Table of Contents

The Economic Survey is an important document from the Finance Ministry's Department of Economic Affairs. It reviews how the economy has performed over the past year and gives knowledge of what to expect in the future. This survey is key to shaping the country's final budget. For investors, it's especially useful because it reveals the government's main focus areas and initiatives. By understanding these priorities, investors can spot potential growth sectors and make smarter investment choices.

Economic Survey: How India’s GDP Growth Look Like?

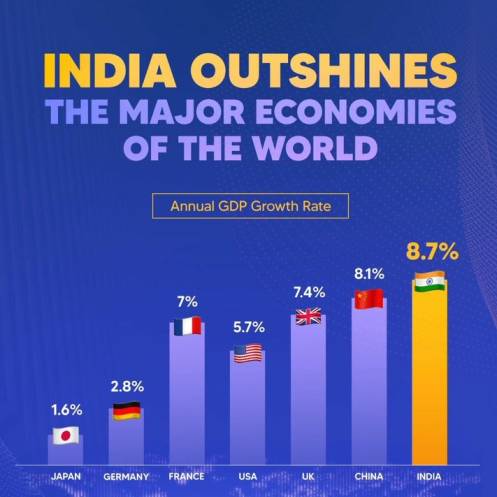

India's economy has been doing well, growing to around $3.5 trillion and with a strong growth rate of 8.2% this year. This is indeed one of the highest growth rates globally, which is commendable. However, the estimated growth rate for the next year is a more conservative 6.5%, and due to some important reasons.

Globally, the risk environment is quite high due to geopolitical tensions, the ongoing war, and the increasing debt to GDP ratios of many countries. These factors represent a significant risk that cannot be ignored.

Interestingly, India's GDP growth is primarily driven by government and private capital expenditure. While this is a positive sign, the growth in private consumption is still relatively normal, and the rural demand in India is also quite weak. This suggests that the economic recovery may not be as broad-based as one would hope.

When we look at the supply-side factors, the manufacturing growth in the industry sector has risen by a healthy 9.5%. However, the growth in the agriculture and services sectors is yet to be fully realized. This means that the overall economic picture is still mixed, and investors should be mindful of these details.

Economic Survey: Drawing Your Attention to the Inflation Factor

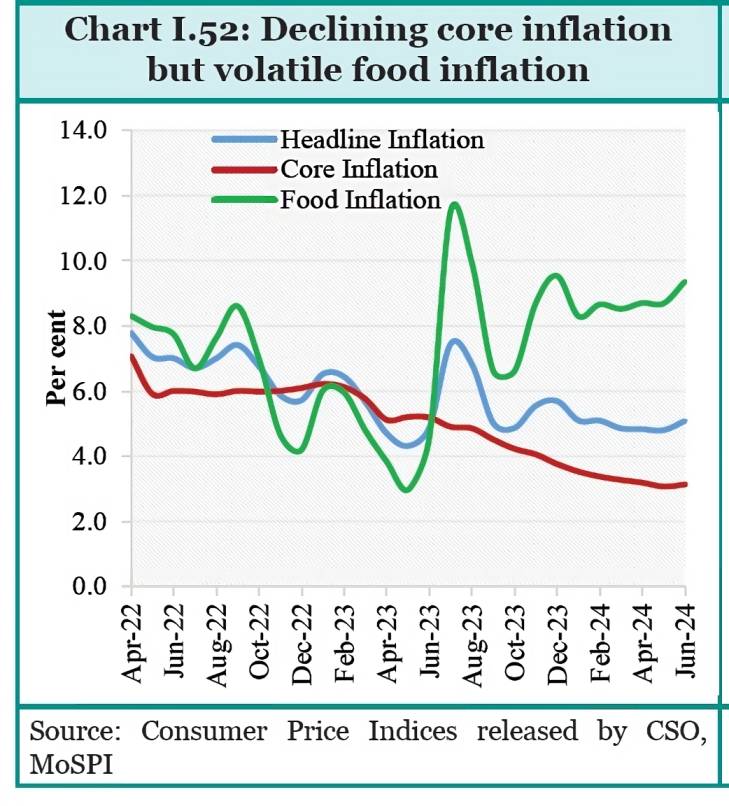

Inflation is a critical factor that influences economic growth, and it is closely monitored by investors. In India, the latest data shows that inflation has come down from the earlier high of 6.7% to a more manageable 5.4%. This is a positive development, as the Indian government has been able to manage inflation well despite the global challenges.

It's worth noting that India's current inflation rate is lower than the average inflation seen in emerging and developed economies. This is a remarkable achievement and speaks to the effectiveness of the government's efforts in containing inflationary pressures.

The moderation in inflation is mainly driven by a reduction in core inflation, which excludes volatile food and energy prices. However, food inflation in India is still relatively high, standing at around 7.5%. This is primarily due to the unfavorable weather conditions experienced last year, which impacted agricultural production.

From an investor's perspective, if inflation remains within the Reserve Bank of India's (RBI) target range, it would predict well for economic and market growth. Stable inflation creates an environment that is good for businesses to bloom and consumers to spend, ultimately supporting the overall economic expansion.

However, if inflation were to increase again, it would become a significant risk factor for the economy. A rise in inflation can reduce consumer purchasing power, lead to higher interest rates, and potentially slow down economic activity.

Economic Survey 2024: What Does It Reveal About Employment?

Employment is a key driver of economic growth and development. The latest survey reveals some important information on India's job market.

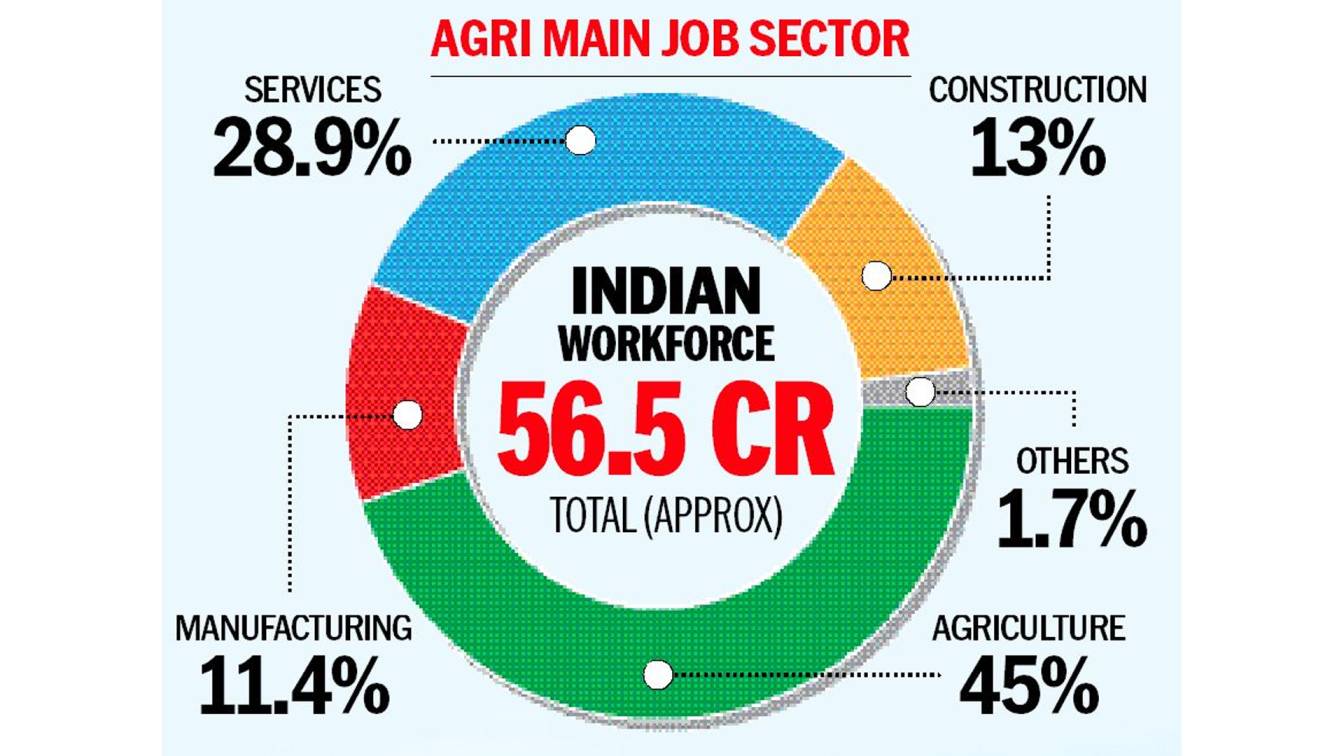

India's workforce is about 565 million people. Around 45% of them work in agriculture, showing that this sector is still the largest employer. The service sector employs 28.9% of the workforce, highlighting its growing role.

Urban unemployment is at 6.7%, which is relatively stable and positive. The survey also shows that more young people and women are joining the workforce, which is a good sign.

There’s also a noticeable increase in jobs in smaller factories, indicating that employment is spreading across various sectors. This expands the economic base, which is important for growth. However, challenges remain. Issues with job distribution and unemployment need to be addressed to ensure fair and sustainable employment for everyone.

Overall, a strong and growing employment sector is crucial for long-term economic growth, boosting consumption and investment while supporting social stability.

Economic Survey 2024: Highlighting the Fiscal Deficit Factor

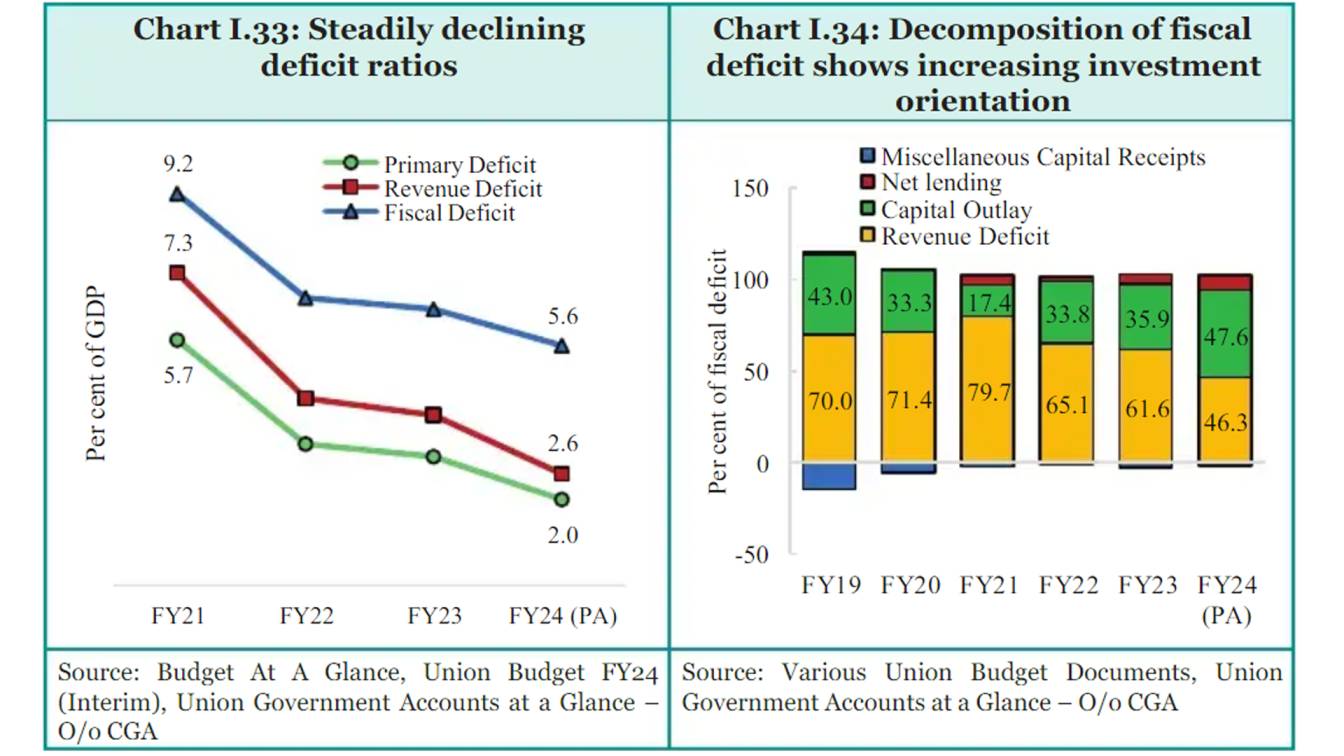

The fiscal deficit, which is the difference between the government's revenue and expenditure, is an important indicator of the country's financial health. According to the latest data, India's fiscal deficit stands at 5.6% of its Gross Domestic Product (GDP).

While this fiscal deficit figure may appear high in absolute terms, it is important to consider it in a comparative context. Compared to many other economies, India's fiscal deficit is in a relatively better position, which is a positive sign.

However, the government's focus is on bringing down the fiscal deficit further, with a target of reducing it to 4.5% of GDP. This is a sensible move, as a high fiscal deficit means the government is borrowing heavily to cover its expenses, which can lead to a higher debt burden and increased interest payments in the future.

The issue of high fiscal deficits is not unique to India, as it is a significant challenge faced by many countries, including the United States. The high fiscal deficit in the US is a source of global economic risk, as it can have the effect of fluctuating waves for the global financial system.

Key Points of Indian Economic Survey

- Economic Growth & Development: Identifying investment opportunities is crucial for capitalizing on growth

- PM Gati Shakti: Improved logistics services, benefiting the logistics and supply chain sector.

- Government Capex Allocation: Focus on infrastructure and construction, aligning with growth objectives.

- Manufacturing & Green Energy: Emphasis on rapid growth in sunrise sectors, including Manufacturing Sector and renewable energy.

- Railway Capex Increase: A 77% rise in railway capital expenditure over the past 5 years, positively impacting railway and defense stocks.

- Industrial Growth & MSMEs: Strategic initiatives planned for industrial growth and the expansion of Micro, Small, and Medium Enterprises (MSMEs).

- Agriculture Sector: Focus on technology, crop diversification, and value addition for fishermen, enhancing growth in agriculture and related sectors.

- Green Energy Transition: The government is prioritizing green energy with massive investments. This creates significant opportunities for investment in the renewable energy sector.

Read our latest Blogs

1. Manufacturing Mutual Funds: Everything You Need to Know

2. Manufacturing Funds Trending: Why You Should Take in Your Portfolio?

.webp&w=3840&q=75)