Table of Contents

- Have moderate to low risk appetite

- Seek consistent and stable returns

- Tendency to panic in negative market cycle

- Pick large-cap over other equity funds

Are you an investor who doesn’t like taking much risk? Do you prefer low risk even if the returns involved are not as attractive? If the answer is a yes, then you are a conservative investor. There are a number of schemes for such investors from which they can select the right one to invest in. In this article, you will get to read about who conservative investors are and the suggested portfolio for them.

Table of Content

The conservative investors who wish to invest for a long-term may select the large cap funds or the hybrid funds. Large cap funds are those that invest in the equity and equity related instruments of the top 100 companies in terms of full market capitalization. Hybrid funds invests in a mixture of stocks and securities which include equity, debt, and money market instruments. Let’s read in detail about it.

Who Are Conservative Investors?

Conservative investors are those investors whose risk-bearing capability is low and prefer to be on the safer side even if the returns are a little less.

Portfolio for Conservative Investors

There are numerous schemes that can be chosen by an investor to invest in. Below is the table which shows the schemes in which an investor may invest via SIP mode to earn the best returns in long-term. The investment percentage has been shown in the same table. Investing via SIP will help an investor earn better in the long run as a result of the compounding benefit. Under SIP investment, there is no need for an investor to time the market. No matter when you invest, in the long run, the overall NAV will be balanced because of its another feature named rupee-cost averaging.

| Name of the Scheme | Investment (%) |

|---|---|

| SBI Bluechip Fund | 40% |

| ICICI Prudential Equity and Debt Fund | 30% |

| ABSL Regular Savings Fund | 30% |

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Top Schemes for Investment in 2018

The top schemes mentioned in the above table have been selected by the experts of MySIPonline after conducting in-depth research. Let’s read in detail about each one of them.

SBI Bluechip Fund (G)

Launched on February 14th, 2006, the investment objective of this scheme is to help investors earn long-term capital appreciation by investing in the stocks of large cap companies. The investment style followed by the fund manager Ms. Sohini Andani is a blend of the top-down and bottom-up approach along with a mixture of growth and value style of investing.

| Basic Information | |

|---|---|

| Parameters | SBI Bluechip Fund |

| Category | Equity: Large Cap |

| Benchmark | S&P BSE 100 TRI |

| Launch Date | 2/14/2006 |

| Asset Size | Rs. 19213 crore(As on Sep 30, 2018) |

| Fund Manager | Sohini Andani |

| Expense Ratio | 2.36%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 5000 |

| Minimum SIP | Rs. 500 |

| Exit Load | 1% for redemption within 365 days |

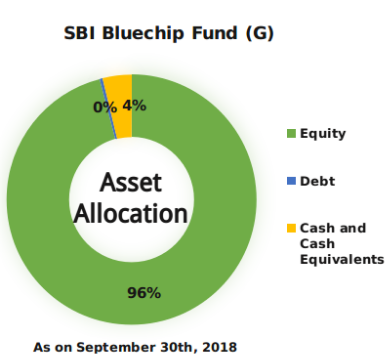

Under this scheme by SBI Mutual Fund, the maximum assets have been inclined towards equity which is a fine decision considering the equity category to which it belongs. It has invested its assets across equities such as giant cap, large cap, mid cap, and small cap with major allocation in the giant cap equities with 62% of the total assets. Major allocation in equity will facilitate an investor to earn well on the amount invested with time. This fund involves high risk on the principal amount invested, and therefore only those should invest in it who are conservative equity investors.

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| SBI Bluechip Fund | -9.48% | 7.58% | 15.88% | |||

| NIFTY 100 TRI | -1.80% | 10.18% | 14.01% | |||

| Category | -2.97% | 8.70% | 13.13% | |||

| As on October 10th, 2018 | ||||||

- In the past one year, SBI Bluechip Fund by SBI Mutual Fund has yielded 9.48% returns.

- The three-year returns generated by this scheme is 7.58% which is higher than both its benchmark NIFTY 100 TRI and category.

- In terms of five-year returns, it has managed to beat both the benchmark and category by generating 15.88% of returns.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| SBI Bluechip Fund | 13.48 | 0.91 | 0.28 | |||

| NIFTY 100 TRI | 14.17 | - | 0.47 | |||

| Category | 14.30 | 0.99 | 0.36 | |||

| As on September 30th, 2018 | ||||||

- The standard deviation of this scheme is 13.48 which is less than the standard deviation of benchmark NIFTY 100 TRI and category which shows that it is comparatively less likely to fluctuate.

- The Sharpe ratio of this scheme is 0.28 which is less than both its benchmark and category. This represents that the returns generated in comparison to the risk taken is comparatively less.

ICICI Prudential Equity and Debt Fund (G)

Formerly known as ICICI Prudential Balanced Fund, this scheme helps the investors earn long-term capital appreciation along with consistent income by investing in equity, debt, and money market instruments. This scheme by ICICI Prudential Mutual Fund was launched on November 03rd, 1999.

| Basic Information | |

|---|---|

| Parameters | ICICI Prudential Equity & Debt Fund |

| Category | Hybrid: Aggressive Hybrid |

| Benchmark | CRISIL Hybrid 35+65 Aggressive |

| Launch Date | 11/3/1999 |

| Asset Size | Rs. 27342 crore(As on Sept 30, 2018) |

| Fund Managers | Atul Patel, Manish Banthia, Priyanka Khandelwal, and Sankaran Naren |

| Expense Ratio | 2.04%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 5000 |

| Minimum SIP | Rs. 1000 |

| Exit Load | For units in excess of 10% of the investment,1% will be charged for redemption within 365 days |

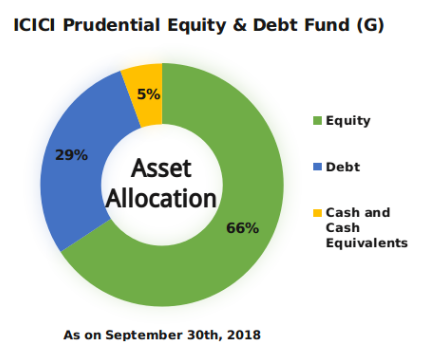

This ICICI Prudential Equity and Debt Fund has inclined its assets majorly towards the equity followed by debt and cash and cash equivalents. The assets under this scheme have been allocated across 80 stocks. It has invested majorly in the energy sector followed by financial, metals, and technology. Investment in equity in the current market scenario will help investors earn well with the improvement in the correction phase. It should be noted that equity investments involve high risk on the principal amount invested but also provides an opportunity to investors to earn high returns.

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| ICICI Prudential Equity & Debt Fund | -5.17% | 10.24% | 16.52% | |||

| VR Balanced TRI | 0.94% | 9.22% | 11.99% | |||

| Category | -6.61% | 7.82% | 14.29% | |||

| As on October 10th, 2018 | ||||||

- ICICI Prudential Equity and Debt Fund has generated 5.17% in the past year till date.

- The three-year returns generated by this scheme is 10.24% which is much more than that yielded by both the benchmark VR Balanced TRI and category.

- The five-year returns generated by this scheme is 16.52% which is again more than its benchmark and category.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| ICICI Prudential Equity & Debt Fund | 10.31 | 0.82 | 0.54 | |||

| VR Balanced TRI | 11.42 | - | 0.45 | |||

| Category | 11.25 | 0.9 | 0.27 | |||

| As on September 30th, 2018 | ||||||

- The standard deviation of this scheme is 10.31 which less the SD of its benchmark and category which are 11.42 and 11.25, respectively. Even the Beta of this fund is less than that of its category. These two factors indicate towards the fact that it is less likely to fluctuate in comparison to others.

- The Sharpe ratio of this scheme is 0.54 which is better than both its benchmark and category. This indicates that it is likely to generate better returns with the risk taken.

ABSL Regular Savings Fund (G)

This scheme by Aditya Birla Sun Life Mutual Fund is an open-ended scheme that invests predominantly in debt instruments along with little inclination towards equity and its related instruments. This scheme was launched on May 22nd, 2018 to help investors earn consistent income along with capital appreciation.

| Basic Information | |

|---|---|

| Parameters | Aditya Birla Sun Life Regular Savings Fund |

| Category | Hybrid: Conservative Hybrid |

| Benchmark | CRISIL Hybrid 85+15 Conservative |

| Launch Date | 5/22/2004 |

| Asset Size | Rs. 2572 crore(As on Sep 30, 2018) |

| Fund Managers | Pranay Sinha, Satyabrata Mohanty, and Vineet Maloo |

| Expense Ratio | 2.10%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 500 |

| Minimum SIP | Rs.1000 |

| Exit Load | For units in excess of 15% of the investment,1% will be charged for redemption within 365 days |

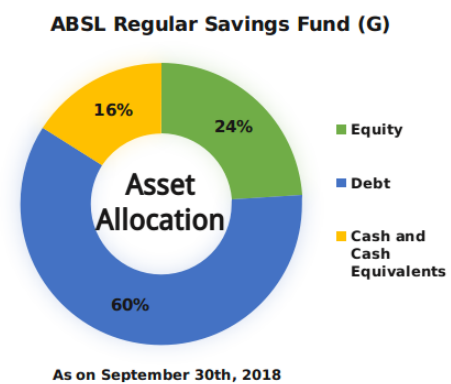

As on September 30th, 2018, it has been observed that Aditya Birla Sun Life Regular Savings Fund Growth has invested majorly in the debt securities with 60% of the total assets. It has also invested in equity and cash and cash equivalents. While investment in debt will help an investor to earn regular income with low risk, the investment in equity will generate high returns with high risk, thus balancing the overall return and risk of the fund.

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| ABSL Regular Savings Fund | -4.98% | 7.26% | 11.57% | |||

| VR MIP TRI | 2.10% | 7.16% | 8.98% | |||

| Category | -1.06% | 6.47% | 9.40% | |||

| As on October 10th, 2018 | ||||||

- The returns generated by Aditya Birla Sun Life Savings Fund in the past one year till date is 4.98%.

- The three-year returns generated by this scheme is 7.26% which is more in comparison to the returns provided by the benchmark VR MIP TRI and category.

- The five year returns generated by this scheme is 11.57% which is much more than the the returns yielded by both the benchmark and the category.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| ABSL Regular Savings Fund | 7.14 | 1.32 | 0.20 | |||

| VR MIP TRI | 4.57 | - | 0.33 | |||

| Category | 4.70 | 0.85 | 0.06 | |||

| As on September 30th, 2018 | ||||||

- The standard deviation of this scheme by ABSL Mutual Fund is 7.14 which is much higher than the SD of the benchmark which is 4.57 and that of category which is 4.70.

- The Sharpe ratio of this scheme is 0.20 which is though more than the category’s ratio but is less than the benchmark’s.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Factors to Consider While Investing

There are a number of factors which every investor should keep in mind while investing and selecting a scheme for investment. These points are as follows.

- Portfolio’s Requirement: It is very important that an investor understands his own portfolio’s requirement. This includes a number of parameters to be taken care of such as the tenure of investment, investor’s risk appetite, amount of investment that one needs to invest, goal, etc. Until and unless one is well aware of his own investment requirement, he won’t be able to make the right investment choice.

- Shortlisting Schemes: Once you understand well your portfolio’s requirement, it won’t take much time to shortlist schemes among many present in the mutual fund investment market by many fund houses. You may select the ones which are backed by the most trustworthy houses which have strong functioning abilities.

- Past Performance: You can further analyze the shortlisted schemes by comparing their past performances over different periods of time under different market conditions.

- Risk Measurement: The risk undertaken by a scheme should be only to help it provide good returns. Any investor should carefully study the risks involved.

- Fund Manager and the Strategies: Make sure that you have gone through the fund manager’s qualification, experience, and how the schemes have performed under them. How a scheme performs depends largely on the fund managers and the investment strategies followed by them.

The Final Note

The schemes that have been added to the portfolio are large cap, aggressive hybrid, and conservative hybrid. While large cap is considered to be a safer investment option compared to the midcap and small cap, hybrid fund provides an opportunity to earn well with balanced risk. You may invest in these funds via MySIPonline. If there is any query that you need to get answered, you may either consult our financial experts or post the same here.

Must Read: