Table of Contents

- Backed by nine years old AMC

- One of the top performing midcap funds

- Investment in emerging companies

- Appropriate for long-term goals

Axis Mid Cap Fund is one of the top performing midcap funds that has yielded remarkable one-year returns beating its peers, benchmark, and category. Although this best midcap fund was not performing well earlier, with recent change in its allocation, the performance scenario has improved to a great extent. Being a midcap fund, its major allocation is in mid-cap equities followed by large-cap which is a good selection approach of the fund manager as their performance is remarkable in the current market phase. Planning to invest in this leading mid cap fund? Find out all the details here!

Table of Content

With the launch of “Mutual Funds Sahi Hai” campaign, there has been a waive of change in the outlook of people towards mutual fund investment. There are a number of categories under which schemes have been launched. Among many, one is mid cap category under which Axis MF launched a scheme named Axis Mid Cap Fund on February 18th, 2011. As per SEBI’s recent circular, Mid cap funds will invest predominantly in the stocks of mid-cap companies which falls under 101 to 250 companies. Let’s read what the experts of MySIPonline have to say about this fund.

Who Should Invest in Axis Mid Cap Fund?

- Investors who are willing to invest in the owner’s fund of mid-cap companies may choose to invest in this scheme.

- The risk involved in it is moderately high so only those investors should direct their surplus in it who have such appetite.

- People who seek an opportunity to invest their money for long-term capital growth may select this fund.

Facts About Axis Mid Cap Scheme - Growth Plan

| Category | Mid Cap |

| Benchmark | S&P BSE Mid Cap TRI |

| Launch Date | 2/18/2011 |

| Asset Size | Rs. 1,564 crore(As on Jul 31, 2018) |

| Fund Managers | Mr. Shreyash Devalkar |

| Expense Ratio | 2.53% (As on Jul 31, 2018) |

| Minimum Lumpsum | Rs 5,000 |

| Minimum SIP | Rs 1,000 |

| Exit Load | 1% for redemption of units more than 10% of the investment within 365 days |

How Is Axis MidCap Fund Performing?

| Return Analysis | Trailing Returns | 3 - Year Rolling Returns with a gap of 6 months | |||||

|---|---|---|---|---|---|---|---|

| Particulars | Since Launch | Last 5 Years | Last 3 Years | Dec 2013 to Dec 2016 | Jun 2014 to Jun 2017 | Dec 2014 to Dec 2017 | May 2015 to May 2018 |

| Benchmark: S&P BSE MidCap | - | 27.41% | 17.24% | 23.36% | 16.19% | 21.18% | 14.74% |

| Axis Mid Cap Fund | 19.52% | 28.50% | 13.77% | 24.76% | 13.42% | 13.24% | 11.87% |

| As on August 29, 2018 | |||||||

- This scheme has yielded annual average returns of 19.52% since inception.

- Though this fund has provided three-year returns lower than its benchmark, still, with time it has managed to generate five-year returns better than the same in the form of 28.50%.

- In terms of rolling returns, this scheme has surpassed its benchmark for the time period Dec 2013 to Dec 2016 with returns of 24.76%.

Axis Mid-Cap Fund: Risk Analysis

| Particulars | SD | Beta | Sharpe | Max Drawdown | Upside | Downside |

|---|---|---|---|---|---|---|

| Benchmark: S&P BSE MidCap | 16.46 | - | 0.65 | -14.55% | 100 | 100 |

| Category | 16.62 | 0.95 | 0.48 | -18.41% | 89 | 98 |

| Axis Mid Cap Fund | 15.09 | 0.83 | 0.43 | -23.41% | 77 | 84 |

| As on July 31, 2018 | ||||||

- The standard deviation of this scheme (15.09%) is lower than both its benchmark S&P BSE Midcap and category. The Beta of the scheme which is 0.83% is again less than its category. This states that the scheme is comparatively less likely to fluctuate.

- The sharpe ratio of this scheme is lower than both its benchmark and category. This shows that the returns that it yields with the risk taken aren’t rational.

- The maximum drawdown of this scheme is -23.41% which is much more than both its benchmark and category. The upside and downside ratios are both lower than the other two.

How Are the Assets of Axis Mid Cap Fund Growth Allocated?

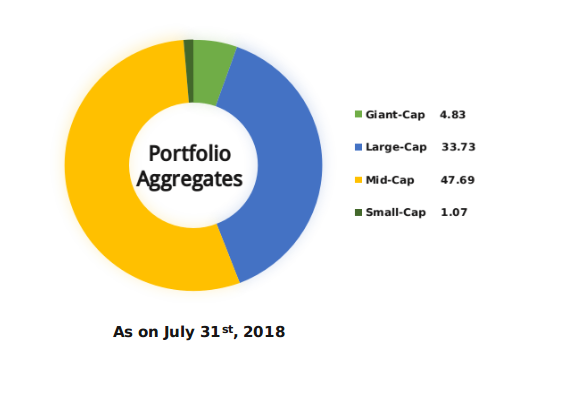

- This scheme has majorly invested in mid-cap equities with 47.695 of the total assets.

- It has also invested a part of its assets in giant-cap, large-cap, and small-cap equities with the assets allocated in them being 4.83%, 33.73%, and 1.07%, respectively. Investment in large-caps will helps in generating attractive returns in the present time and provides a cushion of stability.

| Sectors | Allocation | |||||

|---|---|---|---|---|---|---|

| Cyclical | ||||||

| Basic Material (Agriculture, Chemical, Metal & Mining, Steel, Building Materials) | 5.00% | |||||

| Consumer Cyclical (Auto related industries, Travel & Leisure, Marketing Cos, Apparel & Furniture Mfg Cos) | 35.00% | |||||

| Financial Services | 30.84% | |||||

| Real Estate | 0.00% | |||||

| Sensitive | ||||||

| Communication Services | 0.00% | |||||

| Energy | 0.00% | |||||

| Industrial | 4.78% | |||||

| Technology | 8.62% | |||||

| Defensive | ||||||

| Consumer Defensive | 5.33% | |||||

| Healthcare | 7.63% | |||||

| Utilities | 2.80% | |||||

| As on July 31, 2018 | ||||||

- It has invested about 70% of the assets in cyclical sector with the rest 30% divided into sensitive and defensive sectors. All the stocks chosen are the top performers and are currently market favorable.

- The major allocation has been done in the consumer cyclical which are all in the growth phase. There is no inclination towards real estate, communication services, and energy sectors.

| Stock Name | Weightage (%) | Absolute Returns | Valuation | |||

|---|---|---|---|---|---|---|

| 1 Year | 5 Year | P/BV | PE | |||

| GRUH Finance Ltd. | 6.31 | 36.92% | 580.83% | 15.89 | 61.48 | |

| Page Industries Ltd. | 5.42 | 108.34% | 780.43% | 40.58 | 102.14 | |

| City Union Bank Ltd. | 5.2 | 39.06% | 507.28% | 3.42 | 24.19 | |

| Bajaj Finance Ltd. | 4.83 | 68.26% | 2789.27% | 9.89 | 59.64 | |

| Endurance Technologies Ltd. | 4.19 | 54.09% | - | 9.25 | 50.72 | |

| Supreme Industries Ltd. | 3.81 | 1.4% | 270.49% | 7.42 | 30.67 | |

| Astral Poly Technik Ltd. | 3.64 | 65.8% | 1003.32% | 12.71 | 71.36 | |

| Sundaram Finance Ltd. | 3.22 | 12.6% | 240.37% | 4.46 | 31.35 | |

| Mahindra & Mahindra Financial Services Ltd. | 3.19 | 18.46% | 95% | 3.15 | 27.04 | |

| Avenue Supermarts Ltd. | 2.93 | 55.05% | - | 20.43 | 115.66 | |

| Info Edge (India) Ltd. | 2.6 | 69.32% | 425.76% | 8.85 | 104.39 | |

| Balkrishna Industries Ltd. | 2.58 | 85.15% | 1176.51% | 6.38 | 33.79 | |

| Return: As on July 31st, 2018 | ||||||

- It has invested about 42% of the assets in the top twelve companies which shows that this has moderately diversified its assets.

- Mostly all the companies in which the investment has been made have yielded superb five-year returns.

- The PE and P/BV ratios of the companies show that their stocks have been sold higher than their book value.

Axis Midcap Fund - SIP and Lumpsum Investment

| 3-Years SIP Returns | ||||||

|---|---|---|---|---|---|---|

| Cumulative Investment | Growth Value | Absolute Returns | XIRR | |||

| Axis Mid Cap Fund (G) | 36,000 | 45260 | 25.72% | 15.42% | ||

| 3-Years Lumpsum Returns | ||||||

| Investment 3-Years ago | Growth Value | Absolute Returns | CAGR | |||

| Axis Mid Cap Fund (G) | 100000 | 133399 | 33.40% | 10.06% | ||

| Returns: As on March 31, 2018 | ||||||

- SIP Investment: Any person investing in this scheme through SIP mode of investment with monthly SIP of Rs. 1000 for three years such that the total amount invested is Rs. 36,000 will generate a maturity amount of Rs. 45,260.

- Lumpsum Investment: An investment made in this scheme with Rs. 1,00,000 as lumpsum amount will provide an investor with a maturity amount of Rs. 1,33,399 at the rate of 33.40%.

Conclusion

Aggressive investors who wish to earn high returns by taking high risk may invest in this scheme. It is anticipated that with time Axis Midcap Fund will yield good returns in the current time. However, the future performance entirely depends on the strategies followed by the fund manager. To invest in this top performing mutual fund, simply log on to MySIPonline. To clarify any confusion that you might have, feel free to contact us.

Must Read:

| Fund | Launch | 1-Year Return | 3-Year Return | 5-Year Return | Expense Ratio (%) | Assets (Cr.) |

|---|---|---|---|---|---|---|

| Axis Mid Cap Fund (G) | 18-Feb | 26.4 | 13.75 | 28.48 | 2.53 | 1,564 |

| Kotak Emerging Equity Scheme (G) | 7-Mar | 10.8 | 15.55 | 32.31 | 2.34 | 3,327 |

| ICICI Prudential Mid Cap Fund (G) | 4-Oct | 8.65 | 11.61 | 29.8 | 2.41 | 1,535 |

| L&T Midcap Fund (G) | 4-Aug | 8.71 | 17.67 | 32.08 | 2.39 | 3,066 |

| DSP BlackRock Midcap Fund (G) | 6-Nov | 10.63 | 15.47 | 30.34 | 2.19 | 5,676 |

You may also go through the expert reviews on one of the top mid-cap funds, i.e., Kotak Emerging Equity Scheme by clicking here

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure