Table of Contents

- Long-term Capital Growth

- Professionally Managed

- Best for Long-Term Goals

- Great opportunity for aggressive investors

Are you an aggressive investor who is interested in earning high returns on your hard earned savings? Looking for an investment portfolio in mutual funds? Its good that you have come across this blog as the experts at MySIPonline are sharing with you the same. Equity funds are generally the best investment products for aggressive investors as they may generate huge returns if the investors remain invested for a long-term period. Let’s go through the details which are further mentioned in the coming lines.

Table of Content

Those funds that invest in the equities of companies across sectors are known as equity funds. These are further divided into different categories according to the full market capitalization of companies in which the investment is made. In the following points, you will be reading about who aggressive investors are, a portfolio for them and other details.

Who Are Aggressive Investors?

Aggressive investors are those investors who are ready to take high risk to earn maximum on the money invested. These investors usually invest for longer period of time.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Portfolio for Aggressive Investors

Aggressive investors may invest as per the below mentioned table through SIP mode. 30% in mid cap and small cap fund each will help investors earn high returns. While investment in large cap and multi cap will help normalize the risk factor. Are you wondering why you should be investing through the SIP mode of mutual fund? The reason is that if you invest through this mode for a long-term, the returns generated at the end of the tenure will be much higher as a result of compounding benefit. You don’t need to time the market under this type of investment. The reason is, if you remain invested even through the low phase, you will be benefited by its another feature which is rupee cost averaging.

| Name of the Scheme | Investment(%) |

|---|---|

| Reliance Large Cap Fund | 20% |

| Mirae Asset India Equity Fund | 20% |

| DSP Mid Cap Fund | 30% |

| SBI Small Cap Fund | 30% |

Top Schemes to Invest in 2018

The above-mentioned schemes belong to different categories of equity such as large cap, mid cap, small cap, and multi cap. Following is the description regarding each of these schemes.

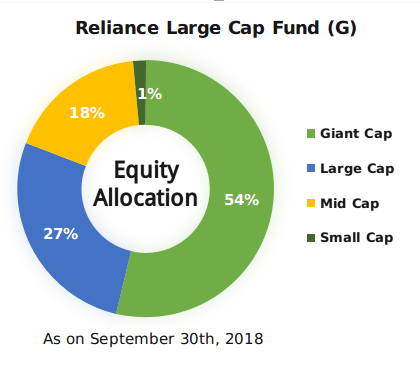

Reliance Large Cap Fund (G)

Formerly known as Reliance Top 200 Fund, the investment objective of this scheme by Reliance Mutual Fund is to generate long-term capital appreciation by mainly investing in the equity and its related instruments of large cap funds. It also aims to generate consistent income by investing in the debt, money market instruments, REITs, and InvITs.

| Basic Information | |

|---|---|

| Parameters | Reliance Large Cap Fund |

| Category | Equity: Large Cap |

| Benchmark | S&P BSE 100 TRI |

| Launch Date | 8/8/2007 |

| Asset Size | Rs. 10,898 crore(As on Sep 30, 2018) |

| Fund Manager | Sailesh Raj Bhan |

| Expense Ratio | 2.30%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 5,000 |

| Exit Load | For units in excess of 10% of the investment,1% will be charged for redemption within 365 days |

Being an equity scheme, the investment has been majorly done in equities. It has inclined its assets majorly towards giant cap. This portfolio opens the gate of earning high returns by investing in the large cap companies. Large cap companies are the top 100 companies in terms of the full market capitalization. The sector in which it has invested the most is the financial sector. Some of the companies in whose stocks it has invested in are State Bank of India, HDFC Bank, ITC, Larsen & Toubro, and Axis Bank. It has invested approximately 30% of the assets in these five companies.

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| Reliance Large Cap Fund | -8.19% | 9.13% | 17.52% | |||

| NIFTY 100 TRI | -3.49% | 9.55% | 13.68% | |||

| Category | -4.62% | 8.07% | 12.80% | |||

| As on October 09th, 2018 | ||||||

The three year return rate generated by Reliance Large Cap Fund is 9.13% as on October 09th, 2018 which is higher than its category’s returns. In five year returns, this scheme has yielded higher than both its benchmark and category.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| Reliance Large Cap Fund | 15.56 | 1.07 | 0.4 | |||

| NIFTY 100 TRI | 14.17 | - | 0.47 | |||

| Category | 14.30 | 0.99 | 0.36 | |||

| As on September 30th, 2018 | ||||||

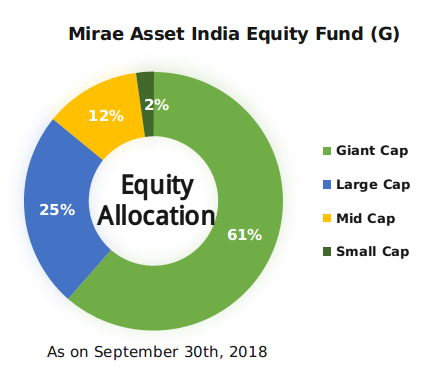

Mirae Asset India Equity Fund (G)

Formerly known as Mirae Asset India Opportunities Fund, this scheme is an open-ended scheme that invests across equities such as large cap, mid cap, and small cap. The investment objective of this scheme is to help investors earn long-term capital appreciation by investing in the equity and equity related instruments and by capitalizing the investment opportunities present in the market.

| Basic Information | |

|---|---|

| Parameters | Mirae Asset India Equity Fund |

| Category | Equity: Multi Cap |

| Benchmark | S&P BSE 200 TRI |

| Launch Date | 4/4/2008 |

| Asset Size | Rs. 8,755 crore(As on Sept 30, 2018) |

| Fund Managers | Harshad Borawake and Neelesh Surana |

| Expense Ratio | 2.08%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 5000 |

| Exit Load | 1% for redemption within 365 days |

This scheme is a multicap fund, i.e., the investment is made across equities. In the above pie chart it can be seen that it has invested 61% of its assets in giant cap, 25% in large cap, 12% in mid cap, and the rest 2% in small cap. This states that it provides huge scope to its investors to earn high returns on the money invested. This scheme has inclined around 32.84% of the assets in the financial sector followed by other sectors which are energy, technology, FMCG, and automobile. The top five companies in which it has invested around 28% of the total assets are HDFC Bank, Reliance Industries, ICICI Bank, Infosys, and Tata Consultancy Services.

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| Mirae Asset India Equity Fund | -7.58% | 11.24% | 19.36% | |||

| NIFTY 200 TRI | -6.17% | 9.33% | 14.10% | |||

| Category | -11.63% | 7.82% | 16.46% | |||

| As on October 09th, 2018 | ||||||

Mirae Asset India Equity Fund by Mirae Asset Mutual Fund has surpassed both its benchmark and category in three and five year time period. It has helped investors earn returns worth 11.24% and 19.36% in three and five years time.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| Mirae Asset India Equity Fund | 14.70 | 0.97 | 0.53 | |||

| NIFTY 200 TRI | 14.55 | - | 0.45 | |||

| Category | 15.46 | 0.98 | 0.32 | |||

| As on September 30th, 2018 | ||||||

DSP Mid Cap Fund (G)

Formerly known as DSPBR Small and Mid Cap Fund, this scheme by DSP Mutual Fund aims to yield long-term capital appreciation by investing in the equity and equity related instruments of mid cap companies. Simultaneously, the fund managers also invest in other equities to generate optimum returns.

| Basic Information | |

|---|---|

| Parameters | DSP Mid Cap Fund |

| Category | Equity: Mid Cap |

| Benchmark | NIFTY Midcap 100 TRI |

| Launch Date | 11/14/2006 |

| Asset Size | Rs. 5,215 crore(As on Sep 30, 2018) |

| Fund Managers | Jay Kothari, Resham Jain, and Vinit Sambre |

| Expense Ratio | 2.14%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 500 |

| Exit Load | 1% for redemption within 364 days |

Mid cap funds are those which invest its assets majorly in the equity and equity related instruments of mid cap companies. Midcap companies are the 101 to 250 companies in terms of the full market capitalization. This scheme being a mid cap scheme has invested 83% of the assets in the mid cap stocks. This investment seems to be in accordance with the category’s requirement. Further the fund managers have inclined the stocks across sectors such as financial, chemicals, healthcare, engineering, cons durable, construction, FMCG, etc.

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| DSP Mid Cap Fund | -19.66% | 8.98% | 22.11% | |||

| NIFTY Midcap 100 TRI | -23.62% | 7.70% | 18.35% | |||

| Category | -20.44% | 6.29% | 21.23% | |||

| As on October 09th, 2018 | ||||||

This scheme by DSP Mutual Fund has generated three and five year returns higher than both its benchmark NIFTY Midcap 100 TRI and category.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| DSP Mid Cap Fund | 18.54 | 0.93 | 0.37 | |||

| NIFTY Midcap 100 TRI | 19.03 | - | 0.31 | |||

| Category | 17.55 | 0.89 | 0.21 | |||

| As on September 30th, 2018 | ||||||

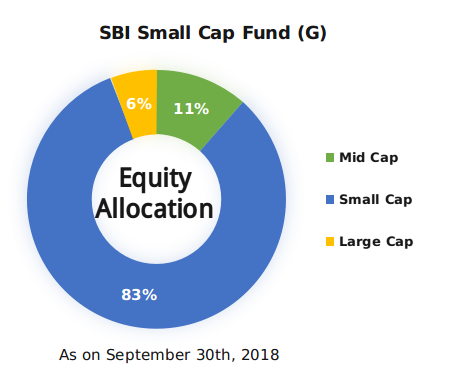

SBI Small Cap Fund (G)

Formerly known as SBI Small and Mid Cap Fund, this scheme provides long term capital growth by investing in equities of small cap companies across sectors.

| Basic Information | |

|---|---|

| Parameters | SBI Small Cap Fund |

| Category | Equity: Small Cap |

| Benchmark | S&P BSE Small Cap TRI |

| Launch Date | 9/9/2009 |

| Asset Size | Rs. 1,038 crore (As on Sep 30, 2018) |

| Fund Managers | R. Srinivasan |

| Expense Ratio | 2.74%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 5000 |

| Exit Load | 1% for redemption within 365 days |

Launched on September 09th, 2009, this scheme by SBI Mutual Fund has been successful in accumulating the assets under management worth Rs. 1038 crores as on September 30th, 2018.

With allocation of 83% assets in the small cap companies, this small cap fund has been true to its name. These funds are highly risky, and therefore only the aggressive investors should invest in them. Mr. Srinivasan has invested most of the assets in the FMCG sector with 19.25% of the total, followed by the engineering, financial, cons durable, and services sectors. It has invested around 18% of the total assets in the top five companies with major allocation. These companies are Blue Star, Hawkins Cookers, Simran Wind Project, Tamil Nadu Newsprint, and Alembic.

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| SBI Small Cap Fund | -25.14% | 13.63% | 30.05% | |||

| NIFTY Smallcap 250 TRI | -32.72% | 4.28% | 19.53% | |||

| Category | -25.60% | 7.89% | 22.53% | |||

| As on October 09th, 2018 | ||||||

The returns generated by this scheme in three-year time period is 13.63% which is higher than both the benchmark NIFTY Smallcap 250 TRI and category’s returns. In five-year time period, the rate of return generated by this scheme is 30.05% which is much higher than both the others.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| SBI Small Cap Fund | 20.54 | 0.82 | 0.57 | |||

| NIFTY Smallcap 250 TRI | 22.97 | - | 0.15 | |||

| Category | 19.76 | 0.83 | 0.29 | |||

| As on September 30th, 2018 | ||||||

Points to Keep in Mind While Investing

Mutual funds are always subject to market risk, and it is this reason that investors should carefully select the investment products for their portfolio. Below are the major points that every investor should be aware of.

- Portfolio Analysis: You should be well aware about how the assets have been allocated. It should be carefully studied that the companies and the stocks selected are of good quality and have high growth scope in future.

- Performance Analysis: Return is the main reason behind any investment, therefore, it is important to analyze the past returns and how the scheme has responded to different market conditions.

- Risk Analysis: Proper risk management affect the returns generated in a positive way. Although equity funds involve high risk, managing the risk properly can turn it in favor of the investor.

- Fund Managers: All the decisions regarding investments of the corpus are taken by the fund managers. Therefore, it is important that the managers are well qualified and experienced.

- Investment Strategies: The selection of the investment strategies leads to better performance of the scheme. There are a number of strategies such as bottom-up, top-down, etc. The one selected at the right time keeping in mind the market scenario can help to a large extent.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

The Bottom Line

Equity schemes are the best for aggressive investors as they facilitate them to earn high returns with time which are much more than those offered by traditional options. Looking at the current market situation when correction phase is going on, it is anticipated that with improvement in it, the returns generated by mid cap and small will rise too. Large cap funds are already the equity investors’ favorite right now. You may invest in all these schemes via MySIPonline, a leading platform with multiple benefits. To discuss any query related to regular funds, you can either consult the financial experts or post the same here.

Must Read: