Table of Contents

The 2024 Union Budget has brought significant changes to the taxation of mutual funds. In this blog, we’ll simplify these new tax rules to help you better understand how they affect your investments. We'll use clear examples and data to illustrate the updated tax slabs for Mutual Funds, helping you navigate the new regulations with confidence. Let’s dive in and simplify these changes together.

Budget 2024: Taxation Changes on Mutual Fund

The recent tax changes for mutual funds in India have introduced three main categories:

1.Equity Mutual Funds:

These mutual funds have over 65% of their holdings in equities, which are known as Equity Mutual Funds.

-

Short-term capital gains (STCG): In equity mutual funds, if you sell your units before 1 year, a 20% tax rate applies to the entire gain.

Example: If you invest Rs. 1,00,000 in an equity mutual fund and sell the units after 8 months for Rs.1,20,000, your gain would be Rs. 20,000. Since you sold the units before 1 year, the STCG rate of 20% applies to the entire gain. This means you would have to pay Rs. 4,000 in taxes (Rs. 20,000 * 20%) on your short-term capital gains. -

Long term Capital Gain (LTCG): if you sell your units after 1 year and your gain exceeds Rs.1,25,000, the tax rate of 12.5% applies only to the amount exceeding Rs.1,25,000.

Example: If you invest Rs. 2,00,000 in an equity mutual fund and sell it for Rs. 3,00,000 after 1 year, your gain is Rs.1,00,000. Since this is less than Rs.1,25,000, you don't need to pay any tax. But if you sell it for Rs. 3,50,000, your gain would be Rs. 1,50,000. You only pay tax on the gain above Rs.1,25,000, which is Rs.25,000 (150000 – 125000). With a tax rate of 12.5%, you would pay Rs. 3,125 in taxes (Rs. 25,000 * 12.5%).

2. Debt Mutual Funds:

These mutual funds invest more than 65% of their assets in debt securities, making them Debt Mutual Funds.

-

Short Term Capital Gain: Any gain from selling mutual fund units before 2 years are subject to tax at the rate specified by your income tax bracket.

Long Term Capital Gains: If you sell mutual fund units after 2 years, any gains are taxed according to your income tax slab rate.

Example: Let's assume if you invest Rs. 1,00,000 in a debt mutual fund and sell it after 2 years for Rs.1,20,000, your gain is Rs. 20,000. Since the tax on debt mutual funds is based on your income tax slab rate, if your slab rate is 30%, you would pay Rs. 6,000 in taxes (Rs. 20,000 * 30%).

3. Other Mutual Funds:

This category includes funds like Hybrid Funds, gold funds

- Short-Term Capital Gains: If you sell mutual fund units within 2 years, any gains are taxed according to your income tax slab rate.

For example: the tax treatment depends on the holding term. If you put Rs.1,00,000 in a gold ETF and sell it after 1.5 years for Rs. 1,20,000, you will gain Rs. 20,000. Short-term investments are taxed at your marginal rate. assume if your rate is 30%, you would pay Rs. 6,000 in taxes. -

Long-Term Capital Gains: If you sell mutual fund units after 2 years, the gains are taxed at a flat rate of 12.5%, regardless of your income tax slab.

Example: Investing Rs.1,00,000 in an international mutual fund and selling it after 3 years for Rs. 1,40,000 yields a Rs. 40,000 profit. This long-term investment is subject to a 12.5% tax rate, resulting in a Rs. 5,000 tax bill.

The key benefit of these changes is for long-term investors in the third category. Previously, these funds were taxed at the marginal rate, but now they are subject to a lower 12.5% capital gains tax for investments held for more than 2 years.

Overall, the new tax regime simplifies the structure for mutual fund taxation and provides better treatment for long-term investors, particularly in the third category of funds.

Budget 2024: Changes in the New Tax Regime?

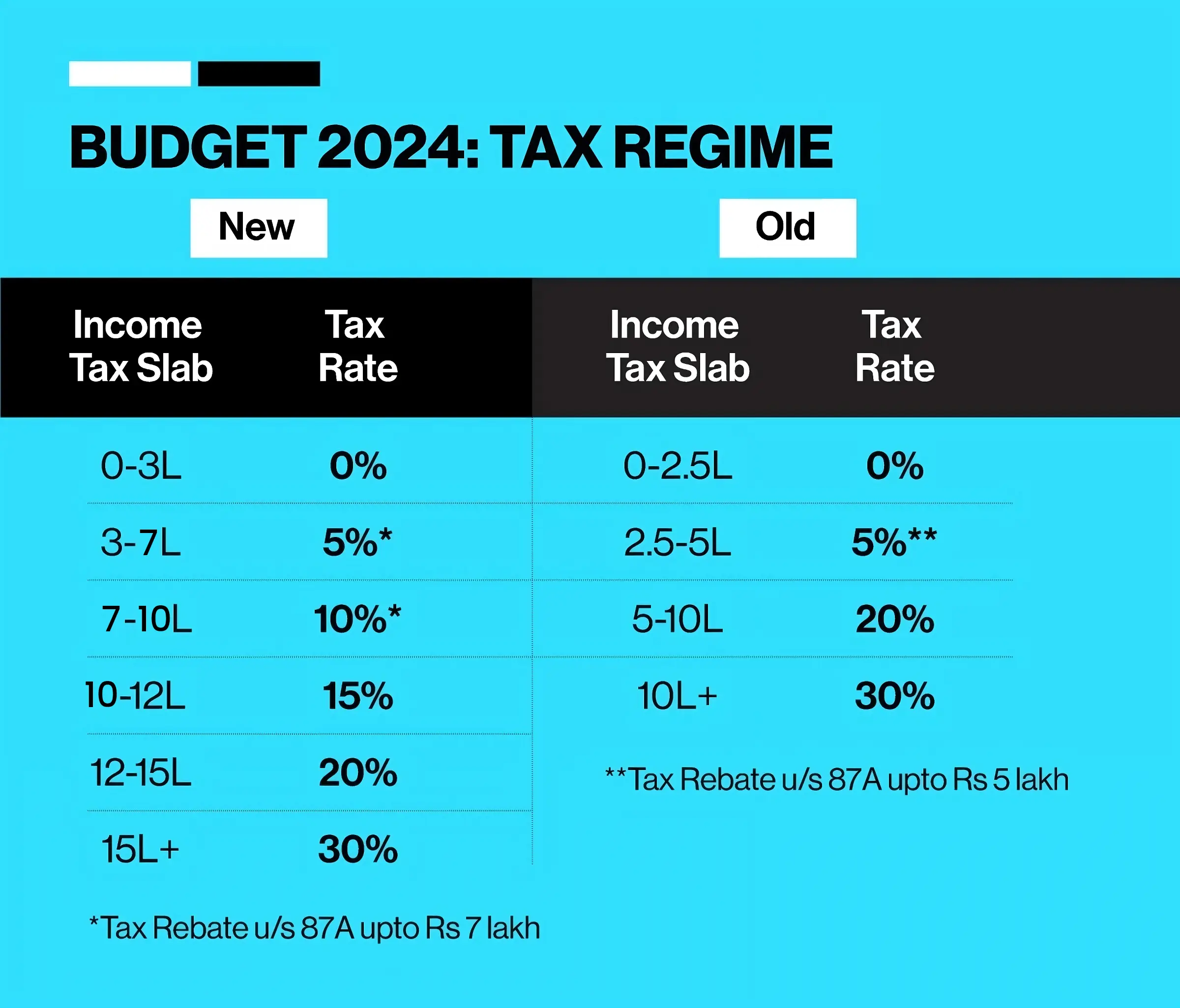

The ratios of the New and Old Tax Regimes, together with their distinctions and observations, are compared in the table below:

- Increased Tax Rebate Threshold: The new tax regime now offers a full rebate on income up to ₹7 lakhs, compared to ₹5 lakhs under the old regime. This means that individuals with an income of up to ₹7 lakhs will pay no tax at all under the new system.

- Updated Tax Exemption Limit: The exemption limit has been raised to ₹3 lakhs, simplifying the tax structure and potentially reducing the taxable income for many taxpayers.

- Standard Deductions: The Union Budget 2024 has made it easier for taxpayers to save money. For salaried employees, the Rs. 50,000 standard deductions have been raised to Rs. 75,000 now.

This helps them save more on taxes by allowing them to lower their taxable income by Rs. 75,000. The Pensioners also benefit from a higher deduction on their family pensions, which has increased from Rs. 15,000 to Rs. 25,000.

Overall, the new tax rules could save taxpayers up to Rs. 17,500, especially helping those who are salaried.

Budget 2024: Old vs New Tax Regime

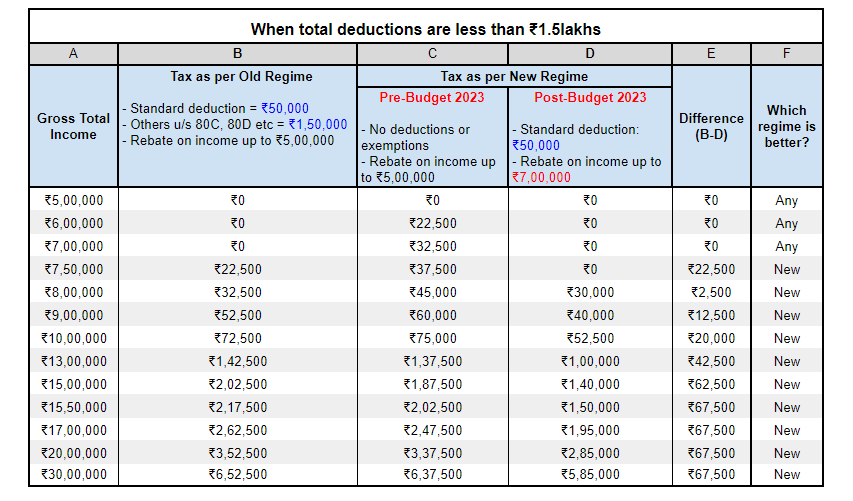

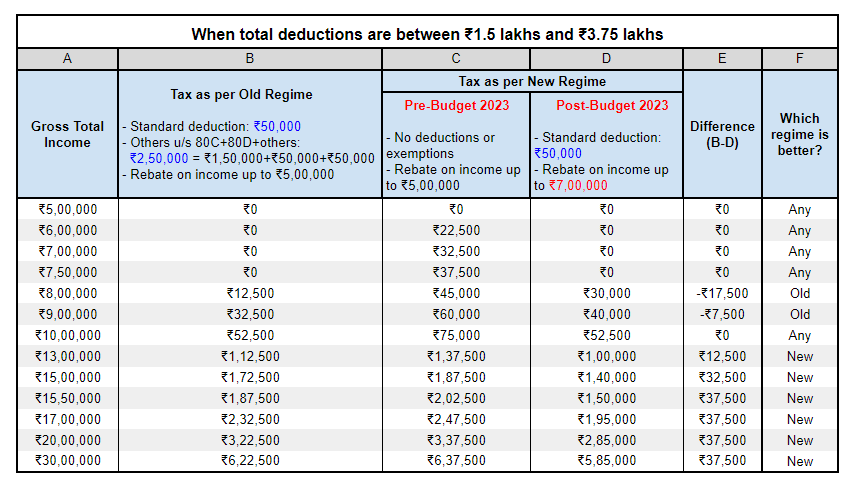

Here’s how to choose between the old and new tax regimes based on your deductions:

- Deductions up to ₹1.5 lakhs: The new tax regime is likely more advantageous.

- Deductions above ₹3.75 lakhs: The old tax regime may offer greater benefits.

- Deductions between ₹1.5 lakhs and ₹3.75 lakhs: The best option depends on your total income.

1. If your total deductions are ₹1.5 lakhs or less, the new tax regime is usually more advantageous.

Time for an example: For an income of ₹10 lakh, the tax payable under the old regime is ₹72,500. However, under the new tax regime introduced post-Budget 2023, the tax payable is reduced to ₹52,500. This results in a significant tax saving of ₹20,000 when compared to the old regime.

2. If your total deductions are greater than ₹3.75 lakhs, opting for the old tax regime could provide greater tax savings.

An example works Better: The old regime taxed an income of Rs.10 lakh at Rs. 26,500. The new regime Post Budget 2023 imposes a tax of Rs. 52.500. This results in a saving of Rs. 26, 000 with the old regime. The old tax structure is more advantageous for higher incomes, particularly when deductions reach Rs. 3.75 lakh.

3. The best tax regime will change depending on your income if your total deductions fall between ₹1.5 lakhs and ₹3.75 lakhs.

Here’s an example: Consider an individual with a gross total income of Rs. 13 lakh. Under the old tax regime, this person would pay Rs. 1,12,500 in taxes. However, with the new tax regime introduced post-Budget 2023, the tax payable is reduced to Rs. 1,00,000 This results in a tax saving of Rs. 12,500 compared to the old regime. Therefore, for an income of Rs.10 lakh, the new regime (post-Budget 2023) is more beneficial, reducing the tax burden significantly.

Check Out: Union Budget 2024: Key Highlights for Indian Investors

Best ELSS Tax Saving Mutual Fundto Invest in 2024?

| Fund Name | Launch Date | AUM (Crore) | Average Return (3 Year) |

|---|---|---|---|

| BANDHAN ELSS Tax Saver Fund | 26-12-2008 | 6,857.69 | 18.49% |

| DSP ELSS Tax Saver Fund | 05-01-2007 | 16,286.91 | 18.08% |

| Parag Parikh ELSS Tax Saver Fund | 05-07-2019 | 3,731.18 | 24.56% |

| Quant ELSS Tax Saver Fund | 01-04-2000 | 10,490.93 | 25.59% |

| Mirae Asset ELSS Tax Saver Fund | 01-12-2015 | 24,347.21 | 20.22% |

1. BANDHAN ELSS Tax Saver Fund

The BANDHAN ELSS Tax Saver Fund was launched on 26 December 2008. It focuses on Long-term investing means buying stocks to hold for years, relying on growth. Key to this strategy is researching industries to find promising stocks.

2. DSP ELSS Tax Saver Fund

Launched on January 5, 2007, the DSP ELSS Tax Saver Fund uses a blend of growth drivers and valuation metrics to identify attractive stocks.

3. Parag Parikh ELSS Tax Saver Fund

The Parag Parikh ELSS Tax Saver Fund was established on Launched on July 5, 2019, focusing on value investing, targeting reasonably valued, low-debt, and fundamentally strong companies.

4. Quant ELSS Tax Saver Fund

Investing in trending sectors and equities with excellent growth potential, the Quant ELSS Tax Saver Fund, with an AUM of Rs. 10,490.93 crores, focuses on active management to take advantage of market trends.

5. Mirae Asset ELSS Tax Saver Fund

The Mirae Asset ELSS Tax Saver Fund was established on December 1, 2015, and it focuses on value investing in companies with growth potential. With an AUM of Rs. 24,347.21 crores, it takes a bottom-up strategy.

Read More : Indian Economic Survey 2024: Released Update

.webp&w=3840&q=75)