Table of Contents

- What is an Expense Ratio in a Mutual Fund?

- Key Components of Expense Ratio in Mutual Funds

- How Does the Expense Ratio Impact Your Fund Returns?

- How to Calculate the Expense Ratio in a Mutual Fund?

- What are Expense Ratio Limits Set by SEBI?

- What is a Good Expense Ratio for a Mutual Fund Investment?

- Lowest Expense Ratio Mutual Funds in India

- Highest Expense Ratio Mutual Funds in India

- What are the Factors Influencing Expense Ratios in Mutual Funds?

- Conclusion

You did deep research and checked everything out, then only invested in mutual funds and thought you would get some mind blowing returns. But, in reality, it was nothing as you expected. Wondering why your mutual fund returns are not as good as you hoped? Well, this may be because you missed the sneaky annual fee that can eat up your returns, ever heard about Expense Ratio in Mutual Funds? '"Sounds familiar, but did not consider it", right? This is the mistake many investors make and end up getting disappointed with their returns.

Basically, an expense ratio is the fee charged by the AMC for managing your investments in a mutual fund. But here is the twist: a high expense ratio can really drag down your long-term returns.

Want to know how? Dive into this post to uncover how the expense ratios affect your net returns. You will also get to know other details and the lowest expense ratio mutual funds list. So let us begin.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

What is an Expense Ratio in a Mutual Fund?

The expense ratio is the annual fees charged by the AMC (Asset Management Company) for managing the mutual fund, shown as a percentage of your investment's value. These fees cover the operating and management costs of the fund, including fund manager salaries, marketing costs, administrative expenses and distribution charges.

How it works

The expense ratio shows how much a mutual fund spends each year to operate, compared to its average AUM (Assets Under Management). Investors do not pay this fee separately; instead, it is taken out daily from the fund’s assets and shown in the daily NAV (Net Asset Value). These costs reduce the fund’s value that investors see each day, which lowers their overall returns over time.

Now, let us look at the main components of expense ratios.

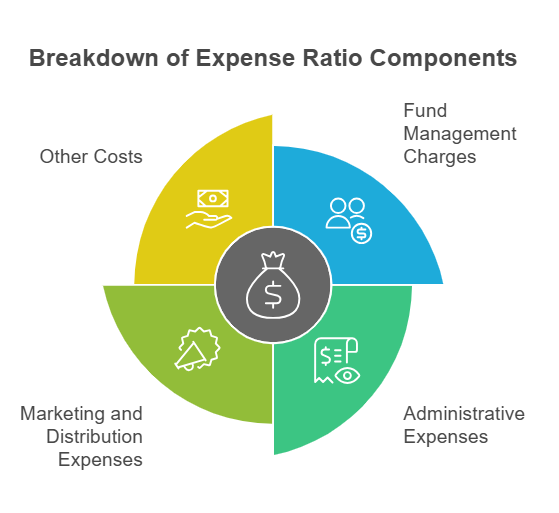

Key Components of Expense Ratio in Mutual Funds

The following are the main components included in a base expense ratio (BER) in mutual funds:

-

Fund Management Charges

These fees are used to pay the fund manager and their team for managing the fund and making investment decisions for you.

-

Administrative Expenses

These are the costs for daily operations. They include keeping records, audit fees, customer support and compliance expenses.

Best Mutual Funds for 2026 Backed by Expert Research

-

Marketing and Distribution Expenses

These costs include advertising, promotions and the commissions paid to brokers or distributors who sell the fund's shares.

-

Other Costs

This includes fees for keeping the fund's securities safe, managing investor records and buying and selling securities in the fund's portfolio.

Next, let us understand what impact expense ratios have on your mutual fund returns.

Must Read: Mutual Fund Entry vs Exit Load: What Matters Most In 2025?

How Does the Expense Ratio Impact Your Fund Returns?

An expense ratio is a fee that is deducted daily from the fund's total assets, before the NAV is calculated, therefore, it directly reduces your net returns of the mutual fund investments. If you choose a fund with a high expense ratio, it can lower your total returns. This effect increases over long investment periods because of compounding. A fund with a low expense ratio is better than a fund with a high expense ratio.

Direct Reduction of Returns

The expense ratio reduces your investment returns. You do not pay this fee separately; it is included in the fund's daily NAV. This means the returns you get are the ones after deducting expenses. Let us understand it like this, if a fund's gross annual return is 10% and the expense ratio is 1%, your actual return will be 9%.

Long-Term Compounding Effect

Even slight differences in expense ratios can lead to big differences in how much wealth you can build over time. Here is what happens if you choose a fund with:

- Lower Expense Ratio: You keep more of your money invested, so it grows better and also allows compounding to work effectively for better results.

- Higher Expense Ratio: It can take a big part of your annual returns, weaken the effect of compounding and reduce your financial corpus over time.

Let us take one more example to clear this concept. Assume you invested $10,000 through SIP in mutual funds over 10 years with a 10% annual return. Now, if you choose a fund with a 0.5% expense ratio, then you can earn much more. On the other hand, if you choose a fund with a 1.5% expense ratio, you will earn less than the other investment. This difference is mainly due to the costs involved.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

In the next part, you will learn how you calculate the expense ratio in your mutual fund.

Start Your SIP TodayLet your money work for you with the best SIP plans.

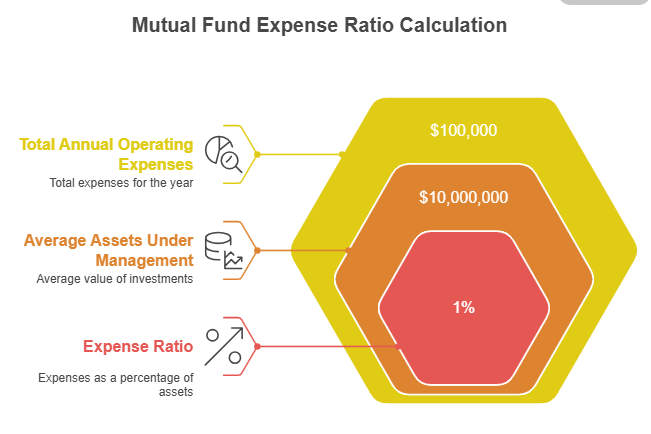

How to Calculate the Expense Ratio in a Mutual Fund?

To calculate the expense ratio in a mutual fund, you can use the formula given below and the result will be displayed as a percentage.

Formula for Calculating the Expense Ratio:

Expense Ratio =Total Annual Operating Expenses / Average Assets Under Management (AUM) × 100

Where,

- Total Annual Operating Expenses: This amount includes all the costs the AMC has to pay to run the fund for one year.

- Average Assets Under Management (AUM): This is the average total value of all the money invested in the scheme over a specific period, usually a year.

You do not need to do this calculation by yourself every time you are analysing a fund for your investment. The expense ratio of a fund is already calculated and you can easily find it in the fund's Scheme Information Document.

It is also listed on the official website of the fund house and in the monthly fact sheets. You can also find this information on financial platforms and the AMFI (Association of Mutual Funds in India) website.

Moving on, let us know the limits of the expense ratio defined by SEBI.

What are Expense Ratio Limits Set by SEBI?

These expense ratio limits set by SEBI determine how much a mutual fund can charge, depending on the type of mutual fund and its total AUM. Recently, SEBI has changed the rules for expense ratios. Now, the Total Expense Ratio (TER) includes the Basic Expense Ratio (BER), brokerage fees and other required charges. The revised limits for the BER are as follows:

| Scheme Type | AUM Slab | Maximum BER Allowed (Excluding Statutory Levies) |

|---|---|---|

| Equity-oriented schemes | Up to ₹500 crore | 2.10% |

| Equity-oriented schemes | Above ₹50,000 crore | 0.95% |

| Other-than Equity-oriented schemes | Up to ₹500 crore | 1.85% |

| Other-than Equity-oriented schemes | Above ₹50,000 crore | 0.70% |

| Index Funds / ETFs | Across all AUMs | 0.90% |

| Close-ended equity-oriented schemes | Across all AUMs | 1.00% |

Next, you will find out the number you should look for in a fund that will be the ideal ratio. So, keep reading.

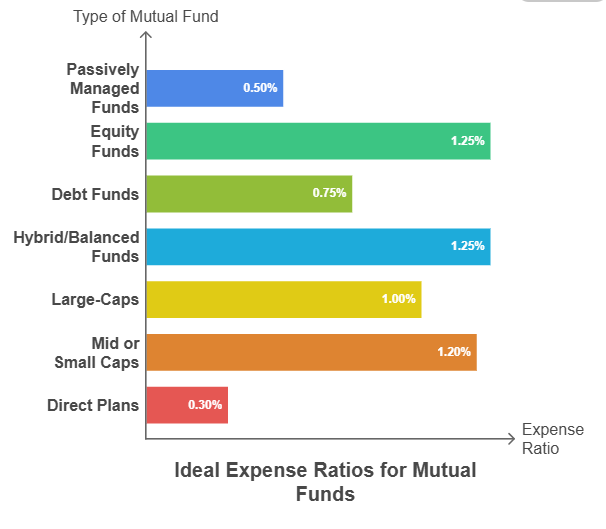

What is a Good Expense Ratio for a Mutual Fund Investment?

An ideal expense ratio for mutual funds is generally a lower one. Well, the good expense ratio depends on the type of mutual fund because all mutual funds have different cost structures.

Here are the general ranges for an ideal expense ratio for different types of mutual funds:

Passively Managed Funds

These are the Index Funds and ETFs, since they track a market index & do not require active management, their expense ratio are the lowest. The index funds and ETFs have an expense ratio of less than 0.50%. Many available options have 0.20% or less cost, with some even as low as 0.05% to 0.10%.

Actively Managed Funds

These funds have high operational costs as they aim to outperform the market benchmark. Here are the ranges of these funds-

- Equity Funds- The ideal ratio for equity mutual funds is less than 1.25%. Funds with ratios below 1% are an excellent choice, between 1% and 1.5% are reasonable, but above 2% is very high.

- Debt Funds- For these funds, an expense ratio less than 0.75% is said to be a good ratio.

- Hybrid/Balanced Funds- For these mutual funds, a less than 1.25% expense ratio is very suitable.

Benchmarks by Category

- Large-Caps- Under 1.0%

- Mid or Small Caps- 0.6%-1.2%

Avoid fees higher than 2% because they can significantly reduce your returns. It is recommended that you choose a direct plan over the regular plans, as direct mutual fund plans are bought directly from AMCs and have lower expense ratios at 0.1%-0.3% because they do not pay commissions to intermediaries, unlike regular plans that are bought through brokers or advisors.

One of the most critical factors is the fund’s return after expenses. Remember, a fund that has a 1.2% expense ratio and consistently delivers strong returns after costs is a better investment than a fund with a 0.5% expense ratio that does not perform well compared to its benchmark.

Also Read: ARN in Mutual Funds: Why It Matters for Safe Investing?

Now, let us look at some mutual funds that have the lowest expense ratios in India.

Lowest Expense Ratio Mutual Funds in India

Here is the list of the top 3 low expense ratio mutual funds in India:

| Fund Name | AUM (₹ in cr) | Expense Ratio (%) |

|---|---|---|

| ICICI Pru BSE Sensex Index Fund | 2,010.60 | 0.28 |

| UTI BSE Sensex Index Fund | 214.29 | 0.30 |

| Kotak Nifty 50 Index Fund | 1,048.72 | 0.32 |

After the lowest ones, let us also look at the highest ones.

Highest Expense Ratio Mutual Funds in India

Here is the list of the top 3 mutual funds with the highest expense ratios in India:

| Fund Name | AUM (₹ in cr) | Expense Ratio (%) |

|---|---|---|

| LIC MF Focused Fund | 173 | 2.52 |

| LIC Mid Cap Fund | 350 | 2.50 |

| Baroda BNP Paribas Banking and Financial Services Fund | 366 | 2.41 |

Lastly, let us look at the factors influencing the expense ratios in mutual funds.

What are the Factors Influencing Expense Ratios in Mutual Funds?

Here are the main factors that influence an expense ratio in mutual fund investments:

- The primary factor to look for is the management style of the fund, that is, whether it is active or passive.

- Look for the total AUM or fund size, as a fund with high AUM will have a lower ratio and a fund with small AUM will have a high expense ratio.

- Check the distribution model. When you buy a fund, how you purchase it affects the costs.

- Expense ratio varies based on the fund type, asset class and its investment strategy.

- Check out the market regulators like SEBI, their guidelines and the limits set by them on the expense ratios.

- Funds that frequently buy and sell securities have higher brokerage fees and transaction costs.

Smart Investments, Bigger Returns

Conclusion

Wrapping up, the expense ratio in mutual funds is an annual fee that eats into your returns, covering everything from fund management to admin costs. Remember, a lower expense ratio means more of your money is invested and more returns you get, especially over time.

SEBI defines the limits for these ratios to keep things fair. Always check the fund's performance after expenses & go for direct plans to cut out extra commissions.

Related Blogs:

- Tax on Mutual Funds: Complete Guide with Smart Saving Plans

- What is Risk in Mutual Fund and Its Types?

FAQs

-

Does the expense ratio directly reduce my returns?

Yes, it cuts away daily from NAV before returns hit your account. So, always check the post-expense performance of the fund.

-

How much does the expense ratio differ in direct vs regular plans?

Direct plans skip distributor cuts, so ratios are 30-100 bps lower, whereas the regular plans have intermediaries, so they have high expense ratios.

-

Can the expense ratio change over time?

Yes, it fluctuates with AUM growth (larger AUM means a lower ratio and vice versa), investment strategy shifts or SEBI rules.

-

How do I find the lowest expense ratio funds in India?

Use mutual fund platforms to find funds. Filter for "direct" and sort by Total Expense Ratio (TER).

-

Why do small-cap funds have higher expense ratios?

Investing in small-cap funds requires more research and trading, which can increase costs to about 1.5-2%.

.webp&w=3840&q=75)

.webp&w=3840&q=75)