ICICI Prudential Bluechip Fund is a name that has been creating a buzz in the mutual fund industry from a very long time. The fund was launched amid the market crisis of 2008, so the start was not that good, but after that, it has not shown any kind of weakness and has been providing consistent growth. This is the reason that it is included in every list of mutual fund recommendation. So, today, let’s see what makes this mutual fund scheme so great.

| Basic Details | |

|---|---|

| Description | ICICI Prudential Bluechip Fund |

| Category | Equity : Large Cap |

| Benchmark | NIFTY 100 TRI |

| Launch Date | 23-May-08 |

| Asset Size | Rs. 18,870 crore(As on Oct 31, 2018) |

| Expense Ratio | 1.96%(As on Oct 31, 2018) |

| Minimum Lumpsum | Rs. 100 |

| Minimum SIP | Rs. 100 |

| Return Since Inception | 14.14% |

| Exit Load | 1% on redemption before 365 days |

Asset Allocation & Investment Strategies: ICICI Prudential Bluechip Fund (G)

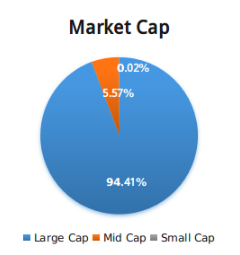

ICICI Pru Bluechip Fund has been following an optimal asset allocation as well as investment style. To make sure that a high growth can be maintained along with the stability, it has been following a mix of value and growth investment. The scheme being from the large cap category picks instruments from the top 100 stocks of the mutual fund market as per the market capitalization. Also, in addition to the equities, a considerable part is also given to the debt space (13.28%), so extra stability can be added. In terms of the market capitalization, the scheme invests predominantly in the large caps, the allocation in which can be checked from the pie-chart below.

Here, it can be seen that around 94% of the total equity investments are in the large cap space. This allows it to show a consistent growth and cap losses during the volatile market conditions. Now, let’s move to the sector allocation of the fund.

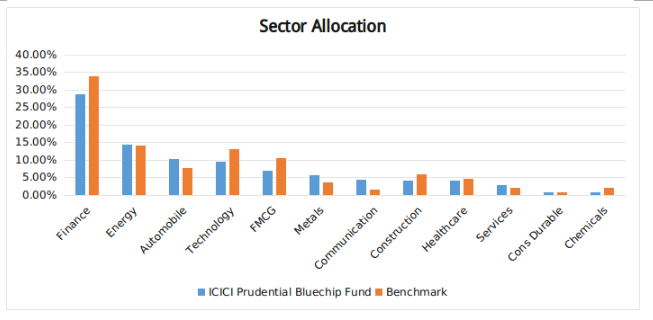

ICICI Prudential Bluechip Fund is following a diversified style of investing and at present has an investment in 57 stocks. These stocks are picked from 12 major equity sectors, the allocation in which can be checked from the above bar graph. The high allocation in finance, energy, automobile, and technology is really great, as the major stocks from these sectors are currently available at discounted prices and are expected to show a great growth in the coming years. The top 5 holdings in the portfolio include the top players of the equity market such as ICICI Bank, HDFC Bank, HDFC, Infosys, and ITC.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Past Performance: ICICI Prudential Bluechip Fund (G)

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Description | 1 Year | 3 Years | 5 Years | 10 Years | ||

| ICICI Prudential Bluechip Fund | 2.60% | 12.55% | 15.28% | 19.38% | ||

| Benchmark | 6.53% | 13.38% | 14.32% | 17.01% | ||

| Category | 4.95% | 11.73% | 13.43% | 15.39% | ||

| As on Dec 04, 2018 | ||||||

Risk Parameters: ICICI Prudential Bluechip Fund (G)

The above table shows that in the short term, the fund has not managed to beat the benchmark and category returns. The reason behind this is the high volatility in the equity space and the fall faced by the top stocks of the portfolio. Now, this fall should not matter as it is a long-term investment solution. And, in the long term, the returns are just exceptional and the longer the tenure is, the more will be the returns and the difference between the returns of benchmark and category.

| Risk Analysis | ||||

|---|---|---|---|---|

| Risk Parameters (%) | SD | Beta | Sharpe | Alpha |

| ICICI Prudential Bluechip Fund | 13.68 | 0.92 | 0.41 | -0.36 |

| Benchmark | 14.55 | 1 | 0.32 | - |

| Category | 14.7 | 0.98 | 0.35 | -1.21 |

From the above table, it can be seen that the SD and Beta are lower than the category’s average and benchmark which means that the volatility it shows is lower. But the major parameter to see here is the Sharpe ratio, which is greatly better than the benchmark and category’s average, and shows that the rewards you get for taking the risk with your investments are really high. Due to the volatility in 2018, the Alpha of the ICICI Bluechip Fund has gone down, but it has still managed to cap the drop exceptionally. All the credit for this goes to the over the top management of the scheme.

Conclusion:

From the above write-up, you can easily conclude that ICICI Prudential Bluechip Fund is excelling in every single check. However, you must remember that if you are planning on making investments in the scheme, then keep an investment horizon of 7 years and more. This will allow you to enjoy the true benefits of the scheme, the risk associated with your investments will decrease, and you will be able to experience the true power of compounding. .

Must Read:

Should You Invest in Mirae Asset Emerging Bluechip Fund?

Top Mutual Funds to Invest in December 2018