Table of Contents

In the financial year 2024, the Indian Technology Industry has crossed the revenue of 254 Billion dollars, according to the International Data Corporation (IDC) IT sector in India would grow at a compound average growth rate (CAGR) of 9.9% in the upcoming years.

So if you are interested in IT businesses rather than investing in an individual stock, there are specific technology mutual fund which invest in high growth tech companies. The Franklin India Technology Fund is one of the top fund in IT sector. Let’s see what Franklin IT fund brings to the investors and have a clear understanding of how this fund is best for your mutual fund portfolio. To start the Franklin technology fund review we will analyze its SIP returns.

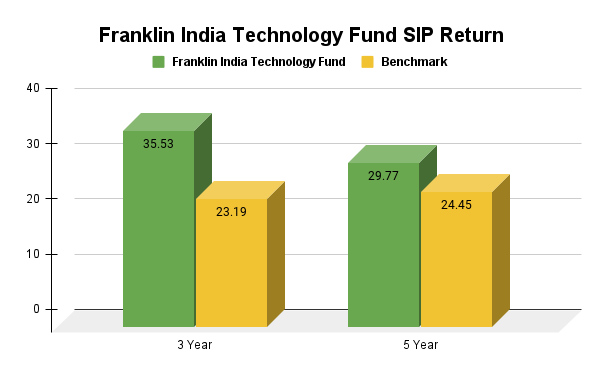

Analysis of Franklin India Technology Fund SIP Return

The SIP return is a profit you had gain from consistently investing in Mutual Funds. Your value would have increased by Rs. 1,80,000 if you had invested Rs. 3000 in this fund over the past 5 year, which increasing your total investment to Rs. 3,65,734.

The Franklin India Technology Fund has delivered amazing SIP annualised returns of 35.53% in 3 year and 29.77%, over the past 5 years. In both years this fund tremendously outperformed its benchmark index of 23.19% and 24.45%, this is a live example of the growth of the IT sector. This fund is suited for the invested who believe in the IT sector rapid growth in the upcoming years as well as long term investment.

Which Investing Style Franklin India Technology Fund Follows?

It invests in telecom, semiconductor and tech services, the Franklin India Technology Fund focusses on domestic and international technology companies. A method for long term capital growth is to purchase low price stocks companies that have solid fundamentals and market advantage. This fund allocates its assets among a variety of businesses in order to reduce risk, it also focusing on innovative businesses that can adapt the volatility of the market. Franklin Templeton mutual funds combines specific expertise with international experience to understand the long term opportunities for future growth.

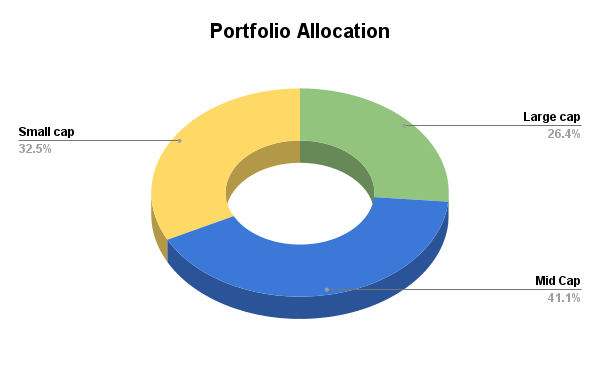

How Franklin India Technology Fund Distributes Your Invested Money

Portfolio Allocation

Franklin India Technology has allocated 41.1% of its portfolio to mid cap with high potential growth, 32.5% to small cap funds, and 26.4% to large cap fund. This diversity helped the fund to take advantage of several growth opportunities in various market segments while also reducing risk, this portfolio is designed to reduce risk while aiming for high returns.

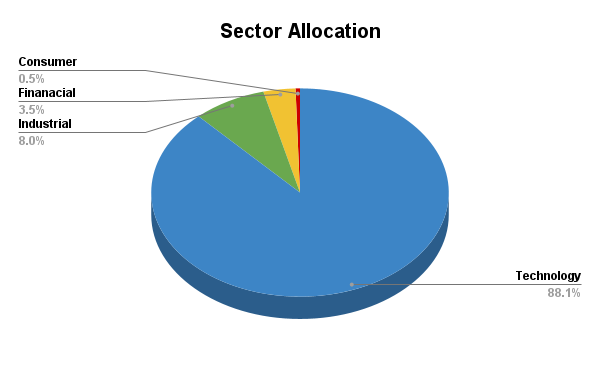

It’s important to know the sector diversification which gives you the clarity of this IT sector funds and in which sector it makes more investment with an aim to achieve the perfect portfolio for the investors. Let’s delve into sector diversification.

The Franklin India Technology Fund mainly focuses on the technology sector with 88.1% of the investment, such tech companies are Infosys, TATA consultancy, Bharti Airtel, Zomato, etc. It also has 8.0% in the industrial sector which involves India mart, and team lease service, the other one is the financial sector which has 3.5%, it involves PB fintech, and the last one is Consumer discretionary is 0.5%. This sector allocation shows that the fund mainly focuses on the technology sector, which leads this fund to high growth potential.

Portfolio Fundamentals of Franklin India Technology Fund

| Fundamental Ratio | Values |

|---|---|

| Sales Growth | 15.40% |

| Earning Growth | 17.99% |

| Cash Flow Growth | 25.28% |

| PE Valuation | 35.49% |

- The Franklin India Technology fund has shown strong quality stocks which highlights the potential for strong performance. the sales growth of average companies is 15.40%, which shows healthy revenue growth.

- The long term earning growth stands impressive at 17.99%, which involves the solid profit potential of this fund.

- Another is Cash flow growth at 25.28%, which reflects effective management.

- The last one is a PE Valuation of 35.49%. this high growth and valuation fabricate a balanced and informed investment approach to optimize the returns.

Is Franklin India Technology Fund Meant for You?

One excellent option to invest in India’s rapidly growing tech industry is through the Franklin India Technology Fund. This fund is a good option to increase your wealth due to its outstanding returns. It’s designed for the investor who are okay with high risk and want to invest for long term duration. This IT sector fund guarantee high quality investment, by focusing on companies that have strong profit and sales growth. An SIP (Systematic Investment Plan) offers you steady wealth creation. Adding this fund to your portfolio makes sense if you think that the IT industry will boost in the upcoming year.

Read More : ICICI Prudential Technology Fund: 4X AUM Growth in 4 Years