Table of Contents

- Aggressive Investors

- Moderate Investors

- Conservative Investors

Risk, a four letter word which is enough to make you hesitate and think whether to invest in a scheme or not. Since mutual funds are always subject to market risk, it is very important that the investor understands the risk involved in a particular fund. Investing without giving a thought to the implications can lead to a shocking situation. Are you aware of the fact that how much risk you can bear? Without knowing the same you might have problem in selecting the right fund. Well, don’t worry as our experts are there to help you out regarding the same.

Table of Content

Risks are of different types; to know the risks involved in a scheme it is important that one reads the scheme information document carefully. They can be of different types such as market risk, concentration risk, interest rate risk, liquidity risk, credit risk, currency risk, inflationary risk, political risk, etc. The risk involved shown in the scheme with the help of the risk meter is mainly the overall risk that it involves. Before getting to know further, first let’s know what risk actually means!

What Is Risk in Mutual Funds?

Risk in general terms means a situation indulging into which can cause harm or loss. Connecting it with mutual funds, it can be said that the risk factor here denote the harm or a situation of loss that is likely to occur on the principal amount invested.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

How Fund Selection According to Risk Profile Can Help You?

It is really important to select the right scheme according to your risk portfolio as the right fund selection will help you in reaching the financial goal that you need to. In case the selection is not proper, then it can further lead to a number of losses such as monetary as well as loss of time and energy.

Investors are usually considered to be of three types in mutual fund industry. They are aggressive investors, moderate investors, and conservative investors. The fund selection can be done accordingly to the type of investors, for example, it is recommended that an aggressive investor invests mainly in the equity funds while the conservative investors can go in for low risk funds.

What Happens in Case of Wrong Fund Selection?

Hari is an aggressive investor who opted for a low risk fund, although the returns were stable, he was highly disappointed as he was unable to reach his financial goal. In another case, Ram being a conservative investor went on to select a small cap equity fund. With time, he suffered huge losses and had to sell his own property to fulfill his financial responsibilities for which he was saving.

Therefore, it is very important to know your risk profile and select the right fund accordingly.

Also Read:

Best Mutual Fund Portfolio for Aggressive Investors

Best Conservative Investment Portfolio for Investors

Questions to Ascertain Your Risk Profile

If you are an investor who is unaware of his own risk factor, then answering the below questions will help you know the same.

Question 1: I would describe my knowledge of investment as:

A.None, 0 point

B.Limited, 2 points

C.Good, 4 points

D.Extensive, 6 points

Question 2: When I invest my money, I am:

A.Most concerned about my investment losing value, 0 point

B.Equally concerned about my investment losing or gaining value, 4 points

C.Most concerned about my investment gaining value, 8 points

Question 3: Select the investment you currently own or have owned in the past with number of points:

A.Money market funds or cash investments, 0 point

B.Bonds and/or bond funds, 3 points

C.Stocks and/or stock funds, 6 points

D.Sector Index Fund, 8 points

Question 4: Imagine that in the past three months, the overall stock market lost 25% of its value. An individual stock investment you own also lost 25% of its value. What would you do?

A.Sell all of my shares, 0 point

B.Sell some of my shares, 3 points

C.Do nothing, 6 points

D.Buy more shares, 8 points

Question 5: Review the chart below. There are five schemes that have been randomly picked, all you need to do is to select the one that you feel to be the most appropriate.

| Plan | Average Return | High Return | Low Return | Points |

|---|---|---|---|---|

| A | 7.20% | 16.30% | –5.6% | 0 |

| B | 9.00% | 25.00% | –12.1% | 3 |

| C | 10.40% | 33.60% | –18.2% | 6 |

| D | 11.70% | 42.80% | –24.0% | 8 |

| E | 12.50% | 50.00% | –28.2% | 10 |

You also need to be sure of the time period for which you are willing to invest, in case you are not aware of the time period, answer the following questions to find out the same.

Question 1: I plan to begin withdrawing money from my investments in:

A.Less than three years, 1 point

B.3-5 years, 3 points

C.6-10 years, 7 points

D.11 years or more, 10 points

Question 2: Once I begin withdrawing funds from my investments, I plan to spend all of the funds in:

A.Less than 2 year, 0 point

B.2-5 years, 1 point

C.6-10 years, 4 points

D.11 years and more, 8 points

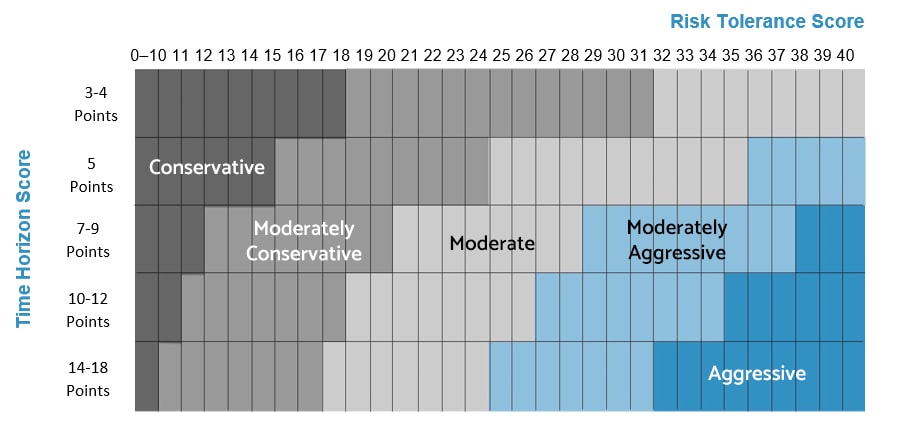

Determining Your Profile

Add up the scores of all the questions from 1 to 5 mentioned to calculate risk to get the total risk tolerance score and then get the time horizon score by adding up the scores of the above two questions. According to your scores, you can find out your profile level by going through the following chart, the point where your risk tolerance score and time horizon score intersects shows the same.

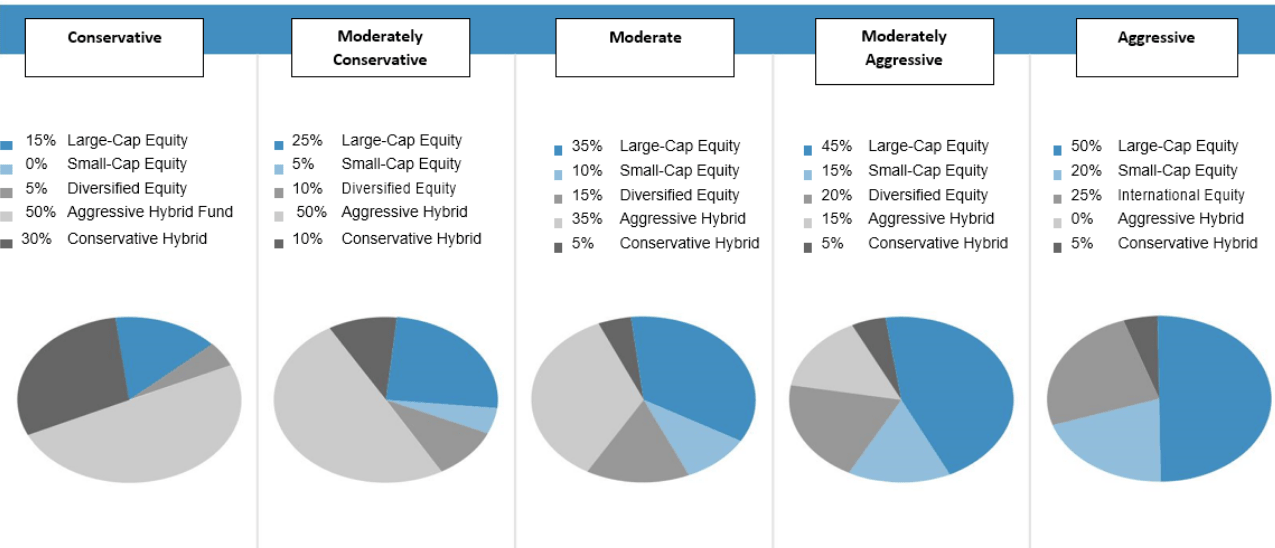

Selecting the Right Plan for Investment

Once you know where your profile lies, you can select the investment portfolio combination according to the following table. Please note that the selections are not given on the basis of the future forecast or current market conditions. They are simply a established approach of investing.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Conclusion

Hope you found this blog to be useful, connect with the financial experts of MySIPonline to get rid of any confusion that you might be having @9660032889. In case you have any query regarding the regular funds, you can post the same here.

Must Read:

Active Fund Management: Get Shielded Against the Market Risk in Correction Risk

Invest in Mutual Funds for Handling Mid-life Wealth Crisis by Taking Moderate Risks

How to Measure the Risks Associated with Mutual Funds?