profile of the fund, the flexibility in asset allocation allows the fund managers to adapt to changing market conditions. The equity allocation can range from 35% to 80%, meanwhile, the debt allocation can vary between 10% and 55%, and the gold which can also fluctuate between 10% to 55%. Their asset allocation is decided on algorithms and macroeconomic conditions. When the algorithm suggests expected high returns & high risk for every asset class. So based on the indicators the fund management team changes the allocation between equity, debt, and other asset classes.

When there is opportunity in the equity market it puts high allocation up to the maximum limit allowed in the equity class and targets higher returns. But when stocks become less promising then they focus on risk management.

One of the fund’s strengths is its utilization of all asset classes to generate high returns. This sets it apart from other AMCs that rely on debt instruments for risk management

Now let’s check how this fund and its strategy performed in the past. Comparing the performance with its benchmark and category average.

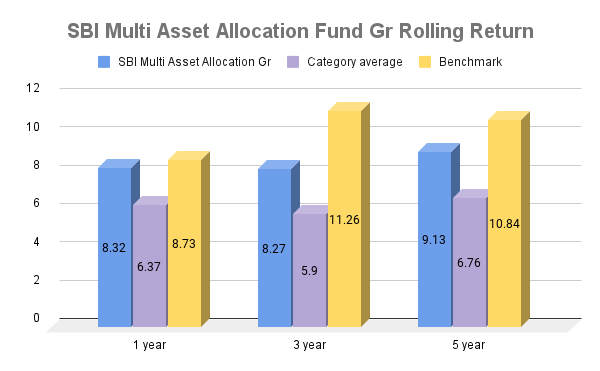

Rolling Returns

SBI Multi Asset Allocation Fund has shown strong performance over the past 1 year (8.32%), 3 years (8.27%) and 5 years (9.13%). When compared to its category average of 1 year (6.37), 3 years (5.9), and 5 years (6.76), the fund has outperformed its peers in all these time frames. However, when we compare the fund’s performance to its benchmark, it appears to have underperformed.

The Recent Performance of the SBI Multi Asset Allocation Fund

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

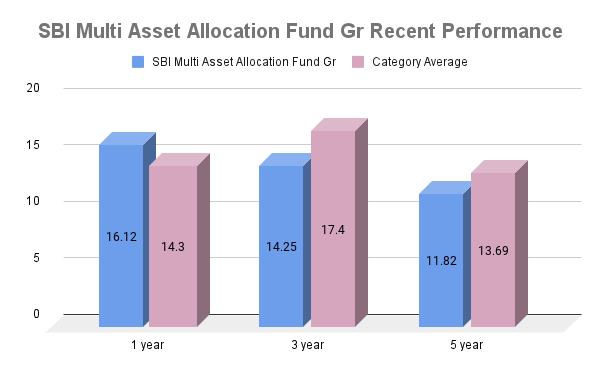

Recent Performance

The recent performance of the fund for 1, 3, and 5 years is 16.12, 14.25, and 11.82. SBI Multi Asset Allocation has outperformed the category average in terms of recent performance for YTD, 1 year, although not significantly. However, its long term of 3 and 5 years the fund has not beaten the category average.

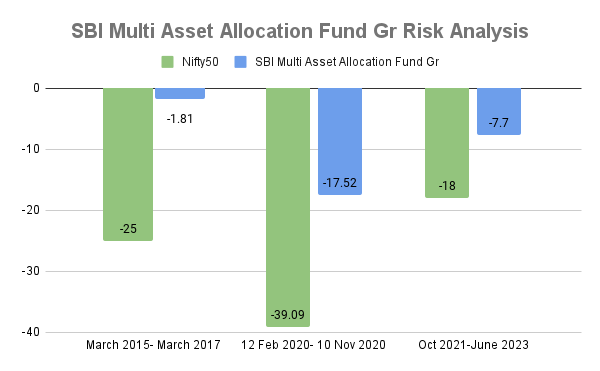

Risk Analysis

During March 2015- March 2017 the fund fell (-1.81%), and its Nifty50 is (-25%). In comparison, the Nifty50 index, which represents the overall stock market, had a much larger fall. Even after the drop, the SBI Multi Asset Allocation Fund recovered very fast.

In the period of 12 February 2020 – 10 November 2020 (-17.52%). When compared to its Nifty50 (-39.09%) this fund bounced back from losses more quickly than the peer market.

In the phrase of Oct 2021 – June 2023 (-7.7%), the SBI Multi Asset Allocation Fund shows a small decrease in value. In comparison to the Nifty50 index of (-18%), this fund recovered very fast from losses.

This fund might have a certain level of risk but SBI multi asset fund behaving in a very stable manner will relatively get a higher allocation.

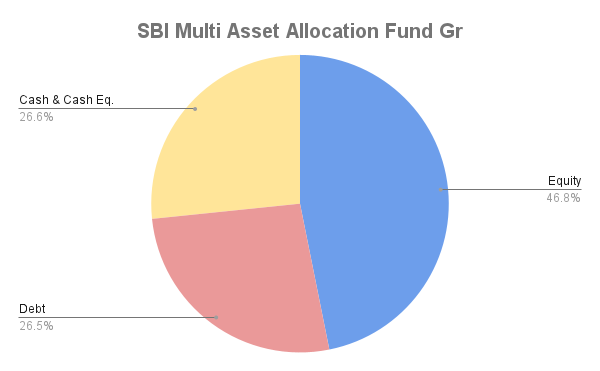

Current asset allocation of SBI Multi Asset Allocation Fund.

In the total allocation of the fund:

Equity is 46.84%. This means a significant portion of the fund’s investments are in stocks, which can potentially offer higher returns, but they can be a bit risky

Cash is 26.63%. This is like having a good amount of money in a savings account.

Debt is 26.53%. This part is invested in loans and bonds, which are generally more stable and can provide a regular income.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Conclusion

Normal Historical Performance: SBI mutual fund house is one of the best AMCs that offers qualitative funds and has shown very good performance in other categories like SBI small cap fund, SBI bluechip funds & more.

As per the historical performance, the fund has fantastic risk management and could be taken as best in the hybrid mutual fund category

- Overall returns are normal and equivalent to the benchmark. It has not shown very extraordinary performance.

- SBI Multi Asset Allocation Fund appears to be a suitable option for investors looking for a balanced and diversified approach to wealth accumulation. If you are not okay with sharp swings in your returns, you can go for this fund. Returns will be equal to market returns.

Read More : Is it Good to Invest in TATA Multi-Asset Allocation Fund? Reviews 2023

(1).webp&w=3840&q=75)