In the past couple of years many schemes have gained and lost the positions in the list of top mutual funds, and one of the main reasons behind that is the ups and downs in performance they show during different market and economic conditions. But, one scheme that has maintained a fixed position in this list is Mirae Asset Emerging Bluechip Fund. This fund has made a special place in the hearts of investors by giving a consistent performance even in volatile market conditions. So, today let’s see that how good the scheme really is by analyzing its various parameters.

Table of Content

| Basic Details | |

|---|---|

| Description | Mirae Asset Emerging Bluechip Fund |

| Category | Equity : Large & Midcap |

| Benchmark | NIFTY Large Midcap 250 TRI |

| Launch Date | 9-Jul-10 |

| Asset Size | Rs. 5,780 crore(As on Oct 31, 2018) |

| Expense Ratio | 2.07%(As on Oct 31, 2018) |

| Minimum Lumpsum | Rs. 5000 |

| Minimum SIP | Rs. 1000 |

| Return Since Inception | 20.97% |

| Exit Load | 1% on redemption before 365 days |

Past Performance

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Description | 1 Year | 3 Years | 5 Years | 7 Years | ||

| Mirae Asset Emerging Bluechip Fund | -1.17% | 16.97% | 28.33% | 24.81% | ||

| Benchmark | -0.96% | 13.46% | 18.17% | 16.23% | ||

| Category | -3.89% | 11.20% | 17.60% | 15.88% | ||

| As on Dec 04, 2018 | ||||||

If you are aware of the volatility that went throughout the year 2018, one thing you must have noticed is that almost all the equity schemes that have a high allocation in the mid cap and small cap space were showing a great drop. The returns of all the top funds were falling severely, but during these tough times too, this scheme managed to cap the losses greatly. From the above table you can see that where the category average is -3.89%, Mirae Asset Emerging Bluechip Fund Growth has managed to stop the losses at -1.17%, which shows that it has the capability to perform well in the market downside as well. And, in the long-term, the returns of benchmark and the category are nowhere near to that of the scheme.

Portfolio Allocation

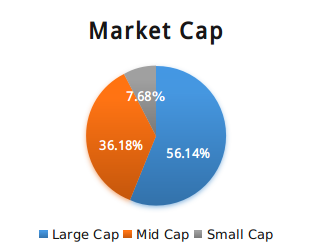

In terms of asset allocation, Mirae Asset Emerging Bluechip Fund is really great and keep up with the trends to provide optimal allocation. As for investment across the market cap, it currently has 56.14% investment in the large caps, 36.18% in the mid-cap and 7.68% in the small-cap companies. The allocation in the mid-cap has been decreased due to the recent correction it faced so further effects can be avoided.

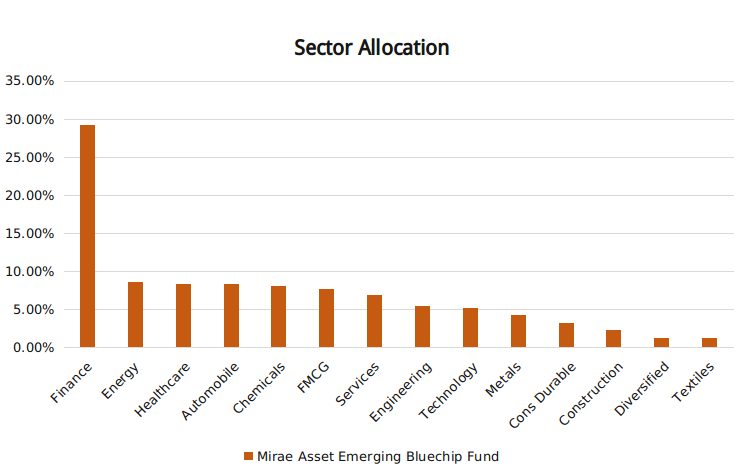

As for sector allocation, the Mirae Asset Emerging Bluechip Fund is following a portfolio which is not under-diversified or over-diversified. At present, it has an investment in a total of 59 stocks, and the allocation in different sectors can be checked from the above graph. For stock picking, a blend of value and growth investing is being used so a perfect balance between stability and growth can be created. Now, as you can see that the highest allocation is in the finance sector, which is really great as all the stocks were available at lower prices and the scheme has taken full advantage of that by increasing the investments in top-notch banking stocks. Other than this, all the other equity sectors are given a good weightage, so that stability can be maintained if some of the sectors don’t show a good performance.

Risk Measures

| Risk Analysis | ||||

|---|---|---|---|---|

| Risk Parameters (%) | SD | Beta | Sharpe | Alpha |

| Mirae Asset Emerging Bluechip Fund | 16.24 | 0.97 | 0.63 | 3.3 |

| Benchmark | 16.13 | 1 | 0.37 | - |

| Category | 15.73 | 0.94 | 0.32 | -1.64 |

Now, in terms of risk measures, Mirae Asset Emerging Bluechip Fund is way ahead of its peers. From the above table, it can be seen that the Standard Deviation and Beta of the scheme are a bit higher than the benchmark and category average, which shows that the fluctuations in returns are a bit higher. But, the rewards you get for taking this risk are even higher, and the difference between the Sharpe and Alpha is showing the same.

Is Mirae Asset Emerging Bluechip Fund Worth the Investment?

Well, if you are looking for a high growth, then definitely yes. The scheme has shown Excellency in all the parameters and looking at them a great performance can be expected in the future too. Just remember that this scheme is a pure equity fund, so is not suitable for every investor type. So, before making an investment check from below, if the scheme suits you or not.

Who Should Invest in Mirae Asset Emerging Bluechip Fund?

This large and mid-cap category scheme is a great option for investors, who have a moderately high risk appetite, want a high and stable growth by investment in a portfolio of large and midcaps, and have an investment tenure of more than 7 years. Also, remember that being an equity scheme, Mirae Asset Emerging Bluechip Fund can show fluctuations during volatile market conditions. At such times, don’t discontinue your investments, as it will lead to a disruption of your long term goals.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Important Note: Mirae Asset Emerging Bluechip Fund has stopped the lumpsum mode of investments. So, investors can only invest in this scheme through the SIP mode of investment and additional purchase are not allowed.

Must Read: