Table of Contents

The largest sectoral fund in India, the ICICI Prudential Technology Fund, began its finest plan on March 3, 2000, and has already been in existence for 24 years. In early 2020, this fund had around Rs. as its asset under management (AUM). of Rs. 13,422.37 crores. This ICICI IT Fund achieved three times more growth in the 4 years of period, the reason for this immense growth might be the euphoria of the fund, sector performance, and fund good performance. Let’s delve into this fund in detail.

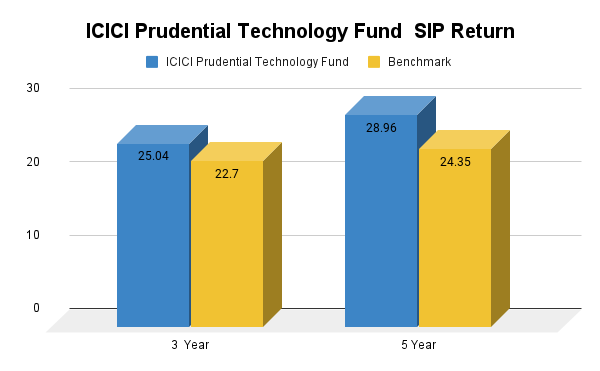

ICICI Prudential Technology Fund: SIP Returns

When we talk about the IT sector Mutual Funds we don’t miss out on the ICICI Prudential Technology fund. As we can see this fund 3 year annualised SIP return of 25.04%, remarkably beating its benchmark of 22.7%.

Does the ICICI Prudential Technology scheme give a commendable performance in the 5 years too? Let’s check, in the past 5 years the SIP annualised return has been 28.96%, and it outperformed its benchmark index of 24.35%.

If you invested Rs. 3000 in this fund during the last 5 years, your investment amount would have been Rs. 1,80,000, and you would now have an impressive amount of Rs. 3,59,498. The ICICI Tech MF is meant for investors looking for long-term development opportunities in the IT sector.

In just 5 minutes Calculate Your Investment Returns with the SIP Calculate

The Investment Strategy of ICICI Prudential Technology Fund

This fund invests in technology companies that have the potential for long-term growth. The ICICI Prudential Technology Fund uses a bottom-up strategy and focuses on developments that provide a competitive advantage, such as IT services, software growth, and hardware, with the primary goal of profit. They diversified their investment portfolio to reduce market risk.

Even in the volatile market, The ICICI Prudential Mutual Fund is a fantastic choice for investors that support value based investment. Investors who are okay with a certain level of risk and who are focused on producing larger returns over the next several years will find it most effective. If market volatility is acceptable to you in exchange of potential long-term gains, this can be a smart choice.

How ICICI Prudential Technology Fund Invest Your Money

Portfolio Allocation

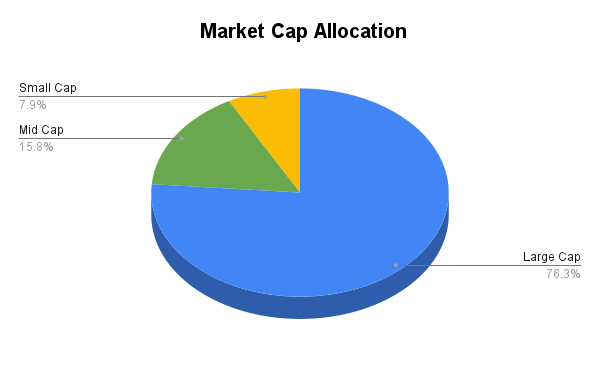

This multi cap technology fund invests your money of 76.3% in large tech companies. These are well-established companies with large market capitalizations such as Apple, Google, Microsoft, etc. The fund manager this fund invests 15.8% and 7.9% in mid and small cap, with an aim of value based investing and higher returns. Investing in mid and small companies provides a balance of risk and reward to the funds' portfolio. Now comes the turn of sector allocation.

The Sector Allocation of ICICI Prudential Technology Fund

India is growing fast in terms of the technological and digitalization sector let’s see how it will boom in the future.

The IT software accounts for 65.76% of the fund's portfolio, and the ICICI Prudential Technology Fund has a large tech holding, demonstrating its focus on the core of the digital economy. Using the growing communication industry as a base, telecom services account for 10.45%. The fund's tech-driven strategy is completed by IT services, which make up 4.62%, and Retail, which accounts for 6.13%, brings a little diversity. This combination highlights the fund's dedication to expansion in the technology industry. Time to know the Top Holdings of ICICI Prudential Technology Scheme:

Top Holdings of ICICI Prudential Technology Fund

| Company | Holdings (%) |

|---|---|

| Infosys | 24.73 |

| TATA Consultancy Service Ltd. | 12.1 |

| Bharti Airtel Ltd. | 8.04 |

| HCL Technologies Ltd. | 5.44 |

| Tech Mahindra Ltd. | 5.09 |

| Larsen & Toubro Infotech Ltd. | 4.83 |

| TREPS | 2.96 |

| Persistent Systems Ltd. | 2.51 |

| Wipro Ltd. | 2.43 |

| Zomato Ltd. | 2.37 |

The ICICI Prudential Technology Fund is designed for those investors who want a value-based investing in a market valuation, especially for those who can take high-risk but are also capable of seeing high risk in the upcoming year

How ICICI Prudential Technology Fund Defines Its Stock Quality

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 15.26% |

| Earning Growth | 16.99% |

| PE Valuation | 31.44% |

| Cash Flow Growth | 10.30% |

This IT sector fund shows a robust demand and strong quality with a sales growth of 15.25% and 16.99% of its earnings growth as well as a good cash flow of 10.30%. The ICICI Prudential Technology Fund also provides the possibility for reinvestment and financial stability. The PE valuation of this fund stands at 31.44% which indicates confidence in future growth. It looks like a good alternative for investors due to its strong growth quality.

In the Nutshells

The ICICI Prudential Technology Fund has shown amazing SIP returns and fabricated good options for wealth creation. It also shows a commendable skill set of the management team which focuses on a diverse portfolio in the technology sector and offers investors a balanced approach to portfolio management. It is meant for investors who are okay with the high-risk tolerance, it's best to invest for the long term at least for 5-7 years of duration. ICICI mutual fund has in-depth expertise in managing sectoral funds. Add this fund to your portfolio for better growth opportunities.

.webp&w=3840&q=75)