Table of Contents

- What is Digital Gold?

- Benefits of Digital Gold Investments

- What is Physical Gold?

- Benefits of Physical Gold Investments

- Difference Between Digital Gold and Physical Gold

- Digital Gold vs Physical Gold: Which is better for 2025?

- Best Ways to Buy Physical Gold and Digital Gold

- Digital Gold and Physical Gold Rates 2025

- What is the Loan Value of Physical Gold vs Digital Gold?

- Conclusion

Are you feeling confused about which form of gold you should invest your money in for this Dhanteras? Well, this is the age-old debate between Digital Gold vs Physical Gold. Where digital gold offers unmatched convenience and liquidity, physical gold provides the timeless, tangible security of holding actual gold bars, coins or jewellery.

But digital gold investments are more preferred because of their lower transaction and premium costs compared to physical gold. At the same time, many investors go for a balance, using digital gold for short-term flexibility and physical gold for lasting security.

Still overthinking "Which is better for you in 2025, physical gold or digital gold?" Dive into this guide for expert insights, current gold rates and a detailed comparison of "Physical Gold vs Digital Gold" to find your perfect gold investment strategy this festive season.

What is Digital Gold?

Digital Gold is an electronic way to invest in gold without physically holding it. Each purchase of the digital gold is backed by an equivalent amount of 24-karat, 99.9% pure physical gold. The digital gold investments allow investors to buy, sell or store pure gold digitally. The digital investments in gold often start with tiny amounts, as little as Rs 1.

How Digital Gold Investments Work?

Many platforms offer digital gold. When investors buy it, the platform secures an equal amount of physical gold with certified bullion companies to store.

- Buy- Buy from fintech apps, digital wallets, and jewellery platforms at transparent rates.

- Store- Stored in an insured vault by a custodian without concerns like theft, damage or locker fees.

- Sell- Sell any time at the current market price.

- Redeem- Conversion to physical coins, bars or jewellery with little charges.

One of the best methods to invest in digital gold in 2025 is to start SIP in Gold Mutual Funds, which allows a systematic investment in gold for optimized long-term returns.

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Let us explore the benefits offered by the digital gold investments.

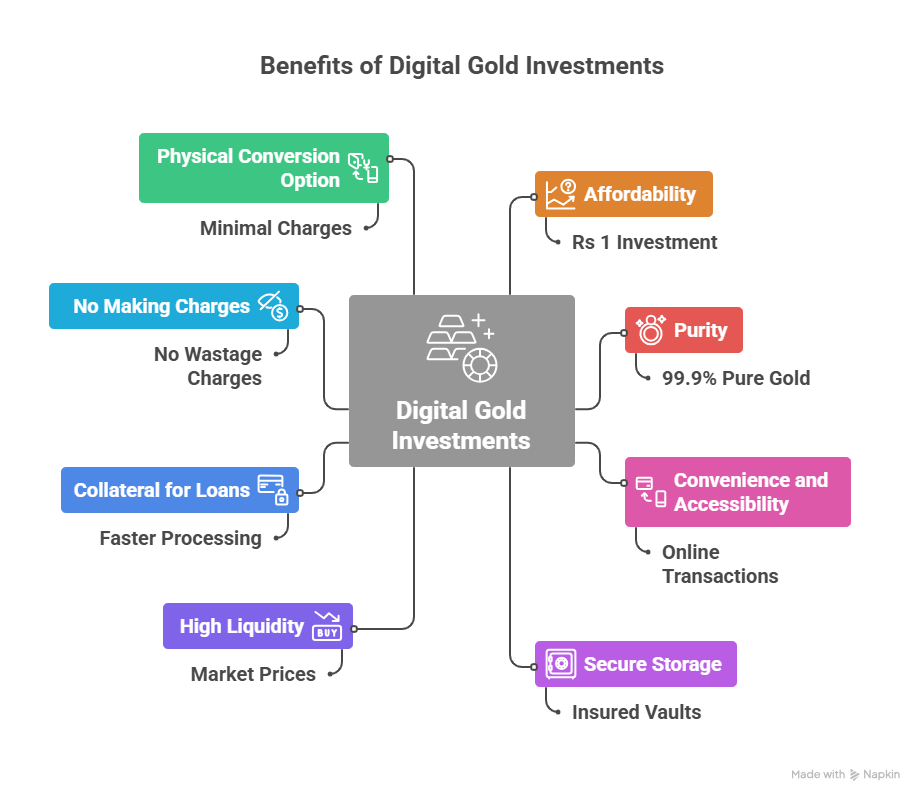

Benefits of Digital Gold Investments

Digital Gold offers several benefits for modern investors, some of which are:

- Affordability: Allow investments with just Rs 1, making it affordable to almost anyone.

- Purity: The digital gold provided by the providers is certified as 24K, 99.9% pure gold.

- Convenience and Accessibility: Digital gold can be bought and sold instantly online.

- Secure Storage: Purchased gold is stored in secure, insured vaults by the provider.

- High Liquidity: You can sell your digital gold at any time at the current market prices.

- Collateral for Loans: You can use digital gold as collateral to secure online loans with faster processing.

- No Making Charges: There are no additional making or wastage charges with digital gold, unlike physical gold.

- Physical Conversion Option: You can convert your digital gold into physical coins, bars or jewellery, with minimal making and delivery charges.

Now, let us talk about physical gold and its investments.

What is Physical Gold?

Physical gold is the oldest traditional and tangible form of gold that an individual or organisation can hold and possess directly. It is available as Gold bars or bullion, Gold coins, Gold jewellery and Gold biscuits or ingots. It is considered a cultural significance and has been valued for decades. It can be touched, stored and securely held by the owner. Investment-grade gold is usually 22K or 24K, which means it is 99.9% pure.

Characteristics of Physical Gold

- Real, solid metal with physical properties such as density, malleability and ductility.

- Gold purity is measured in karats and weighed in grams or ounces.

- Requires secure storage like home safes or bank lockers and there are risks like theft, loss or damage.

- Holds emotional & cultural significance beyond investment.

- Usually liquid, but selling may require finding buyers.

Next, we will explore the benefits of physical gold investments.

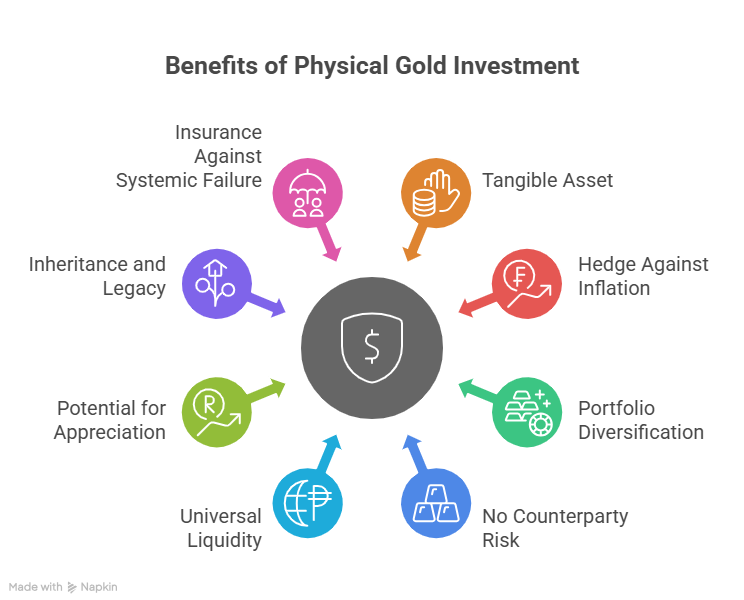

Benefits of Physical Gold Investments

Physical gold investment has several benefits that make it a famous option for investors, including:

- Tangible Asset: You can hold and store it physically, giving direct ownership to you.

- Hedge Against Inflation: Gold assets have been a reliable way to protect against inflation.

- Portfolio Diversification: Adding physical gold can reduce the overall risk and volatility of your portfolio.

- No Counterparty Risk: There is no reliance on a third-party financial institution or counterparty.

- Universal Liquidity: It is a globally recognised and accepted item, making it relatively easy to sell.

- Potential for Appreciation: Gold prices can increase over time, specifically during economic downturns.

- Inheritance and Legacy: It is a traditional way of keeping and passing down wealth through generations.

- Insurance Against Systemic Failure: It acts as an insurance policy against the failure of any currency or economy.

In the next heading, let us look at the comparison table of Digital vs Physical Gold.

Difference Between Digital Gold and Physical Gold

Here is the detailed comparison of digital gold and physical gold:

| Aspect | Digital Gold | Physical Gold |

|---|---|---|

| Form | Owned online; backed by real gold | Tangible asset: coins, bars, jewellery |

| Investment Size | Can invest small amounts easily | Typically larger minimum investment |

| Storage | Insured vault by provider | Requires physical storage (safe/locker) |

| Liquidity | High; instant online transactions | High; but needs buyer/jeweller |

| Costs | 3% GST, no making charges | Making charges (20–30%) |

| Purity | Guaranteed 24K (99.9%) | May vary; needs testing |

| Taxation | Same (slab rate/20% with indexation) | Same (slab rate/20% with indexation) |

| Risks | Platform/counterparty risk | Theft, damage, purity risk |

Now, the main question: "Digital Gold vs Physical Gold, Which is a better investment in 2025?" Keep reading to know.

Start Your SIP TodayLet your money work for you with the best SIP plans.

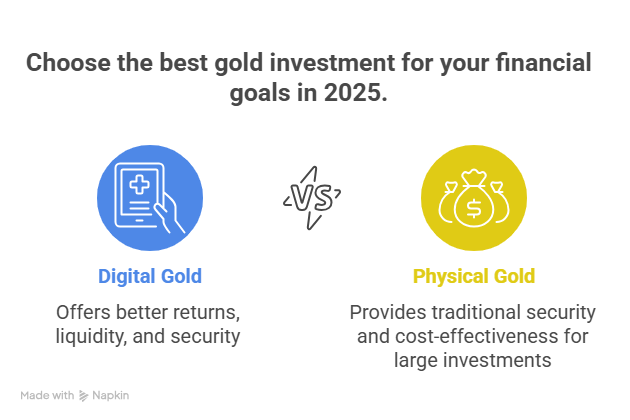

Digital Gold vs Physical Gold: Which is better for 2025?

While physical gold gives a feeling of security, digital gold provides better returns. Here is a breakdown to help you decide which is better for your financial goals in 2025.

Easier Liquidity: Digital gold offers more liquidity

You can buy or sell digital gold 24/7 through online platforms at the current market rates and cash is credited instantly to your account. Whereas, selling physical gold requires visiting a jeweller, undergoing a purity check and negotiating a buyback price, resulting in delays and deductions. Therefore, digital gold offers instant liquidity, which is easier than selling physical gold.

Storage Safety: Digital gold is generally safer

Digital gold is backed by equivalent physical gold stored in secure, insured vaults managed by reputable custodians (like MMTC-PAMP), minimising risks of theft or damage. Meanwhile, storing physical gold at home poses risks and using a bank locker has rental costs and may lack full-value insurance. So, due to the security protocols, most investors prefer digital gold as a safer investment option.

Better Post-Tax Returns Over 5–10 Years: Digital gold offers better returns.

Digital gold investments are likely to offer slightly better post-tax returns over a 5-10 year duration, as digital gold does not carry any making and storage fees like physical gold, so your entire amount is invested. Both types of investments are taxed at the same rate of 20% for long-term gains if held over 36 months, with indexation benefits. However, digital gold investments like gold Mutual Funds make it easier to handle taxes by keeping automated records.

When Physical Gold Becomes More Sensible

Physical gold can be more cost-effective for investments over Rs 2-3 lakh, over time. But, for the smaller amounts, physical gold investments can eat into the returns due to the cost associated with them, such as making charges and locker fees. However, if you care more about tradition or owning a physical asset than about making money with investments, buying physical gold can be a good choice, regardless of the amount.

In the end, the best option for 2025 depends on your goals. According to the experts, one can also invest in a balanced strategy, using digital gold for short-term flexibility and liquidity while holding a key portion in physical form for long-term security and tradition.

Let us explore the ways to purchase physical and digital gold in India.

Best Ways to Buy Physical Gold and Digital Gold

Listed below are the best ways to invest in physical and digital gold in 2025:

For Digital Gold-

- Fintech Apps and E-Wallets:Ideal for investors seeking high liquidity and minimal handling with small, frequent investments. Examples include PhonePe, Google Pay, Paytm, Fiydaa and Jar.

- Jewellery Platforms:This is ideal for buyers who prefer digital savings. An example is Tanishq DigiGold.

- Brokerages (as ETFs): Gold ETFsand Gold Mutual Funds allow investments without a demat account. You buy units representing physical gold, offering regulated gold exposure for investors.

For Physical Gold-

- Banks:Banks like HDFC and Axis offer the option to buy 24-karat gold online, available for pickup at branches. This is ideal for those seeking guaranteed purity, as they provide certified, tamper-proof products.

- Jewellers: Allows you to inspect gold before buying, with many available options. Best suited for individuals who value the tangible aspect of gold.

- Online Bullion Dealers:They offer a wide selection of gold bars and coins, with low premiums. It is best for investors to buy larger quantities of gold bullion.

Also Read: Gold Mutual Funds vs. Gold ETF Which One is Best for You?

In the next heading, you will know the current rates of gold in India. So, keep scrolling.

Digital Gold and Physical Gold Rates 2025

The current gold rates as of October 16, 2025, are:

Physical Gold:

- 24K Gold:It is priced around Rs 12,800 to Rs 13,000 per gram. This is the pure gold rate in India, reaching a new record. The final price for a physical gold item will vary according to its making charges (an additional 8% to 25% for jewellery) and GST (3%).

- 22K Gold:It costs around Rs 11,700 to Rs 12,000 per gram (depending on the city). This is the standard purity for gold jewellery in India.

Digital Gold:

- The prices of digital gold are based on the cost of pure 24K gold. The price of digital gold per gram is similar to that of physical gold, but with added charges.

- On top of this, a 3% GST is also applied and platforms offering digital gold also include a buy-sell spread of 2-5% (to cover operational expenses like vaulting, insurance, and fees).

When looking at the overall cost, digital gold is generally cheaper than physical gold for investment purposes as physical gold includes significant additional costs like making charges, storage fees and potential losses on resale, which digital gold avoids.

Must Read: How Much GST on Gold is Charged in India? 2025 Update

Let us explore the loan value and compare the loan value of physical and digital gold.

What is the Loan Value of Physical Gold vs Digital Gold?

There is a vast difference in the loan process and the collateral used for physical vs digital gold, though the key loan value is calculated similarly.

Physical Gold Loans require an in-person visit to a lender for valuation and are secured by tangible jewellery or coins. Whereas digital gold loans are entirely online, using your digital holdings as collateral. Both are subject to a maximum loan-to-value (LTV) ratio of around 75%.

Here is a loan value comparison of physical and digital gold:

| Aspect | Physical Gold | Digital Gold |

|---|---|---|

| Loan to Value (LTV) | Up to ~75% of market value | Slightly lower LTV, varied by lender |

| Collateral Requirement | Physical pledge of coins/bars/jewellery | Electronic pledge of digital gold holdings |

| Loan Process | In-person verification and pledge | Online application and digital verification |

| Loan Disbursement | Cash or bank credit after physical pledge | Instant digital transfer post approval |

| Verification | Assay and purity check of physical gold | Platform verifies digital gold ownership |

| Convenience and Speed | Slower due to physical handling | Fast, completely digital and paperless |

| Security Risks | Risk of theft unless secured properly | Platform and cyber risk; gold stored in insured vaults |

| Repayment and Gold Unlock | Physical gold is released on loan closure | Digital gold is released/unlocked digitally |

| Availability | Widely available at banks, NBFCs, and pawn shops | Emerging availability via select fintech lenders and platforms |

| Charges | Interest rates + valuation fees + storage costs | Interest rates + platform fees (may vary) |

These steps show how to avail a gold loan against digital gold:

- Hold your digital gold in a platform that collaborates with lending partners.

- Apply for an online loan through the platform or lender app.

- Link your digital gold holdings as collateral electronically.

- Undergo instant verification by the platform/lender.

- Upon approval, get the loan disbursal directly into your bank account digitally.

- Repay EMI or loan amount as per the schedule; collateral is unlocked once the loan is cleared.

Smart Investments, Bigger Returns

Conclusion

To conclude the comparison of the digital gold vs the physical gold, if you want convenience, liquidity, risk-free, cost-efficient and small investments, you can choose digital gold. But if you are investing a large sum of money and prefer owning a tangible asset, you should go for physical gold.

You can also invest in a balanced mix of both digital & physical gold, covering both short-term liquidity and long-term safety.

Related Blogs:

1. Gold BeES vs Gold ETFs: Expert Comparison to Invest in Gold

2. What will be the Expected Gold Rate in 2025 in India?

FAQs

-

Is digital gold a safer investment than physical gold?

Digital gold is safer for storage, while physical gold's security depends on locker safety and insurance coverage.

-

Can you use digital gold for a gold loan?

Yes, some lenders offer gold loans against digital gold, usually through online collateral agreements with partnered platforms.

-

Is digital gold RBI-approved?

Digital gold is not officially RBI-approved but is backed by physical gold stored in insured and secure vaults.

-

Which is better, FD or digital gold?

FDs promise fixed interest; digital gold’s returns fluctuate with market prices, offering potential for higher gains.

-

Is your gold safe if the digital gold provider goes out of business?

Your digital gold remains safe if the provider fails, kept in insured, audited vaults, but verify the platform's credibility first.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)