Despite tensions between the US & China, higher inflation, rising trade deficit numbers and selling by FIIs, market barometer closed higher while broader indices ended marginally lower. Let’s find out in detail, what’s happened in the market last week.

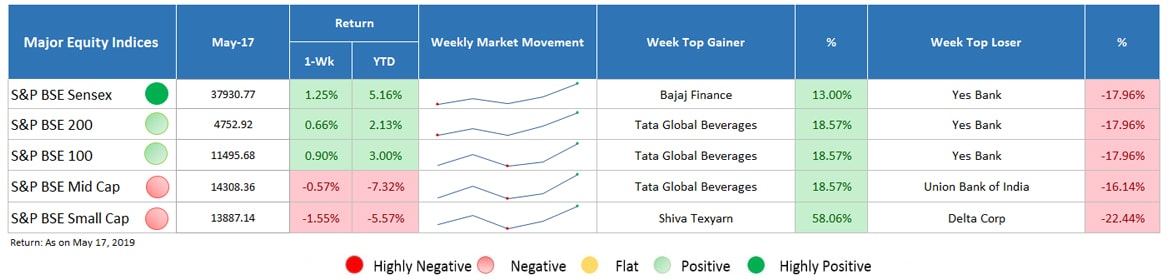

Major Equity Indices Performance

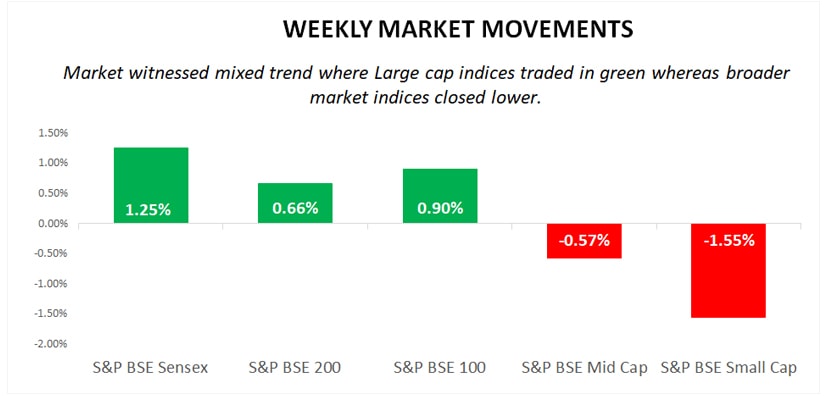

Sensex closed 1.25% higher at 37,930.77 followed by BSE 100 and BSE 200 which provided returns of 0.90% and 0.66%, respectively. On the contrary side, broader market indices traded lower, BSE Midcap fell 0.57% and BSE Smallcap down by 1.55%.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

On the domestic front, macroeconomic numbers including inflation and trade deficit data were released. As per the report, rise in trade deficit dampened market sentiments. Evidencing it, April month’s trade deficit heightened to 5-month high at $15.33 billion. Rising import of oil & gold products and slow growth in exports since last 4-months are the reasons for high trade deficit.

Moreover, consumer price inflation, also called retail inflation increased to 2.92% which is highest since the last 6-months. Hike in food inflation is the main reason behind high retail inflation but as it is still below RBI’s medium term target rate of 4%, expectations of rate cut by RBI have hiked. Despite rising food products prices, wholesale price inflation ease to 3.07% against 3.18% in March. It is because, food inflation was compensated by lower inflation of fuel, power and manufactured goods.

Talking about institutional activities, institutional investors followed last week’s trend where FIIs remained net sellers while DIIs were net buyers. Although FIIs sold equities worth INR 6,221.35 crore but high inflow by DIIs worth INR 6,730.35 crore provided support to the market.

On the global front, persistent trade tensions between the US and China affected sentiments adversely. Investors were afraid of retaliatory measure by China through tariff imposition on US imports.

Due to all of these reasons, indices were marginally up and down during the initial trading sessions but on the last trading session, buying in banking, auto and FMCG stocks pushed market higher.

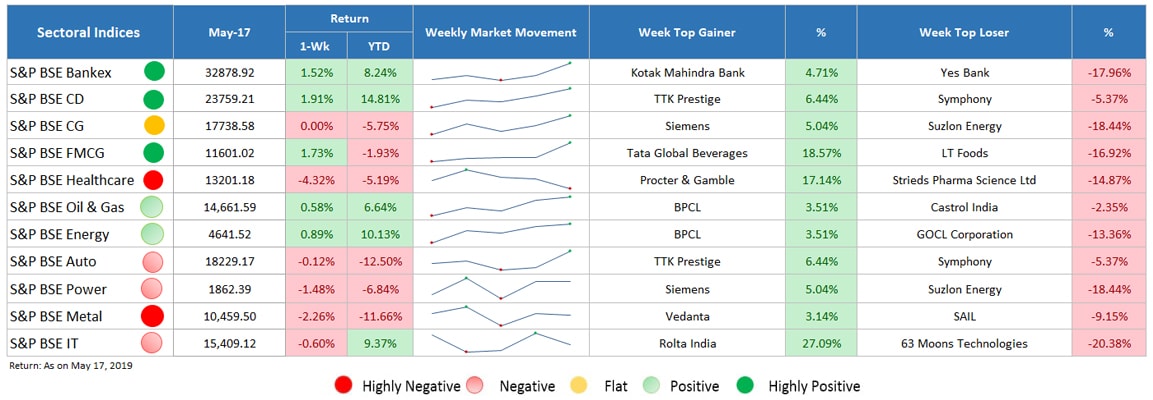

Sectoral Indices Performance

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Gaining Sectors

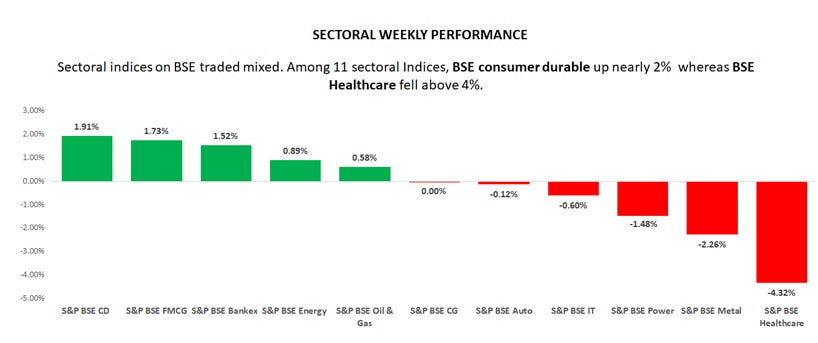

Among 11 sectors, 5 sectors advanced and 1 sector ended flat.

- BSE consumer durable sector was the top-gainer, up nearly 2% followed by BSE FMCG, up by 1.73%. Strong quarterly results by FMCG major, ITC reported nearly 19% rise in net profit helped the sector to close higher.

- Other sectors including bankex, energy and oil & gas were marginally higher by 1.52%, 0.89% and 0.58% respectively.

- BSE Capital goods sector ended flat.

Losing Sectors

Among 11 sectors, 5 sectors declined.

- BSE healthcare was the worst performer, fell above 4% due to high selling pressure witnessed in drug producer, Aurobindo Pharma after the regulator, USFDA classified the inspection as Official Action Indicated (OAI).

- BSE Metal sector was down above 2% due to mounting trade tensions between the US and China followed by BSE power fell nearly 1.50%.

- BSE IT, Auto and capital goods sector ended marginally lower, below 1%.

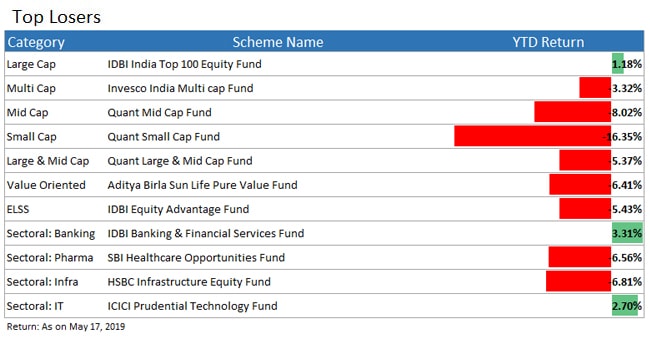

Top Performers & Losers

Conclusion

These were all the major updates from the past one week. Now, in the coming sessions too market is expected to show a similar kind of behavior. So, keep investing and stay tuned with us for the next week’s update. For any queries related to mutual funds, feel free to connect with the experts.

- Ask Questions

- Give Answers

- Improve Knowledge

- Invest Wisely