Mid cap space after a painful run in 2018 is ready again to take a flight in 2019. The market experts are predicting that after a continuous fall in the last year, mid caps will show a great performance and will outperform the large cap space this year. So, at present, it is the right time to make an investment in mid cap mutual funds as they have not yet fully recovered from the previous fall and are available at discounted prices. Today, we will get a quick look at top 5 mid cap funds in 2019 and their investment strategies, so you can also take advantage of this recovery.

L&T Midcap Fund (G)

| Basic Information | |

|---|---|

| Benchmark | NIFTY Midcap 100 TRI |

| Launch Date | 9-Aug-04 |

| Asset Size | Rs. 3,685 crore (As on Nov 30, 2018) |

| Expense Ratio | 2.17% (As on Nov 30, 2018) |

| Minimum investment | Rs. 5000 |

| Minimum SIP | Rs. 500 |

| Return Since Inception | 19.57% |

| Exit Load | 1% on redemption before 365 days |

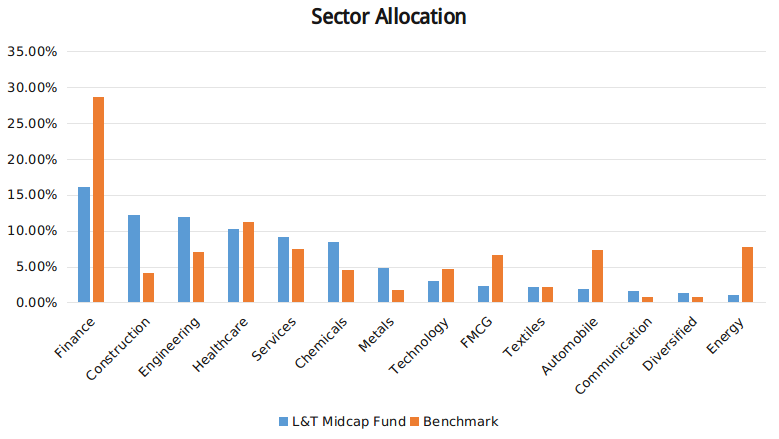

L&T Midcap Mutual Fund has maintained a top ranking in the mid cap space from the start. The scheme has provided exceptional growth to investors with the help of its diversified style of investment and the consistency in picking up the best opportunities of the market. The scheme invests predominantly in the equities, but due to the recent correction in the mid cap space, it has increased its allocation in the cash instruments (13.77%). Now, let’s have a look at the sector allocation to get a better idea about the future growth aspects.

As you can see from the above graph, L&T Midcap Fund is not following an approach same as the benchmark and has diversified the allocation a bit more in comparison to the benchmark. This will help the scheme to show a much better performance than the index, just like it has shown in the past years.

Invesco India Mid Cap Fund (G)

| Basic Information | |

|---|---|

| Benchmark | NIFTY Midcap 100 TRI |

| Launch Date | 19-Apr-07 |

| Asset Size | Rs. 269 crore (As on Nov 30, 2018) |

| Expense Ratio | 2.69% (As on Nov 30, 2018) |

| Minimum investment | Rs. 5000 |

| Minimum SIP | Rs. 500 |

| Return Since Inception | 14.23% |

| Exit Load | 1% on redemption before 365 days |

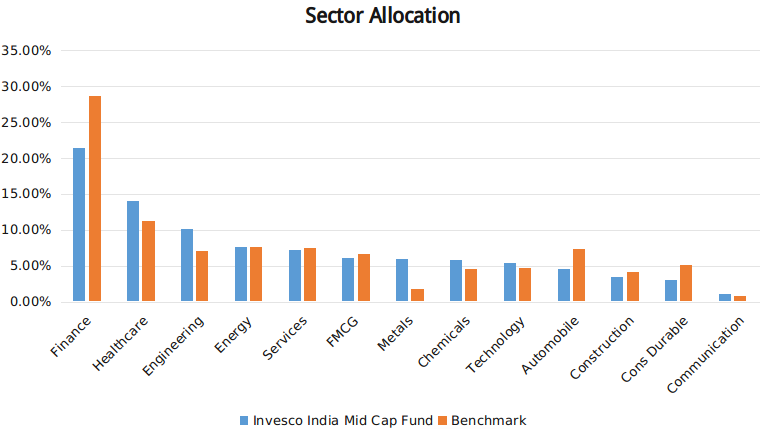

The size of the AUM of Invesco India Mid Cap Mutual Fund may not seem that big in comparison to the peers, but the performance it has shown over the years is exceptional. In the last 10 years, it has provided an annual average growth of 23.92% (As on Jan 10, 2019), securing the first rank in the mid cap category. This scheme follows a bit focused approach of investing and currently have 42 stocks in the portfolio. The sector allocation of the scheme is as follows.

Invesco India Mid Cap Fund is also investing majorly in the finance sector, followed by healthcare, engineering, energy, services, and other major sectors. Looking at the sector allocation and the top holdings which include major players of the market such as RBL Bank, City Union Bank, Apollo Hotels, Aditya Birla Fashion and Retail, and Exide Industries, a much better growth can be expected in the upcoming years.

DSP Midcap Fund (G)

| Basic Information | |

|---|---|

| Benchmark | NIFTY Midcap 100 TRI |

| Launch Date | 14-Nov-06 |

| Asset Size | Rs. 5,704 crore (As on Nov 30, 2018) |

| Expense Ratio | 2.24% (As on Nov 30, 2018) |

| Minimum investment | Rs. 500 |

| Minimum SIP | Rs. 500 |

| Return Since Inception | 14.54% |

| Exit Load | 1% on redemption before 365 days |

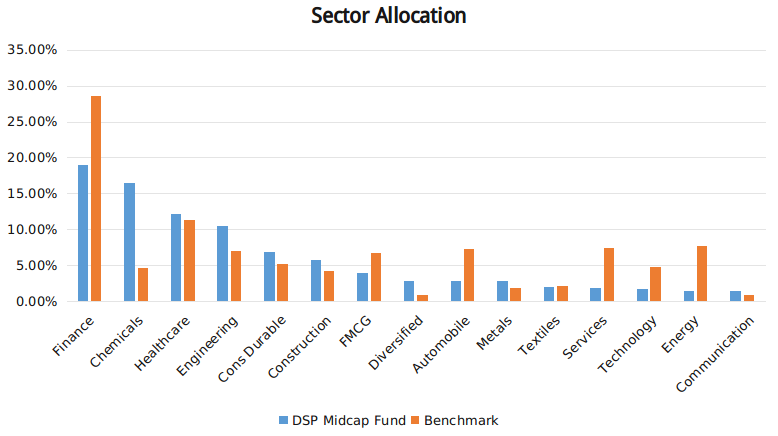

DSP Mutual Fund has always been among the top AMCs of India and one of the major reasons behind that is the extraordinary mutual fund schemes it has offered in the equity space. One such scheme that has contributed to increasing its popularity is DSP Midcap Fund. This scheme picks stocks using a blend of value and growth investment style, which helps it in providing high growth while maintaining stability. Have a look at the sector allocation to see how it can perform in the future.

Now, what makes DSP Midcap Fund one of the best choices right now is the high allocation in the finance and the chemicals sector, as both of these are expected to show great growth in the year 2019. In addition to this healthcare, engineering, and Cons Durable also holds the major investments and will help the fund in a spectacular long term growth.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

ICICI Prudential Mid Cap Fund (G)

| Basic Information | |

|---|---|

| Benchmark | NIFTY Midcap 150 TRI |

| Launch Date | 28-Oct-04 |

| Asset Size | Rs. 1,523 crore (As on Nov 30, 2018) |

| Expense Ratio | 2.19% (As on Nov 30, 2018) |

| Minimum investment | Rs. 5000 |

| Minimum SIP | Rs. 100 |

| Return Since Inception | 17.08% |

| Exit Load | 1% on redemption before 365 days |

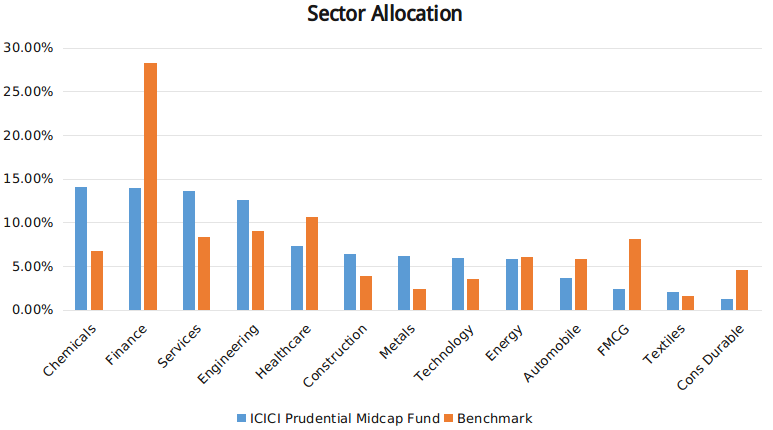

ICICI Prudential Mutual Fund is an AMC which does not need an introduction. The schemes it has provided over the years have helped a large number of investors in reaching their long term as well as short term goals. ICICI Pru Mid Cap Fund is also a scheme that is working in the welfare of the investors from a very long time. It was launched in the year 2004 and since then it has provided an annual average returns of more than 17%.

ICICI Prudential Midcap Fund is also investing majorly in the chemical and finance sector, making it one of the prominent choices in the mid cap space. Around 20% of the total equity holdings are held by the top 4 major stocks of the mid cap space, which are Indian Hotels, Exide Industries, Tata Chemicals, and L&T Infotech. The investment style is a blend of value and growth which further adds a growth factor to the scheme.

SBI Magnum Midcap Fund (G)

| Basic Information | |

|---|---|

| Benchmark | NIFTY Midcap 150 TRI |

| Launch Date | 29-Mar-05 |

| Asset Size | Rs. 3,523 crore (As on Nov 30, 2018) |

| Expense Ratio | 2.08% (As on Nov 30, 2018) |

| Minimum investment | Rs. 5000 |

| Minimum SIP | Rs. 500 |

| Return Since Inception | 15.24% |

| Exit Load | 1% on redemption before 365 days |

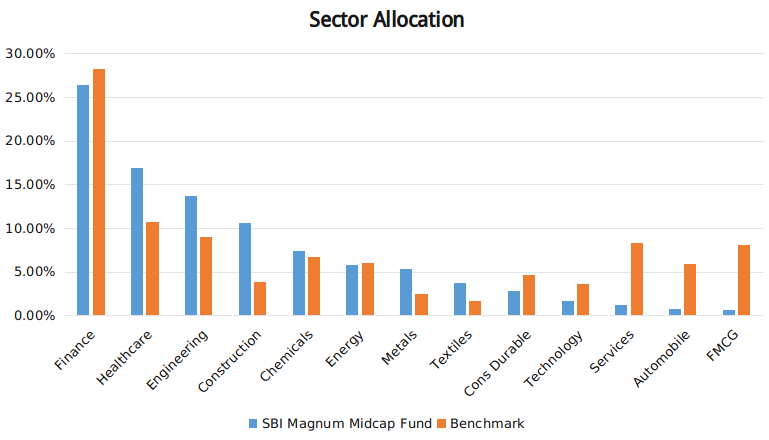

Launched in 2005, SBI Magnum Midcap Fund has provided an annual growth of more than 15% with the help of its optimal investment strategies. To get the advantage from the previous year's downfall in the mid cap space, it is currently giving a higher weightage to value investment style and is accumulating top mid cap stocks at discounted prices. Although, in the past 1 year, it has shown a great fall in returns, looking at the current instruments and sectors a tremendous growth is expected in the coming years. The sector allocation of the fund is as follows.

Here also, the highest growth is seen in the finance sector, and the other top sectors also match the market trends. The stock selection is partially diversified with current investment in 48 stocks. This is because the fund manager gives a more weightage to the quality of the stocks rather quantity.

Now, it depends on you which scheme you want to go with. Remember that to manage the market fluctuations if there are any in future, select a scheme from a category that has a lower risk associated with it, so a balance can be created. So, start your investment now and experience the unpredictable growth opportunities of the mid cap space.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Must Read:

Top Mutual Fund Plans for SIP of 10 Years in 2019

Top 5 Best Multi Cap Mutual Funds 2019